Automotive Clutch Market Report Scope & Overview:

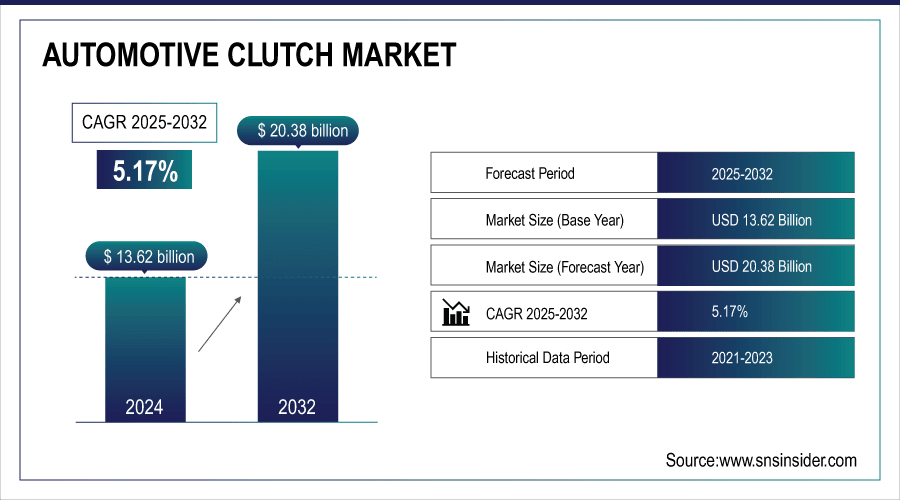

The Automotive Clutch Market size was valued at USD 13.62 Billion in 2024 and is projected to reach USD 20.38 Billion by 2032, growing at a CAGR of 5.17% during 2025–2032.

The global Automotive Clutch Market is experiencing steady growth, driven by rising demand for commercial vehicles and the increasing adoption of advanced transmission technologies. Key players are focusing on innovation, including automated and high-performance clutch systems, to improve efficiency, durability, and driver comfort. Strong OEM and aftermarket networks ensure consistent replacement demand, even amid fluctuations in new vehicle sales. Technological advancements, such as enhanced materials and digital integration, are boosting product reliability and performance. With these trends, the market is well-positioned for sustained expansion across light, medium, and heavy commercial vehicle segments worldwide.

Setco Automotive expands beyond clutches with the launch of its Automotive Water Pump on June 5, 2025, engineered for durability, optimal coolant circulation, and enhanced NVH performance for LCVs and MHCVs. This strategic diversification strengthens OEM and aftermarket presence while delivering superior engine protection and efficiency.

To Get More Information On Automotive Clutch Market - Request Free Sample Report

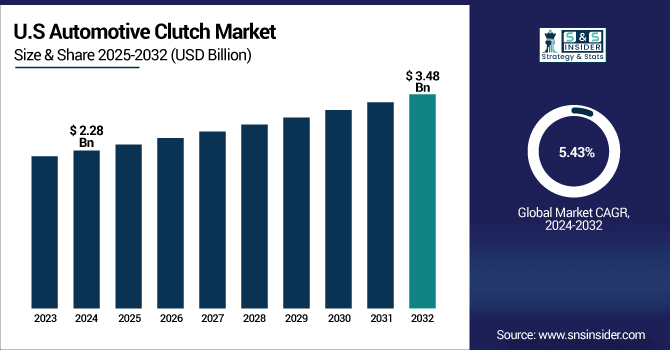

The U.S. Automotive Clutch Market size was valued at USD 2.28 Billion in 2024 and is projected to reach USD 3.48 Billion by 2032, growing at a CAGR of 5.43% during 2025–2032.

Automotive Clutch Market growth is driven by increasing commercial vehicle production, rising demand for fuel-efficient and durable transmission systems, and technological advancements in automated and dual-clutch systems, supported by strong OEM and aftermarket replacement demand.

Automotive Clutch Market Report Highlights:

-

Rising demand for advanced and automated clutch systems in two-wheelers is driven by urban commuting, traffic congestion, and rider convenience

-

Technological advancements, including electronic control units and automated clutch mechanisms, enhance performance, reliability, and durability of two-wheeler transmissions

-

Consumer preference for fuel-efficient, low-maintenance vehicles and stringent safety and emission regulations encourage OEMs to integrate smart clutch solutions

-

High costs, technological complexity, and regulatory hurdles limit adoption, particularly in price-sensitive regions, and slow widespread market penetration

-

Opportunities arise from increasing EV and hybrid adoption, driving demand for shiftable, automated, and electronic clutch solutions

-

Innovations like Nidec Mobility’s electric clutch ECU and Schaeffler’s shiftable one-way clutch improve efficiency, reduce energy loss, and support modular vehicle architectures

Automotive Clutch Market Drivers:

-

Rising Demand for Advanced and Automated Clutch Systems in Two-Wheelers

The global two-wheeler clutch market is driven by increasing demand for rider convenience, enhanced safety, and seamless gear-shifting solutions. Growth in urban commuting and traffic congestion has accelerated the adoption of automatic and semi-automatic clutch systems, reducing rider fatigue and improving efficiency. Technological advancements, including electronic control units and automated clutch mechanisms, are enhancing performance, reliability, and durability of two-wheeler transmissions. Additionally, consumer preference for fuel-efficient, low-maintenance vehicles, coupled with stringent safety and emission regulations, is encouraging OEMs to integrate smart clutch solutions, positioning the market for sustained growth across emerging and developed regions.

