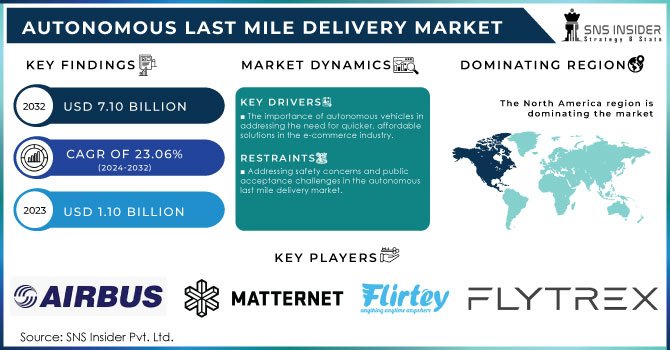

Autonomous Last Mile Delivery Market Size & Growth:

The Autonomous Last Mile Delivery Market size was valued at USD 1.10 Billion in 2023. It is estimated to reach USD 7.10 Billion by 2032, growing at a CAGR of 23.06% during 2024-2032. Advancements in artificial intelligence, robotics, and logistics automation are fueling the rapid growth of the autonomous last mile delivery market. Autonomous delivery technologies are becoming a solution to tackle these inefficiencies, offering to streamline operations, cut labor expenses, and improve customer satisfaction. In 2023, the United States made substantial investments, surpassing USD 600 million, that have driven market expansion. At present, there are more than 500 autonomous last mile delivery devices in use, like ground robots and drones, with significant implementations in different U.S. cities. Well-known retailers like Walmart and Kroger are currently testing these advancements. Ground robots are the most common, making up approximately 60% of the total fleet. Around 40% of American consumers are interested in using these services. Autonomous last mile delivery can reduce delivery expenses by up to 30% and decrease carbon emissions by approximately 15% per delivery.

Get E-PDF Sample Report on Autonomous Last Mile Delivery Market - Request Sample Report

The increase in online shopping is a main factor fueling the growth of the autonomous last mile delivery industry. E-commerce sales in the U.S. hit over USD 2 trillion in 2023, with retail e-commerce contributing about USD 936 billion, making up roughly 20% of overall retail sales. Roughly 80% of internet users in the United States bought something online in the previous year, with the typical shopper spending about USD 4,500 on the internet. Major e-commerce sectors consist of electronics, clothing, and household items, while online grocery sales are experiencing rapid expansion, valued at approximately USD 100 billion. Amazon continues to be the leading competitor in 2023, with approximately 40% of market share, followed by Walmart, eBay, and Target. Faster delivery options are now essential, as 90% of online shoppers prioritize fast shipping, leading to the popularity of same-day delivery and next-day delivery services. As more customers choose to shop online, companies are feeling the need to offer fast and dependable delivery options. Autonomous delivery systems can function around the clock, removing limitations caused by human work schedules and shortages in labor. In addition, decreasing human participation may result in reduced costs, allowing for decreased shipping fees for customers.

Autonomous Last Mile Delivery Market Dynamics

Drivers

-

The importance of autonomous vehicles in addressing the need for quicker, affordable solutions in the e-commerce industry.

With the development of e-commerce and online shopping, there is an enormous influence on the demand for fast and efficient last-mile delivery. More and more customers resort to e-commerce and need their purchases to be delivered as soon as possible. Subsequently, businesses that establish and offer these delivery services face the necessity of developing added value for their customers by accelerating and optimizing the process of delivery. At the same time, there is the challenge of reducing operational costs, and many companies solve it with the help of autonomous delivery vehicles as the solution to the challenges of last-mile delivery. The advantages of online shopping for customers have aggravated the situation with different aspects of delivery. Customers want to benefit from instrumental convenience and order their desired purchases online. However, the same customers demand the delivery of these purchases shortly and as soon as possible. These factors determine the benefits and the promise of implementing autonomous last-mile delivery systems. The systems can ensure the high quality of services and finalize these deliveries promptly. Besides, they can deliver 24/7 even after the end of the working day when the work of other delivery services is typically transferred to the following day. In addition, these systems meet the demand for same-day or next-day delivery, which is supported by market growth every year.

-

Enhancing security and customer trust through contactless solutions.

A reduction in the level of human interaction at the stage of delivery transitioned to the increased popularity of autonomous last-mile delivery. By definition, it is oriented toward the possibility of delivering products to the client without direct contact with the delivery person. As was previously mentioned, public concern for the preservation of their health and high levels of hygiene led to such a significant relevant rise in demand. Contactless delivery is more beneficial from the point of view of security and safety of customers. Autonomous delivery vehicles are equipped with special secure compartments for the carrying of goods. Therefore, autonomously transporting them, drivers are not to come into direct contact with goods that a customer will eventually get. Those compartmental containers also guarantee the safe delivery of products, excluding any possibility of damage. It is an effective method for improving loyal customer relationships and trust in the applied delivery system. In the current market, the convenience of delivery services is one of the leading customer requirements. Therefore, the use of an autonomous vehicle for deliver is a popular form of integral differentiation of goods and services.

