Airport Automation Market Size & Trends:

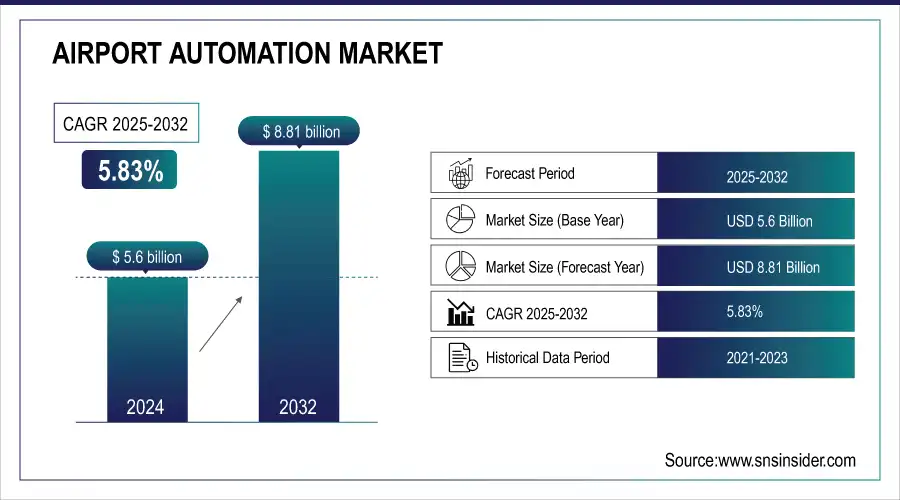

The Airport Automation Market size was valued at USD 5.6 Billion in 2025 and is projected to reach USD 9.87 Billion by 2035, growing at a CAGR of 5.83% during 2026-2035.

The Airport Automation Market growth is driven by the adoption of modern technologies like AI, interactive holograms, autonomous systems, and sensory innovation. Omni-channel communication tools, robotics and data-driven platforms are some of the ways in which airports around the globe are improving their operations and elevating their passengers' experience. The concept of humanizing the automation will take center stage, as digital transformation begins to focus more on smooth and seamless travel with an emotional connection, taking AI beyond predictive maintenance. In this fast-paced episode, we cover how solutions such as chatbot-assisted navigation, autonomous maintenance equipment, and AI-based analytics are evolving traditional airport ecosystems to be more inter-active and self-learning.

Airport Automation Market Size and Forecast:

-

Market Size in 2025: USD 5.6 Billion

-

Market Size by 2035: USD 9.87 Billion

-

CAGR: 5.83% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Airport Automation Market - Request Free Sample Report

Key Trends in the Airport Automation Market:

-

Rising adoption of automated baggage handling systems, self-service check-in kiosks, and biometric passenger processing to enhance operational efficiency.

-

Increasing integration of AI, IoT, and machine learning for predictive maintenance, security screening, and passenger flow management.

-

Growing need for contactless and touchless technologies, driven by demand for safer and faster passenger experiences.

-

Expansion of autonomous vehicles and robotics for cargo handling, cleaning, and security patrolling within airport premises.

-

Higher investments in airport IT infrastructure and advanced automation solutions by governments and private airport operators.

-

Strategic partnerships and collaborations between technology providers, airport operators, and aviation authorities to deploy next-generation automation systems.

-

Increasing focus on smart airport initiatives and digital transformation to improve passenger experience, reduce operational costs, and enhance security.

