3D NAND Flash Memory Market Size Analysis:

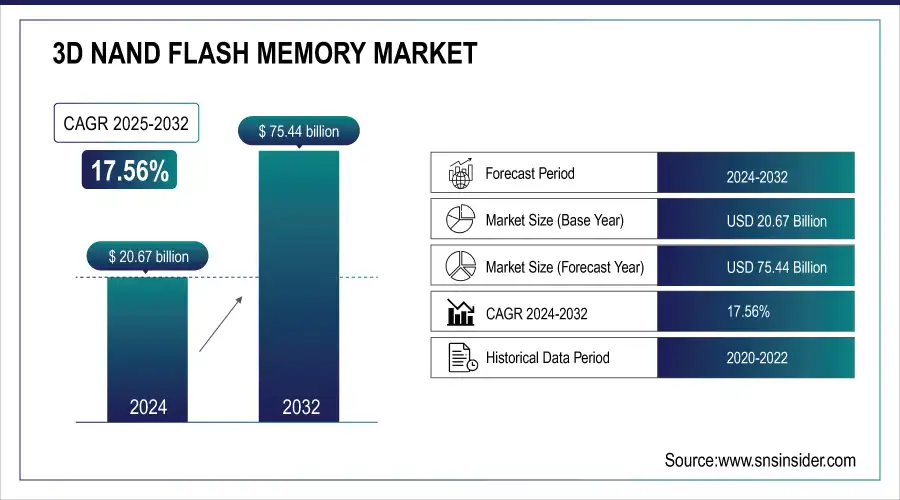

The 3D NAND Flash Memory Market Size was USD 20.67 Billion in 2024 and is expected to Reach USD 75.44 Billion by 2032 and grow at a CAGR of 17.56% over the forecast period of 2025-2032.

3D NAND memory technology represents a significant advancement in data storage, offering enhanced performance and efficiency compared to traditional 2D NAND. Unlike 2D NAND, which arranges memory cells in a flat structure, 3D NAND stacks memory cells vertically, creating a three-dimensional structure. This innovation allows for a greater number of memory cells within the same footprint, improving storage density and enabling faster data access. One of the key benefits of 3D NAND is its ability to reduce the physical space needed for memory storage while simultaneously increasing the amount of data that can be stored, with some configurations achieving storage densities of up to 1 terabit per chip.

As technology continues to evolve, 3D NAND memory is gaining traction across various applications, including smartphones, tablets, laptops, and data centers. Its ability to deliver high read/write speeds, with rates exceeding 500 MB/s, improved power efficiency, and increased durability typically boasting endurance ratings of up to 1000 write cycles makes it a preferred choice for modern storage solutions. Additionally, advancements in manufacturing processes have made 3D NAND more accessible, allowing for widespread adoption in both consumer electronics and enterprise environments.

Market Size and Forecast:

-

3D NAND Flash Memory Market Size in 2024: USD 20.67 Billion

-

3D NAND Flash Memory Market Size by 2032: USD 75.44 Billion

-

CAGR: 17.56% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get More Information on 3D NAND Flash Memory Market - Request Sample Report

Key 3D NAND Flash Memory Market Trends

-

Increasing demand for high-capacity SSDs in consumer electronics and PCs

-

Integration of 3D NAND with AI and machine learning applications for faster data processing

-

Growing use in automotive electronics and advanced driver-assistance systems (ADAS)

-

Expansion of IoT devices requiring reliable, high-density memory solutions

-

Shift from planar NAND to 3D NAND for better performance and longevity

-

Rising investments in manufacturing facilities and production technology upgrades

-

Increasing demand from gaming consoles, smartphones, and laptops for faster storage

3D NAND Flash Memory Market Growth Drivers

-

The surge in data-intensive applications like cloud computing, big data analytics, and AI is fueling the need for high-performance storage solutions, with 3D NAND memory providing the necessary density and speed for optimal performance.

