Telecom Expense Management Market Report Scope & Overview:

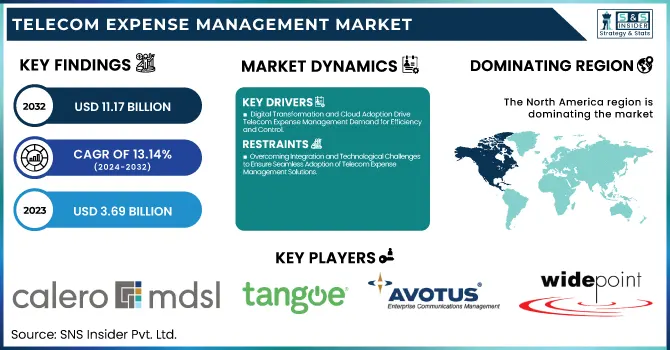

The Telecom Expense Management Market was valued at USD 3.69 billion in 2023 and is expected to reach USD 11.17 billion by 2032, growing at a CAGR of 13.14% over the forecast period 2024-2032.

To Get more information on Telecom Expense Management Market - Request Free Sample Report

The Telecom Expense Management (TEM) market is witnessing strong growth, owing to the complexity of telecom services, high telecom infrastructure management costs, and rising telecom expenses. Because of this, organizations especially from verticals like IT, telecom, and BFSI cannot keep track of huge telecom expenses, manage them, and optimize them. The rise of telecom usage due to the rapidly growing adoption of advanced technologies like 5G, cloud computing, and IoT has also seen rising telecom costs. The demand in the market is driven by the need for companies to optimize telecom expenditure, ensure compliance, and eliminate billing errors, which can be achieved through TEM solutions. In addition, the difficulties in providing necessary telecom services from various vendors worldwide as these businesses grow and become more global increases the demand for effective TEM solutions as well. The growing number of deployed Bring Your Own Device (BYOD) policies, adopted in more than 60% of organizations, is also increasing your telecom bills. 5G will roll out through the year, by the end of 2024 more than 2.8 billion people can expect coverage and >20 billion IoT device connections. These solutions help organizations achieve 20% lower telecom costs and annual savings of up to 20% for large enterprises by service optimization and error elimination.

Furthermore, the growth of the market is attributed to the rising demand for automation and cost optimization in different industries. TEM solutions help organizations remove manual processes such as invoice, dispute resolution, and usage tracking, thus saving operational time and effort in telecom expense management. That is another factor driving the TEM market as the necessity to enhance financial visibility and minimize operational costs initiatives are gaining traction. This is especially true for heavy telecom customers such as BFSI, healthcare, and manufacturing industries, where they need to manage expenses more effectively to remain profitable and efficient. In 2024, over 70% of telecom management processes like telecom invoice validation, dispute, etc are automated with TEM solutions. 22% of Global Telecom Spending comes from the BFSI sector, and these costs are growing at a rage of 8% per year. More than 10 million connected devices are expected to be deployed in the healthcare industry, increasing telecom service demand. Telecom services contribute to about 15% of operational expenses in manufacturing. Through the elimination of billing errors and tuning usage, companies are reporting 18% annual savings by using TEM, and large enterprises are saving up to 25%.

MARKET DYNAMICS

KEY DRIVERS:

- Digital Transformation and Cloud Adoption Drive Telecom Expense Management Demand for Efficiency and Control

The growth of the Telecom Expense Management (TEM) market is primarily attributed to the growing need for digital transformation and the feasibility of advanced technologies for other industries. With enterprises transitioning to cloud, virtualization, and automation, efficient telecom service management is becoming imperative. Heavy connectivity comes coupled with digital transformation, and this means that companies are relying on complex telecom systems that need to be monitored and optimized. TEM solutions also help businesses to exercise more control over telecom contract management, as well as monitoring performance for both inefficiencies and redundancy ensuring that businesses are agile and competitive at lower telecom costs. Integration of TEM with overall IT asset management systems is also becoming a trend, as organizations aim to tame their operational processes and improve resource resourcefulness across different sectors. The widespread adoption of smart technology means devices and networks are now more interconnected than ever before, and this naturally heightens the demand for TEM systems to assist organizations with the tracking and management of the increasing amount of telecommunication services that are used. As 92% of organizations have adopted cloud services in 2024, and as 79% of organizations are using multiple clouds, the telecom services used in these clouds will need to be effectively managed as well. Moreover, 51% of enterprise IoT adopters intent to increase their IoT budgets, and 22% are anticipating more than a 10% budget increase. Seventy-eight percent of organizations will integrate telecom services with IT and asset management systems by 2024, 70% of businesses will ramp-up smart device use.

