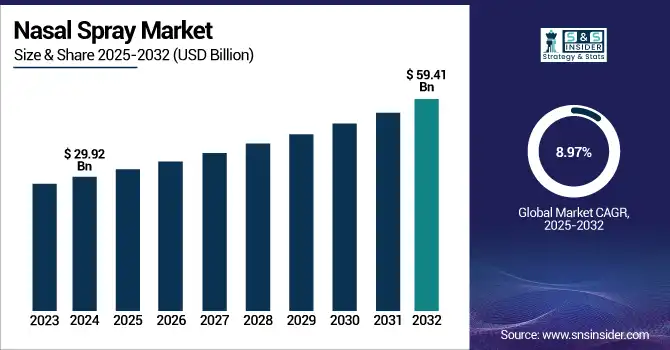

Nasal Spray Market Size Analysis:

The Nasal Spray Market size was valued at USD 29.92 billion in 2024 and is expected to reach USD 59.41 billion by 2032, growing at a CAGR of 8.97% over the forecast period of 2025-2032.

To Get more information on Nasal Spray Markett - Request Free Sample Report

Rapid growth of the nasal spray market analysis is attributed to increasing global prevalence of respiratory allergies, sinusitis, and allergic rhinitis. Illnesses such as allergic rhinitis impact 30% of the U.S. population, and more than 50 million individuals have some form of allergies each year (CDC, CHOP). The rising incidences of such disorders are the ultimate driving factor of the nasal spray market solutions as primary alternatives. Mount Sinai and Mayo Clinic contend that corticosteroid nasal sprays are still the best remedy for chronic sinusitis and allergy symptoms.

For instance, Bayer and Johnson & Johnson announced at the WAO a preservative-free nasal spray for chronic rhinitis, emphasizing the decrease in side effects and the improvement in long-term treatment compliance, as reported in the World Allergy Organization Journal.

Novel delivery systems, including breath-actuated and metered-dose devices, are leading to improved drug efficacy and patient adherence. R&D spend has increased, driven by an increase in FDA approvals of patents, from biologics to combination therapies. The nasal spray market also faces mounting regulatory scrutiny, including the enactment of tighter formulation and labelling requirements by the FDA and EMA to make sure of the safety and efficacy of such products.

Companies are focusing on the pediatric and geriatric population with tailor-made dosing formulations. Academic partnerships and government-funded clinical trials (such as NIH-sponsored trials) are further aiding product pipeline growth. The US nasal spray market is supported robust healthcare infrastructure and increasing penetration of OTC products.

For instance, both Pfizer and GlaxoSmithKline have been investing in R&D around intranasal delivery systems targeting improved absorption and patient experience in the therapy of allergy, as was stated in a 2024 ISPOR conference.

Nasal Spray Market Dynamics:

Drivers:

-

Rising Prevalence of Respiratory Disorders and Innovation in Drug Delivery Propel the Market Growth

The rising incidence of respiratory diseases such as allergic rhinitis, chronic sinusitis, and non-allergic rhinitis, along with the technological development of the nasal drug delivery systems, is the major driving factor for the nasal spray market growth. The American College of Allergy, Asthma, and Immunology (ACAAI) reports that more than 40 million Americans have allergic rhinitis. There is a preference to avoid invasiveness with faster action, and nasal sprays are the preferred route of administration among pediatric and geriatric subjects. Moreover, there is an increasing consumer preference for self-medication and over-the-counter (OTC) products that are driving the demand.

Defining may also involve investment towards R&D, with pharmaceutical companies ramping up for this, such as AstraZeneca, which is investing in the R&D of nanoparticle-based nasal formulations with improved mucosal absorption. Moreover, the regulatory agencies (i.e., the U.S. FDA and the EMA) have expedited the approval processes for nasal products through 505(b)(2) submissions, thus leading to faster time-to-market for reformulated products. Regulatory backing for getting systemic drugs into the body through the nasal passage, such as ketamine for depression and naloxone for opioid overdoses, also widens the market potential. As air pollution, seasonal allergens, and viral respiratory infections such as RSV and rhinoviruses continue to rise, demand is growing. The convenience of accurate dosing, easy administering, and portability with nasal sprays encourages increased adherence and repeat usage, adding to the nasal spray market trends.

