TC-SAW Filter Market Report Scope & Overview:

The TC-SAW Filter Market size was valued at USD 1.44 Billion in 2025E and is projected to reach USD 2.43 Billion by 2033, growing at a CAGR of 6.84% during 2026-2033.

The TC-SAW Filter Market is growing due to rising demand for compact, cost-effective, and high-performance RF filters used in 4G/5G smartphones, IoT devices, and wireless communication systems. Increasing deployment of 5G infrastructure, growth in multi-band RF front-end modules, and expanding use in automotive telematics, wearables, and consumer electronics further accelerate adoption. Advances in temperature-compensated designs also enhance performance, supporting market expansion.

Market Size and Forecast:

-

Market Size in 2025E USD 1.44 Billion

-

Market Size by 2033 USD 2.43 Billion

-

CAGR of 6.84% From 2026 to 2033

-

Base Year 2024

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get More Information On TC-SAW Filter Market - Request Free Sample Report

Key TC-SAW Filter Market Trends

-

Increasing adoption of 4G/5G networks driving demand for high-performance TC-SAW filters in smartphones and mobile devices.

-

Rapid growth of IoT, M2M, and LPWAN devices requiring compact, energy-efficient, and cost-effective RF filtering solutions.

-

Rising integration of TC-SAW filters in automotive telematics, V2X communication, consumer electronics, and industrial automation systems.

-

Growing need for high-frequency support including Wi-Fi 6/6E, sub-6 GHz 5G, and emerging 6G communication technologies.

-

Demand for highly integrated modules such as duplexers, diplexers, and multiplexers, with enhanced temperature compensation, low insertion loss, and miniaturization.

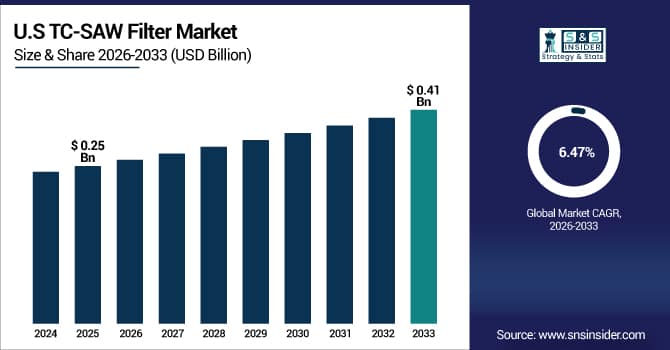

The U.S. TC-SAW Filter Market size was valued at USD 0.25 Billion in 2025E and is projected to reach USD 0.41 Billion by 2033, growing at a CAGR of 6.47% % during 2026-2033. The U.S. TC-SAW Filter Market is growing due to strong 5G deployment, high demand for advanced RF front-end modules in smartphones, rising IoT adoption, and increasing use in defense, aerospace, and automotive communication systems supported by robust semiconductor innovation and manufacturing capabilities.

TC-SAW Filter Market Growth Drivers:

-

TC-SAW Filter Market Growth Driven by 4G 5G IoT Automotive and Consumer Electronics Adoption

The TC-SAW Filter Market is propelled by rapid advancements in wireless communication technologies, particularly the rising adoption of 4G/5G networks that require high-performance RF filtering solutions. Mobile and smartphone manufacturers increasingly depend on TC-SAW filters for stable frequency control, enhanced signal integrity, and improved temperature performance across multi-band operations. The accelerating proliferation of IoT, M2M, and LPWAN devices also fuels demand, as these applications require compact, energy-efficient, and cost-effective filters capable of supporting diverse connectivity standards. Additionally, growing integration of RF components in consumer electronics, automotive telematics, V2X communication, and industrial automation systems further strengthens market growth. The U.S., Japan, South Korea, and China continue to drive adoption, benefiting from strong semiconductor manufacturing ecosystems and high device penetration rates.

Major automakers like Tesla, Toyota, and BMW embed TC-SAW-based RF filters in telematics control units, GPS modules, and V2X communication systems.