- Rising Regulatory Pressures Fuel Telecom Expense Management Demand for Compliance and Data Security in Healthcare

Increasing regulatory pressure for improved compliance and data security, mainly in the highly regulated sectors including finance and healthcare, is another key factor contributing to the growth of the TEM market. With the mounting trend of regulations for data privacy, cost control, and vendor management, organizations need their telecom expense processes to be transparent and auditable, more than ever. TEM solutions are built with regulatory compliance in mind to offer features such as detailed industry reports and audit trails with secure data handling. This kind of feature is highly necessary for companies that are working under sectors where they have complex laws to protect data, like GDPR in Europe, or HIPAA in the U.S. Telco firms can ensure they stay compliant with regulatory standards and reduce their exposure to expensive penalties while maintaining higher data governance that further fuels the demand for telecom expense management solutions across various segments of the industry by tapping into TEM systems. At the time, 92% of healthcare organizations had suffered a cyberattack in 2024, and the average cost of a healthcare data breach increased to USD 9.77 million. 13 data breaches impacting more than 1 million records each hit U.S. healthcare systems. Violations of HIPAA can incur fines of up to USD 1.5 million on an annual basis, where GDPR can incur up to EUR 20 million or 4% of a business’s global turnover.

RESTRAIN:

- Overcoming Integration and Technological Challenges to Ensure Seamless Adoption of Telecom Expense Management Solutions

The challenge that limits the growth of the Telecom Expense Management (TEM) market is the rise in complexities in integrating TEM solutions with existing IT and telecom infrastructure. TEM solutions are often tricky to apply seamlessly in many businesses because they run with scores of legacy systems and provider variety on the telecom front. These solutions typically require time, resources, and expertise to integrate into a customer's existing IT architecture, which often results in delays when implementing them. This complexity acts as a roadblock preventing small companies or organizations with little IT capability from adopting TEM solutions and therefore, sluggish adoption can be observed. Also, the changing nature of telecom technologies such as the migration to 5G and the increasing number of IoT devices are another market challenge. TEM solutions have to update and innovate continuously to be aligned with such technological changes. Such fast-paced change would make it difficult to keep TEM solutions relevant and useful, and organizations need continual upgrades to meet challenges from new telecom service complexities and maintain the best performance.

SEGMENTS ANALYSIS

BY SOLUTION

The Invoice Management segment held the largest Telecom Expense Management (TEM) market share of over 34.6% in 2023 and is estimated to grow at the fastest CAGR between 2024 to 2032 due to these factors. The complex business environment First, the complexity of telecom services has increased, whether we talk about multiple service providers, different pricing models, and various billing cycles, invoice management has become an important need of the business. As telecom costs contribute heavily to operational expenditures, organizations today look for effective telecom expense management solutions to automate invoice processing, minimize invoice processing errors, and pay just for the services they consume. Invoice management-focused TEM solutions address this complexity by automating the capture, validation, and reconciliation of telecom invoices to achieve substantial cost savings. In addition, with more enterprises taking up enhanced innovations like cloud, 5G and IoT, telecom products and associated bills will likely see both higher volumes and diversity. These increasing expenses need to be managed and tracked and Invoice Management solutions are your solution to doing so. In addition, the increasing focus on cost control, openness, and regulation compliance is also boosting the automated invoice management system market growth. The increasing dominance of Telecom spend visibility and enhanced financial forecasting capability is making it a priority for several enterprises to invest in Invoice Management Solutions.

BY SERVICE

The hosted services vertical held the highest share of 65.9% in the Telecom expense management (TEM) market based on delivery type partly because hosted services can scale easily and are flexible and economical. In particular, hosted services provide cloud-enabled platforms for the outsourcing of telecom expense management without the need for substantial on-premise hardware. Given that they have to be more flexible and cost-effective at recreation, this is another excellent solution for businesses of all sizes, especially as the telecom service becomes more complex. In addition, hosted services provide the option to connect with already existing IT systems, allowing the business to manage telecom expenses in a seamless manner across multiple locations and telecom service providers. With organizations continuing to shift to the cloud and a hybrid and remote work model, the demand for such hosted TEM services will continue to be robust and hold a leading market share.

