Kitchen Appliances Market Report Scope & Overview:

Get More Information on Kitchen Appliances Market - Request Sample Report

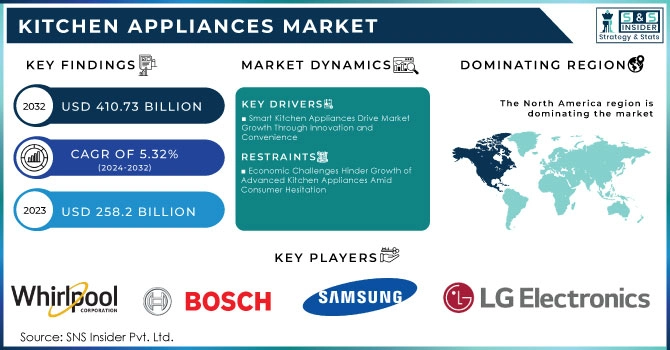

The Kitchen Appliances Market Size was valued at USD 258.2 Billion in 2023 and is expected to reach USD 410.73 Billion by 2032 and grow at a CAGR of 5.32% over the forecast period 2024-2032.

The kitchen appliances market is growing strongly because of increased demand for convenience and technology, along with the trend of smart homes. Consumers are becoming busier with time. There is an ever-increasing demand for time-saving, energy-friendly, and multi-function kitchen appliances. Such products include smart ovens, smart touchscreen refrigerators, and artificially integrated cooking appliances that allow ease and connectivity via the IoT. In addition to this is the disposable income of consumers and greater awareness of environmentally friendly and energy-efficient products. Ecological washing machines, high-class induction cooktops, and other high-quality kitchen appliances are determining the future orientations of the market. Consumers tend to opt for appliances that consume less energy while supplementing the function of an appliance.

LG Electronics, a South Korean electronics company, plans to sell built-in appliances worth 1 trillion won (USD 722 million) globally by 2030, nearly doubling an estimated 500 billion won in sales in 2023. The most promising region for LG is Europe, as it holds 42% of the global built-in appliance market with USD 21.2 billion in sales in 2023. LG will not miss the opportunity by aggressively marketing their high-end and midrange products, coupled with proprietary AI technology for connection with European consumers.

The trend of home delivery services and health-conscious lifestyles is fueling the at-home cooking trend, which is the highest consumer of modern kitchen appliances, namely air fryers, blenders, and multifunctional cookers. The market should continue to be stable going forward due to further innovation in the product and an expansion of the e-commerce platform, hence increasing accessibility among a global consumer base.

Kitchen Appliances Market Dynamics

Key Drivers:

-

Smart Kitchen Appliances Drive Market Growth Through Innovation and Convenience

As smart kitchen appliances are seeing rising adoption, kitchen appliances market growth drivers seem to gain pace steadily. This is evident because such appliances have a huge demand due to enhanced functionalities, energy efficiency, and also due to increased automation with home automation. Controlling through smartphones or even voice assistants, smart refrigerators, ovens, and dishwashers somewhat lead the line now, as they are convenient and user-friendly. This trend is all the more pronounced among tech-savvy consumers and young demographics, who are more interested in seamless integration with overarching smart home ecosystems for their kitchen appliances.

-

Rising Energy Efficiency in Kitchen Appliances Fuels Market Growth Through Sustainability

Increasing energy efficiency in the kitchen stems from consumers' growing environmental concerns and rising utility costs. Consumers are therefore looking for appliances that meet not only efficiency but also sustainable practice standards, such as reducing carbon footprints and minimizing waste. Government regulation and incentives, such as energy efficiency ratings and rebates on appliances that save energy are the other factors driving demand in this direction. As concern for the environment keeps building up, so does the development and adoption of energy-saving technologies in the kitchen appliance industry, hence taking market growth to another higher level.

Restrain:

-

Economic Challenges Hinder Growth of Advanced Kitchen Appliances Amid Consumer Hesitation

kitchen appliances as they incur costly initial investments in very advanced smart, energy-efficient ones. Most consumers, especially in emerging markets, do not want to spend too much money or invest any further in fancy kitchen appliances. In times of economic fluctuations and uncertainty in terms of inflation or recession, consumers also alter spending on non-essential items like kitchen appliances. These factors would cause a lag in the market growth of appliances, mainly where the appliance is considered luxury rather than a necessity. Manufacturers are further squeezed on trying to keep quality in step with affordability to reach out to a wider number of people.

Kitchen Appliances Market Segmentation Overview

BY Product

Refrigerators accounted for the largest portion of the revenue in the kitchen appliances market, which stood at more than 35.89%. In the pursuit of food and beverage storage solutions primarily for merchandising purposes, demand has remained elevated in the commercial space. Demand for replacing older models with newer variants will contribute to an increase in the coming years, as consumers as well as businesses seek better features and energy efficiency.

The cooking appliances segment is expected to grow the highest during the forecast period with a CAGR of 6.59%. This category, which comprises cooktops & ranges, ovens, and others, encourages growth based on this trend of smart homes and connected technologies. Consumers would prefer more appliances they could control and monitor via their smartphones or voice-activated assistants.

by Technology

The conventional appliances segment had the highest revenue share, with a market size exceeding 72.67% in 2023. This is because the number of customers asking for such appliances exceeds many expectations, as most customers love the traditional appliances and hence find them easy to use. Many users feel much more comfortable and confident with traditional designs and functionalities. In addition, conventional appliances are more cost-effective as compared to more advanced, high-tech ones. This also boosts its demand among budget-sensitive consumers.