TC-SAW Filter Market Restraints:

-

TC-SAW Filter Market Faces Challenges from Advanced RF Technologies Pricing Pressures and Supply Chain Constraints

The TC-SAW Filter Market faces restraints due to increasing competition from advanced RF technologies such as BAW and FBAR filters, which offer better performance at higher frequencies. Limited suitability of TC-SAW filters for mmWave applications, pricing pressures, and rapid miniaturization demands challenge manufacturers. Additionally, supply chain constraints and dependence on specialized materials restrict large-scale production efficiency.

TC-SAW Filter Market Opportunities:

-

Advanced TC-SAW Filters Unlock Opportunities Driving High Frequency Connectivity Automotive Smart Infrastructure and 6G Innovation

Significant opportunities emerge from the expanding need for advanced filters that support higher frequency ranges, including Wi-Fi 6/6E, sub-6 GHz 5G, and upcoming 6G communication technologies. As devices become more compact, demand for highly integrated modules such as TC-SAW duplexers, diplexers, and multiplexers continues to increase. Growth in automotive connectivity, smart infrastructure, and defense communication systems provides further potential for specialized, ruggedized TC-SAW variants. Rising investments in telecom infrastructure across emerging regions and the shift toward multi-band, carrier-aggregation-enabled smartphones also open new avenues. Moreover, manufacturers focusing on enhanced temperature compensation, lower insertion loss, and miniaturization can unlock competitive advantages in next-generation RF front-end designs.

Companies like Murata, TDK, and Taiyo Yuden are developing ultra-miniature TC-SAW filters with reduced insertion loss to meet OEM requirements for compact RF modules

TC-SAW Filter Market Segment Analysis

-

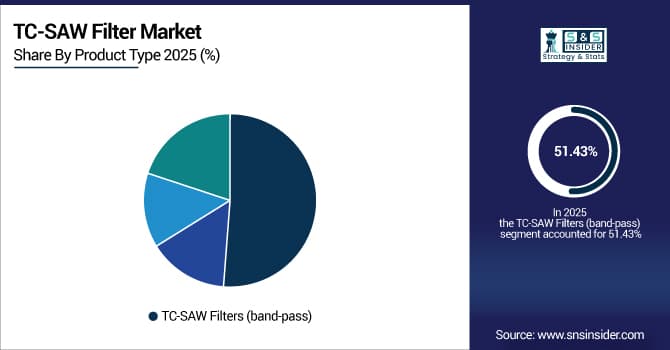

By Product Type, TC-SAW Filters (band-pass) dominated with 51.43% in 2025E, and TC-SAW Duplexers & Diplexers is expected to grow at the fastest CAGR of 7.78% from 2026 to 2033.

-

By Frequency Band, Mid Frequency (1–2.5 GHz) dominated with 45.77% in 2025E, and High Frequency (2.5–6 GHz) is expected to grow at the fastest CAGR of 7.33% from 2026 to 2033.

-

By Application, Mobile & Smartphones (RF front-ends) dominated with 48.87% in 2025E, and IoT, M2M & LPWAN devices is expected to grow at the fastest CAGR of 7.98% from 2026 to 2033.

-

By End User, OEMs (smartphone/tablet manufacturers) dominated with 43.73% in 2025E, and RF module & filter manufacturers is expected to grow at the fastest CAGR of 7.49% from 2026 to 2033.

By Product Type, TC-SAW Band-Pass Filters Dominate Market While Duplexers and Diplexers Drive Fastest Growth Through 2033

The TC-SAW Filters (band-pass) segment dominated the market in 2025E due to its widespread use in smartphones, IoT devices, and RF front-end modules requiring efficient mid-band filtering. Meanwhile, TC-SAW Duplexers & Diplexers are expected to witness the fastest CAGR from 2026–2033, driven by increasing carrier aggregation, multi-band device requirements, and the growing demand for compact, high-performance integrated RF modules in 5G-enabled consumer electronics and wireless infrastructure.

