Subcutaneous Drug Delivery Devices Market Report Scope & Overview:

Get More Information on Subcutaneous drug delivery devices Market - Request Sample Report

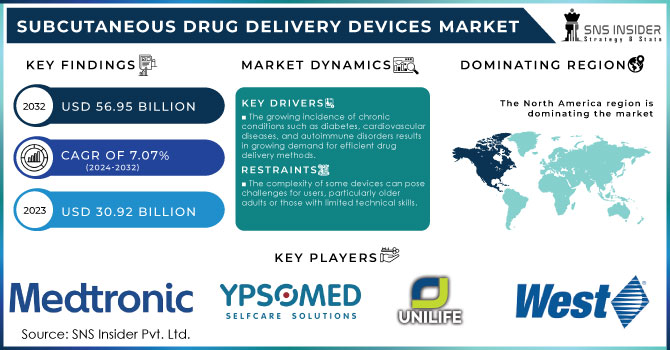

The Subcutaneous Drug Delivery Devices Market was worth USD 30.92 billion in 2023 and is predicted to be worth USD 56.95 billion by 2032, growing at a CAGR of 7.07 % between 2024 and 2032.

The rising prevalence of diabetes and cardiovascular diseases (CVD), along with surging biological drug development, is significantly boosting the demand for advanced minimally invasive Subcutaneous drug delivery devices. According to the International Diabetes Federation (IDF), there will be a 47.8% increase in the number of global diabetes cases from 2017 to year 2045, with major increases occurring in low and middle-income countries. The World Heart Federation notes that diabetics with type 2 diabetes have a higher risk of developing CVD than non-diabetic individuals. The increased purchasing power of the state and advanced healthcare facilities present in California leads to high sales revenues. To address the diabetes surge, companies are focusing on developing prefilled syringes like insulin autoinjectors. Some examples are Biocorp's Mallya device which gained FDA 510(k) clearance and a CE mark in December 2022, throwing open the doors for drug-device combination product innovation. This results in a higher prevalence of cardiovascular diseases and diabetes among the elderly population which makes it more necessary to use a subcutaneous delivery mechanism for drug administration purposes. The American Heart Association predicts that by 2050, cardiovascular disease will affect 15% of the population, up from 11.3% in 2020, with stroke rates expected to double.

Increased prevalence of chronic diseases is driving the market, with changing regulatory approvals impacting competition. Companies such as Insulet Corporation and Ypsomed AG are heavy investments in R&D activities followed by strategic partnerships. Industry and Innovation are Transforming the Health Category with Smart Capabilities for Remote Monitoring, Bio-Compatible Materials and Miniaturized Equipment. For example, the BD Libertas™ Wearable Injector (BD), launched in May 2024 streamlines self-administered subcutaneous injections with automated functions to improve overall patient experience.

Drivers

-

The growing incidence of chronic conditions such as diabetes, cardiovascular diseases, and autoimmune disorders results in growing demand for efficient drug delivery methods.

-

Continuous innovations in subcutaneous drug delivery devices, including smart features and improved materials, enhance their effectiveness and appeal.

-

The increasing elderly population with chronic health conditions boosts the demand for user-friendly and effective drug delivery solutions.

-

The trend toward self-administration and home-based care supports the growth of devices that allow patients to manage their conditions independently.

The increasing prevalence of chronic diseases such as cardiovascular conditions and diabetes are the important drivers for the growth of the subcutaneous drug delivery devices market. The International Diabetes Federation (IDF) forecasts the total number of diabetic patients worldwide will achieve 1.28 billion by 2050, which illustrates a growth rate of an incredible up to nearly 47% increase from 2017. This expanding patient population highlights an imperative necessity for well-designed and user-friendly subcutaneous drug delivery devices. The high burden of these chronic conditions is further exemplified by the World Heart Federation, which estimates that 17.6 million people die every year from cardiovascular diseases. This increasing incidence results in a greater need for effective drug delivery platforms, specifically to administer treatments that necessitate chronic use. According to the American Diabetes Association, for instance, some 38.38 million Americans suffered from diabetes in 2021 which is a significant segment of the population that are prime candidates for advanced treatment solutions. The increasing number of chronic diseases requires ongoing technical innovations for drug delivery, allowing patients to be satisfied and improve their quality of life.