The smart appliances segment is expected to maintain the growth pace with the highest CAGR of 7.91% over the forecasting period, thereby expecting to increase the demand for smart homes and rapid adoption of IoT technologies. Such appliances provide users with easy control and monitoring from anywhere, thanks to smartphone applications or voice assistants. Such a trend towards smart technology further accelerates the demand for smart kitchen appliances.

by Application

The residential segment has acquired 63.8% of the overall revenue share in 2023. The growth is resulting from an expanding global population and rapid urbanization. Such a trend has boosted residential construction and housing development. With increased home construction, the requirement for kitchen appliances has increased and led to a larger market for the residential sector.

The commercial is projected to capture the largest CAGR of 7.10% in the entire forecast period. Refrigeration equipment in commercial usage is dominant within every type of setting, including grocery stores, convenience stores, cafeterias, restaurants, specialty food outlets, and supermarkets. High disposable income, lifestyle changes, and growing replacement of old appliances are likely to contribute significantly to market growth for residential kitchen appliances over the entire forecast period.

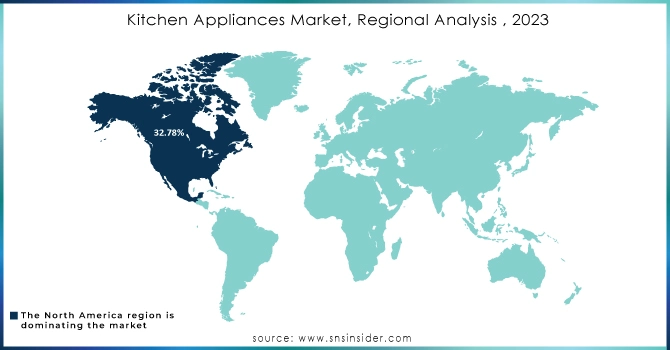

Regional Analysis

North America led the market, capturing the largest revenue share of 32.78% in 2023. It has been fundamentally driven by the growth of the region due to its technological advancements. The arrival of new features like touch screens, wireless connectivity, and advanced sensors fueled consumers' interest, hence, many of them want their updated kitchen appliances.

Asia Pacific is expected to grow at a 6.89% CAGR during the forecast period. This is because of the increase in residential projects and the steadily on-rising nuclear family trend in this region. Growth in the infrastructure of power, especially in rural India, is likely to provide new growth opportunities for industry players in the region. The expansion of the power infrastructure, especially for rural India, is to provide new growth opportunities to industry players. Improved electrification and quality of living in rural areas, through government initiatives, are to improve demand for basic home appliances.

Need Any Customization Research On Kitchen Appliances Market - Inquiry Now

Key Players in Kitchen Appliances Market

Some of the major players in the Kitchen Appliances Market are:

-

Whirlpool Corporation (Refrigerators, Ovens)

-

Bosch (Dishwashers, Cooktops)

-

Samsung Electronics (Smart Refrigerators, Microwave Ovens)

-

LG Electronics (Smart Ovens, Washers)

-

General Electric (GE) (Refrigerators, Ranges)

-

Electrolux (Dishwashers, Refrigerators)

-

Frigidaire (Microwave Ovens, Range Hoods)

-

KitchenAid (Stand Mixers, Ovens)

-

Miele (Coffee Machines, Dishwashers)

-

Panasonic (Microwave Ovens, Induction Cooktops)

-

Haier (Refrigerators, Washing Machines)

-

Toshiba (Microwave Ovens, Rice Cookers)

-

Sharp (Microwave Ovens, Dishwashers)

-

Whirlpool India (Washing Machines, Refrigerators)

-

Beko (Refrigerators, Washing Machines)

-

Maytag (Dryers, Refrigerators)

-

Viking Range (Ranges, Refrigerators)

-

Wolf Appliance (Ranges, Ovens)

-

Smeg (Refrigerators, Cooktops)

-

Aga Rangemaster (Cookers, Ovens)

Recent Trends

-

In Sep 2024, Daewoo announced its entry into the kitchen and home appliances segment in India, Korean brand Daewoo said that the company aims to bag a bigger share of the burgeoning Indian market. The company entered the domestic market last year and offers a range of LED TVs, IFP LEDTVs, Alkaline, and battery inverters.

-

In June 2024, Bengaluru-based Atomberg, which manufactures premium fans, is now getting into the kitchen appliance space. The company plans to launch complementary products like juicers and food processors over the next 12-15 months.

-

March 2024, V-Guard Consumer Products (VCPL), a wholly-owned subsidiary (WOS) of the company commenced commercial production of kitchen appliances (mixer grinder & gas stove) at its manufacturing facility set up in Vapi, Gujarat on 6 March 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 258.2 Billion |

| Market Size by 2032 | USD 410.73 Billion |

| CAGR | CAGR of 5.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Refrigerator, Cooking Appliances (Cooktops & cooking range, Ovens, Others), Dishwasher, Range Hood, Others) • By Technology (Conventional, Smart Appliances) • By Application (Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Whirlpool Corporation, Bosch, Samsung Electronics, LG Electronics, General Electric (GE), Electrolux, Frigidaire, KitchenAid, Miele, Panasonic, Haier, Toshiba, Sharp, Whirlpool India, Beko, Maytag, Viking Range, Wolf Appliance, Smeg, Aga Rangemaster |

| Key Drivers | • Smart Kitchen Appliances Drive Market Growth Through Innovation and Convenience • Rising Energy Efficiency in Kitchen Appliances Fuels Market Growth Through Sustainability |

| RESTRAINTS | • Economic Challenges Hinder Growth of Advanced Kitchen Appliances Amid Consumer Hesitation |