Hydrogen Peroxide Market Analysis & Overview:

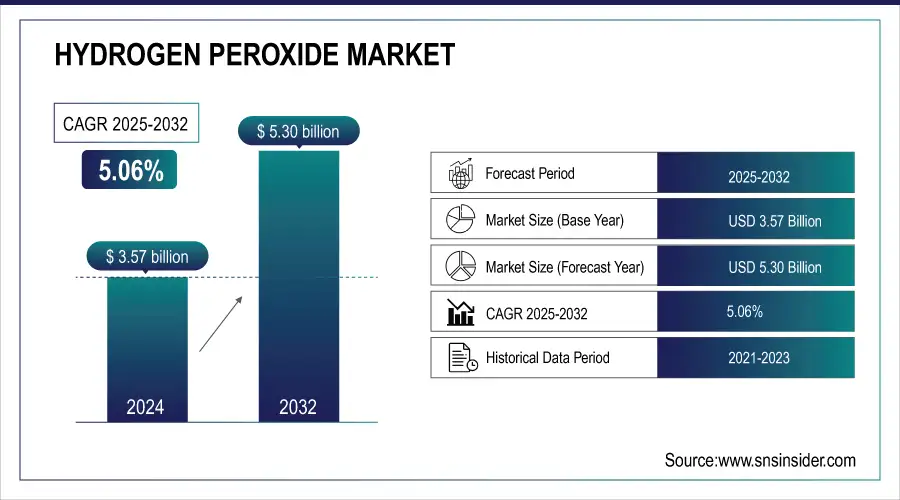

The Hydrogen Peroxide Market Size was valued at USD 3.57 billion in 2024 and is expected to reach USD 5.30 billion by 2032 and grow at a CAGR of 5.06% over the forecast period 2025-2032.

The market is growing at a significant rate due to diversified applications in the health industry, food industries, and textile industries. One of the prime drivers for this market is the rising demand for products that are not just environmentally friendly and sustainable but also cause less or no harm and are non-toxic. Because of its non-poisonous nature, hydrogen peroxide is a favorite as it is well-suited for use in hospitals and laboratories. For instance, a research group at the Karlsruhe Institute of Technology has recently discovered a new method of producing hydrogen peroxide from water and air by using material that mimics photosynthesis. So, this will be a great leap in changing the world of hydrogen peroxide production as this uses abundant natural resources while it is less expensive. This innovation can dramatically reduce the carbon footprint associated with traditional hydrogen peroxide production, making the product one of the best substitutes for various environmentally friendly applications.

Get More Information on Hydrogen Peroxide Market - Request Sample Report

Hydrogen Peroxide Market Size and Forecast:

-

Market Size in 2024: USD 3.57 Billion

-

Market Size by 2032: USD 5.30 Billion

-

CAGR: 5.06% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Hydrogen Peroxide Market Trends

-

Growing demand for eco-friendly bleaching agents in the pulp & paper industry.

-

Rising use in wastewater treatment and environmental remediation due to strict regulations.

-

Increasing adoption in electronics and semiconductor cleaning applications.

-

Expansion in the pharmaceutical and healthcare sectors for disinfectants and sterilization.

-

Shift toward green propellants and energy applications in aerospace and defense.

-

Advancements in on-site hydrogen peroxide production technologies to reduce logistics costs.

-

Rising focus on bio-based and sustainable hydrogen peroxide production methods.

Hydrogen Peroxide Market Growth Drivers

-

Hydrogen peroxide is widely used in healthcare for sterilizing equipment and surfaces, with rising demand driven by increased focus on hygiene and infection control.

