Sulfonated Naphthalene Formaldehyde Condensate Market Report Scope & Overview:

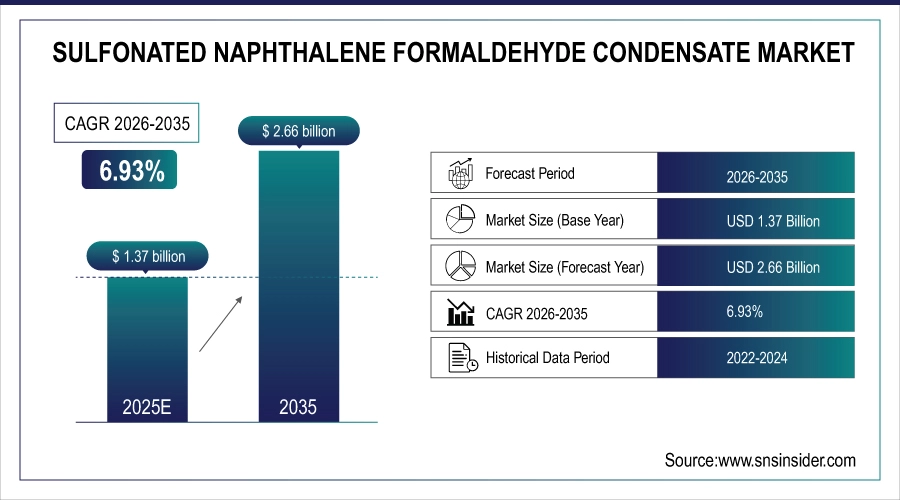

The Sulfonated Naphthalene Formaldehyde Condensate Market size was valued at USD 1.37 Billion in 2025 and is projected to reach USD 2.66 Billion by 2035, growing at a CAGR of 6.93% during 2026-2035.

The Sulfonated Naphthalene Formaldehyde (SNF) Condensate market is growing primarily due to the rapid expansion of the construction and infrastructure sector, particularly in emerging economies, where demand for high-performance concrete is increasing. Its use as a concrete admixture improves workability, strength, and durability, driving adoption. Growth in oil & gas, water treatment, and industrial applications further supports demand. Additionally, urbanization, industrialization, and government initiatives for sustainable infrastructure are encouraging the use of advanced chemical additives like SNF, fueling overall market expansion globally.

Market Size and Forecast:

-

Market Size in 2025: USD 1.37 Billion

-

Market Size by 2035: USD 2.66 Billion

-

CAGR: 6.93% From 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information on Sulfonated Naphthalene Formaldehyde Condensate Market - Request Free Sample Report

Key Sulfonated Naphthalene Formaldehyde Condensate Market Trends

-

Growing adoption of high-performance concrete admixtures to improve workability, strength, and durability in large-scale infrastructure projects.

-

Increasing focus on sustainable and eco-friendly construction materials, driving innovation in low-environmental-impact SNF formulations.

-

Rising demand for premium and specialty/customized formulations to meet specific construction and industrial project requirements.

-

Expansion of SNF applications in oil & gas drilling fluids, water treatment chemicals, and industrial processing, beyond traditional construction uses.

-

Strong growth potential in emerging regions such as the Middle East, Africa, and Latin America, fueled by rapid urbanization and infrastructure development.

The U.S. Sulfonated Naphthalene Formaldehyde Condensate Market size was valued at USD 0.26 Billion in 2025 and is projected to reach USD 0.49 Billion by 2035, growing at a CAGR of 6.60%during 2026-2035. The U.S. Sulfonated Naphthalene Formaldehyde Condensate market is growing due to increasing construction and infrastructure projects, rising demand for high-performance concrete admixtures, and adoption in oil & gas, water treatment, and industrial applications across the country.

