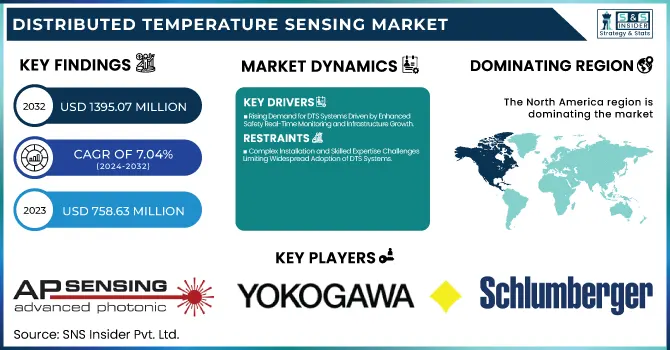

Distributed Temperature Sensing Market Size & Industry Insights:

The Distributed Temperature Sensing Market was valued at USD 758.63 million in 2023 and is expected to reach USD 1395.07 million by 2032, growing at a CAGR of 7.04% over the forecast period 2024-2032. DTS market drivers are related to the improvement in various parameters which will boost the performance of the system. Operational efficiency metrics are all about responsiveness to problems, avoidance of outages and incidents, and interoperability with industrial automation.

To Get more information on Distributed Temperature Sensing Market - Request Free Sample Report

The performance and accuracy metrics, while stressing high spatial resolution, accurate temperature measurement, and stable data output in constantly changing environments. Performs various tests of fiber optics for attenuation rates, bend loss, and clear signals, all necessary for solid data transmission. And, data analysis and precision metrics are on accurate temperature profiling, low latency reporting, and higher signal-to-noise ratio results to provide DTS systems with meaningful results for better safety and asset protection.

Distributed Temperature Sensing (DTS) Market Dynamics

Key Drivers:

-

Rising Demand for DTS Systems Driven by Enhanced Safety Real-Time Monitoring and Infrastructure Growth

The increasing demand for advanced monitoring solutions in the oil and gas, power transmission, and fire detection industries is one of the major drivers. Remote real-time temperature data provided by DTS systems ensures early detection of any temperature aberration and possible hazards. Increasing demand due to the need for efficient pipeline monitoring over long distances, and in remote and hazardous environments. Moreover, increasing investments in infrastructure projects such as smart grids and power distribution networks are anticipated for cable temperature monitoring utilizing DTS over the forecast period. Due to their increased safety over traditional sensor systems, reliability, and cost-effectiveness, integration of DTS systems in industrial applications is growing quickly.

Restrain:

-

Complex Installation and Skilled Expertise Challenges Limiting Widespread Adoption of DTS Systems

The installation and integration of systems are complex, which is a major hurdle. DTS systems, in particular, require accurate placement such as oil rigs, power plants, or large industrial plants. If the installation is not done properly, it will yield wrong data readings which will result in ineffective use of the system. Moreover, the requirement for specialized technical knowledge to manage, calibrate, and interpret DTS data becomes a hurdle for various companies that do not have skilled personnel. Such complexity makes it time-consuming to deploy and limits adoption within industries.

Opportunity:

-

Expanding DTS Opportunities Driven by IoT Integration Environmental Monitoring and Clean Energy Projects

A key opportunity in the DTS market is the increasing use of fiber optic sensing technology in environmental monitoring and smart city projects. With industries moving towards digitalization and automation, there is a growing use of DTS systems as a part of IoT platforms to enable real-time analysis and predictive maintenance. An additional opportunity for expansion arises with the increasing focus on clean energy developments such as wind and solar plants. Emerging opportunities have positioned companies that provide innovative DTS solutions with a higher level of accuracy and remote monitoring on the bright side of the sun as we can say.

Challenges:

-

Overcoming Environmental Vulnerabilities and Data Interpretation Challenges for Reliable DTS System Performance

DTS systems also face a broader challenge in their newfound vulnerability to the environment and mechanics. Fiber optic cables while sturdy are prone to mishaps when being installed, and industrial environments often expose the cable to a harsher level of operating conditions. Signal integrity and performance of the system can be compromised due to vibration, bending stress, chemical exposure, etc. In addition, difficulties may also occur with interpreting the data, especially when measuring small variations in temperature in moving settings. Organizations need to invest in high-quality data analytics tools and skilled professionals to ensure the DTS systems provide perfect insights. Eliminating these technical hurdles is essential for harnessing the completeness of DTS technology in many fields.

Distributed Temperature Sensing Market Segmentation Overview

By Operating Principle

The DTS market was dominated by Optical Time Domain Reflectometry with a market share of 76.2% in 2023. OTDR is the entire fault detection function, locating the breakpoints and long-distance accurate tests, which stand over the power. It has strengthened its market position due to its extensive applications in the oil & gas, power transmission, and fire detection industries.

Optical Frequency Domain Reflectometry (OFDR) is expected to show the fastest CAGR from 2024 to 2032. Its outstanding accuracy, high spatial resolution, and detection of small temperature changes in a shorter span of distance are the main driving factors for OFDR market growth. The growing need of industries for advanced monitoring solutions of critical infrastructure is expected to drive substantial demand for OFDR, particularly in the research, aerospace, and manufacturing sectors.

