IoT Integration Market Report Scope & Overview:

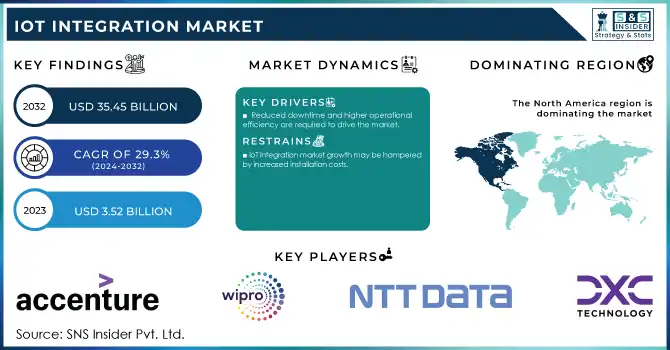

IoT Integration Market was valued at USD 4.67 billion in 2023 and is expected to reach USD 55.01 billion by 2032, growing at a CAGR of 31.58% from 2024-2032.

To Get More Information on IoT Integration Market - Request Sample Report

The IoT integration market is witnessing substantial expansion, propelled by the rising utilization of IoT devices in multiple industries, including healthcare, manufacturing, automotive, and smart homes. As the overall count of cellular IoT connections is set to hit 3.4 billion by the conclusion of 2023 and worldwide IoT expenditures are projected to reach 260 billion US dollars in 2024, companies are keen to utilize these technologies to optimize operations, boost efficiency, and elevate customer experiences. The growth of interconnected devices, along with progress in AI, 5G, and cloud technology, has intensified the need for strong IoT integration solutions. A prime illustration is Salesforce's introduction of the Connected Vehicle app in 2024, which assists car manufacturers in providing AI-powered, tailored driving experiences. IoT integration services have become crucial for the digital transformation strategies of companies.

The need for IoT integration is anticipated to keep growing as sectors aim to leverage the potential of real-time data and automation. Firms are progressively adopting IoT platforms to enhance supply chain efficiency, oversee equipment from afar, and obtain more profound understanding of consumer habits. This increase in demand is also fueled by the necessity for interoperability among various devices and systems. As companies progress and shift towards intricate IoT environments, the demand for smooth and secure integration solutions will increase, creating opportunities for expansion in software creation, cloud platforms, and network infrastructure.

Looking forward, the IoT integration sector is set for significant expansion, with major chances emerging from the development of smart cities, advancements in healthcare, and the growing emphasis on sustainability. As governments and organizations put money into smart infrastructure and sustainable technologies, the integration of IoT will be essential for enhancing energy efficiency, decreasing waste, and elevating overall life quality. Additionally, the growth of edge computing and the need for real-time data processing are expected to open up new opportunities for IoT integration, keeping the market vibrant and primed for innovation.

IoT Integration Market Dynamics

Drivers

-

Cloud Computing and Data Analytics Enhance IoT Growth by Enabling Real-Time Insights, Efficiency, and Business Optimization.

The rapid growth of IoT technology generates vast volumes of data from connected devices, creating the need for advanced analytics tools to extract meaningful insights. By integrating these analytics with cloud computing infrastructure, businesses can efficiently process, store, and analyze this data in real-time. Cloud platforms provide scalable solutions that enable organizations to manage and access IoT data from anywhere, enhancing decision-making capabilities. Additionally, the combination of cloud and data analytics enables predictive maintenance, optimized resource management, and the identification of new business opportunities. These tools offer significant advantages, including cost reductions, operational efficiency, and better customer experiences. As the IoT ecosystem expands, the demand for integrated solutions combining data analytics and cloud computing continues to rise, driving further market growth and innovation.

-

IoT Integration Drives Smart City Development, Enhancing Infrastructure, Sustainability, and Quality of Life Through Connected Solutions

The development of smart cities relies heavily on the integration of IoT technology to enhance urban infrastructure and improve the quality of life for residents. Connected devices and systems help manage traffic flow, monitor environmental conditions, and optimize waste and energy management. IoT-enabled sensors allow for real-time monitoring and decision-making, leading to reduced traffic congestion, better waste disposal, and improved energy efficiency. Furthermore, IoT solutions facilitate the efficient management of public services, such as water distribution and emergency response systems. The integration of these technologies within smart city frameworks fosters sustainability and cost-effectiveness while enhancing urban mobility and public safety. As governments and municipalities increasingly invest in smart city initiatives, the demand for IoT integration solutions continues to rise, propelling the market forward and paving the way for smarter, more connected urban environments.

Restraints

-

High Initial and Ongoing Costs of IoT Integration Create Barriers for Small and Medium-Sized Enterprises.