Restraints:

-

Product Recalls, Side Effects, and Regulatory Barriers Hinder the Market Expansion

An obstacle that appears to be constant is the relatively high level of recalls that occur with nasal sprays, caused by inadequacies of the final product or manipulation. In 2023, for instance, the U.S. FDA recalled multiple lots of OTC nasal sprays after detecting microbial contamination that could have endangered immunocompromised patients. Indeed, side effects such as nasal irritation, dryness, rebound congestion, and corticosteroid-related problems can make it difficult to rely on these sprays over the long term and can undermine patient confidence in them. Such concerns are especially problematic for steroid-based sprays, which are commonly prescribed for chronic conditions.

Manufacturing and quality regulations for intranasal drugs are still a high priority issue for the U.S. FDA and European Medicines Agency to meet stringent standards and increase COGs. In addition, restricted insurance for brand-name and newer nasal sprays limits access, particularly among low-income groups. Variability in nasal mucosal permeation and formulation complexity may also contribute to delays in development times for products. Drug makers struggle to get drugs to be effective and easy to use and to remain stable, especially when combining multiple drugs or employing biologic agents in nasal sprays. These factors in the aggregate represent a hurdle that slows down the growth of market share for the nasal spray category, particularly for nascent nasal spray companies who may be small or mid-tier nasal spray houses without the volume commitment to warrant such above-noted manufacturing constraints.

Nasal Spray Market Segmentation Analysis:

By Product Type

The corticosteroids segment held the highest share of the market in 2024 and is anticipated to continue to do so throughout the forecast period. They are popular due to they are effective in the management of chronic nasal inflammation, allergic rhinitis, and sinusitis, they are strongly recommended by physicians, and are easily accessible. Corticosteroid nasal sprays such as fluticasone and mometasone tend to be first-line treatments as they provide long-lasting relief and have low systemic absorption.

The saltwater solutions section is anticipated to be the most lucrative on account of being a non-pharmacological, free of side effects product. The growing preference of consumers for natural, preservative-free nasal rinses, especially in the pediatric and geriatric population, will favour this trend. Increased availability of the product in the counter channel and increased awareness of nasal hygiene in the post-pandemic period will bode the growth of the nasal spray market.

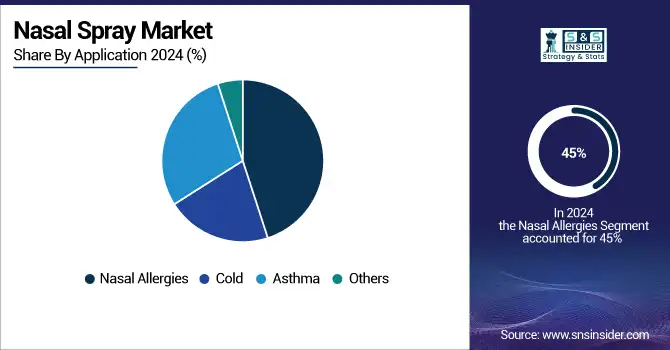

By Application

The nasal allergies segment was the largest in 2024 and accounted for over 45% market share. This market is led due to the increasing incidence of allergic rhinitis across the world and the intranasal route for local administration of the drug with immediate effects.

On the other hand, the asthma category is anticipated to be the fastest-growing segment, with companies focusing on the intranasal administration of bronchodilators and corticosteroids targeted at upper airway inflammation. Growing nasal sprays as an accompaniment to asthma inhalers and supportive clinical data are the trends for the nasal spray market.

By Age Group

The adult segment contributed the largest share to the market in 2024, with 63% of the total revenue, due to the higher prevalence of chronic sinusitis and allergic conditions in the population of working age. Adults are also more likely to buy Rx and OTC nasal sprays for everyday use.

The pediatric segment is projected to expand at a higher rate, on account of rising product innovation for children, including flavored sprays, smaller nozzles, and smoother formulations, and rapidly increasing awareness among parents about the safe and healthier nasal hygiene in children.

By Type

The prescription-based segment accounted for a significant share of the nasal spray market in 2024 due to the wide usage of corticosteroid and antihistamine-based nasal sprays that generally require a medical prescription.