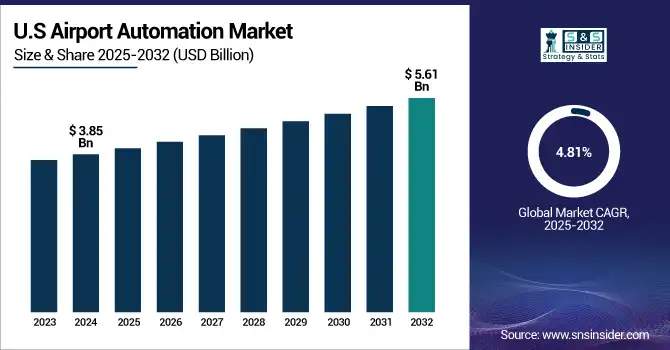

The U.S Airport Automation Market size was valued at USD 3.85 Billion in 2025 and is projected to reach USD 5.61 Billion by 2035, growing at a CAGR of 4.81% during 2026-2035. Airport Automation Market growth is driven by rising air traffic, increasing focus on contactless passenger experience, and strong investments in AI, robotics, and real-time data platforms. Airports are modernizing with advanced baggage handling, security automation, and digital self-service tools. The push toward operational efficiency, sustainability, and improved traveler satisfaction continues to accelerate market adoption across commercial and regional airports.

The Airport Automation Market Trends include the rise of AI-powered passenger assistance systems, integration of biometric verification for seamless check-ins, and deployment of autonomous service robots. Airports are adopting digital twins for predictive maintenance, interactive holograms for customer service, and edge computing for real-time decision-making. There is growing emphasis on modular, upgradable automation platforms and enhanced cybersecurity for operational resilience. These trends reflect a broader shift toward smart, efficient, and passenger-centric airport ecosystems aligned with future-ready digital infrastructure.

Airport Automation Market Drivers:

-

Rising Demand for Seamless Passenger Experience Driving Airport Automation Adoption

The growing demand for a seamless and intuitive passenger experience is a major driver of the Airport Automation Market. As travelers increasingly expect speed, convenience, and minimal contact, airports are investing in advanced technologies such as AI-powered chatbots, biometric check-ins, autonomous service robots, and interactive holograms. These innovations reduce congestion, improve navigation, and enhance overall satisfaction. In response, airports are modernizing infrastructure to include real-time data systems, digital twins for predictive maintenance, and modular automation platforms. This cause-and-effect relationship between evolving passenger expectations and technological deployment is accelerating the shift toward intelligent, efficient, and passenger-centric airport ecosystems, making automation an essential component of future-ready airport operations.

Advanced Airport Automation, AI assistance, Biometrics & Autonomous Systems will have transformed the passenger journey (July 22) Wayne breaks down how digital twins, interactive holograms, and modular platforms will usher in smart, resilient airport ecosystems.

Airport Automation Market Restraints:

-

Obstacles Slowing the Growth of Airport Automation Systems

The Airport Automation Market faces several key restraints despite growing demand. High initial capital expenditure for systems like self-service kiosks, biometric gates, and automated baggage handling limits adoption, particularly in small or mid-sized airports. Legacy infrastructure and fragmented systems create integration challenges, increasing costs and project timelines. Strict EU regulations such as GDPR, alongside diverse EMEA country-specific safety and security standards, add compliance complexity. Cybersecurity risks, technological obsolescence, and dependency on skilled personnel further hinder deployment. Labor concerns, budget constraints, and passenger adaptability issues also slow adoption. Collectively, these factors challenge airports in achieving operational efficiency, forcing stakeholders to carefully balance technological advancement with financial, regulatory, and human-resource limitations.

Airport Automation Market Opportunities:

-

Strategic Digitalization Creating Growth Opportunities in Airport Cargo Automation

Rising global trade complexities and the need for faster, more resilient logistics systems are driving significant opportunities in airport cargo automation. AI-powered cargo processing, digital tracking across the airport process locations and temperature-controlled logistics have improved scalability in airports to manage increased volumes while still addressing sensitive goods like pharmaceuticals and perishables. By adding automation capabilities to its existing API, the platform can be included in larger event-driven systems with various business processes and rules that can use this cause-and-effect dynamic of generating actions based on these state changes to make turnaround times faster, have better visibility and far less human error. With the evolution of global standards for data interoperability and paperless trade, airports that invest in digital infrastructure and automation will emerge as strategic hubs in supply chains which are future-ready.

