Tire Machinery Market size Report Scope & Overview:

Get More Information on Tire Machinery Market - Request Sample Report

The Tire Machinery Market size was recorded at USD 2.08 Bn in 2023 and is expected to reach USD 2.90 Bn by 2032. And grow at a CAGR of 3.8% over the forecast period of 2024-2032.

The apparatus used to assemble the tread, bead, and carcass of a tire is known as tire building machinery. Usually extremely complex, this equipment makes use of numerous automated procedures to guarantee the precision and uniformity of the final product.

From 2023 to 2031, the global tire market is projected to expand at a compound annual growth rate (CAGR) of 3.5%, driven by factors like rising disposable incomes, increasing vehicle production, and increasing urbanization. Growing demand for high-performance tires: As sports cars and SUVs gain in popularity, so does the need for high-performance tires. The equipment needed to make these tires is more advanced. To create new and more effective machinery, the tire machinery industry is always coming up with new ideas. As a result, tire quality is increased and production costs are decreased.

Automation is being used by tire manufacturers more and more to increase productivity and efficiency. The need for more automated tire machinery is resulting from this. In an effort to lessen their influence on the environment, tire manufacturers are also concentrating on sustainability. This is creating a need for tire machinery that consumes less waste and uses less energy. To enhance their production procedures, tire manufacturers are employing data analytics more and more. Tire equipment that can gather and analyze data is becoming more and more in demand as a result.

The need for tires is directly related to the vehicle sector. There is an increasing demand for automobiles, including cars, trucks, and motorcycles, as the world's population grows and becomes more urbanized. This is what fuels the demand for tire manufacturing machinery. Tire replacement and upkeep are necessary because they have a finite lifespan. Tire machinery is required to manufacture new tires and retread old ones as the number of vehicles on the road increases and the need for tire replacement and servicing grows.

Market Dynamics;

Driver:

- Rising demand for tire machinery as the increase in sales of vehicles is contributing to the demand.

The demand for vehicles is primarily driven by the increasing number of vehicles on the planet, especially in developing nations. Since producing EV tires calls for more advanced machinery, the growing demand for EVs is also fueling the need for tire machinery. The market for replacement tires is a significant factor driving demand for tire machinery in addition to the growing need for automobiles. Tires on cars need to be changed on a regular basis as they get older. Tire manufacturers have to produce a lot of replacement tires every year, so this is a big source of demand for tire machinery.

Restrain:

- The current supply chain constrains and the fluctuations in tax rates.

Opportunity

- The rising trends in the industry and the technological advancement associated with it.

Tires require upkeep or replacement because their lifespan is limited. Tire machinery is required to manufacture new tires and retread old ones as the number of vehicles on the road increases and the need for tire replacement and servicing grows. The creation of eco-friendly or low-rolling-resistance tires, for example, can necessitate the upgrading of machinery in order to manufacture these specialty tire kinds. The demand for machinery designed to produce particular tire varieties, like performance, all-terrain, or winter tires, can also be influenced by consumer preferences.

Challenges

- The regulatory restrictions and the changes in the trading policies.

Impact of Recession;

The demand for tire machinery is likely to decrease because companies are less likely to invest in new equipment during a downturn. During a recession, there will probably be less consumer spending, which will lead to a decline in the market for new tires and tire machinery. Companies are likely to become more competitive as they fight to survive in a downturn. Manufacturers of tire machinery may experience lower margins and price wars as a result. Manufacturers of tire machinery may find it harder to get financing during a recession as banks become more cautious. They might find it challenging to grow their business and make investments in new machinery as a result.

Impact of Russia Ukraine War

Numerous industrial machinery manufacturers are based in Ukraine, and the conflict may cause supply chain disruptions for tire machinery spare parts and components. Delays in tire manufacturing equipment maintenance and production could result from this. Machine Types, steel, and other inputs used in the manufacturing of tire machinery may see price increases as a result of supply chain disruptions and geopolitical unrest. This may therefore result in increased tire machinery manufacturing costs, which could have an impact on market pricing. The international trade of tire machinery may be impacted by export restrictions imposed by Russia or Ukraine. The availability of particular machinery or technologies from these regions may be restricted by export prohibitions or sanctions.

By Machine Type

-

Cooling units

-

Extruders

-

Inner Liners Lines

-

Others

By Tire Type

-

Radial Tire

-

Bias Tire

By Application

-

Two wheelers

-

Passenger Vehicles

-

Commercial Vehicles

-

Others

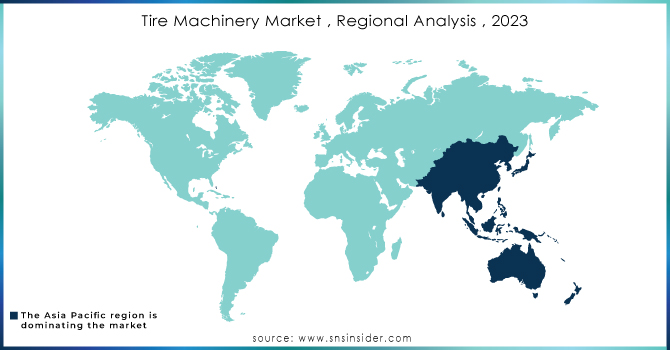

Regional Analysis:

APAC is said to be the region with the highest share because with more than half of the global market share, the Asia Pacific region is the largest market for tire machinery. Some of the top tire producers in the world, including Bridgestone, Michelin, and Goodyear, are based in the area. The demand for tire machinery is being driven by the expansion of the tire industry in the region. Because of the quick expansion of the automotive sector in nations like China and India, the Asia-Pacific region holds a prominent position in the global tire machinery market.

China is home to many tire machinery manufacturers as it is the world's largest producer and consumer of tires. The need for reasonably priced, high-quality tires has prompted improvements in tire manufacturing equipment and procedures. Sales of tire machinery are increasing, which is also attributed to emerging markets in Southeast Asia.

Need any customization research on Tire Machinery Market - Enquiry Now

Key Players

The major key players are AS Tyre Machines, All Well Industry, MERTC, MESNAC, Pelmar Group, Plastea Group, Samson Machinery, TKH Group NV, Marangoni Double Star Machinery and others.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.08 Bn |

| Market Size by 2032 | US$ 2.90 Bn |

| CAGR | CAGR of 3.8 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Machine Type (Cooling units, Extruders, Inner Liners Lines, Others) • By Tire Type (Radial Tire, Bias Tire) • By Application (Two wheelers, Passenger Vehicles, Commercial Vehicles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AS Tyre Machines, All Well Industry, MERTC, MESNAC, Pelmar Group, Plastea Group, Samson Machinery, TKH Group NV, Marangoni Double Star Machinery |

| Key Drivers | • Rising demand for tire machinery as the increase in sales of vehicles is contributing to the demand. |

| Market Restraints | •The regulatory restrictions and the changes in the trading policies. |