Surface Disinfectant Market Report Scope & Overview:

Get E-PDF Sample Report on Surface Disinfectant Market - Request Sample Report

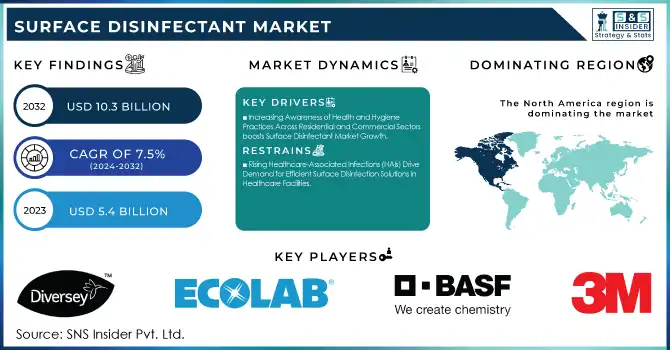

The Surface Disinfectant Market size was valued at USD 5.4 billion in 2023, and is expected to reach USD 10.3 billion by 2032, and grow at a CAGR of 7.5% over the forecast period 2024-2032.

The surface disinfectant market is witnessing significant growth driven by rising awareness of hygiene, the surge in healthcare-associated infections, and stringent government regulations mandating sanitation standards across various sectors. The demand for advanced disinfectant solutions is particularly pronounced in healthcare, hospitality, and residential applications, where maintaining a germ-free environment is crucial. Companies are continually innovating to develop faster, more effective, and environmentally friendly solutions to cater to the evolving needs of consumers. In May 2024, Diversey introduced Oxivir Three 64, a next-generation accelerated hydrogen peroxide disinfectant cleaner, enhancing efficiency in high-risk environments. Similarly, SC Johnson launched a new disinfectant line in May 2023 to expand its professional-grade solutions, demonstrating the industry's focus on delivering versatile and powerful cleaning products. Additionally, research published in May 2023 confirmed the efficacy of alcohol-based disinfectants in neutralizing emerging pathogens like the monkeypox virus, reinforcing the importance of reliable surface disinfectants in combating outbreaks.

Technological advancements and sustainability trends also shape market dynamics. Companies are exploring innovative formulations, such as accelerated hydrogen peroxide and bio-based disinfectants, to provide safer and more effective solutions. Regulatory pressures to reduce the use of hazardous chemicals encourage the development of eco-friendly products, creating new opportunities for market participants. Notable developments include the increased adoption of alcohol-based disinfectants, as highlighted in May 2023, when their protective benefits against novel viruses were demonstrated. Furthermore, product launches like Diversey's Oxivir Three 64 in May 2024 and SC Johnson's disinfectant line in May 2023 signify a growing commitment to catering to diverse consumer needs with high-performance solutions. These innovations reflect a competitive market landscape where companies are racing to meet the demand for superior hygiene solutions in an increasingly health-conscious world.

Surface Disinfectant Market Dynamics:

Drivers:

-

Increasing Awareness of Health and Hygiene Practices Across Residential and Commercial Sectors boosts Surface Disinfectant Market Growth

The growing focus on maintaining cleanliness and hygiene in both residential and commercial spaces is significantly contributing to the surface disinfectant market's expansion. With the rise of health-conscious consumers and stricter hygiene regulations, individuals and organizations are more inclined to invest in surface disinfectants to prevent the spread of germs and infections. This trend has been amplified by the increasing occurrence of health-related outbreaks, which raises concerns over sanitation standards in public and private spaces. As a result, cleaning and disinfection routines are becoming more regular and integral to daily life, creating heightened demand for surface disinfectants across industries such as hospitality, healthcare, food service, and residential cleaning. Consumer education on the importance of using effective cleaning products also accelerates the adoption of disinfectants, with companies increasingly focusing on product efficacy, safety, and ease of use. Consequently, this shift towards enhanced hygiene practices in various sectors is a key driver for market growth.