The growing elderly population is a prominent factor that propels the subcutaneous drug delivery devices Industry. According to the World Economic Forum, 1 in 10 people were aged 80 or older in Japan by 2023. That demographic shift also translates into a greater incidence of NCDs diabetes, COPD and heart failure are all typical examples which are diseases that predominantly affect the elderly. The rising elderly population will result in soaring demand for easier and more efficient drug delivery solutions, as conventional routes often present limitations while managing multifaceted morbidities.

Restraints

-

The high cost associated with advanced subcutaneous drug delivery devices can limit their accessibility, particularly in low- and middle-income regions.

-

The complexity of some devices can pose challenges for users, particularly older adults or those with limited technical skills.

One major factor restricting the subcutaneous drug delivery devices market is that it has a high price which comes with advanced devices. The price is not just in the initial purchase of these devices but ongoing costs related to maintenance and consumables. The price of an insulin pump-based a subcutaneous drug delivery device, for example, can cost $4-7k just for the machine itself with add-on costs to cover consumables and supplies.

This high cost can be a barrier to adoption, especially in countries with low and middle-income per head where health budgets are tight. A WHO report in 2023 reveals that nearly round about 40% of diabetics are deprived of diabetes care because of a lack of affordability. Consequently, patients in these regions could not benefit from the latest drug delivery technologies for disease management and treatment. The financial burden associated with these devices can potentially hinder the worldwide adoption, and market growth as well for regions showing low health care expenditure.

Market Segment Analysis

By Product

The pen injectors segment held a dominant position in the market on account of their high convenience, easy handling, and efficient enhancement to patient compliance witnessed through a 35% share in revenue generated by it during 2023. The increasing prevalence of chronic diseases, coupled with technological advancements has fuelled the use of pen injectors for insulin delivery in diabetes and other chronic disease management. The consistently high prevalence of breast cancer and continuously shifting trends towards home-based treatments are other value propositions favoring this segment to emerge as the largest market globally. Thus, in February 2023, Phillips-Medisize a Molex company announced the launch of an innovative and market-driven disposable pen injector.

On the other hand, auto-injectors are projected to grow with a significant CAGR during 2024-2032. This supply includes devices for self-administered medicines in areas such as autoimmune diseases, allergies, and hormone deficiencies. Ypsomed reached a long-term agreement with Novo Nordisk in September 2023 to supply autoinjectors for treatments of metabolic conditions. The fact that Novo Nordisk is investing to extend capacity at Ypsomed's facility indicates rising demand in the market. The ADA classification follows on the heels of FDA clearance for interscatter communication-based smart contact lens technology, which can be used to program and monitor intraocular pressure based on glucose levels in persons with diabetes. Novo Nordisk's investment in expanding Ypsomed's production capacity underscores the growing market need. The new autoinjectors, anticipated for Novo's GLP-1 drugs by 2025, highlight the expanding demand in this segment.

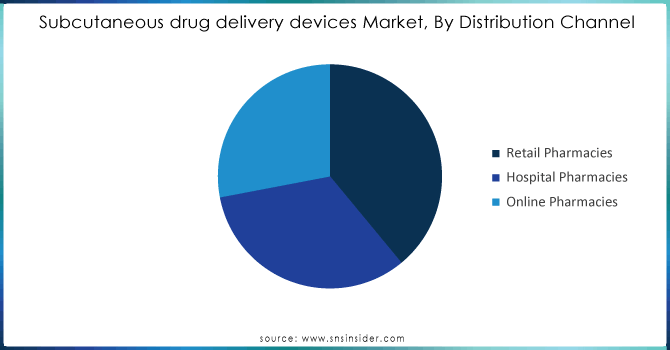

By Distribution Channel

The retail pharmacies led the market with more than 45% revenue share in 2023 largely due to easy-access subcutaneous drug delivery devices that are available over-the-counter. It is a convenient procurement point for patients with chronic conditions such as Diabetes who require regular medication. What's more, the personalized care & support provided by pharmacists is effective in increasing patient compliance and driving better treatment outcomes; a factor further underpinning its lead as it remains segment's dominant market position.

On the other hand, the online pharmacies segment is likely to grow at the fastest growth rate of 8.5% during the forecast period. This is driven by increased demand for the convenience of online pharmaceutical purchasing, especially in patients with multiple disorders. Subcutaneous drug delivery devices are delivered to your door via online pharmacies with little or no embarrassment and are available widely. Furthermore, the growing adoption of digital health solutions and attractive offers at competitive prices with detailed information about products are further fuelling this segment. The shift is geared toward a more tech-savvy patient population that expects health care to be delivered in an effective, efficient manner. Online pharmacies will be able to have a larger part of the market as they improve their services and reach.