Sulfonated Naphthalene Formaldehyde Condensate Market Growth Drivers:

-

Rapid Construction Expansion and Industrial Demand Drive Global SNF Condensate Market Growth

The global Sulfonated Naphthalene Formaldehyde (SNF) Condensate market is primarily driven by the rapid expansion of the construction and infrastructure sector, especially in emerging economies like China, India, and Southeast Asia. SNF is widely used as a high-performance concrete admixture, improving workability, strength, and durability of concrete, which is critical for large-scale infrastructure projects, commercial buildings, and urban development. Increasing urbanization, industrialization, and government investments in smart cities, roads, bridges, and energy infrastructure are creating substantial demand for SNF-based admixtures. Additionally, its applications in oil & gas drilling fluids, water treatment chemicals, and industrial processing further bolster market growth. The ease of handling, cost-efficiency, and performance enhancement offered by SNF solutions make them a preferred choice for construction and industrial industries, ensuring steady adoption globally.

More than 45% of developers are using low‑emission and recyclable concrete additives to align with green building practices, showing real implementation of eco‑friendly materials in construction.

Sulfonated Naphthalene Formaldehyde Condensate Market Restraints:

-

SNF Market Faces Challenges from Environmental Regulations Skilled Labor Shortages and Raw Material Variability

The Sulfonated Naphthalene Formaldehyde (SNF) Condensate market faces restraints from stringent environmental and regulatory standards, as improper handling or disposal can cause water and soil pollution. Limited awareness of advanced admixture benefits in some emerging markets, dependency on skilled labor for proper dosing, and variability in raw material quality can also hinder consistent adoption and performance across applications.

Sulfonated Naphthalene Formaldehyde Condensate Market Opportunities:

-

Premium and Specialty SNF Formulations Unlock Global Growth Opportunities in Sustainable and High-Performance Construction

Significant opportunities exist in the premium and specialty formulations segment, as construction companies increasingly adopt high-strength and customized admixtures to meet specific project requirements. The rising focus on sustainable and eco-friendly construction materials also creates avenues for SNF innovations with lower environmental impact. Emerging regions such as the Middle East & Africa and Latin America offer growth potential due to rapid infrastructure development. Moreover, ongoing research in advanced chemical additives and tailored formulations for diverse industrial applications presents long-term prospects for manufacturers, enabling expansion into new markets and boosting global revenue streams.

Japanese energy firm ENEOS and Maersk invested $100 million in C2X’s green methanol project in Louisiana, aimed at producing ~500,000 tonnes per year and capturing ~1 million tonnes of CO₂ for storage or use.

Sulfonated Naphthalene Formaldehyde Condensate Market Segment Analysis

-

By Product Type, Powder SNF dominated with 45.24% in 2025, and it is expected to grow at the fastest CAGR of 7.22% from 2026 to 2035.

-

By Application, Concrete Admixtures & Construction Chemicals dominated with 51.34% in 2025, and Water Treatment Chemicals is expected to grow at the fastest CAGR of 7.80% from 2026 to 2035.

-

By End-User Industry, Construction & Infrastructure dominated with 48.32% in 2025, and Water Treatment & Utilities is expected to grow at the fastest CAGR of 7.67% from 2026 to 2035.

-

By Formulation/Grade, Standard Grade dominated with 43.59% in 2025, Premium/High-Performance Grade is expected to grow at the fastest CAGR of 7.33% from 2026 to 2035.

By Product Type, Powder SNF Leads Market with Strong Growth Driven by High Performance Concrete Demand

In 2025, Powder SNF led the market due to its widespread use in construction and industrial applications, offering ease of handling and effective performance. From 2026 to 2035, Powder SNF is expected to continue strong growth, supported by rising demand for high-performance concrete and industrial processes. Innovations in powder formulations that enhance solubility, dispersion, and workability are also driving adoption, while emerging markets in Asia and Latin America present additional growth opportunities throughout this period.

By Application, Concrete Admixtures Dominate SNF Market While Water Treatment Chemicals Drive Future Growth

In 2025, Concrete Admixtures & Construction Chemicals dominated the SNF market, fueled by extensive infrastructure and building projects worldwide. Between 2026 and 2035, Water Treatment Chemicals are expected to grow rapidly, driven by increasing water treatment infrastructure and industrial applications. The shift toward sustainable and eco-friendly water management solutions, along with regulatory emphasis on clean water, is accelerating demand. SNF’s versatility in improving chemical performance in water treatment applications ensures it becomes a key component in future industrial and municipal projects.