By Frequency Band, Mid Frequency Leads TC-SAW Filter Market While High Frequency Segment Projects Fastest Growth Through 2033

The Mid Frequency (1–2.5 GHz) segment dominated the TC-SAW Filter Market in 2025E due to its extensive use in LTE and 5G sub-6 GHz communication bands, supporting the majority of mobile and IoT connectivity. In contrast, the High Frequency (2.5–6 GHz) segment is projected to grow at the fastest CAGR from 2026–2033, fueled by rising adoption of 5G NR, Wi-Fi 6/6E, and advanced RF front-end modules requiring higher-band filtering performance.

By Application, Mobile Smartphones Dominate TC-SAW Filter Market While IoT Devices Drive Fastest Future Growth

The Mobile & Smartphones (RF front-ends) segment dominated the TC-SAW Filter Market in 2025E owing to the high volume of 4G/5G smartphones requiring multi-band, temperature-stable filtering solutions. Meanwhile, IoT, M2M & LPWAN devices are expected to record the fastest CAGR from 2026–2033, driven by rapid expansion of connected devices, smart home systems, industrial automation, and low-power wide-area networks that rely on compact, cost-efficient TC-SAW filters for reliable wireless communication.

By End User, OEMs Lead TC-SAW Filter Market While RF Module Manufacturers Drive Fastest Future Growth Through Innovation

The OEMs (smartphone/tablet manufacturers) segment dominated the TC-SAW Filter Market in 2025E, supported by the high production volume of 4G/5G devices that require advanced, multi-band RF filtering solutions. In contrast, RF module & filter manufacturers are expected to witness the fastest CAGR from 2026–2033 as demand grows for customized, high-frequency, and highly integrated TC-SAW components in next-generation RF front-end modules, driven by 5G expansion, IoT scale-up, and increasing device miniaturization.

TC-SAW Filter Market Report Analysis

North America TC-SAW Filter Market Insights

North America accounted for 22.64% of the TC-SAW Filter Market in 2025E, driven by strong adoption of 4G/5G smartphones, expansion of telecom infrastructure, and high penetration of IoT and connected devices. The region benefits from leading RF component manufacturers, advanced semiconductor capabilities, and strong demand across automotive, consumer electronics, aerospace, and defense sectors, supporting steady market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. TC-SAW Filter Market Insights

In the North America region, the United States dominated the TC-SAW Filter Market in 2025E. The U.S. leads due to its strong semiconductor ecosystem, high 5G deployment rate, large smartphone user base, and significant demand from aerospace, defense, automotive, and consumer electronics industries.

Europe TC-SAW Filter Market Insights

Europe accounted for 16.87% of the TC-SAW Filter Market in 2025E, driven by increasing adoption of 4G/5G networks, advanced industrial automation, and rising demand for connected vehicles and smart infrastructure. Countries like Germany, France, and the UK lead the market due to strong telecom investments, high smartphone penetration, and growing deployment of IoT and wireless communication systems. The presence of leading RF component manufacturers and emphasis on miniaturized, high-performance filters supports steady regional market growth.

Germany TC-SAW Filter Market Insights

In Europe, Germany dominated the TC-SAW Filter Market in 2025E. Germany leads due to its strong automotive industry, high adoption of industrial automation and IoT technologies, significant 5G infrastructure investments, and the presence of major electronics and RF component manufacturers driving demand for advanced TC-SAW filters.

Asia Pacific TC-SAW Filter Market Insights

The Asia Pacific region dominated the TC-SAW Filter Market in 2025E with a 46.24% share, driven by high smartphone production, rapid 4G/5G adoption, and growing demand for IoT, automotive, and consumer electronics applications. The region is expected to record the fastest CAGR of 7.27% from 2026–2033, supported by strong manufacturing capabilities, increasing multi-band and high-frequency device deployment, and rising investments in telecom infrastructure and next-generation wireless communication technologies.

China TC-SAW Filter Market Insights

In the Asia Pacific region, China dominated the TC-SAW Filter Market in 2025E. China leads due to its massive smartphone manufacturing base, rapid 5G rollout, high adoption of IoT and connected devices, and strong presence of major RF component manufacturers supporting both domestic and global demand.

