Supercomputer Market Report Scope & Overview:

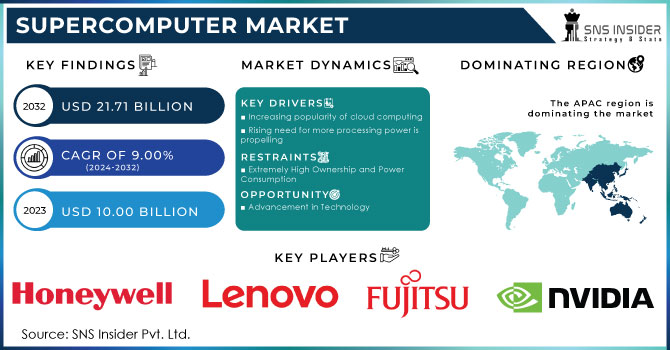

The Supercomputer Market size was valued at USD 9.96 billion in 2023 and is expected to grow to USD 24.40 billion by 2032 and grow at a CAGR of 10.84% over the forecast period of 2024-2032. Key factors influencing this growth include the increasing installed base of supercomputers across industries and research centers, as well as advancements in AI and machine learning applications. Energy consumption and efficiency are critical metrics, as supercomputers continue to become more power-efficient while maintaining high performance. Reliability is also key, with some work on improving operational uptime and failure rates of supercomputing systems. In addition to that, a lot of money is flowing into supercomputing for AI/ML applications, contributing to the growth of this market as well as its technology.

Get More Information on Supercomputer Market - Request Sample Report

Supercomputer Market Dynamics:

Drivers:

-

Revolutionizing Supercomputing with Cloud and Parallel Computing

The supercomputing landscape is undergoing a major shift, driven by cloud technology that is transforming traditional infrastructure. Modern supercomputer architectures now rely on parallel computing, allowing multiple tasks to be processed simultaneously The rise of cloud-based supercomputing solutions This trend in supercomputing, allowing a wider range of organizations access to high-powered computing equipment through platform-as-a-services models. Research institutions, for their part, own the majority of the world’s most powerful supercomputers, with more than 50% of the top supercomputers owned by research based organizations as of 2023 further emphasizing this broader accessibility. Fugaku, the world's fastest computer, which has 7.6 million cores and a peak speed of 442,010 TFlops/s, is driving innovation in aerodynamics and multi-scale simulations and structural validation, greatly accelerating R&D.

Restraints:

-

Supercomputer integration with existing IT systems can be complex due to compatibility issues, specialized requirements, and the need for expert management.

The integration of Supercomputers within existing IT infrastructures is characterized by strong technical difficulties. However, they usually come with compatibility issues when trying to connect advanced supercomputing systems with legacy systems, which in most cases need special adapters or software updates. In addition to this, supercomputers have their own requirements such as high-performance storage systems, special networking protocols, and dedicated cooling systems and so on, which makes the integration even more difficult. This complexity is further compounded by the challenge of a skilled workforce to deploy and maintain these systems. Insufficient in-house skills can lead to operational inefficiencies and prolonged downtime. Moreover, retrofitting existing systems to work with these hyperactive scale machines can be time-consuming and expensive.

Opportunities:

-

Sustainability and specialization in supercomputing are driving energy-efficient designs, green computing, and tailored applications for research, AI, and quantum computing.

Supercomputing is increasingly following the path of sustainability, with pretty much all manufacturers putting significant emphasis on green computing and energy-efficient designs. And companies are investing in novel cooling technologies and power management methods to strike a balance between performance and sustainability. And there's HPE's USD 100 million-dollar Cambridge-1 supercomputer investment from 2023 at the high end of the field, liquid-cooled to bring high-performance computing into greener, power-controlled territory. There’s also a trend toward specialization, particularly in scientific research, climate modeling and nuclear research. As Abu Dhabi prepares to bring its first quantum supercomputer to life, the next generation of supercomputing technology is determined by the impact of quantum computing and the availability of specialized software for AI and big data.

Challenges:

-

Energy consumption in supercomputing is a rising concern due to the high electricity demands of these systems, raising sustainability and cost challenges.

Supercomputers require huge amounts of electricity to do complicated calculations, which incurs significant energy costs. Because these systems are designed for extremely high performance workloads, their energy and electricity demands are generally much higher than traditional computing infrastructures. Such increased energy use poses a sustainability challenge, given that data centers are growing around the world. Hence, manufacturers are emphasizing on energy-efficient designs, such as improved power management and cooling technologies, to mitigate environmental impact. supercomputing systems need both power and sustainability solutions, meaning striking a balance between performance and energy remains a compliance challenge if users want their systems to remain viable long-term.