By Fiber

Single-mode Fiber held the highest share of the Distributed Temperature Sensing (DTS) market in 2023, accounting for 64.4% market share. It is this superiority that is responsible for the domination of long-distance sensing applications, high signal integrity, and low attenuation rates. Single-mode fiber is widely used for long-range temperature measurements in key industries like oil & gas, power transmission, and infrastructure.

Multi-mode Fiber is expected to witness the fastest CAGR from 2024 to 2032. The temporal phase unwrapping technique has gained popularity due to its cost-efficient nature, ease of installation, and the ability to be utilized in short to medium-length sensing applications. Multi-mode fiber is anticipated to witness high growth in the forthcoming years owing to the increasing localization of temperature monitoring and asset protection with consideration to the expansion from industry segments.

By Application

The Oil and Gas sector accounted for the largest share of the Distributed Temperature Sensing (DTS) market 38.7% in 2023. The ease of use of distributed temperature sensing especially for downhole monitoring, pipeline integrity management, and wellbore temperature profiling has led to the dominance of DTS systems in the segment. Due to the strong industry focus on safety and monitoring pipelines in remote and unsafe locations in real-time, DTS solutions also have obtained rapid penetration within the industry.

The Process & Pipeline Monitoring segment is projected to witness the fastest CAGR from 2024 to 2032. This growth is driven by the growing need to implement process control, asset protection, and thermal management more efficiently within various industrial facilities. There will also most likely be a huge increase in the adoption of DTS in this segment, as industries take note of predictive maintenance and operational efficiency.

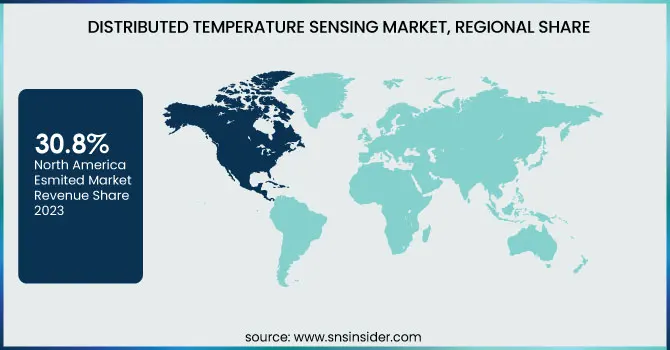

Distributed Temperature Sensing Market Regional Landscape

North America held the largest share of the Distributed Temperature Sensing (DTS) market at 30.8% in 2023. The leadership position is attributed to the oil & gas, power transmission, and fire detection sectors present across the region. In the United States, DTS has been widely institutionalized in shale gas exploration, pipeline monitoring, and power cable detection. Some big energy infrastructure projects, such as the Permian Basin oil fields in Texas, are highly dependent on DTS systems to directly monitor downhole temperature in real-time, to make the operations safer, and more efficient. Moreover, the rise in building fire detection systems based on DTS, particularly in commercial and industrial establishments, is likely to bolster market growth in the region.

Asia-Pacific is estimated to be the fastest-growing region with the highest CAGR throughout the forecast period (2024-2032) owing to rising rapid industrialization urbanization and rising infrastructure development. China, India, Japan, and many other countries are on the move to invest in smart city projects and renewable resources that propel the DTS needs. Examples include Thermal Detection Solutions (DTS) integrated into China expanding high-voltage power grid networks and pipeline infrastructure projects in India for thermal monitoring and fault detection. As such, Asia-Pacific is anticipated to emerge as a prominent growth region for the DTS market in the years ahead.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Distributed Temperature Sensing Market are:

-

AP Sensing (Linear Heat Detection System)

-

Yokogawa Electric Corporation (DTSX200 Distributed Temperature Sensor)

-

Schlumberger Limited (FIBREWATCH DTS)

-

Halliburton (FiberWatch DTS)

-

Weatherford International (SureView® DTS)

-

Omnisens SA (DiTeSt DTS)

-

Sumitomo Electric Industries (SOR2 DTS System)

-

Bandweaver Technology (FireLaser DTS)

-

NKT Photonics (LIOS DE.TECT DTS)

-

Silixa Ltd. (iDAS DTS)

-

Sensornet Ltd. (Halo DTS)

-

OFS Fitel, LLC (TrueSense DTS)

-

AGL Construction (SmartTracer DTS)

-

Luna Innovations Incorporated (ODiSI DTS)

-

Brugg Kabel AG (Brugg DTS System).

Recent Trends

-

In January 2024, AP Sensing partnered with STS Group to deploy a four-channel DTS system, enabling real-time temperature monitoring across a two km range per channel for enhanced data center safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 758.63 Million |

| Market Size by 2032 | USD 1395.07 Million |

| CAGR | CAGR of 7.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operating Principle (Optical Time Domain Reflectometry (OTDR), Optical Frequency Domain Reflectometry (OFDR)) • By Fiber (Single-mode Fiber, Multi-mode Fiber) • By Application (Oil and Gas, Power Cable Monitoring, Fire Detection, Process & Pipeline Monitoring, Environmental Monitoring, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AP Sensing, Yokogawa Electric Corporation, Schlumberger Limited, Halliburton, Weatherford International, Omnisens SA, Sumitomo Electric Industries, Bandweaver Technology, NKT Photonics, Silixa Ltd., Sensornet Ltd., OFS Fitel, LLC, AGL Construction, Luna Innovations Incorporated, Brugg Kabel AG. |