The increasing demand for high-performance storage is primarily fueled by the rapid expansion of data-intensive applications, including cloud computing, big data analytics, and artificial intelligence (AI). As organizations across various sectors generate vast amounts of data, the need for robust storage solutions that can efficiently handle this influx becomes paramount. Traditional storage technologies often struggle to keep pace with the performance and capacity requirements of modern applications. In this context, 3D NAND memory has emerged as a game-changer. Unlike conventional 2D NAND, 3D NAND stacks memory cells vertically, allowing for greater density and enhanced performance. This innovative architecture not only increases storage capacity but also significantly improves data access speeds, making it highly suitable for demanding workloads. Studies show that 3D NAND can deliver write speeds that are up to 50% faster than traditional NAND solutions. Additionally, the energy efficiency of 3D NAND reduces operational costs, making it an attractive option for enterprises looking to optimize their IT infrastructure. With the proliferation of AI applications, which require rapid data processing and analysis, high-performance storage has become critical. Research indicates that approximately 70% of enterprises are investing in new storage technologies to support their digital transformation initiatives. This trend underscores the critical role of advanced storage solutions in enabling organizations to harness the power of data-driven technologies effectively. As data continues to grow exponentially, the demand for high-performance storage will likely intensify, driving further innovations in memory technologies like 3D NAND.

-

The widespread use of smartphones, tablets, and other portable devices drives the demand for compact and efficient storage solutions, with 3D NAND technology offering superior size, speed, and energy efficiency compared to traditional storage options.

This rapid growth drives the demand for compact and efficient storage solutions to accommodate the increasing amount of data generated by applications, multimedia content, and user-generated files. With the average smartphone user reportedly storing around 80 apps, photos, and videos, the need for high-performance storage is critical.

3D NAND technology has emerged as a key player in addressing this demand, offering several advantages over traditional storage solutions. Unlike planar NAND, 3D NAND stacks memory cells vertically, significantly enhancing storage density while minimizing the physical footprint. This technology not only allows for greater data storage capacity in smaller devices but also improves read and write speeds, enhancing overall device performance. For example, devices equipped with 3D NAND can achieve speeds that are up to three times faster than those using traditional NAND, resulting in quicker app launches and file transfers. Additionally, 3D NAND is more energy-efficient, which is crucial for battery-operated devices. With energy consumption being a top concern, 3D NAND reduces power usage, extending battery life and contributing to the overall sustainability of mobile technology. As mobile devices continue to proliferate, the reliance on advanced storage solutions like 3D NAND will only increase, reshaping the future of mobile computing and data management.

3D NAND Flash Memory Market Restraints

-

Market saturation in consumer electronics and mobile devices results in slower growth in demand for 3D NAND memory, restricting potential expansion.

Market saturation in the consumer electronics and mobile device sectors is increasingly evident as the proliferation of advanced technologies has resulted in a significant increase in product offerings. With many companies competing for market share, consumer choices have expanded, leading to a slowdown in growth rates for various components, including 3D NAND memory. The global smartphone market has seen annual growth rates decline from around 10% a few years ago to approximately 3% recently, indicating a mature market where most consumers already own smartphones. Similarly, the proliferation of smart devices and IoT gadgets has saturated the market, leaving little room for new entrants or innovative products that can drive demand for advanced memory solutions.

Additionally, the trend toward device longevity means consumers are holding onto their gadgets longer, further decreasing the frequency of upgrades. A report highlighted that the average lifespan of smartphones has extended from around two years to approximately three years, which reduces the overall demand for memory upgrades associated with new devices. Moreover, as manufacturers focus on optimizing existing products rather than introducing entirely new lines, the push for advanced memory technologies may wane. As a result, 3D NAND manufacturers could face challenges in finding new markets or expanding existing ones, impacting their growth potential in an increasingly saturated environment. This scenario underscores the necessity for companies to innovate and explore alternative applications for their technologies to sustain growth amid market saturation.