Supercomputer Market Segment Analysis:

By Type

The Tightly connected cluster computer segment led the supercomputer market with the largest revenue share of approximately 48% in 2023. This segment's dominance is driven by its ability to efficiently manage parallel processing tasks across multiple interconnected nodes, offering high computational power and scalability for diverse applications. Due to combining various processors and computers, cluster computing allows for cost-effective scaling with significant flexibility and resource management. Its popularity is especially notable in sectors that demand high-performance computing for applications like simulations, scientific research, and AI modeling. Due to increasing adoption of these solutions among enterprises and research institutions, the tightly connected cluster computer segment will retain its leadership in the ecosystem.

The commodity segment is set to experience the fastest growth in the supercomputer market over the forecast period from 2024 to 2032. This growth is driven by the rising need for high-performance computing solutions that are cost-effective and capable of scaling. Commodity supercomputing systems use standard hardware components (e.g., processors and storage units), which lead to overall lower cost than that of specialized, custom-built supercomputers. These systems are flexible and efficient, as they are based on commodity parts, meaning that they can be considered a worthy alternative in a wider range of sectors, such as research establishments and small and medium businesses and cloud service providers. The commodity segment is expected to be an important driver of market growth in the future years, especially owing to its cost-effectiveness along with high-performance capabilities.

By Application

The scientific research segment held the largest revenue share, approximately 48%, in the supercomputer market in 2023. Due to the increasing dependence on supercomputers for complex simulations, data analysis, and modelling across many scientific disciplines. These breakthroughs have much to do with the capabilities of supercomputers, which are able to execute complex simulations at a level of detail beyond the capabilities of traditional computing systems — and that’s critical in fields such as climate science, physics, biology and materials science. The need for high-performance computing to tackle complex scientific problems will continue to fuel growth in this segment, which research institutions and universities are pioneering with cutting-edge supercomputing technology.

The Defense segment is poised to be the fastest-growing in the supercomputer market from 2024 to 2032. Demand for advanced supercomputing systems is being driven by the increasing complexity surrounding military operations, including cybersecurity, simulations and intelligence analysis. These high-performance systems make it possible to process large amounts of data in real-time for strategic planning, advanced radar systems and combat training simulations. And as defense agencies migrate toward technological innovation and data-driven decision-making, supercomputers are central to advancing national security in a number of fields, including but not limited to autonomous vehicles, missile defense, and predictive analytics.

By End Use

The commercial industries segment dominated the largest share of the supercomputer market, accounting for approximately 55% of the revenue in 2023. The adoption of supercomputing solutions for databased decisions, analytics, and complex simulations in industries like finance, healthcare, retail, and manufacturing is driving this dominance. In business, supercomputers are used to model and optimize manufacturing processes, simulate products for design improvements and better customer experiences, and to drive innovation. The surge in demand for AI-based solutions, big data analytics, and cloud computing on the back of changes in businesses and consumers, is pushing companies across these sectors to invest their capital in supercomputing resources to maintain a competitive edge and improve overall business efficiency supporting the growth of this segment.

The research institutions segment is expected to be the fastest-growing segment in the supercomputer market over the forecast period from 2024 to 2032. The growing need for high-performance computing (HPC) to enable cutting-edge research in areas such as genomics, climate modeling, physics, and material science continues to fuel this expansion. Supercomputers for that and to drive breakthroughs and innovation are being picked up by research institutions utilizing complex simulations, data analysis and machine learning. As the funding for scientific research going on is also increasing rapidly, the demand for more powerful computing resources has increased which in turn led the research institutions to prioritize investments in supercomputing infrastructure, which is expected to drive the growth of this segment in the coming years.

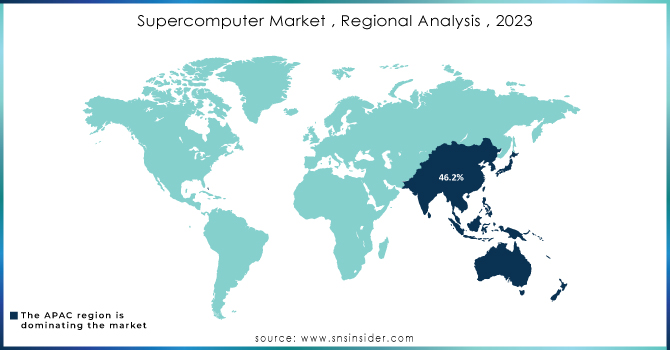

Supercomputer Market Regional Analysis:

The Asia-Pacific region dominated the largest share of the supercomputer market, accounting for around 47% of the revenue in 2023. This dominance is primarily driven by investments in supercomputing infrastructure by the likes of China, Japan and South Korea governments and research institutes. China is continuing to dominate the world of supercomputing with a focus on AI, big data, and quantum computing, developing some of the world’s most powerful supercomputers. Japan and South Korea also play major roles, investing in AI, climate modeling, and industrial applications. The area's continued rise is powered by robust public sector backing, a growing pool of HPEC projects, and increasing demand from research entities and commercial industries.