The OTC segment is expected to witness significant growth in the nasal spray market, as consumers are increasingly shifting toward self-medication, particularly for mild allergies and blocked noses. Availability at retail and online channels is driving the OTC nasal sprays on the world stage.

By Distribution Channel

Drug stores and retail pharmacies were leading the market distribution landscape in 2024 with a revenue share of above 48%, account to their large network of physical stores and preference of customers to purchase in person and quickly.

The online pharmacies section is projected to grow at the highest CAGR, with the increasing movement of consumers toward digital health offerings. Ease, free delivery, and discount offers along with the increasing proliferation of the Internet and e-commerce, are influencing the nasal spray market trends in the online distribution space.

Regional Insights:

North America held the largest global nasal spray market share in 2024 due to the high incidence of allergic rhinitis, asthma, and chronic sinusitis; developed healthcare infrastructure; and strong consumer awareness. The U.S. nasal spray market size was valued at USD 10.22 billion in 2024 and is expected to reach USD 18.07 billion by 2032, growing at a CAGR of 7.44% over the forecast period of 2025-2032. The U.S. maintains the largest share in the region due to high R&D expenditure, better reimbursement policies, and fast approval for regulatory purposes. Sinusitis, the leading chronic illness in the U.S., affects more than 26 million adults in the U.S. each year, with a related increase in prescriptions and use of over-the-counter (nose) nasal sprays, according to the CDC. Also, higher number of FDA nods – such as Lupin’s generic Atrovent and ARS Pharma’s Neffy – boost market penetration. Canada is seeing mild growth as a result of public healthcare spending and increased seasonal allergy sufferers. At the same time, Mexico is developing into a low-cost manufacturing center for OTC sprays.

Europe is the second leading region in the nasal spray market size on account of the increasing prevalence of respiratory diseases and strong healthcare expenditure. Germany leads the region on account of high usage of prescription-based nasal sprays, together with the presence of the world-leading pharmaceutical manufacturers. Over 20% of Germany’s population suffers from allergic rhinitis. France and the UK are close behind, with high rates of over-the-counter usage and growing e-pharmacy use. The fastest-growing market in Europe is Poland, backed by increased investments in the local production of pharmaceutical drugs and escalating air pollution, which results in sinus-related disorders. Government efforts to promote access to inexpensive allergy treatments and extend health insurance coverage are also driving demand.

Asia Pacific is estimated to grow at the highest CAGR during the forecast period owing to its large population, growing urban pollution due to the expanding industrial sector, and increasing access to healthcare. China is the regional leader in the market, as there is a high burden of respiratory diseases and rising penetration of local and global nasal spray brands. More than 300 million people in China suffer from respiratory diseases, and rising awareness is leading to increased sales of OTC products, according to WHO estimates. India is also recording impressive growth, driven largely by pediatric and decongestant sprays, due to increased caseload of allergy cases and escalation in e-commerce pharmaceutical platforms.

Get Customized Report as per Your Business Requirement - Enquiry Now

Nasal Spray Market Key Players:

Leading nasal spray companies operating in the market are GSK, Viatris, Emergent Devices, Cipla, Bayer, Aurena Laboratories, Aytu Health, Procter & Gamble, AstraZeneca, and Johnson & Johnson.

Recent Developments in the Nasal Spray Market:

-

In February 2025, Lupin received U.S. FDA approval for its generic version of Atrovent nasal spray, marking a significant expansion of its respiratory product portfolio in the U.S. market.

-

In January 2025, Corstasis Therapeutics announced the FDA acceptance of its New Drug Application (NDA) for Bumetanide nasal spray, aimed at treating pulmonary edema, signaling a new entrant in critical care nasal therapeutics.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 29.92 Billion |

| Market Size by 2032 | USD 59.41 Billion |

| CAGR | CAGR of 8.97% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Corticosteroids, Salt Water Solutions, Topical decongestants, Antihistamine, and Others) • By Application (Nasal Allergies, Cold, Asthma, and Others) • By Age Group (Pediatric, Adults) • By Type (Prescription-Based, Over-the-Counter) • By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GSK, Viatris, Emergent Devices, Cipla, Bayer, Aurena Laboratories, Aytu Health, Procter & Gamble, AstraZeneca, and Johnson & Johnson. |