Restraints

-

Addressing safety concerns and public acceptance challenges in the autonomous last mile delivery market.

Public acceptance and safety concerns present major restraints for the Autonomous Last Mile Delivery Market. While autonomous vehicles offer many advantages, safety concerns, and their potential unreliability give cause for concerns. High-profile accidents and other instances of autonomous vehicles malfunctioning can erode public faith in these vehicles, thereby reducing public acceptance of autonomous delivery solutions. Safety concerns for autonomous systems extend beyond single events and vehicle operators. Autonomous vehicles will need to operate in complex urban environments, at much lower speeds than many other vehicles, and so must take into account many variables such as pedestrians, cyclists, other vehicles, road conditions, and weather. The relatively high number of variables that may change rapidly makes it difficult to predict all potential issues for autonomous vehicles, thereby necessitating constant testing and monitoring. As such, the task of ensuring that such systems are safe and reliable is complex and potentially resource-intensive. Public acceptance, on the other hand, can be affected by the baseline attitudes of society towards new technology and fears of job loss. Autonomous delivery systems may potentially reduce employment prospects for last-mile delivery drivers, and so such concerns also need to be addressed if the market is to take off at a high speed.

Autonomous Last Mile Delivery Market Segmentation

By Platform

Ground delivery vehicle platform led the market in 2023 with a market share of 75%. These vehicles are created to drive themselves on streets using sophisticated sensors and AI technology to maneuver through city and suburban areas. They provide substantial benefits in scalability and capacity, managing higher amounts of packages than drones. Nuro and Rivian are at the forefront of this industry with Nuro's autonomous delivery vans tailored for transporting groceries and goods, and Rivian working on electric delivery vans for Amazon that prioritize sustainability and efficiency.

Aerial delivery drones are accounted to have a major growth rate during the forecast period. These drones can avoid traffic and access remote or congested areas swiftly, providing a fast and effective delivery solution. They are especially beneficial for delivering small packages and time-sensitive shipments. Companies like Wing (owned by Alphabet) and Zipline are leaders in this area.

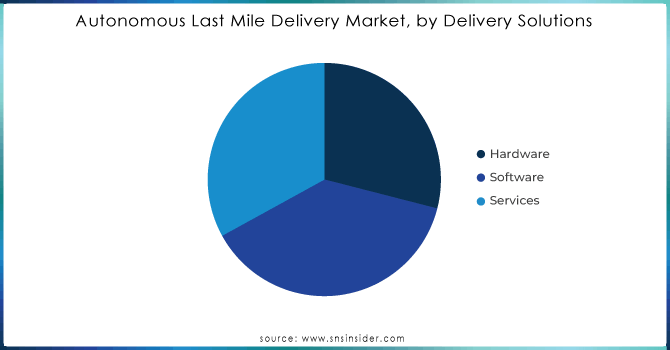

By Delivery Solutions

The hardware segment had a major market share of over 41% in 2023. This sector dominates the industry because of the crucial role of these technologies in carrying out independent delivery activities. Hardware is crucial as it consists of the necessary infrastructure and devices for carrying out delivery solutions. For example, companies such as Nuro focus on autonomous delivery vehicles made for final-stage logistics, greatly affecting city delivery efficiency.

The services sector is accounted to have the fastest CAGR during 2024-2032 because of the rising need for comprehensive solutions with features like route optimization, live tracking, and customer assistance. The growth of this segment is fueled by the demand for complete service packages that improve operational efficiency and customer satisfaction. Businesses such as Starship Technologies are broadening their offerings by providing comprehensive delivery solutions that combine their autonomous robots with advanced service platforms.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Range

Short Range segment dominated in 2023 with an 80% market share. This section experiences cost savings and decreased complexity by enabling vehicles to travel through well-known, heavily populated areas. Small, lightweight delivery robots or electric vehicles are frequently used for short-term solutions, especially in urban areas with frequent stops. Starship uses robots to deliver groceries and packages in neighborhoods, while Nuro focuses on delivering goods from nearby stores to people's homes.

Long-distance segment is to experience a rapid growth rate during 2024-2032. This section frequently needs advanced technology to manage various road conditions and longer durations of travel. Cars in this class are generally bigger and sturdier, built for faster speeds and longer trips, incorporating advanced navigation and communication technology. TuSimple specializes in autonomous long-distance trucking, moving products over large distances from warehouses to nearby centers or stores.

