Surgical Robots Market Report Scope & Overview:

Get more information on Surgical Robots Market - Request Sample Report

The Surgical Robots Market Size was valued at USD 3.95 billion in 2023, and is expected to reach USD 8.79 billion by 2032, and grow at a CAGR of 9.3% over the forecast period 2024-2032.

The Surgical Robots Market is experiencing rapid expansion, driven by a confluence of technological advancements and a growing preference for minimally invasive procedures. These sophisticated systems, equipped with robotic arms, high-definition cameras, and intuitive surgeon consoles, offer unparalleled precision, dexterity, and visualization during complex surgeries.

Surgical robots have become indispensable tools in modern healthcare, driving demand in the surgical robotics market. Their application spans a wide range of procedures, including appendectomy, colectomy, gallbladder removal, gastric bypass, hernia repair, hysterectomy, mitral valve repair, and pancreatectomy. These procedures benefit immensely from the advantages offered by robotic surgery, such as reduced pain during recovery, minimized blood loss, smaller incisions resulting in reduced scarring, and a lower risk of infection. According to PubMed, the lifetime risk of appendectomy is estimated to be 12% for men and 23.1% for women. However, other sources indicate that only around 7% of the population undergoes an appendectomy during their lifetime.

The increasing prevalence of chronic diseases, coupled with an aging population, has led to a surge in demand for minimally invasive procedures. Moreover, the technology's ability to tackle complex procedures with precision has solidified its position as a preferred surgical approach. Noncommunicable diseases (NCDs) i.e. chronic disease pose a significant global health challenge, accounting for a staggering 74% of all deaths worldwide, or approximately 41 million people annually. These diseases disproportionately affect low- and middle-income countries, where 77% of all NCD deaths occur.

The escalating prevalence of degenerative bone conditions, including arthritis and osteoporosis, has led to a surge in demand for hip and knee replacement surgeries. This growing patient pool presents a significant opportunity for the surgical robotics market. The United States, for instance, records over 450,000 hip replacement surgeries annually, according to the Agency for Healthcare Research and Quality, highlighting the substantial market potential for robotic surgical systems in orthopedic procedures.

Patients are increasingly opting for robotic surgery due to its associated benefits, including reduced pain, shorter hospital stays, and improved cosmetic outcomes. The technology's ability to access confined spaces and perform intricate maneuvers with precision has captivated surgeons, leading to a surge in demand for robotic platforms.

The supply side is characterized by intense competition among industry players, each striving to develop innovative robotic systems with expanded capabilities. Advancements in artificial intelligence, augmented reality, and data analytics are further propelling the market forward. Intuitive Surgical, with its da Vinci system, has been a pioneer in the field, but a growing number of specialized systems are emerging to address specific surgical needs. Vandalia Health has made a significant stride in healthcare technology by becoming the first healthcare provider in West Virginia to utilize the latest surgical robot.

The overall market for surgical robots is projected to experience substantial growth in the coming years, driven by technological advancements, increasing adoption, and a favorable regulatory environment.

MARKET DYNAMICS

Drivers

-

The surgical robotics market is undergoing rapid growth, driven by a confluence of demographic, technological, and policy factors.

A burgeoning geriatric population is a primary catalyst. As individuals age, the incidence of chronic diseases such as arthritis, cancer, and heart disease increases, necessitating complex surgical interventions. For example, the number of people aged 65 and older is predictable to double worldwide by 2050, in the United Nations. This demographic shift is driving demand for precise and minimally invasive surgical solutions, a core competency of robotic systems.

Simultaneously, rapid advancements in robotic technology are expanding the scope of applications. The integration of haptic feedback, which simulates the sense of touch, and image-guided surgery, which provides real-time visual guidance, has significantly enhanced the capabilities of surgical robots. For example, the development of da Vinci Research Kit (dVRK), a platform for research and development of robotic surgical systems, has accelerated innovation in the field.

Moreover, supportive government policies are crucial in fostering market growth. Many countries are implementing reimbursement policies and regulatory frameworks to encourage the adoption of robotic surgery. In the United States, for example, the Centers for Medicare & Medicaid Services (CMS) has introduced reimbursement codes for robotic-assisted procedures, making the technology more accessible to patients. Additionally, regulatory approvals for new robotic systems have streamlined the market entry process, stimulating innovation and competition.

These combined factors have created a fertile environment for the surgical robotics industry, propelling its growth and expansion into new frontiers of medical care.

Restraints

-

High costs

The initial investment in robotic systems can be substantial, limiting accessibility in certain regions.

-

Skillset requirements

Surgeons need specialized training to operate robotic systems, which can pose a challenge in terms of workforce availability. Although rare, robotic malfunctions can disrupt procedures and require a shift to traditional surgical methods.