Need any customization research on subcutaneous drug delivery devices market - Enquiry Now

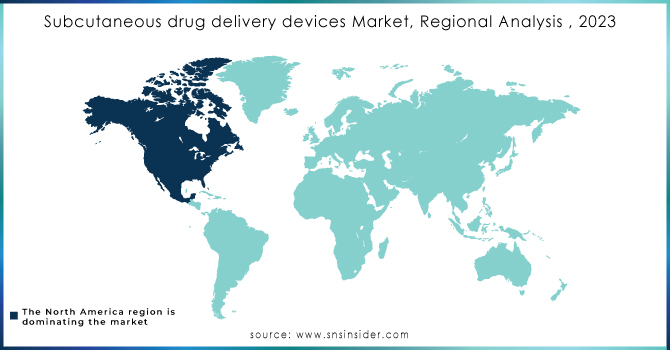

Regional analysis

North America dominated the subcutaneous drug delivery devices market with more than 43% share of revenue in 2023 due to the presence of a well-established healthcare sector, advanced infrastructure and a higher focus on research & development activities that aid regional growth. The high rates of chronic conditions, such as diabetes, autoimmune disorders and cardiovascular diseases underpin this dominance. In 2021, the American Diabetes Association found that there were already some 38.39 million Americans (approx. 11.58% of the total population) with diabetes implying a need for management tools to help. In North America alone, the US accounts for a considerable share of the market due to the high prevalence of diabetes and prediabetes gaining over 136 million adults with these conditions as per CDC data. Big players including Insulet Corporation, Enable Injections, Amgen BD, and others are innovating New Devices catering to the Rising Demand for Chronic Diseases.

The market is growing in the Asia Pacific region with the fastest CAGR of 8.7% during the forecast period, increasing disposable income, improved healthcare infrastructure, and economic development of countries such as Japan, China, and India. This region claims the highest number of individuals dispatched in the quest for more affordable cures supported by big investments from multinationals. Japan, has a large number of social pensioners (more than 10 percent are expected to be over the age of 80 by 2023). This demographic shift has led to more chronic diseases such as COPD and heart failure, which in turn is increasing demand for patient-centric drug delivery solutions. China is anticipated to witness substantial growth majorly due to a vast aging population, and healthcare reforms. Additionally, India's growth is attributed to favorable regulations and higher healthcare spending while cancer incidence increased with around 1,461427 new cancer cases in 2022.

Key Players

The Major players in market are Amgen Inc., West Pharmaceutical Services, Inc., Medtronic Plc, Ypsomed AG, Becton, Dickinson and Company, Elcam Medical Group, Novo Nordisk, Gerresheimer AG, Insulet Corporation, , PharmaJet, Halozyme, Inc. Enable Injections, and others in final report.

Recent Developments

-

Novo Nordisk A/S teamed up with HemoCue to enhance point-of-care diagnostic testing for children with type 1 diabetes in low- and middle-income countries back in February 2024.

-

Ypsomed came together with ten23 health in April 2024 to market the YpsoDose patch injector. This collaboration will accelerate the progress of developing a user-friendly continuous subcutaneous drug delivering device YpsoDose for better patient convenience. The partnership marries the capabilities of both companies to make this highly advanced injection technology available commercially.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 30.92 Billion |

| Market Size by 2032 | US$ 56.95 Billion |

| CAGR | CAGR of 7.07 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Auto Injectors, Prefilled Syringes, Pen Injectors, Wearable Injectors, Needle-free Injectors) • By Application (Diabetes, Oncology, Fertility) • By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amgen Inc., West Pharmaceutical Services, Inc., Medtronic Plc, Ypsomed AG, Becton, Dickinson and Company, Elcam Medical Group, Novo Nordisk, Gerresheimer AG, Insulet Corporation, , PharmaJet, Halozyme, Inc. Enable Injections |

| Key Drivers | • The growing incidence of chronic conditions such as diabetes, cardiovascular diseases, and autoimmune disorders results in growing demand for efficient drug delivery methods. • Continuous innovations in subcutaneous drug delivery devices, including smart features and improved materials, enhance their effectiveness and appeal. |

| RESTRAINTS | • The high cost associated with advanced subcutaneous drug delivery devices can limit their accessibility, particularly in low- and middle-income regions. • The complexity of some devices can pose challenges for users, particularly older adults or those with limited technical skills. |