-

Rising Healthcare-Associated Infections (HAIs) Drive Demand for Efficient Surface Disinfection Solutions in Healthcare Facilities

-

Strict Government Regulations and Industry Standards for Hygiene and Sanitization Boost Market Demand for Surface Disinfectants

-

Technological Advancements and Innovations in Disinfectant Formulations Drive Product Performance and Efficiency

Technological advancements in disinfectant formulations are a key driver of growth in the surface disinfectant market. Manufacturers are continuously developing more effective and efficient disinfectant products that can kill a broader range of pathogens in a shorter amount of time. Innovations such as accelerated hydrogen peroxide (AHP) formulations, alcohol-based disinfectants, and eco-friendly solutions are enhancing the performance of surface disinfectants while meeting consumer demand for safer, more environmentally responsible products. These new formulations are designed to work more effectively on various surfaces, including high-touch areas, without causing damage or leaving harmful residues behind. The integration of advanced technologies such as antimicrobial agents, longer-lasting disinfecting properties, and faster action times is increasing product efficiency, which appeals to businesses looking to streamline their cleaning processes. This technological evolution in surface disinfectants is meeting the needs of sectors such as healthcare, food service, and hospitality, where high-performance cleaning is crucial.

Restraint:

-

High Costs of Premium Disinfectant Products and Limited Availability of Affordable Solutions Restrict Market Growth

Opportunities:

-

Expansion of Disinfectant Products for Residential and Commercial Use Presents Untapped Market Potential

-

Growing Demand for Innovative Surface Disinfectant Solutions in Emerging Markets Drives Market Expansion

-

Introduction of Antimicrobial Surface Coatings as Complementary Products Creates New Market Avenues

The growing interest in antimicrobial surface coatings offers an exciting opportunity for surface disinfectant manufacturers to diversify their product offerings. Antimicrobial coatings provide long-lasting protection against bacteria, viruses, and fungi on high-touch surfaces, complementing traditional disinfectant products. These coatings can be applied to surfaces in healthcare facilities, commercial spaces, public transportation, and residential homes to reduce the need for frequent cleaning. By combining surface disinfectants with antimicrobial coatings, companies can offer consumers and businesses a more comprehensive solution for maintaining hygiene and preventing cross-contamination. This innovation opens new avenues for market growth and provides a competitive edge for manufacturers looking to enhance their product portfolios.

Challenge:

-

Regulatory Challenges and Compliance with Strict Disinfection Standards Pose Obstacles for Market Players

Impact of E-commerce on Distribution Channels in Surface Disinfectant Market

| Impact | Description |

|---|---|

| Increased Online Availability of Disinfectants | Consumers have easier access to a variety of disinfectant products online, increasing market reach and availability. |

| Shift Towards Direct-to-Consumer (D2C) Sales | Brands are increasingly adopting direct sales models through their own e-commerce websites, bypassing traditional retail channels. |

| Growth of Subscription-Based Models | Subscription services for disinfectants are growing, allowing consumers to receive regular deliveries of products based on their needs. |

| Expansion of E-commerce Platforms in Emerging Markets | E-commerce platforms are helping disinfectant brands reach untapped markets in emerging regions, where retail infrastructure is less developed. |

| Enhanced Consumer Engagement and Product Education | E-commerce channels provide a platform for companies to engage with consumers, offering product details, reviews, and usage guidelines. |

E-commerce has significantly reshaped the distribution channels in the surface disinfectant market by broadening the accessibility of products and driving consumer convenience. Online platforms have made it easier for consumers to access a wide range of disinfectant products, thereby increasing the availability of various brands. The shift towards direct-to-consumer (D2C) sales has allowed brands to build stronger customer relationships and bypass traditional retail networks. Additionally, subscription-based models are emerging as a popular way for consumers to receive regular deliveries of disinfectants, ensuring they always have the products on hand. E-commerce platforms have also expanded into emerging markets, enabling disinfectant companies to reach consumers in regions with limited retail infrastructure. Finally, e-commerce channels provide an opportunity for brands to engage more directly with consumers, offering product education and detailed usage information, further enhancing the overall customer experience.