Managed Services are anticipated to be the leading sector, growing at the highest CAGR across 2024-2032, due to organizations opting for a larger scope, outsourced telecom expense management solutions. These managed services offer organizations full-fledged control over telecom expenses including strategy, implementation, optimization, and continuous support. In the current scenario, where organizations have to double down on core business aspects and somehow strip away operational slack from their processes, managed services have become more of a necessity than just a trend. They provide businesses with the expertise and resources needed to manage telecom expenses effectively while enabling internal teams to focus on other core areas, without having to deal with telecom operations on a day-to-day basis. And then there are recent trends with telecom environments transitioning to more complexity, 5G, IoT, and multi-cloud ecosystems, which will be driving even more demand for managed services to achieve and maintain both effective management of telecom expenses, as well as optimization of their performance. The increasing inclination towards outsourcing telecom management functions is likely to spur the quick development of the managed services phase.

BY ENTERPRISE TYPE

In 2023, large-size enterprises accounted for a higher and commanding share of the TEM market attributable to massive and complex telecom requirements of enormous-size enterprises, reaching 68.7% in 2023. Such organizations usually operate thousands of telecom services over several departments, office locations, and sometimes even countries, making it difficult to control and optimize expenses. Thus, large enterprises need strong telecom expense management solutions to monitor and control their telecom expenditure accurately, with bill audits, service compliance, and effective usage management. TEM is essential for cost management and improving operational efficiency due to the scale of telecom services (multiple service providers, complex contract structure) within large organizations. Furthermore, extensive enterprises are competent to invest in next-generation TEM systems thus contributing to the high dominance of this segment.

Small and Medium-sized Enterprises (SMEs) are projected to have the largest CAGR from 2024–2032. However, as SMEs grow, the need to control and manage their telecom costs object is desired to be more prominent. Unlike some big enterprises that may have the telecom resources managed in-house most SMEs prefer TEM solutions for telecom management. Further, technology prices have fallen, with TEM solutions becoming more affordable and SMEs are further using these systems for better tracking of telecom expenditure. Cloud-based TEM solutions deliver on-demand scalability and cost-effectiveness, enabling SMEs to implement a telecom management strategy without needing TCO for high-level upfront investment. Higher awareness about controlling costs and obtaining better financial visibility among SMEs is expected to lead to the rapid growth of TEM solutions in this segment over the next few years.

BY INDUSTRY VERTICAL

In 2023, the IT and Telecom sector accounted for the largest share of 34.7% of the Telecom Expense Management (TEM) market. This is because the industries are very telecom-dependent managing the service effectively is critical. IT and telecom have complex networks and communications infrastructure as part of their critical day-to-day operations. The sector has the requirement of balancing telecom expenditure optimization, cost control, and service contract compliance, which in turn drives the demand for TEM solutions. Moreover, with the technological advancements (deployment of 5G, cloud services, and IoT, etc.) it is inevitable for IT and telecom companies to organize and deal with a higher number of telecom services, making TEM systems imperative for minimizing inefficiencies and avoiding excess payments. The rapidly changing technology landscape and rising competition are forcing IT and telecom businesses to utilize TEM solutions that can minimize expenses and competition.

BFSI (Banking, Financial Services, and Insurance) is anticipated to register the highest growth rate during 2024–2032. The rapid growth of telecom service complexities and volumes, escalating cost pressures, and the need for telecom regulatory compliance have been the main driving forces for financial institutions to automate their telecom processes. Telecom contracts and providers are one of the most complex areas banks and other financial institutions have to manage because they rely on secure communication networks to facilitate transactions with clients and processes internally. Thus, TEM solutions help such organizations streamline their telecom expenditures, provide visibility, and help prevent any billing errors. Additionally, the BFSI sector has very strong NDAs and contracts as far as data security and compliance are concerned, and that is where the transparency and the audit trails provided by TEM solutions come in very handy. The continued growth of digital banking, mobile services, and financial technologies, will see telecom expense management become an increasingly critical function, leading to rapid growth of the BFSI segment.

REGIONAL ANALYSIS

North America held the largest market share of 36.7% in 2023 in the Telecom Expense Management (TEM) market as the telecom infrastructure in the region is established and the high adoption of the latest technologies. North American enterprises, especially in IT, telecom, BFSI, and healthcare, are adopting TEM solutions for better telecom cost management. TEM solutions have seen quicker market penetration in North America, especially among large enterprises, due to the more complex and larger telecom networks of the U.S. and Canadian enterprises than most international enterprises. Companies like AT&T and Verizon have adopted sturdy TEM systems to simplify their telecom expense management operational flow for cost-effective approach and service contract compliance. Moreover, How JP Morgan Chase uses TEM to monitor, govern, and manage telecommunications expenses under the umbrella of its broader digital transformation initiatives.