Key Segmentation

By Application

The surgical robotics market is primarily driven by applications in oncology, laparoscopy, and other general surgical procedures, collectively contributed to 44.76% of the total revenue in 2023. The increasing adoption of robotic systems for cancer treatment and minimally invasive laparoscopic surgeries has been instrumental in driving this segment's growth.

The neurology segment is emerging as a rapidly growing sector, with an anticipated CAGR of 17.6% from 2024 to 2032. The demand for precision and accuracy in neurosurgeries, coupled with the limitations of traditional techniques, has fueled the adoption of robotic systems. The rising prevalence of neurological disorders further exacerbates the need for advanced surgical solutions. Platforms like ROSA ONE Brain exemplify the increasing reliance on robotic technology for minimally invasive brain procedures.

By End-use

Inpatient segment, such as hospitals, dominated the surgical robotics market, capturing a significant 53.21% revenue share in 2023. These institutions possess the financial resources, infrastructure, and skilled personnel essential for the integration and operation of advanced robotic systems. Additionally, the established trust and credibility of hospitals drive patient and surgeon preference for robotic-assisted procedures.

However, the outpatient segment is poised for rapid expansion, with an anticipated CAGR of 9.7% from 2024 to 2032. Ambulatory surgical centers (ASCs) and other outpatient facilities are increasingly adopting surgical robots to meet patient demand for shorter hospital stays and faster recovery times. Aligned with the benefits offered by robotic surgery, these facilities are experiencing growth as regulatory and reimbursement landscapes evolve to accommodate this technology.

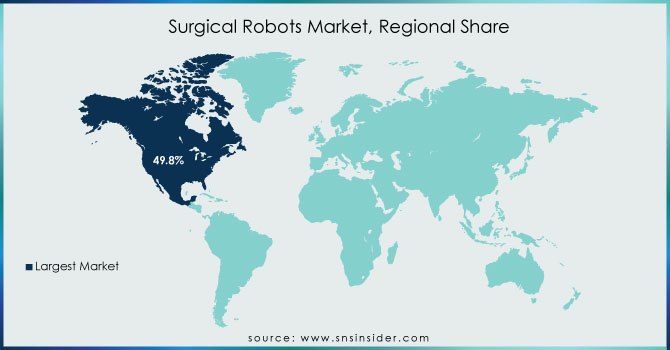

Regional Analysis

North America was dominated the surgical robotics market, capturing 49.8% share in 2023. This leadership position is attributed to advanced healthcare infrastructure, a robust pipeline of surgical procedures, and a strong focus on technological innovation. The region's early adoption of robotic surgery, coupled with favorable regulatory environments, has fostered market growth. The Asia Pacific region is poised for rapid expansion, projected to grow at a CAGR of 14.1% from 2024 to 2032. Factors driving this growth include rising disposable incomes, increasing healthcare expenditure, and supportive government initiatives promoting advanced medical technologies. Countries like India, China, and Singapore are at the forefront of this growth trajectory.

Need any customization research on Surgical Robots Market - Enquiry Now

KEY PLAYERS:

Think Surgical, Medrobitcs Encore, Curexo’s spine system, Medtronic’s Stealth Station Autoguide, Mazor’s Renaissance, J&J’s/Auris Monarch endoluminal system, Zimmer/Medtech’s Rosa Robot, Transenterix (Asensus Surgical, Inc.), Mazor’s Mazor x, the Corindus CorPath, Smith and Nephew, Stryker/Mako’s Rio Robot, the ARTAS robot, Intuitive Surgical, Renishaw plc and others.

Recent Developments

In Aug 2024, Globus Medical has received the necessary regulatory approvals from the US Food and Drug Administration (FDA) to ramp up production and market launch of its advanced surgical robotics systems.

In July 2024, Intuitive Surgical has reported strong second-quarter earnings, driven by robust demand for its surgical robots. The company's market performance reflects a broader industry trend towards minimally invasive procedures.

In Aug 2023, Stryker has initiated a direct-to-patient marketing campaign centered on joint replacement procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.95 Billion |

| Market Size by 2032 | US$ 8.79 Billion |

| CAGR | CAGR of 9.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Application [Orthopedics (Knee, Hip, Spine, Others), Neurology, Urology, Gynecology, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Think Surgical, Medrobitcs Encore, Curexo’s spine system, Medtronic’s Stealth Station Autoguide, Mazor’s Renaissance, J&J’s/Auris Monarch endoluminal system, Zimmer/Medtech’s Rosa Robot, Transenterix (Asensus Surgical, Inc.), Mazor’s Mazor x, the Corindus CorPath, Smith and Nephew, Stryker/Mako’s Rio Robot, the ARTAS robot, Intuitive Surgical, Renishaw plc and others. |

| DRIVERS | • The surgical robotics market is undergoing rapid growth, driven by a confluence of demographic, technological, and policy factors. |

| RESTRAINTS | • High costs • Skillset requirements |