The initial investment required for IoT infrastructure, integration, and ongoing maintenance can be a significant barrier to adoption, particularly for small and medium-sized enterprises. The cost of acquiring IoT-enabled devices, setting up the necessary network, and ensuring seamless integration with existing systems can be prohibitive for businesses with limited budgets. Additionally, the continuous need for software updates, data storage solutions, and security measures adds to the long-term financial burden. While large enterprises may have the resources to absorb these costs, SMEs often face challenges in justifying such investments, leading to slower adoption of IoT solutions. As a result, the high upfront and ongoing costs create a significant obstacle to the widespread deployment of IoT integration technologies, potentially slowing the growth of the market.

-

IoT Data Security and Privacy Concerns Limit Adoption and Growth of IoT Integration Solutions.

The vast amounts of data generated by IoT devices pose significant security and privacy challenges that can hinder the adoption of IoT solutions. As IoT networks expand, they create more entry points for potential cyberattacks, leaving sensitive data vulnerable to breaches. Businesses face the risk of exposing personal and confidential information, which can lead to legal repercussions, reputational damage, and financial losses. These security concerns make companies cautious about fully embracing IoT integration, particularly in industries dealing with highly sensitive data, such as healthcare and finance. The lack of standardized security protocols across different IoT platforms further complicates efforts to ensure data integrity and privacy. Until these security risks are effectively addressed, many organizations may hesitate to invest in or scale their IoT solutions, limiting the overall growth of the IoT integration market.

IoT Integration Market Segment Analysis

By Services

In 2023, the Device and Platform Management segment dominated the IoT Integration Market, capturing the highest revenue share of approximately 30%. This dominance can be attributed to the increasing need for efficient management and monitoring of connected devices across industries. As businesses deploy more IoT solutions, managing diverse devices, ensuring seamless communication, and maintaining system performance become critical. The demand for integrated platforms that offer real-time monitoring, troubleshooting, and device optimization has driven growth in this segment, positioning it as the market leader.

The System Design and Architecture segment is poised to grow at the fastest CAGR of about 34.61% from 2024 to 2032. This rapid expansion is driven by the increasing complexity of IoT systems and the growing demand for customized, scalable architectures that can support a wide range of devices and applications. As organizations seek to build more robust and flexible IoT ecosystems, the focus on system design and architecture becomes pivotal in ensuring compatibility, reliability, and future scalability, fueling the segment’s accelerated growth.

By Application

In 2023, the Smart Building & Home Automation segment dominated the IoT Integration Market, holding the highest revenue share of approximately 26%. This dominance stems from the increasing adoption of IoT technologies to enhance energy efficiency, security, and convenience in residential and commercial buildings. With the growing demand for smart homes and intelligent building systems that offer automation, real-time monitoring, and optimized energy management, this segment has seen substantial investment, positioning it as the market leader.

The Smart Healthcare segment is expected to grow at the fastest CAGR of about 37.84% from 2024 to 2032. This rapid growth is driven by the increasing integration of IoT in healthcare to improve patient monitoring, diagnosis, and treatment outcomes. The adoption of wearable devices, telemedicine, and remote monitoring solutions is revolutionizing healthcare, enhancing both efficiency and accessibility. As healthcare providers seek to leverage IoT for personalized care and improved operational efficiency, the Smart Healthcare segment is set for explosive growth in the coming years.

By End Use

In 2023, the Manufacturing & Industrial segment dominated the IoT Integration Market, accounting for the highest revenue share of approximately 23%. This leadership is largely driven by the widespread adoption of IoT for predictive maintenance, process optimization, and real-time monitoring across manufacturing operations. Industries are increasingly relying on IoT solutions to reduce downtime, improve production efficiency, and ensure higher levels of automation, making this sector the key revenue generator in the market.

The Healthcare & Life Sciences segment is projected to grow at the fastest CAGR of about 35.03% from 2024 to 2032. This surge is primarily fueled by the growing demand for IoT-enabled solutions that enhance patient care, streamline hospital operations, and improve diagnostics through connected devices. The integration of wearable health monitors, telemedicine, and remote patient management systems is transforming healthcare delivery, driving rapid expansion in this segment as both providers and patients embrace the benefits of IoT technology for better outcomes.

Regional Analysis

In 2023, North America dominated the IoT Integration Market, holding the highest revenue share of approximately 39%. This dominance can be attributed to the region’s advanced technological infrastructure, strong presence of key market players, and high adoption rates of IoT solutions across various industries. The widespread deployment of IoT applications in sectors such as manufacturing, healthcare, and smart cities has positioned North America as a leader in the IoT space, driving significant market growth and innovation.

