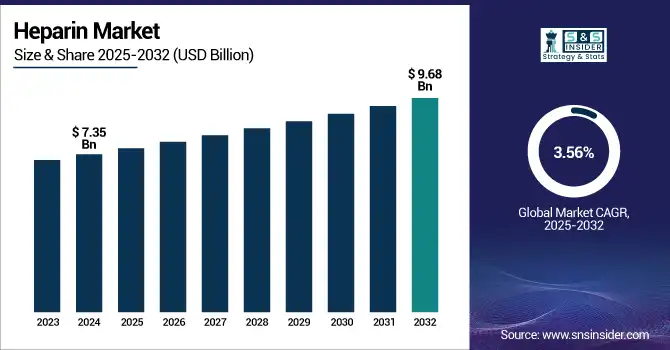

Heparin Market Size Analysis

The Heparin Market size was valued at USD 7.35 billion in 2024 and is expected to reach USD 9.68 billion by 2032, growing at a CAGR of 3.56% over the forecast period of 2025-2032.

To Get more information on Heparin Market - Request Free Sample Report

The global heparin market is driven by the high prevalence of cardiovascular and thromboembolic disorders across the globe. Rising surgical procedures, a more significant geriatric population, and increased awareness of anticoagulant therapies are driving the demand. Market development to continue R&D and technological collaboration research development, to use the manufacturing, nativeness, and key players to cooperate in the purification technology. Future market growth is further aided by emerging economies and better healthcare infrastructure.

The U.S. heparin market size was valued at USD 2.51 billion in 2024 and is expected to reach USD 3.18 billion by 2032, growing at a CAGR of 3.08% over the forecast period of 2025-2032. The North America heparin market is dominated by the U.S. due to a larger base of cardiovascular and thromboembolic disorders, along with advanced healthcare infrastructure. Moreover, the existing strong pharmaceutical R&D capabilities and favourable regulatory environment have further cemented the region's leadership in this segment.

In August 2023, the U.S. Food and Drug Administration (FDA) approved the Hepzato Kit (melphalan/hepatic delivery system) as a liver-targeted therapy for adults with metastatic uveal melanoma and unresectable liver metastases involving less than 50% of the liver.

Global Heparin Market Dynamics

Drivers

- The Increasing Prevalence of Cardiovascular Diseases (CVDs) is Driving the Market Growth

Due to sedentary lifestyles, unhealthy eating habits, and an aging population, cardiovascular diseases such as deep vein thrombosis, a pulmonary embolism, or coronary artery disease have become more frequent globally. Heparin is an essential drug because these disorders usually require anticoagulant therapy to prevent the formation of blood clots. An increase in the number of patients suffering from such disorders boosts market growth, as the demand for effective anticoagulants such as heparin increases exponentially.

For instance, according WHO, Cardiovascular diseases remain the leading cause of death globally, accounting for over 17.9 million deaths annually, which constitutes approximately 33% of all global deaths.

- Preference for Low Molecular Weight Heparin (LMWH) is Driving the Market Growth

Low molecular weight heparin is preferred over unfractionated heparin because of its several clinical benefits. LMWHs have a more predictable anticoagulant response, longer half-life, and a lower risk of some side effects, such as heparin-induced thrombocytopenia, compared with heparin. Also, LMWH can be given by subcutaneous injection, often permitting outpatient or even self-injection, which is more convenient for the patient and encourages compliance. The advantages mentioned above have contributed to a higher adoption of low molecular weight heparin, thereby growing the heparin market.

Restraint

- Risk of Side Effects and Complications is Restraining the Market from Growing

One of the most important complications is heparin-induced thrombocytopenia (HIT), an immune-mediated response resulting in a severe decrease in the platelet count and paradoxical thrombosis. Furthermore, bleeding or haemorrhage is a well-documented side effect of heparin therapy, particularly in the case of insufficiently monitored dosing. Unfavorable side effects associated with the use of heparin necessitate caution on the part of the healthcare provider in prescribing this drug, occasionally leading to a preference for alternative anticoagulants that possess a superior safety profile, thus inhibiting the market expansion of the heparin market.

Heparin Market Segmentation Insights

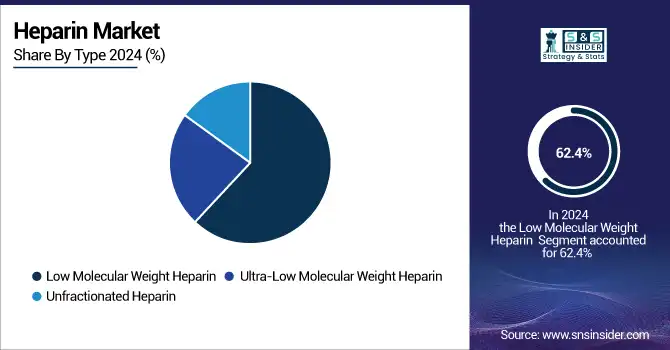

By Type

The low molecular weight heparin (LMWH) segment dominated the heparin market with a 62.4% market share in 2024. LMWH combines a favorable half-life, predictable anticoagulant response, and limited frequency of monitoring, which makes it a suitable agent for the treatment and prevention of venous thromboembolism and deep vein thrombosis. The widespread adoption of the treatment in the outpatient and inpatient settings, together with the established clinical guidelines supporting its use, has secured its leadership position in the market.