Hydrogen peroxide is now widely used in the health sector as a sterilizing agent, mostly in the use of medical equipment and health facilities, due to its excellent antimicrobial capacity. In this hospital setting, it is paramount, to consider patient safety and measures required for infection control. Hydrogen peroxide has proved to be effective in killing bacteria, viruses, and fungi, presenting it as a reliable hygiene standards tool for reducing HAI and safe medical procedures. Moreover, since the poisonous residues of hydrogen peroxide break down into water and oxygen, they do not linger. As a result, hydro-decomposition has become an even safer chemical sterilant than others. As time goes by and with strict hygiene practices being implemented by regulatory bodies in the healthcare sector, the requirement for this chemical within the healthcare sector shall continue to rise gradually in due course.

-

Being eco-friendly, hydrogen peroxide decomposes into the harmless residues of water and oxygen; therefore, its use in industries has increased with this environmental awareness.

Hydrogen peroxide is one such friendly chemical alternative, driven by the recent global industrial shift toward sustainability and responsible environmental practices. Since it is also a natural decomposer into harmless water and oxygen, hydrogen peroxide makes it more acceptable than the traditional chemicals which often result in more environmental danger. It is a non-toxic substance in textile, pulp paper, and wastewater treatment industries, thereby ensuring the manufacturing process would have the least possible effects on the environment. For instance, the reason hydrogen peroxide is replacing chlorinated compounds in paper bleaching is that it poses less impact on the environment. The decomposition of contaminants without the introduction of extra contaminants, as applied in wastewater treatment, makes its use viable. In all these ways and with the green chemical trends that it is witnessing, hydrogen peroxide's place as a sustainable industrial solution has been cemented.

Hydrogen Peroxide Market Restraints

• The very high reactivity of hydrogen peroxide makes its handling, storage, and transportation quite hazardous, necessitating strict safety arrangements that would somewhat limit wider application in certain sectors.

Many of the benefits of hydrogen peroxide are linked to its reactivity; it is dangerous. Hydrogen peroxide can be corrosive and explosive at high concentrations. Therefore, it is considered a dangerous good and has to be treated in this way even when handling and storing at industrial levels. With the improper handling or improper storage of hydrogen peroxide in an industrial setting, dangerous incidents involving fire and explosion may occur. In addition, hydrogen peroxide is unstable to light and heat, which requires special containment measures, and thus adds to operational costs in those industries that use it in large volumes. These safety concerns can be inhibitory to its wider adoption, especially in smaller businesses or in industries that might not have the means to implement adequate safety protection. This includes regulatory requirements governing the safe handling and transportation of hydrogen peroxide, which will add complexity and cost to its usage and is a restraint on market growth.

Hydrogen Peroxide Market Opportunities

-

The growing global demand for clean water is driving the adoption of hydrogen peroxide in wastewater treatment, as it effectively oxidizes contaminants and disinfects without harmful by-products.

Water scarcity and contamination are certainly critical issues driving the search for the ultimate solution toward effective wastewater treatment. Hydrogen peroxide is rapidly emerging as a significant constituent in water treatment due to its powerful oxidation properties, thereby helping in breaking down harmful contaminants like organic matter, pollutants, and heavy metals. Unlike most chemical treatments that yield secondary pollutants, hydrogen peroxide decomposes to give water and oxygen, therefore making it a cleaner option for disinfecting water. Municipal water treatment plants, just like various industrial facilities needing to treat effluents before discharge, are becoming increasingly reliant on hydrogen peroxide for its efficacy and environmental safety. Increased regulation on water quality and more stringent restrictions on the discharge of wastewater should result in increased demand for hydrogen peroxide in water treatment, thus providing significant market potential.

Hydrogen Peroxide Market Challenge:

-

The high production cost of hydrogen peroxide, particularly from advanced methods like electrochemical synthesis, along with competition from chemicals like chlorine and ozone, hinders its broader adoption.