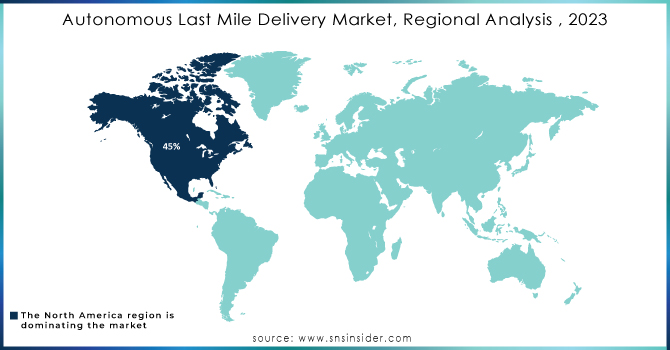

Autonomous Last Mile Delivery Market Regional Analysis

North America led the market in 2023 with 45% market share. This control is fueled by sophisticated technological infrastructure, substantial investment in autonomous vehicle research, and a significant number of leading technology companies. Amazon and Google are leading the way; Amazon is rolling out autonomous delivery robots in certain locations and Alphabet, Google's parent company, is making significant investments in autonomous vehicle technology with Waymo. The regulatory environment in the U.S. and Canada, along with their large consumer base, also helps strengthen the market position of the region.

The APAC region is accounted to have a faster CAGR during the forecast period 2024-2032. This growth is being driven by rapid urbanization, a growing middle class, and a rise in investments in smart city projects. China and Japan are at the forefront of embracing autonomous delivery technologies, with corporations allocating funds towards autonomous delivery robots and drones. For example, Delivery robots from JD.com are increasingly seen in Chinese cities, as Alibaba incorporates autonomous technology into its delivery system.

KEY PLAYERS

The key players in the Autonomous Last Mile Delivery market are:

-

Airbus S.A.S. (Skyways Drone Delivery System, Vahana)

-

Matternet (Matternet M2, Station M)

-

Flirtey (Flirtey Eagle, Flirtey Delivery Platform)

-

Drone Delivery Canada (Sparrow Drone, Condor Drone)

-

Flytrex (Flytrex Mule, Flytrex Hub)

-

Amazon.com (Amazon Scout, Prime Air)

-

JD.com Inc. (JD Autonomous Delivery Robots, JD Delivery Drones)

-

Marble Robot (Marble Autonomous Delivery Robot, Marble's Delivery Fleet Management System)

-

Starship Technologies (Starship Delivery Robots, Fleet Management System)

-

Savioke (Relay Robot, Relay+)

-

DHL International GmbH (DHL Parcelcopter, StreetScooter)

-

United Parcel Service of America, Inc. (UPS Flight Forward, UPS Delivery Bots)

-

DPD (DPD Robotics Delivery Solution, DPD City Drones)

-

Starship Technologies (Starship Delivery Robots, Fleet Management System)

-

Nuro (Nuro R2, Nuro G2)

-

Wing (Alphabet) (Wing Delivery Drones, Airspace Systems)

-

FedEx (FedEx SameDay Bot (Roxo), SenseAware ID)

-

UPS (UPS Flight Forward, UPS Delivery Bots)

RECENT DEVELOPMENT

-

March 2024: DroneUp, America's leading autonomous drone delivery company, today unveiled groundbreaking technology to revolutionize last-mile logistics.

-

February 2024: Estonian delivery robot company Starship Technologies announced today that it has raised $90 million, co-led by Plural and Iconical.

-

March 2024: DHL announced its plans to launch a fleet of autonomous delivery vans, designed in partnership with a leading tech firm, to begin operating in urban areas across Germany

-

September 2023: Google's sister company, Wing, launched a new, smaller autonomous drone designed for last-mile delivery of small packages. The drone can carry out fully autonomous deliveries within a 10-mile radius.

-

March 2023: Starship Technologies increased the number of its autonomous robots operating on university campuses, reaching over 50 campuses globally. These robots deliver food and packages.

-

January 2023: Nuro launched its third-generation autonomous delivery robot, designed to handle larger payloads and include enhanced safety features.

-

July 2023: Serve Robotics, known for sidewalk autonomous robots, expanded its partnership with Uber Eats to provide autonomous food deliveries in major U.S. cities.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.10 Billion |

| Market Size by 2032 | USD 7.10 Billion |

| CAGR | CAGR of 23.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Ground Delivery Vehicles, Aerial Delivery Drones) • By Solution (Hardware, Software, Services) • By Range (Short Range, Long Range) • By End User (Food & Beverages, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Airbus S.A.S., Matternet, Flirtey, Drone Delivery Canada, Flytrex, Amazon.com, JD.com Inc., Marble Robot, Starship Technologies, Savioke, DHL International GmbH, United Parcel Service of America, Inc., DPD, Amazon, Starship Technologies, Nuro, Wing (Alphabet), FedEx, UPS |

| Key Drivers | • The importance of self-driving vehicles in addressing the need for quicker, affordable solutions in the e-commerce industry. • Enhancing security and customer trust through contactless solutions. |

| RESTRAINTS | • Addressing safety concerns and public acceptance challenges in the autonomous last mile delivery market. |