3D NAND Flash Memory Market Segment Analysis

By Types

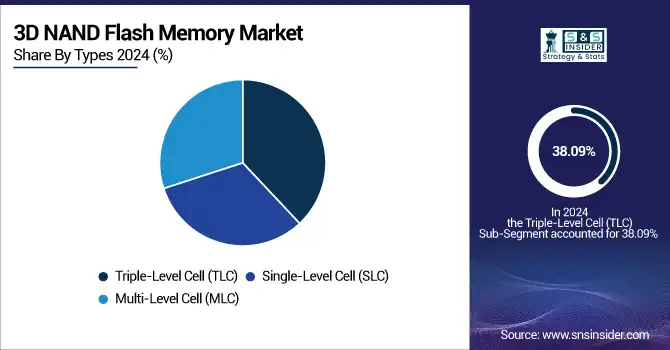

Triple-Level Cell (TLC) dominated the market share over 38.09% in 2024, striking an optimal balance between cost, performance, and storage capacity. TLC can store three bits of data per cell, allowing for higher density compared to Single-Level Cell (SLC) and Multi-Level Cell (MLC) technologies. This increased density translates to larger storage capacities, which is crucial for modern consumer electronics, such as smartphones, tablets, and solid-state drives (SSDs). As a result, TLC has become the dominant segment in the 3D NAND memory market, catering to the growing demand for affordable yet efficient storage solutions. Its ability to deliver satisfactory performance for everyday applications, combined with cost-effectiveness, makes it a preferred choice among manufacturers.

By Application

The smartphones and tablets segment dominated the market share over 42.06% in 2024. As smartphones and tablets become essential tools for daily activities, users increasingly rely on mobile applications that require significant storage. Additionally, the proliferation of high-resolution cameras in these devices enhances the need for ample storage capacity to accommodate the growing volumes of photos and videos. Multimedia content, such as video streaming services, gaming applications, and mobile productivity tools, further contributes to this demand, as users expect seamless performance and quick access to their data. With 3D NAND memory offering faster read and write speeds, improved endurance, and higher storage density compared to traditional memory types, it is increasingly favored for smartphones and tablets.

3D NAND Flash Memory Market Regional Analysis

Asia-Pacific 3D NAND Flash Memory Market Insights

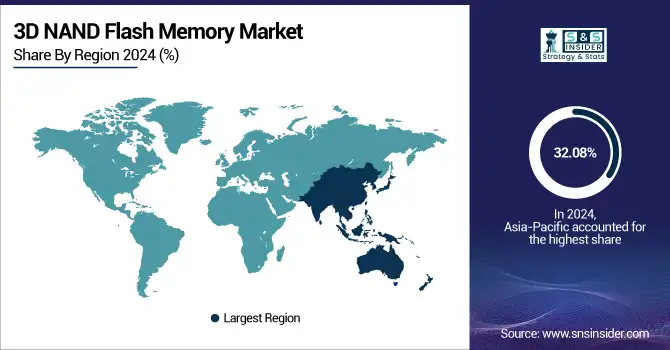

The Asia-Pacific region dominated the market share over 32.08% in 2024, fueled by the presence of industry giants like Samsung, SK Hynix, and Micron Technology. This concentration of major semiconductor manufacturers creates a robust ecosystem for 3D NAND technology development and innovation. A significant driver of market demand is the booming consumer electronics sector, particularly in smartphones, tablets, and laptops. The growing need for high-capacity storage solutions, driven by data-intensive applications, further enhances the region's appeal.

Need Any Customization Research On 3D NAND Memory Market - Inquiry Now

North America 3D NAND Flash Memory Market Insights

North America is experiencing the fastest growth in the 3D NAND memory market, driven by the surging adoption of cloud computing and the expansion of data centers. As enterprises increasingly rely on cloud services and high-performance computing, the demand for solid-state drives (SSDs) has escalated significantly, propelling the need for advanced memory solutions. The Internet of Things (IoT) market's growth further contributes to this trend, as connected devices necessitate efficient data storage and processing capabilities. Major players in the region are heavily investing in technology innovation, enhancing the capabilities and applications of 3D NAND memory. In recent years, investments in data centers have increased by over 20%, underscoring the urgency for high-capacity storage solutions.

Europe 3D NAND Flash Memory Market Insights

Europe holds a 27% share of the market, with Germany, the UK, and France at the forefront. The region’s growth is fueled by strong regulatory frameworks supporting technology adoption, increasing investments in semiconductor fabrication, and the integration of 3D NAND Flash Memory in high-performance computing and data center applications. Initiatives to enhance cloud infrastructure and digital services further strengthen the European market.

Latin America 3D NAND Flash Memory Market Insights

Latin America holds an 8% market share, with Brazil and Mexico leading adoption. Growth is supported by modernization of IT infrastructure and increasing awareness of 3D NAND Flash Memory for enterprise and data storage applications. Limited technological readiness and budget constraints across countries continue to restrict broader adoption.