The North American region is the fastest-growing in the supercomputer market over the forecast period 2024-2032. The expansion is mostly attributable to activity in the U.S., which hosts many research institutions, technology companies, and government agencies that emphasize progress in the area of supercomputing. High-performance computing (HPC), triggered by huge investments in AI, machine learning, and big data analytics, especially from NASA, the Department of Energy, and proprietary tech companies, is driving up demand. Canada's increasing role in AI research and its collaborations with international tech companies further drive growth in the area.

Need any customization research on Supercomputer Market - Enquiry Now

Supercomputer Market Key Players:

Some of the Major Key Players in Supercomputer Market along with their product:

-

Atos SE (France) – (HPC solutions, Cloud services, Big data analytics, Cybersecurity, IT services)

-

Cray (United States) – (Supercomputers, AI/ML solutions, Data analytics)

-

Dell Technologies (United States) – (Servers, Storage systems, Workstations, Laptops, Cloud solutions)

-

Fujitsu (Japan) – (Supercomputers, Servers, Storage solutions, Cloud computing, AI solutions)

-

Hewlett Packard Enterprise (HPE) (United States) – (Servers, Storage systems, Networking, Cloud solutions, AI-driven technology)

-

Honeywell International Inc. (United States) – (Quantum computing, Aerospace, Industrial automation)

-

International Business Machines (IBM) (United States) – (Mainframe computers, Watson AI, Cloud computing, Quantum computing)

-

Lenovo (China) – (Personal computers, Laptops, Servers, Workstations, Storage solutions, AI/ML solutions)

-

NEC Corporation (Japan) – (IT solutions, High-performance computing, Networking, Cybersecurity)

-

Nvidia Corporation (United States) – (GPUs, AI/ML solutions, Data center solutions, Autonomous vehicle tech)

-

Intel (United States) – (Processors, AI solutions, Data center solutions, Memory, FPGA)

-

D-Wave Systems (Canada) – (Quantum computing solutions, Quantum annealers)

-

SpaceX (United States) – (Reusable rockets, Satellite internet, Spacecraft)

-

CISCO (United States) – (Networking hardware, Software solutions, Cybersecurity)

-

Advanced Micro Devices (AMD) (United States) – (Processors, GPUs, Data center solutions)

List of Suppliers who provide raw material and component in Supercomputer Market

-

Intel (United States)

-

TSMC (Taiwan)

-

Samsung Electronics (South Korea)

-

Micron Technology (United States)

-

SK hynix (South Korea)

-

NVIDIA (United States)

-

Advanced Micro Devices (AMD) (United States)

-

Texas Instruments (United States)

-

Qualcomm (United States)

-

STMicroelectronics (Switzerland)

Recent Development

-

June 18, 2024 – Hewlett Packard Enterprise (HPE) and NVIDIA announced NVIDIA AI Computing by HPE, a co-developed AI solution portfolio aimed at accelerating the adoption of generative AI. The centerpiece, HPE Private Cloud AI, combines NVIDIA’s AI computing with HPE’s storage, compute, and GreenLake cloud to deliver an energy-efficient, scalable solution for enterprises.

-

January 15, 2025 – CoreWeave teams up with IBM to offer an AI supercomputer using the NVIDIA GB200 Grace Blackwell Superchip to train IBM's Granite models. Combining NVIDIA GB200 NVL72 systems with Quantum-2 InfiniBand networking and IBM Storage Scale System, the supercomputer is aimed to boost research and development of artificial intelligence.

-

February 12, 2025 – Fujitsu and Yokohama National University achieved the world’s first real-time prediction of tornadoes associated with typhoons using Fugaku supercomputer and the enhanced Cloud Resolving Storm Simulator (CReSS), reducing prediction time from 11 hours to 80 minutes. This breakthrough enables accurate, timely tornado predictions, significantly improving disaster preparedness.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.66 Billion |

| Market Size by 2032 | USD 24.40 Billion |

| CAGR | CAGR of 10.84 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vector Processing Machines, Tightly Connected Cluster Computer, Commodity Cluster) • By Application (Scientific Research, Weather Forecasting, Defence, Simulations, Others) • By End Use(Commercial Industries, Government Entities, Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atos SE (France), Cray (United States), Dell Technologies (United States), Fujitsu (Japan), Hewlett Packard Enterprise (HPE) (United States), Honeywell International Inc. (United States), International Business Machines (IBM) (United States), Lenovo (China), NEC Corporation (Japan), Nvidia Corporation (United States), Intel (United States), D-Wave Systems (Canada), SpaceX (United States), CISCO (United States), Advanced Micro Devices (AMD) (United States). |