Surface Disinfectant Market Segments

By Composition

In 2023, the chemical segment dominated the surface disinfectant market, contributing to around 70% of the market share. Among the various chemical subsegments, alcohol-based disinfectants led the market due to their quick efficacy against a wide range of pathogens and their widespread use in both residential and commercial settings. For example, alcohol-based disinfectants, like those containing isopropyl alcohol or ethanol, are commonly used in hospitals, schools, and other high-traffic areas due to their high-speed disinfection capabilities. Quaternary Ammonium Compounds (QACs) and hydrogen peroxide-based disinfectants are also prevalent but account for a smaller share compared to alcohol-based formulations.

By Form

The liquid segment dominated the surface disinfectant market in 2023, holding a market share of 50%. Liquid disinfectants are preferred for their versatility and effectiveness in both industrial and consumer cleaning applications. For instance, hospital-grade disinfectants, often in liquid form, are used to wipe down medical equipment and surfaces. The liquid form also allows for better coverage in larger areas, which is especially important in sectors like the food and beverage industry. While wipes and sprays are gaining popularity due to their convenience, liquid disinfectants remain the top choice in the market.

By End-use

In 2023, the hospitals and clinics segment dominated the surface disinfectant market, accounting for approximately 40% of the market share. This dominance is driven by the need for stringent hygiene standards and effective infection control practices in healthcare settings. Hospitals and clinics require high-performance disinfectants to sanitize surfaces, medical equipment, and patient rooms. For example, hospitals commonly use alcohol-based and hydrogen peroxide-based disinfectants due to their rapid action and effectiveness against pathogens like bacteria, viruses, and fungi. The critical nature of healthcare facilities drives continuous demand for disinfectants in this sector.

By Distribution Channel

In 2023, online stores emerged as the leading distribution channel for surface disinfectants, contributing to 30% of the market share. The increasing consumer preference for e-commerce platforms for the purchase of disinfectant products has been a major growth factor, as it offers convenience and a wide variety of products. For example, online retailers like Amazon and specialized e-commerce sites provide direct-to-consumer sales, with consumers opting for bulk purchases or subscription-based models. This trend has been especially noticeable during times when in-store shopping was limited, and online availability became essential.

Surface Disinfectant Market Regional Analysis

In 2023, North America dominated the surface disinfectant market with a market share of 40%. This dominance is largely attributed to the heightened awareness surrounding hygiene and sanitation in response to the ongoing need for stringent infection control measures, particularly in healthcare and commercial spaces. In the United States, the demand for disinfectants surged due to government regulations mandating enhanced sanitation in hospitals, schools, and other public areas. Major companies like Ecolab, 3M, and Reckitt Benckiser have established a strong presence in the region, providing a broad range of surface disinfectants. For example, during the pandemic, alcohol-based disinfectants and hydrogen peroxide products became standard in both healthcare facilities and residential use. Canada also saw an increase in disinfectant sales, particularly in the healthcare and food service sectors, where infection control is critical. Furthermore, the region’s well-established e-commerce infrastructure helped facilitate the widespread distribution of disinfectant products to both businesses and households. The higher disposable income and rising consumer preference for eco-friendly disinfectants in North America have also bolstered growth.

Moreover, the Asia-Pacific region emerged as the fastest-growing market for surface disinfectants in 2023, with a CAGR of 7%. This growth is primarily driven by the rising urbanization, industrialization, and awareness of hygiene in countries like China, India, and Japan. In China, there has been a significant uptick in demand for disinfectants due to rapid industrial growth, particularly in healthcare and manufacturing sectors, where infection control measures are critical. The adoption of disinfectants in residential areas, restaurants, and educational institutions is also on the rise, as consumers become more aware of the importance of cleanliness. In India, a growing middle class and expanding healthcare infrastructure have fueled the demand for disinfectants, especially in hospitals and clinics, while the increasing preference for household cleaning products further drives the market. Japan’s aging population also presents opportunities for disinfectant companies, as healthcare and elderly care facilities require high levels of sanitation. Moreover, e-commerce platforms in these countries are becoming increasingly popular, providing easy access to a range of disinfectant products. The combination of increased hygiene awareness, expanding healthcare sectors, and rising disposable income is expected to continue driving rapid growth in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Recent Developments

-

May 2024: Diversey introduced Oxivir Three 64, a hospital-grade disinfectant cleaner that kills bacteria, viruses, and fungi in three minutes. EPA-approved for soft surfaces, it is safe, non-irritating, and effective on various healthcare surfaces.