By End-User Industry, Construction Leads SNF Market While Water Treatment Emerges as Fastest Growing Sector

The Construction & Infrastructure sector was the leading end-user of SNF in 2025, driven by large-scale building, transportation, and urban development projects globally. From 2026 to 2035, the Water Treatment & Utilities sector is expected to grow fastest, propelled by increasing investments in municipal and industrial water systems. The rising emphasis on sustainable water management and long-term durability of infrastructure projects supports SNF adoption, while ongoing urbanization and industrial expansion in emerging economies offer new opportunities for manufacturers.

By Formulation/Grade, Premium High Performance SNF Formulations Set to Lead Market Growth Driven by Advanced Construction Demand

In 2025, the Standard Grade formulation was the most widely used SNF product due to its reliability and broad applicability in construction and industrial processes. Between 2026 and 2035, Premium/High-Performance Grade formulations are projected to grow fastest, driven by demand for high-strength, durable concrete and specialized industrial applications. Innovations in chemical formulations to improve workability, slump retention, and environmental sustainability are fueling this growth, particularly in large infrastructure projects and regions focusing on advanced construction technologies.

Sulfonated Naphthalene Formaldehyde Condensate Market Report Analysis

Asia Pacific Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In 2025, Asia Pacific dominated the Sulfonated Naphthalene Formaldehyde (SNF) Condensate market with 37.35% share, driven by rapid urbanization, industrialization, and massive infrastructure development in countries like China and India. The region’s extensive use of high-performance concrete admixtures in residential, commercial, and transportation projects supports strong SNF demand. From 2026 to 2035, Asia Pacific is expected to register the fastest growth, with a CAGR of 7.29%, fueled by ongoing construction projects, government initiatives, and increasing adoption of advanced and sustainable chemical formulations in industrial and infrastructure applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In 2025, North America accounted for 24.43% of the Sulfonated Naphthalene Formaldehyde (SNF) Condensate market, making it one of the key regional markets globally. The region’s growth is driven by ongoing infrastructure development, urbanization, and industrial expansion across the U.S. and Canada. High demand for concrete admixtures, particularly in commercial and residential construction, supports SNF adoption. Additionally, investments in water treatment and industrial chemical applications contribute to market stability. Technological advancements and emphasis on sustainable construction practices are expected to sustain growth in North America throughout the forecast period.

U.S. Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In North America, the United States dominated the Sulfonated Naphthalene Formaldehyde (SNF) Condensate market in 2025 due to extensive infrastructure projects, high demand for concrete admixtures, industrial applications, and strong adoption of advanced and sustainable construction technologies.

Europe Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In 2025, Europe accounted for 23.12% of the Sulfonated Naphthalene Formaldehyde (SNF) Condensate market, reflecting steady demand across the region. Growth is driven by extensive infrastructure modernization, residential and commercial construction, and industrial applications in countries such as Germany, France, and the U.K. The focus on sustainable construction practices, high-performance concrete, and water treatment solutions further supports SNF adoption. Regulatory emphasis on eco-friendly materials encourages manufacturers to innovate with advanced formulations. Overall, Europe remains a mature but stable market, with continued demand for SNF in specialized and high-performance applications.

Germany Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In Europe, Germany dominated the Sulfonated Naphthalene Formaldehyde (SNF) Condensate market in 2025, driven by extensive infrastructure projects, high adoption of high-performance concrete admixtures, industrial applications, and strong emphasis on sustainable and eco-friendly construction practices across the country.

China Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In Asia Pacific, China dominated the Sulfonated Naphthalene Formaldehyde (SNF) Condensate market in 2025, driven by massive infrastructure projects, rapid urbanization, high adoption of high-performance concrete admixtures, and strong industrial and construction sector growth across the country.