July 23, 2025 – Changi Airport: Strong Import Demand Swings Changi Airfreight Growth to 6.2% in Q2, with Resilient Cargo Flows Amid Global Trade Headwinds | SINAPPS: The Singapore News Aggregator Supporting that role are strategically positioned investments in automation, digitalisation and network expansion.

Airport Automation Market Challenges:

-

Legacy Infrastructure and Integration Barriers Hindering Airport Automation Expansion

The expansion of airport automation faces significant challenges due to legacy infrastructure and complex system integration requirements. Many airports still operate on outdated IT frameworks that are incompatible with modern automation technologies such as AI, IoT, and real-time data platforms. This causes delays in implementation and increases the cost and complexity of upgrades. Additionally, integrating diverse systems from multiple vendors often leads to interoperability issues and operational disruptions. As a result, even technologically advanced solutions may underperform or remain underutilized. This cause-and-effect relationship limits the scalability and efficiency of automation efforts, making it difficult for airports to realize the full benefits of smart infrastructure and digital transformation.

Airport Automation Market Segmentation Analysis:

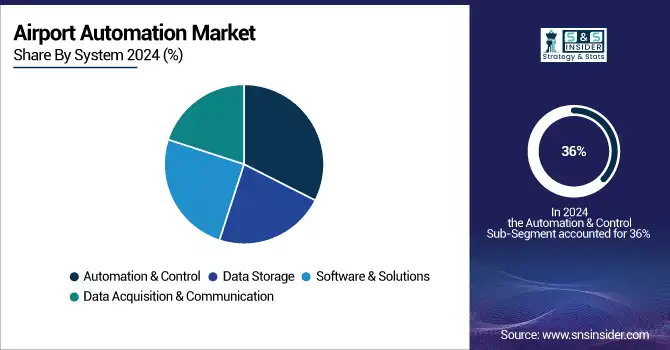

By System, Automation & Control Segment Dominates Airport Automation Market with 36% Share in 2025, Segment to Record Fastest Growth with 5.83% CAGR

The Automation & Control segment held a dominant share of approximately 36% in 2025. Its leadership is driven by increasing adoption of autonomous systems to improve operational efficiency, passenger flow management, and safety. AI-enabled control platforms, smart notification screens, and real-time action-taking tools in terminal operations and airside & cargo handling are accelerating automation. These systems help airports reduce delays, optimize resource utilization, and deliver seamless, data-driven passenger experiences.

The Automation & Control segment is expected to experience the fastest growth in the Airport Automation market over 2026–2035 with a CAGR of 5.83%, fueled by rising investments in AI and machine learning platforms for airport operations and predictive system management.

By Technology, Passenger Processing Segment Dominates with 27% Share in 2025, Automated Ground Handling Segment to Record Fastest Growth with 8.04% CAGR

The Passenger Processing segment accounted for approximately 27% of the market in 2025. Its dominance is due to rising demand for seamless and contactless travel experiences. Airports are implementing biometric verification, self-check-in kiosks, e-gates, and AI-based assistance systems to enhance productivity, reduce waiting times, and improve passenger satisfaction.

The Automated Ground Handling segment is projected to grow at the fastest CAGR of 8.04% over 2026–2035, driven by the need to optimize baggage and cargo handling times, improve security, and adopt autonomous vehicles, robotic loaders, and smart logistics systems that provide 24/7 operational reliability.

By Application, Terminal-Side Operations Segment Dominates with 41% Share in 2025, Airside Operations Segment to Record Fastest Growth with 6.11% CAGR

The Terminal-Side Operations segment held approximately 41% of the market in 2025, driven by automation in passenger check-in, baggage handling, and security screening. Airports are increasingly adopting smart kiosks, automated lanes, and integrated control systems to improve throughput, minimize delays, and enhance passenger experience.