The high cost of production is the biggest challenge that the hydrogen peroxide market faces. Although highly efficient and environmentally friendly, advanced synthesis methods such as electrochemical synthesis are capital-intensive as well, meaning that the selling price of the final product shoots up. Additionally, there is competition posed by other chemicals like chlorine, and ozone; these are cheaper and have a firmly established role in similar applications like disinfection and bleaching. Hydrogen peroxide, in this regard, though appears to be very environmentally friendly, the alternatives are chosen in cost-sensitive industries despite these not showing the apparent environmental benefits of hydrogen peroxide. In addition, the safe handling and transportation of hydrogen peroxide is a complex task and adds to the cost of its operations. The above factors combined with alternative chemical options pose a challenge for hydrogen peroxide to be adopted universally across sectors, especially very cost-sensitive ones.

Hydrogen Peroxide Market Segmentation Outlook

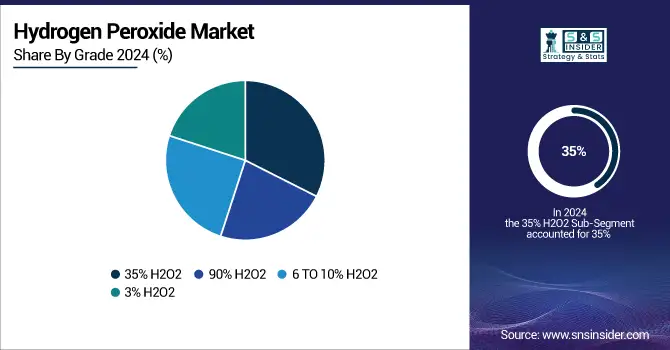

By Grade

In 2024, the 35% hydrogen peroxide segment dominated the market, accounting for an estimated around 45%. This segment is significant for use in large-scale applications in many industries, especially pulp and paper, textile bleaching, and wastewater treatment. This 35% grade is often preferred for effectiveness in oxidation processes and also as a powerful disinfectant. Its effectiveness requires this grade in many industries, especially in areas where hygiene is of utmost importance. For instance, in the pulp and paper industry, it is quite extensively used for bleaching due to its effectiveness and lesser impact on the environment compared with chlorine-based agents. Its application in water treatment facilities for the oxidation of contaminants further adds to its market leadership since its adoption by industries also depends on an effective and eco-friendly solution that meets strict environmental regulations.

By Application

The disinfectant application segment dominated the hydrogen peroxide market in 2024, accounting for almost 40% of the market share. The great demand for the disinfectants, especially in healthcare and food processing applications, has predominantly driven this segment towards high growth rates. Hydrogen peroxide's strong antimicrobial properties have created a high demand for it as an excellent product for the removal of microbes from equipment and surfaces in hospitals. For example, its usage grew rapidly for cleaning and disinfection of operating rooms and patient care areas due to a sudden awakening concerning the infection control mostly after the outbreak of COVID-19 disease. Additionally, in food processing, hydrogen peroxide is used for the sanitization of food-contact surfaces and contact packaging materials to ensure safe products and observance of health standards. This versatility and effectiveness as a disinfectant have placed it at the leading position in application terms within the hydrogen peroxide market.

By End-use Industry

In 2024, the pulp and paper segment dominated the hydrogen peroxide market, with a share of around 35% in the estimated market share. The pulp and paper segment exhibits dominance due to the extensive use of hydrogen peroxide in the bleaching operation in the paper-making process. Hydrogen peroxide is preferred because of its efficacy in producing bright and high-quality paper while being a more environment-friendly method in comparison with the traditional chlorine-based bleaching methods. Example: For instance, leading paper producers in recent times started using hydrogen peroxide for several reasons. First, the producers of such paper were trying to make the processes more environmentally friendly as well as align their processes with sustainable practices, and thus it aligned with legal requirements. More importantly, the importance of hydrogen peroxide is also underlined in the deinking process for recycled paper products because the demand for the latter is increasing day by day. It is henceforth very evident that the pulp and paper industry stands out to be highly in demand by being the market leader with this strong application of hydrogen peroxide.