Latin America (LATAM) and Middle East & Africa (MEA) TC-SAW Filter Market Insights

Latin America (LATAM) and Middle East & Africa (MEA) together account for a smaller share of the TC-SAW Filter Market, driven by emerging telecom infrastructure, growing smartphone adoption, and increasing IoT deployment. Moderate growth is supported by investments in 4G/5G networks, industrial automation, and connected devices. While the market remains nascent compared to other regions, rising demand for cost-effective and compact RF filtering solutions presents opportunities for future expansion.

Competitive Landscape for TC-SAW Filter Market:

Murata Manufacturing Co. Ltd. is a Japan-based global leader in electronic components, specializing in TC-SAW, SAW, and BAW filters. The company provides high-performance RF solutions for smartphones, IoT devices, automotive electronics, and wireless infrastructure, enabling stable frequency control, temperature compensation, and multi-band operation across global communication and consumer electronics markets.

-

In July 2025, Murata announced mass production and commercial shipment of its first high‑frequency XBAR filter, combining its SAW expertise with XBAR tech to support next-gen wireless (5G, Wi-Fi 6E/7, future 6G), offering low insertion loss and high attenuation.

Qualcomm Technologies Inc. is a leading U.S.-based semiconductor and telecommunications company specializing in RF front-end solutions, including TC-SAW, SAW, and BAW filters. The company drives innovations in 4G/5G smartphones, IoT, and wireless communication systems, providing high-performance, temperature-stable, and multi-band filtering solutions for global mobile and connected device markets.

-

In February 2024, Rohde & Schwarz announced a collaboration with Qualcomm to test and demonstrate new frequency ranges (FR3: 7.125‑24.25 GHz) for 5G-Advanced / 6G, which could impact future RF front‑end filter design.

TC-SAW Filter Market Key Players:

Some of the TC-SAW Filter Market Companies

-

Murata Manufacturing Co. Ltd.

-

TAIYO YUDEN Co. Ltd.

-

Qorvo Inc.

-

Skyworks Solutions Inc.

-

TDK Corporation

-

Qualcomm Technologies Inc.

-

Broadcom Inc.

-

Kyocera Corporation

-

ROHM Semiconductor

-

Tai-Saw Technology Co. Ltd.

-

RF360 Holdings (a Qualcomm–TDK joint venture)

-

Infineon Technologies AG

-

WISOL Co. Ltd.

-

Abracon LLC

-

CTS Corporation

-

NDK Nippon Denpa Co. Ltd.

-

Skyworks Filter Solutions

-

Akoustis Technologies Inc.

-

Teledyne Microwave Solutions

-

Cobham Advanced Electronic Solutions

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.44 Billion |

| Market Size by 2033 | USD 2.43 Billion |

| CAGR | CAGR of 6.84% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (TC-SAW Filters (band-pass), TC-SAW Resonators, TC-SAW Duplexers & Diplexers, and TC-SAW Multiplexers / Multi-band Modules) • By Frequency Band (Low Frequency (< 1 GHz), Mid Frequency (1–2.5 GHz), High Frequency (2.5–6 GHz), and Ultra-High / Emerging Bands (> 6 GHz)) • By Application (Mobile & Smartphones (RF front-ends), Wireless Infrastructure (base stations, small cells, repeaters), IoT, M2M & LPWAN devices, Automotive (telematics, V2X), and Consumer Electronics (wearables, routers)) • By End User (OEMs (smartphone/tablet manufacturers), RF module & filter manufacturers, Network equipment vendors / carriers, and EMS/Contract manufacturers and distributors) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Murata Manufacturing Co. Ltd. TAIYO YUDEN Co. Ltd. Qorvo Inc. Skyworks Solutions Inc. TDK Corporation Qualcomm Technologies Inc. Broadcom Inc. Kyocera Corporation ROHM Semiconductor Tai-Saw Technology Co. Ltd. RF360 Holdings Infineon Technologies AG WISOL Co. Ltd. Abracon LLC CTS Corporation NDK Nippon Denpa Co. Ltd. Skyworks Filter Solutions Akoustis Technologies Inc. Teledyne Microwave Solutions Cobham Advanced Electronic Solutions |