The Airside Operations segment is expected to witness the fastest growth over 2026–2035 with a CAGR of 6.11%, fueled by adoption of automated aircraft guidance systems, real-time airside surveillance, and autonomous ground support equipment to enhance safety, reduce delays, and streamline aircraft turnaround processes.

By End-User, Commercial Airports Segment Dominates with 53% Share in 2025, Segment to Record Fastest Growth with 6.91% CAGR

The Commercial Airports segment accounted for approximately 53% of the market in 2025. Its dominance is driven by rising air passenger traffic, growing demand for seamless travel experiences, and widespread deployment of biometric systems, automated check-ins, and smart security lanes.

The Commercial Airports segment is projected to experience the fastest growth in the Airport Automation market over 2026–2035 with a CAGR of 6.91%, as airports prioritize digital transformation to handle higher passenger volumes efficiently, reduce operational costs, and enhance service quality across the global aviation ecosystem.

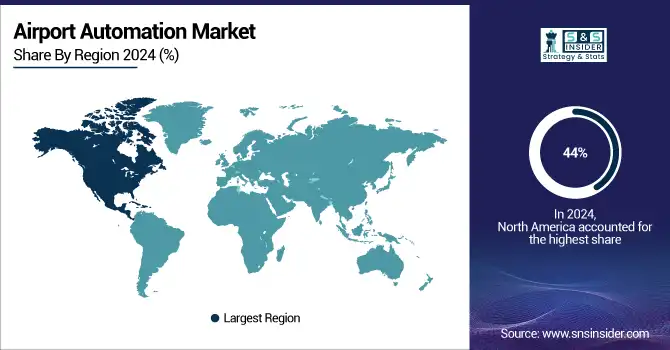

Airport Automation Market Regional Insights:

North America Dominates Airport Automation Market in 2025

In 2025, North America commanded an estimated 44% share of the Airport Automation market, driven by increasing air traffic, rapid adoption of modernized technologies, particularly robotics solutions across airports, and expanding investments in smart airport infrastructure. The region benefits from the dominance of established players, forward-looking regulatory frameworks, and persistent demand for more integrated and seamless passenger journeys.

The United States leads North America’s Airport Automation market, with major airports implementing AI-enabled passenger processing, automated baggage handling, and smart terminal operations. Strong capital investments, advanced aviation infrastructure, and regulatory support further cement its leadership in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is the Fastest-Growing Region in Airport Automation Market over 2026–2035

Asia-Pacific is projected to grow at a CAGR of 7.48% during 2026–2035, driven by rapid airport infrastructure development, rising air passenger traffic, and increased government investment in smart airport initiatives. The region’s growth is supported by a strong focus on digital transformation, especially in emerging economies such as India, China, and Southeast Asia.

Countries including India, China, and Singapore are investing heavily in automated check-in systems, biometric verification, smart baggage handling, and AI-driven operational management. These initiatives position Asia-Pacific as a hub for next-generation airport automation adoption.

Europe Airport Automation Market Insights, 2025

Europe held a significant portion of the Airport Automation market in 2025, fueled by strong regulatory support, advanced aviation infrastructure, and growing demand for seamless passenger experiences. Airports across Germany, France, and the UK are investing in biometric verification, AI-powered passenger flow management, and automated baggage handling.

Germany leads Europe’s Airport Automation market due to its robust airport infrastructure and focus on digital innovation, followed by France and the UK, which are deploying integrated smart systems to improve passenger throughput and operational efficiency.

Middle East & Africa and Latin America Airport Automation Market Insights, 2025

In 2025, Middle East & Africa and Latin America showed steady growth in the Airport Automation market, driven by airport modernization projects, increasing air travel demand, and government investments in smart infrastructure.

Countries such as the UAE, Saudi Arabia, and Brazil are prioritizing automated check-in systems, biometric passenger processing, and smart ground handling technologies to enhance passenger experience and reduce operational costs. These regions are gradually aligning regional airports with global standards in digital aviation and smart airport operations.

Airport Automation Market key Players:

-

Daifuku Co. Ltd.