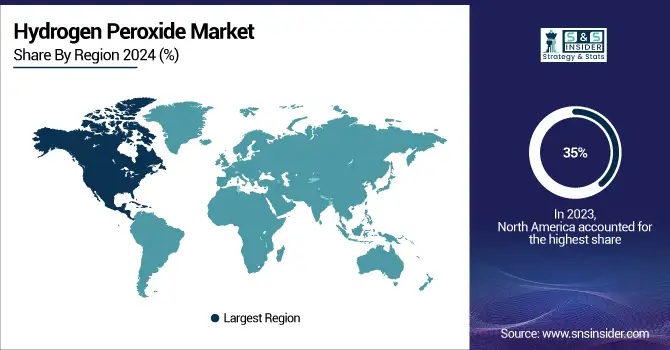

Hydrogen Peroxide Market Regional Analysis

North America Hydrogen Peroxide Market Insights

North America dominated the hydrogen peroxide market share in 2024 and accounted for about 35%. The reason is the increase in demand across several sectors, health care particularly, pulp and paper, and food and beverage sectors. The country has improved its hygiene and safety standards within the healthcare sectors of the country, which prompted increased consumption of hydrogen peroxide by the healthcare industries for disinfecting and sterilizing all medical equipment and surfaces. A highly developed pulp and paper market in North America, where hydrogen peroxide is widely used for pulp bleaching and deinking, helps in further growth of the market. Already strong in this region, large companies are investing significantly in high-production technologies, thereby ensuring a significant foothold for North America in the hydrogen peroxide market. Besides, the stringent regulatory systems that promote environmentally friendly production practices mean that more reliance has been on hydrogen peroxide as a cleaner alternative to the hazardous chemicals used in industrial activities.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific Hydrogen Peroxide Market Insights

Moreover, the Asia-Pacific region experienced the highest growth in 2024, with an estimated compound annual growth rate of approximately 6.5%. Its growth prospects are mainly supplemented by fast industrialization and surging demand in end-use industries such as textiles, electronics, and food and beverages. Hydrogen peroxide is largely used as a chemical in the textile industries of China and India, wherein their industries are being expanded rapidly with bleaching and finishing processes. The country's growing food processing industry is incorporating hydrogen peroxide for sanitation and disinfection purposes. This, therefore, is in line with global food safety standards followed by every region. Higher investment in water treatment infrastructures in developing countries further cements the demand for hydrogen peroxide as an effective oxidizing agent. As the governments of the Asia-Pacific highlight the cause of environmental sustainability, the move towards clean and greener chemicals, such as hydrogen peroxide, puts the region on the growth path in the next years.

Europe Hydrogen Peroxide Market Insights

In Europe, the hydrogen peroxide market in 2024 is supported by strong demand from the pulp & paper industry, robust growth in the textile sector, and rising adoption in wastewater treatment applications driven by stringent EU environmental regulations. The region’s focus on sustainable and eco-friendly bleaching agents, along with advancements in electronics and healthcare industries, continues to propel market expansion.

Latin America (LATAM) Hydrogen Peroxide Market Insights

In Latin America (LATAM), market growth is fueled by increasing industrialization, particularly in Brazil and Mexico, where the pulp & paper, chemical processing, and textile industries are major consumers of hydrogen peroxide. Expanding urbanization and rising demand for clean water are also encouraging its use in wastewater treatment, supporting consistent market growth across the region.

Middle East & Africa (MEA) Hydrogen Peroxide Market Insights

In the Middle East & Africa (MEA), hydrogen peroxide demand is primarily driven by its application in water treatment, food processing, and healthcare industries, especially in Gulf countries facing water scarcity challenges. Large-scale infrastructure projects, growing industrial activity, and rising investments in clean technologies are further boosting market opportunities, making MEA an emerging growth hotspot in 2024.