Latin America (LATAM) and Middle East & Africa (MEA) Sulfonated Naphthalene Formaldehyde Condensate Market Insights

In 2025, the LATAM and MEA regions contributed significantly to the global Sulfonated Naphthalene Formaldehyde (SNF) Condensate market, driven by growing infrastructure, urban development, and industrialization. Countries such as Brazil, Mexico, UAE, and Saudi Arabia are investing in highways, commercial buildings, and water treatment projects, increasing SNF demand. The focus on high-performance concrete, sustainable construction practices, and industrial applications further supports market growth. From 2026 onwards, these regions are expected to offer strong opportunities due to ongoing development projects and adoption of advanced and specialty SNF formulations.

Competitive Landscape for Sulfonated Naphthalene Formaldehyde Condensate Market:

BASF SE is a global leader in chemical solutions, offering a wide range of Sulfonated Naphthalene Formaldehyde (SNF) condensates and concrete admixtures. The company supports construction, industrial, and water treatment applications worldwide, focusing on high-performance, sustainable, and innovative chemical solutions to enhance concrete durability, workability, and efficiency.

-

In May 2025, BASF launched a bio‑based polycarboxylate ether (PCE) admixture designed to promote more sustainable concrete production. Although this product is a PCE type (a different superplasticizer class), this development reflects BASF’s broader strategy to expand sustainable and performance‑enhancing concrete admixture technologies which complements its traditional SNF/naphthalene‑based offerings and supports greener construction practices.

Sika AG is a leading global specialty chemicals company providing Sulfonated Naphthalene Formaldehyde (SNF) condensates and high-performance concrete admixtures. The company serves construction, infrastructure, and industrial markets, focusing on durable, efficient, and sustainable solutions that enhance concrete workability, strength, and long-term performance worldwide.

-

In April 2025, Sika AG opened a new production facility in Ust‑Kamenogorsk, Kazakhstan featuring modern production lines for concrete admixtures and mortars as well as a laboratory to support local demand.

Sulfonated Naphthalene Formaldehyde Condensate Market Key Players:

Some of the Sulfonated Naphthalene Formaldehyde Condensate Market Companies

-

BASF SE

-

Sika AG

-

W. R. Grace & Co.

-

Mitsubishi Chemical Corporation

-

GCP Applied Technologies Inc.

-

Rhein-Chemotechnik GmbH

-

Shandong Wanshan Chemical Co., Ltd.

-

MUHU (China) Construction Materials Co., Ltd.

-

Hangzhou Lans Concrete Admixture Inc.

-

Euclid Chemical Company

-

Mapei S.p.A.

-

Fosroc International Ltd.

-

CICO Technologies Limited

-

Enaspol a.s.

-

Ha-Be Betonchemie GmbH & Co. KG

-

Sobute New Materials Co., Ltd.

-

Shandong Juxin Chemical Co., Ltd.

-

Sure Chemical Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.37 Billion |

| Market Size by 2035 | USD 2.66 Billion |

| CAGR | CAGR of 6.93% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Powder SNF, Liquid SNF, and Solid SNF) • By Application (Concrete Admixtures & Construction Chemicals, Oil & Gas (Drilling Fluids), Water Treatment Chemicals, and Industrial & Chemical Processing) • By End-User Industry (Construction & Infrastructure, Oil & Gas & Mining, Water Treatment & Utilities, and Industrial Manufacturing) • By Formulation/Grade (Standard Grade, Premium/High-Performance Grade, and Specialty Formulations (Custom Blends)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BASF SE, Sika AG, Arkema Group, W. R. Grace & Co., Mitsubishi Chemical Corporation, Kao Corporation, GCP Applied Technologies Inc., Rhein-Chemotechnik GmbH, Shandong Wanshan Chemical Co., Ltd., MUHU (China) Construction Materials Co., Ltd., Hangzhou Lans Concrete Admixture Inc., Euclid Chemical Company, Mapei S.p.A., Fosroc International Ltd., CICO Technologies Limited, Enaspol a.s., Ha-Be Betonchemie GmbH & Co. KG, Sobute New Materials Co., Ltd., Shandong Juxin Chemical Co., Ltd., Sure Chemical Co., Ltd. |