Asia Pacific is projected to witness the largest growth rate during the forecast period from 2024 to 2032, owing to rapid digitalization, telecom infrastructure expansion, and the growing demand for cost optimization in developing countries. Telecom services in India, China, and Japan will continue to grow strongly, driven by 5G, IoT, and smart devices. With enterprises in the region enhancing their digital capabilities, the need for telecom expense management solutions becomes more critical. By way of example, in China, Alibaba has implemented advanced TEM solutions to operate its extensive telecom assets as it expands its cloud and e-commerce business. Likewise, companies like Tata Consultancy Services (TCS) are utilizing TEM to further drive their telecom spend amidst rising rates due to the expanding telecom marketplace and the growing dependence on mobile networks for doing business in India. The increasing demand for telecom optimization in the Asia Pacific region will create huge growth opportunities for the telecommunication expense management solutions market, leading to the large-scale adoption of TEM solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Telecom Expense Management Market are:

-

Calero-MDSL (Telecom Expense Management, Mobility Management)

-

Tangoe (Telecom Expense Management Services, Managed Mobility Services)

-

Sakon (Telecom Expense Management, Managed Mobility Services)

-

Avotus (Intelligent Communications Management, Telecom Expense Management)

-

WidePoint (Telecom Expense Management, Managed Mobility Services)

-

Valicom (Telecom Expense Management, Managed Mobility Services)

-

Upland Software (Cimpl) (Telecom Expense Management, IT Asset Management)

-

One Source Communications (Communications Lifecycle Management, Managed Mobility Services)

-

RadiusPoint (Telecom Expense Management, Utility Expense Management)

-

Cass Information Systems (Telecom Expense Management, Freight Payment)

-

brightfin (IT Expense Management, IT Finance Management)

-

Habble (Telecom Expense Management, Managed Mobility Services)

-

Tellennium (Management of Things, Telecom Expense Management)

-

Mindglobal (Managed Mobility Services, Telecom Expense Management)

-

Telesoft (Telecom Expense Management, Managed Mobility Services)

-

Cimpl (Telecom Expense Management, IT Asset Management)

-

VoicePlus (Managed Mobility Services, Telecom Expense Management)

-

Comview (Telecom Expense Management, Managed Mobility Services)

-

Dimension Data (NTT Communications) (Telecom Expense Management, IT Services)

-

ICOMM (Telecom Expense Management, Managed Mobility Services)

Some of the Raw Material Suppliers for Telecom Expense Management Companies:

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud

-

IBM

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Oracle

-

Cisco Systems

-

VMware

-

Intel

RECENT TRENDS

-

In December 2024, Tellennium joined the NetSpark family of companies to enhance client services, combining resources to drive growth and innovation. This partnership aims to streamline telecom and utility expense management for clients across industries.

-

In August 2024, Calero partnered with Cell Phones for Soldiers to donate smartphones and services to veterans, improving their access to essential communication and support. The initiative aims to connect 1,000 veterans in a pilot program, with plans for nationwide expansion.

-

In January 2024, Tangoe expanded its expense management solution to cover private cloud environments, integrating VMware® private cloud services into its Tangoe One Cloud platform. This enhancement provides businesses with comprehensive visibility and automation to optimize cloud spending.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.70 Billion |

| Market Size by 2032 | US$ 6.26 Billion |

| CAGR | CAGR of 6.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Evaporators and Air Coolers, Condensers) • By Applications (Commercial, Industrial) • By Refrigerant (HFC/HFO, NH3, CO2, Glycol, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carrier Global Corporation, Trane Technologies, Danfoss A/S, Emerson Electric Co., Johnson Controls International, GE Appliances, Whirlpool Corporation, LG Electronics, Samsung Electronics, Hitachi, Ltd., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Frigidaire, Sub-Zero Group, Inc., Blue Star Limited, Panasonic Corporation, Electrolux AB, AHT Cooling Systems GmbH, Beverage-Air Corporation, Kigali Refrigeration. |

| Key Drivers | • Balancing Food Safety and Technological Advancement in the Refrigeration Cooler Market |

| Restraints | • Regulatory compliance challenges represent a significant restraint for the refrigeration coolers market. |