The ultra-low molecular weight heparin segment is anticipated to register the fastest growth over the forecast period. This growth is attributed to the rising preference for targeted and focused anticoagulant therapies with improved bioavailability and safety profiles. This rapid growth of the segment is supported by innovations in the drug formulation and the ever-increasing number of clinical trials currently performed with ultra-low molecular weight variants for newer indications. Furthermore, next-generation heparin formulations are expected to rise in demand due to healthcare providers searching for advanced alternatives with reduced bleeding risks and better acceptance by patients.

By Route of Administration

In 2024, the subcutaneous segment dominated the market and accounted for the largest share of the heparin market with a 68.2% market share due to its practicality and easy route of administration, effective in both inpatient and outpatient settings. Compared to other forms of administration, these subcutaneous injections (especially for LMWH) can be self-administered without hospital or continuous monitoring that is reserved for most forms of VTE prophylaxis and treatment, making them a more appropriate choice for long-term prophylaxis and treatment. This approach is particularly utilized for patients with deep vein thrombosis (DVT) and/or pulmonary embolism (PE), especially older and post-surgical patients needing prolonged out-of-hospital anticoagulation therapy.

The intravenous (IV) segment is expected to grow at the fastest rate in the heparin market over the forecast period, owing to its quick onset of action and extensive utilization in various emergency and critical care settings. IV heparin is the anticoagulant of choice in urgent scenarios (e.g., deep vein thrombosis, pulmonary embolism, cardiac surgical procedures) requiring rapid anticoagulation. The ability for precise dosage makes it ideal for use in intensive care units and surgical procedures.

By Application

In 2024, the coronary artery disease (CAD) segment dominated the heparin market with 26.2% market share, given the high global burden of cardiovascular disease and the prominence of heparin in the management of acute coronary syndromes. Heparin is often used in the setting of PCI and CABG as well as in unstable angina and myocardial infarction patients. This segment was led by the significant rise in the number of patients undergoing cardiac procedures due to the need for the use of anticoagulants such as unfractionated and low molecular weight heparin in these procedures.

The atrial fibrillation (AF) segment is anticipated to experience significant growth between 2025 and 2032. The increasing incidence of AF, particularly due to the aging population, as well as enhancing clinical focus on the prevention of thromboembolic strokes in patients with AF, are driving this. In these cases, heparin is commonly employed as a short-term anticoagulant for patients undergoing cardioversion or as a bridging therapy while awaiting long-term oral anticoagulants. Anticoagulation is required perioperatively in minimally invasive procedures such as catheter ablation, which are increasingly performed for the management of AF, thus increasing the demand for heparin in AF.

By End-use

The heparin market by end-use was led by the outpatient segment in 2024 with 71.08% market share, owing to the increasing trend towards ambulatory care and self-administration of anticoagulant therapy. Patients with specific chronic conditions, such as venous thromboembolism and atrial fibrillation, would prefer to be treated on an outpatient basis to limit their duration of hospitalization. The increased availability of subcutaneously administered agents such as low molecular weight heparin, which can be given at home, is reinforcing the trend toward outpatient care, which is cost-effective and convenient for both the patient and the health care system.

The inpatient segment is projected to grow at the fastest rate in the market during the forecast period. The increasing number of complex cardiac surgeries and orthopedic operations is anticipated to drive the growth of this segment during the forecast period, as these procedures require intensive anticoagulation management in hospital settings. Moreover, the increasing number of hospitalizations with acute thrombotic incidents and Intensive Care Management is driving the consumption of heparin during the In-hospital treatment process. For example, hospitals are still dependent on unfractionated heparin for fast control of anticoagulation, which favors strong segment expansion.

By Source

In 2024, the porcine segment dominated the market and accounted for 89.11% market share in the heparin market. The growth of the porcine segment is mainly attributed to the commercial availability and well-established safety record of the porcine-derived heparin. For decades, the main raw material source of heparin has been porcine intestinal mucosa, which is accompanied by relatively mature extraction and purification technologies. Porcine heparin has become the global standard choice for anticoagulant therapies, with its extensive clinical use, regulatory approvals, and robust supply chains supporting its dominant position.

The Bovine segment is anticipated to grow at the fastest rate throughout the forecast period due to rising demand for an alternative source of heparin, owing to supply chain vulnerability and increasing concerns of porcine-derived diseases. Competing interests (YH) Advances in the production technology and its acceptance by regulators merit additional exploration of this source, especially in regions that restrict the use of porcine products for cultural or religious reasons.