Competitive Landscape for Hydrogen Peroxide Market

Nuberg EPC

Nuberg EPC is a global engineering, procurement, and construction company specializing in chemical process plants and industrial projects. In the hydrogen peroxide segment, it focuses on building world-class production facilities to cater to rising demand.

- In June 2024, Nuberg EPC was awarded a contract by PT Sulfindo Adiusaha to construct a hydrogen peroxide plant in Indonesia, supporting local production expansion and meeting the region’s increasing consumption needs.

U.S. Food and Drug Administration (FDA)

The FDA plays a critical role in regulating medical device safety and sterilization standards, where hydrogen peroxide is widely used as a disinfectant.

In January 2024, the FDA advanced efforts to expand the use of vaporized hydrogen peroxide (VHP) in sterilizing medical devices, reinforcing infection control protocols and improving safety in healthcare facilities.

Dow and Evonik Industries

Dow and Evonik are leading global chemical companies, collaborating extensively on sustainability-driven innovations. In the hydrogen peroxide sector, they focus on high-performance grades and efficiency improvements.

- In October 2023, Dow and Evonik jointly launched the Hyprosyn Project, aiming to develop advanced hydrogen peroxide grades with higher performance and improved production sustainability, marking a breakthrough in eco-efficient chemical manufacturing.

Hydrogen Peroxide Companies are:

-

Aditya Birla Chemicals (Hydrogen Peroxide, Stabilized Hydrogen Peroxide)

-

Akzo Nobel (Hydrogen Peroxide, Peracetic Acid)

-

Akzo Nobel (Hydrogen Peroxide, Aguasol)

-

Chang Chun Petrochemical (Hydrogen Peroxide, High-Grade Hydrogen Peroxide)

-

Evonik Industries (Hydrogen Peroxide, Hydrogen Peroxide Solution)

-

Gujarat Alkalies (Hydrogen Peroxide, Industrial Hydrogen Peroxide)

-

Hansol Chemical CO. Ltd (Hydrogen Peroxide, High-Concentration Hydrogen Peroxide)

-

Kemira Oyj (Hydrogen Peroxide, Peroxide Products)

-

National Peroxide Limited (Hydrogen Peroxide, Stabilized Hydrogen Peroxide)

-

PeroxyChem (Hydrogen Peroxide, Food Grade Hydrogen Peroxide)

-

Solvay (Hydrogen Peroxide, Peracetic Acid)

-

Toshiba Chemical Corporation (Hydrogen Peroxide, Aqueous Hydrogen Peroxide)

-

OCI Company (Hydrogen Peroxide, Technical Hydrogen Peroxide)

-

BASF SE (Hydrogen Peroxide, Hydrogen Peroxide Solution)

-

Fuchs Petrolub SE (Hydrogen Peroxide, Industrial Hydrogen Peroxide)

-

Mitsubishi Gas Chemical Company (Hydrogen Peroxide, High-Grade Hydrogen Peroxide)

-

Ercros S.A. (Hydrogen Peroxide, Industrial Hydrogen Peroxide)

-

JSC Kaustik (Hydrogen Peroxide, Hydrogen Peroxide Solution)

-

DCM Shriram Limited (Hydrogen Peroxide, Hydrogen Peroxide Solution)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 3.57 Billion |

| Market Size by 2032 | US$ 5.30 Billion |

| CAGR | CAGR of 5.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (3% H2O2, 6 TO 10% H2O2, 35% H2O2, and 90% H2O2) • By Application (Disinfectant, Bleaching, Cleaning and Etching, Chemical Synthesis, and Others) • By End-use Industry (Food And Beverages, Pulp And Paper, Textiles and Laundry, Water Treatment, Healthcare, Electronics, Oil And Gas, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Evonik Industries, Solvay, Aditya Birla Chemicals, Gujarat Alkalies, Hansol Chemical CO. Ltd, Chang Chun Petrochemical, Akzo Nobel, Kemira Oyj, National Peroxide Limited, Arkema S. A., and other players. |