-

May 2023: LANXESS stated that the broad-spectrum disinfectant Rely+On Virkon had proven effective against the yeast Candida auris and could be used as a disinfectant in healthcare and institutional facilities.

-

April 2023: SC Johnson launched the FamilyGuard Brand Disinfectant Spray, a lineup of disinfectant formulas designed to help protect families against germs by disinfecting hard, non-porous surfaces.

Key Players

-

3M Company (C. diff Solution Tablets, HB Quat Disinfectant Cleaner)

-

BASF SE (Glutaraldehyde-based disinfectants, Hydrogen peroxide solutions)

-

Diversey Holdings, Ltd. (Oxivir TB, Virex II 256)

-

Ecolab (Oasis Pro 66, Peroxide Multi Surface Cleaner and Disinfectant)

-

Evonik Industries AG (Vestocide, Protectol PE)

-

GOJO Industries, Inc. (PURELL Healthcare Surface Disinfectant, PURELL Professional Surface Disinfectant)

-

Henkel AG & Co. KGaA (Pril Surface Cleaner, Bref Power Cleaner)

-

Johnson & Johnson Consumer Health (Band-Aid Antiseptic Wash, Neosporin Wound Cleanser)

-

Kimberley-Clark Corporation (KCWW) (Kimcare Antibacterial Surface Cleaner, Scott 24 Hour Sanitizing Wipes)

-

Medline Industries (Micro-Kill R2, Micro-Kill One Germicidal Alcohol Wipes)

-

PDI Inc. (Super Sani-Cloth Germicidal Wipes, Sani-Prime Germicidal Spray)

-

Procter & Gamble (Microban 24 Sanitizing Spray, Comet Disinfecting Cleaner)

-

Reckitt Benckiser Group PLC (Lysol Disinfecting Spray, Dettol Antibacterial Surface Cleaner)

-

SC Johnson Professional (TruShot Disinfectant, Windex Multi-Surface Disinfectant Cleaner)

-

Spartan Chemical Company (TB-Cide Quat, Halt Disinfectant Cleaner)

-

Steris (Spor-Klenz Ready-to-Use Disinfectant, Vesphene II SE Disinfectant)

-

The Clorox Company (Clorox Healthcare Bleach Germicidal Wipes, Clorox Disinfecting Mist)

-

Unilever (Domestos Surface Spray, Cif Pro Formula)

-

W.M. Barr (Klean-Strip Disinfectant Cleaner, Mold Armor Mold and Mildew Killer)

-

Whiteley Corporation (Viraclean, Hypochlor)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.4 Billion |

| Market Size by 2032 | US$ 10.3 Billion |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Composition (Bio-based, Chemical [Alcohol-Based, Quaternary Ammonium Compounds (QAC), Chlorine Compounds, Hydrogen Peroxide, Others]) •By Form (Liquid, Sprays, Wipes) •By End-use (Hospitals & Clinics, Food & Beverage Industry, Residential and Commercial Spaces, Retail & Wholesale Stores, Others) •By Distribution Channel (Direct Sales, Online Stores, Retail Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ecolab, 3M Company, Procter & Gamble, Reckitt Benckiser Group PLC, PDI Inc., W.M. Barr, SC Johnson Professional, BASF SE, Steris, Evonik Industries AG, Kimberley-Clark Corporation (KCWW), Medline Industries, Spartan Chemical Company, GOJO Industries Inc., Whiteley Corporation and other key players |

| Key Drivers | •Rising Healthcare-Associated Infections (HAIs) Drive Demand for Efficient Surface Disinfection Solutions in Healthcare Facilities •Strict Government Regulations and Industry Standards for Hygiene and Sanitization Boost Market Demand for Surface Disinfectants |

| Restraints | •High Costs of Premium Disinfectant Products and Limited Availability of Affordable Solutions Restrict Market Growth |