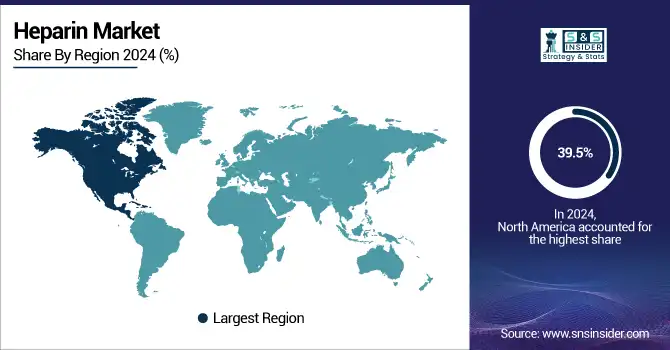

Heparin Market Regional Trends

North America dominated the market and held the largest market share, of 39.5%, in 2024, owing to the presence of a well-established healthcare infrastructure, high awareness about various anticoagulant therapies, and a huge pool of patients suffering from cardiovascular and thrombotic disorders. The presence of leading pharmaceutical players, strong regulatory frameworks ensuring the safety and efficacy of products, and consistent investments into clinical research and development all contribute to the benefits for the region. Additionally, the hospitals and outpatient settings witnessed the growing adoption of low molecular weight heparin, which further bolstered the region’s top position in the global market.

Asia Pacific is the fastest-growing region in the heparin market with 4.24% CAGR over the forecast period, primarily driven by rising healthcare expenditure, growing elderly populations, and increasing incidences of lifestyle-related disorders such as deep vein thrombosis and atrial fibrillation. Health services are improving quickly, and local capacity to produce pharmaceuticals, including heparin of porcine origin, is increasing in countries including China and India. This is encouraging governments to focus on developing healthcare infrastructure and increasing availability of preventive therapies, which is supporting the growth of the market in the region.

Europe is experiencing significant growth in the heparin market, driven by several key factors. The region benefits from a high prevalence of cardiovascular diseases and an aging population, both of which increase the demand for anticoagulant therapies such as heparin. Countries such as Germany, France, and the United Kingdom are at the forefront, contributing substantially to market expansion due to their robust healthcare systems and high healthcare expenditures.

Moreover, stringent guidelines set by the European Medicines Agency (EMA) for the safety and efficacy of heparin products are driving growth in the market, increasing consumers' trust in these products. In addition, the increase in surgical procedures, such as orthopedic and cardiac surgery, is expected to increase the demand for heparin to prevent thromboembolic complications. The focus on healthcare quality in the region, combined with strong support for medical research and innovation, creates a strong foundation for a growing market. In addition, large biopharmaceutical business in Europe is also involved in exploring & developing new formulations of heparin, which is incentivizing market growth.

The heparin market is growing moderately in Latin America and the Middle East & Africa (MEA) due to increasing healthcare infrastructure in these regions, an increasing burden of cardio and thromboembolic disorders, and greater awareness about anticoagulant therapies. Nations such as Brazil, Mexico, and Argentina are developing their pharmaceutical manufacturing capacity and making investments in modernizing their healthcare systems, which facilitates access to treatments like heparin.

Meanwhile, Saudi Arabia, the UAE, and South Africa are driving healthcare access and non-communicable disease management in the MEA regions. The rising incidence of diabetes, which is indirectly leading to obesity, hypertension, and other chronic diseases, is one of the major risk factors for clotting disorders, which in turn require the use of anticoagulants. These factors ensure the consistent rise of the heparin market in both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Heparin Market

Pfizer Inc., Sanofi S.A., Leo Pharma A/S, Baxter International Inc., Hepalink Group, B. Braun Melsungen AG, Teva Pharmaceutical Industries Ltd., Fresenius SE & Co. KGaA, Dr. Reddy’s Laboratories Ltd., Aspen Pharmacare Holdings Limited, and other players.

Recent Developments

-

In November 2023, Leo Pharma to Collaborate with Vianex295 – Out of Denmark, Leo Pharma has entered into a cooperation agreement for the production of standard unfractionated heparin and low molecular weight heparin with the Greek pharmaceutical firm Vianex. Under the terms of the deal, production of injectable heparin preparations will move from Leo Pharma's Ballerup, Denmark, facilities to Vianex's Greece production sites.

- August 2024 — Baxter International Inc. has withdrawn from consumer use one lot of Heparin Sodium in 0.9% Sodium Chloride Injection, USP. This recall was initiated based on the issue with the bacterial endotoxin testing of lot N008235 close to the endotoxin limit set, allowing for the risk that high endotoxin levels can be present.

Heparin Market Report Scope:

Report Attributes Details Market Size in 2024 USD 7.35 Billion Market Size by 2032 USD 9.68 Billion CAGR CAGR of 3.56 % From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Type (Low Molecular Weight Heparin, Ultra-Low Molecular Weight Heparin, Unfractionated Heparin)

• By Route of Administration (Intravenous, Subcutaneous)

• By Application (Venous Thromboembolism, Atrial Fibrillation, Renal Impairment, Coronary Artery Disease, Others)

• By End-use (Outpatient, Inpatient)

• By Source (Porcine, Bovine, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Pfizer Inc., Sanofi S.A., Leo Pharma A/S, Baxter International Inc., Hepalink Group, B. Braun Melsungen AG, Teva Pharmaceutical Industries Ltd., Fresenius SE & Co. KGaA, Dr. Reddy’s Laboratories Ltd., Aspen Pharmacare Holdings Limited, and other players.