-

Collins Aerospace

-

Siemens AG

-

Amadeus IT Group

-

SITA

-

Honeywell International Inc.

-

Thales Group

-

Indra Sistemas S.A.

-

Vanderlande Industries

-

NEC Corporation

-

Bosch Security Systems

-

TAV Technologies

-

Inform GmbH

-

Raytheon Technologies

-

Huawei Technologies

-

IBM Corporation

-

ADB Safegate

-

Alstef Group

-

Embross Group

-

Beumer Group

Competitive Landscape for the Airport Automation Market:

Daifuku Co. Ltd.

Daifuku Co. Ltd. is a Japan-based global leader in airport automation and material handling solutions. The company specializes in automated baggage handling systems, conveyors, sortation systems, and integrated airport logistics solutions. With decades of experience, Daifuku designs, engineers, and implements advanced automation technologies that improve operational efficiency, reduce passenger wait times, and enhance security across airport terminals. Its role in the airport automation market is critical, as it delivers end-to-end solutions that streamline passenger flow, baggage processing, and cargo handling.

-

In 2025, Daifuku expanded its portfolio with AI-driven baggage sortation and autonomous vehicle integration, enabling airports to increase throughput, reduce operational costs, and improve overall service reliability.

Collins Aerospace

Collins Aerospace is a U.S.-based provider of aviation systems and airport automation solutions, including passenger processing, security systems, and airside and landside operational technologies. The company leverages its expertise in aerospace engineering and advanced software platforms to deliver intelligent airport operations, enhancing safety, efficiency, and passenger experience. Collins Aerospace plays a pivotal role in modernizing airport infrastructure globally.

-

In 2025, Collins Aerospace introduced AI-powered automated check-in kiosks and biometric screening systems, strengthening airport efficiency and improving the passenger journey.

Siemens AG

Siemens AG is a Germany-based multinational conglomerate offering a wide range of airport automation and control solutions, including baggage handling, security scanning, passenger flow management, and smart terminal systems. Known for integrating IoT, AI, and digital twin technologies, Siemens enables airports to operate efficiently, maintain security compliance, and optimize resource utilization. Its role in the market is central to driving digital transformation in aviation infrastructure.

-

In 2025, Siemens deployed AI-enabled predictive maintenance and smart airside monitoring systems across several international airports, improving operational uptime and safety.

Amadeus IT Group

Amadeus IT Group is a Spain-based global leader in travel technology and airport automation solutions, specializing in passenger service systems, automated check-in, e-gates, and airport operational management software. Amadeus integrates AI and cloud-based platforms to optimize passenger handling, resource allocation, and real-time decision-making. Its role in the airport automation market is significant, as it enables airports to deliver seamless, efficient, and scalable operations.

-

In 2025, Amadeus launched a next-generation AI-driven passenger flow management system, enhancing airport throughput, reducing congestion, and improving overall traveler satisfaction.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.6 Billion |

| Market Size by 2035 | USD 9.87 Billion |

| CAGR | CAGR of 5.83% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Data Storage, Automation & Control, Data Acquisition & Communication and Software & Solutions) • By Technology (Baggage Handling Systems, Passenger Processing, Security Systems, Air Traffic Management (ATM), IT Solutions and Automated Ground Handling) • By Application (Terminal-side Operations, Airside Operations and Landside Operations) • By End-User (Commercial Airports, Military Airports, Cargo Airports and Private/Regional Airports) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Airport Automation Market Companies include Daifuku Co. Ltd., Collins Aerospace, Siemens AG, Amadeus IT Group, SITA, Honeywell International Inc., Thales Group, Indra Sistemas S.A., Vanderlande Industries, NEC Corporation, Bosch Security Systems, TAV Technologies, Inform GmbH, Raytheon Technologies, Huawei Technologies, IBM Corporation, ADB Safegate, Alstef Group, Embross Group, Beumer Group. and Others. |