The Asia Pacific region is expected to grow at the fastest CAGR of about 34.43% from 2024 to 2032. This rapid growth is driven by increasing industrialization, rising urbanization, and the growing demand for smart solutions in countries like China, India, and Japan. With governments heavily investing in digital transformation, smart cities, and manufacturing automation, Asia Pacific is poised to become a key hub for IoT adoption, propelling the market’s expansion in the coming years.

Do You Need any Customization Research on IoT Integration Market - Enquire Now

Key Players

-

TCS Limited (IoT Framework, Connected Universe Platform)

-

Wipro Limited (Wipro Smart i-Connect, Wipro IoT Platform)

-

Atos SE (Atos Codex IoT Services, BullSequana Edge)

-

Accenture (Accenture IoT Device Platform, Intelligent Enterprise Platform)

-

Fujitsu Ltd. (Fujitsu IoT Solution INTELLIEDGE, Fujitsu Cloud Service K5 IoT Platform)

-

Infosys Limited (Infosys IoT Engineering Services, Infosys Edge Suite)

-

Capgemini (Capgemini IoT Platform, Smart Digital Operations)

-

HCL Technologies Limited (IoT WoRKS, HCL EdgeLITy)

-

Tech Mahindra Limited (Integrated Engineering Solutions, Connected Solutions)

-

DXC Technology (DXC IoT Platform, Industrial IoT Solutions)

-

Deloitte (Deloitte IoT Services, IoT Analytics Platform)

-

IBM (IBM Watson IoT Platform, IBM Maximo)

-

Cognizant (Cognizant IoT Services, Connected Products)

-

Salesforce (Salesforce IoT Cloud, MuleSoft Anypoint Platform)

-

NTT Data (IoT Platform Services, Edge Computing Solutions)

-

Dell EMC (Dell Edge Gateway, Dell IoT Solutions)

-

Damco (IoT Development Services, IoT Consulting Services)

-

Allerin (IoT Application Development, IoT Data Analytics)

-

Softdel (IoT Gateway Solutions, Device Management Services)

-

Phitomas (IoT Solutions, Smart Factory Solutions)

-

eInfochips (IoT Platform Services, Smart Edge Solutions)

-

Timesys (Timesys IoT Security, Timesys IoT Development)

-

Tibbo (Tibbo IoT Modules, Tibbo Project System)

-

Aeris (Aeris IoT Connectivity, Aeris IoT Platform)

-

Macrosoft (IoT Application Development, IoT Testing Services)

-

Meshed (IoT Connectivity Solutions, Smart Building Solutions)

Recent Developments:

-

In 2024, TCS launched a new IoT Engineering Lab in Ohio, designed to drive innovation for clients by advancing Internet of Things technologies. The lab will help improve operational efficiency and support the development of industry-specific solutions.

-

In 2025, Accenture acquired a digital twin technology platform from Percipient to enhance its banking modernization capabilities. This acquisition aims to help financial institutions streamline core system transformations and drive innovation without disrupting operations.

-

In 2024, Infosys expanded its collaboration with NVIDIA to enhance AI-powered solutions for telecom companies, leveraging generative AI technologies to improve customer experiences, network operations, and service delivery.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.67 Billion |

| Market Size by 2032 | USD 55.01 Billion |

| CAGR | CAGR of 31.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Device and Platform Management, System Design and Architecture, Advisory Services, Database & Block Storage Management, Third Party API Management Services, Others) • By Application (Smart Building & Home Automation, Smart Healthcare, Energy & Utilities, Industrial Manufacturing & Automation, Smart Retail, Smart Transportation, Logistics, and Telematics) • By End Use (BFSI, Manufacturing & Industrial, Healthcare & Life Sciences, Government & Defense, Energy & Utilities, Automotive & Transportation, Retail & E-commerce, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TCS Limited, Wipro Limited, Atos SE, Accenture, Fujitsu Ltd., Infosys Limited, Capgemini, HCL Technologies Limited, Tech Mahindra Limited, DXC Technology, Deloitte, IBM, Cognizant, Salesforce, NTT Data, Dell EMC, Damco, Allerin, Softdel, Phitomas, eInfochips, Timesys, Tibbo, Aeris, Macrosoft, Meshed |

| Key Drivers | • The Role of Data Analytics and Cloud Computing in Accelerating the Growth of the IoT Integration Market • The Impact of Smart Cities Development on the Growth of the IoT Integration Market |

| RESTRAINTS | • The Impact of High Implementation Costs on the Growth of the IoT Integration Market • Data Security and Privacy Concerns as Challenges to IoT Integration Market Growth |