Middle East & Africa (MEA) 3D NAND Flash Memory Market Insights

MEA accounts for 7% of the global market, with the UAE, Saudi Arabia, and South Africa driving growth through investments in data centers and smart IT infrastructure. While regulatory barriers and limited technical expertise pose challenges, increasing adoption of cloud services, urban digitalization, and IT modernization are expected to boost 3D NAND Flash Memory deployment across the region.

3D NAND Flash Memory Market Competitive Landscape

Samsung Electronics Co., Ltd.

Samsung Electronics Co., Ltd. is a South Korea–based global leader in memory solutions, semiconductor technology, and consumer electronics.

-

In April 2024, Samsung Electronics Co., Ltd. started mass production of the world’s most advanced 286-layer NAND flash memory chips, offering increased data storage capacity and improved performance for consumer, enterprise, and cloud applications.

Transcend Information Inc.

Transcend Information Inc. is a Taiwan-based company specializing in high-performance memory storage solutions, including SSDs and industrial-grade NAND flash products.

-

In April 2024, Transcend unveiled the all-new MTE560P M.2 SSD featuring PCIe Gen 4x4 interface and high-quality 112-layer 3D NAND flash technology, designed for high-speed performance and wide-temperature range operations in industrial and consumer applications.

Micron Technology, Inc.

Micron Technology, Inc. is a U.S.-based semiconductor company providing advanced memory and storage solutions for consumer, enterprise, and data center applications.

-

In July 2024, Micron announced shipments of ninth-generation (G9) TLC NAND in SSDs, featuring the industry’s highest transfer speed of 3.6 GB/s, delivering best-in-class performance for AI, edge computing, enterprise, and cloud data centers.

Key 3D NAND Flash Memory Companies are:

-

Samsung Electronics Co., Ltd. (V-NAND)

-

Intel Corporation (Optane Memory)

-

Toshiba Memory Corporation (BiCS FLASH)

-

Western Digital Corporation (3D NAND SSDs)

-

Micron Technology Inc. (NAND Flash Memory)

-

SK Hynix Inc. (4D NAND)

-

Kingston Technology Company, Inc. (NAND Flash SSDs)

-

Crucial Technology (Crucial P5 Plus SSD)

-

SanDisk Corporation (3D NAND SSDs)

-

Transcend Information Inc. (3D NAND Flash SSDs)

-

Phison Electronics Corporation (NAND Controllers)

-

Infineon Technologies AG (3D NAND Solutions)

-

Microchip Technology Inc. (NAND Flash Memory Solutions)

-

ON Semiconductor (NAND Flash Memory Solutions)

-

VIA Technologies Inc. (NAND Memory Solutions)

-

Integrated Silicon Solution Inc. (ISSI) (NAND Flash Products)

-

Western Digital Technologies, Inc. (3D NAND Technology)

-

ADATA Technology Co., Ltd. (XPG SSDs)

-

Seagate Technology Holdings plc (3D NAND SSDs)

-

NetApp, Inc. (SolidFire 3D NAND Flash Storage)

Suppliers for NAND controllers; supplies controller solutions for 3D NAND SSDs to 3D NAND Memory Market:

-

Samsung Electronics Co., Ltd.

-

Micron Technology Inc.

-

SK Hynix Inc.

-

Toshiba Memory Corporation

-

Western Digital Corporation

-

Intel Corporation

-

Kingston Technology Company, Inc.

-

Crucial Technology

-

Transcend Information Inc.

-

Phison Electronics Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 20.67 Billion |

| Market Size by 2032 | USD 75.44 Billion |

| CAGR | CAGR of 17.56% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Types (Single-Level Cell (SLC), Multi-Level Cell (MLC), Triple-Level Cell (TLC)) •By Application (Cameras, Laptops & PCs, Smartphone & Tablets, Others) •By End-Users (Automotive, Consumer Electronics, Enterprise, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Samsung Electronics Co., Ltd., Intel Corporation, Toshiba Memory Corporation, Western Digital Corporation, Micron Technology Inc., SK Hynix Inc., Kingston Technology Company, Inc., Crucial Technology, SanDisk Corporation, Transcend Information Inc., Phison Electronics Corporation, Infineon Technologies AG, Microchip Technology Inc., ON Semiconductor, VIA Technologies Inc., Integrated Silicon Solution Inc., Western Digital Technologies, Inc., ADATA Technology Co., Ltd., Seagate Technology Holdings plc, NetApp, Inc. |