On November 14, 2024, Nidec Mobility developed the world’s first electric clutch ECU for two-wheelers, enabling riders to shift gears without using the clutch lever and offering optional manual or automatic modes. Utilizing a rapid model-based development approach, the company delivered prototypes in five months, enhancing product quality, reducing development time, and reinforcing its leadership in advanced automotive electronic control technologies.

Automotive Clutch Market Restraints:

-

High Costs, Technological Complexity, and Regulatory Hurdles Restrain Two-Wheeler Clutch Market Growth

The two-wheeler clutch market faces several challenges that may hinder growth despite rising demand. High costs of advanced electronic and automated clutch systems limit adoption, particularly in price-sensitive regions. Integration of sophisticated technology increases manufacturing complexity and requires skilled labor, raising production and maintenance expenses. Compatibility issues with existing vehicle architectures and varied riding conditions can affect performance and reliability. Additionally, regulatory hurdles and safety certifications for new clutch technologies can delay product launches. Consumer hesitation toward transitioning from traditional manual systems further restricts rapid market penetration, slowing widespread acceptance of innovative clutch solutions globally.

Automotive Clutch Market Opportunities:

-

Rising EV and Hybrid Adoption Drives Demand for Advanced Automotive Clutch Solutions

The Automotive Clutch Market presents significant growth opportunities driven by the increasing adoption of advanced transmission systems in electric and hybrid vehicles. Demand for energy-efficient and high-performance drivetrains is encouraging the development of innovative clutch solutions, such as shiftable, automated, and electronic clutches. Integration of lightweight, durable materials and energy-saving technologies enhances vehicle efficiency and reduces maintenance costs. Additionally, the trend toward modular and easily upgradable clutch systems allows OEMs to streamline vehicle development and cater to diverse global markets, creating new avenues for aftermarket growth and partnerships with commercial and passenger vehicle manufacturers.

On November 19, 2024, Schaeffler began production of its shiftable one-way clutch at the Taicang plant, designed for AWD new energy vehicles to enable rapid 2WD/4WD switching, improve efficiency, and save up to 10% energy. The system, leveraging electromagnet technology and a radial engagement design, ensures fast, reliable operation, reduces drag losses, and integrates easily into existing vehicle architectures, supporting enhanced performance, lower development costs, and extended EV driving range.

Automotive Clutch Market Segment Highlights:

-

By Transmission Type: Dominant – Automatic (Torque-Converter): 50.63% in 2024,; Fastest-Growing – Automated Manual Transmission (AMT): (6.15% CAGR.)

-

By Vehicle Type: Dominant – Passenger Cars: 58.75% in 2024,; Fastest-Growing – Medium & Heavy Commercial Vehicles: (8.00% CAGR.)

-

By Clutch Component: Dominant – Pressure Plate and Cover: 26.09% in 2024, Fastest-Growing – Actuation Systems (Hydraulic, Electro-Hydraulic, Electronic): (5.88% CAGR. )

-

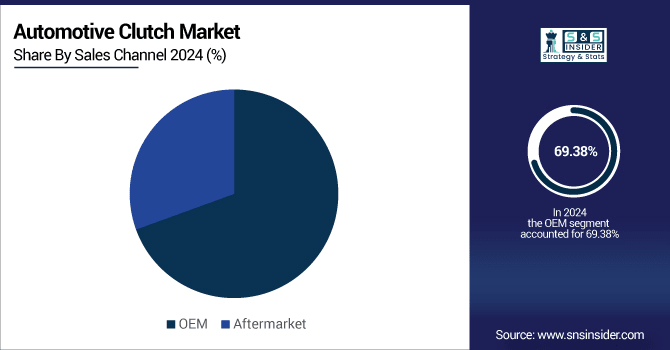

By Sales Channel: Dominant – OEM: 69.38% in 2024 Fastest-Growing – Aftermarket: (6.69% CAGR)

Automotive Clutch Market Segment Analysis:

By Sales Channel, OEM Leads as Aftermarket Segment Grows Fastest

The OEM segment continues to dominate the market, supported by strong partnerships with vehicle manufacturers and steady demand for original equipment clutches. Meanwhile, the aftermarket segment is the fastest-growing, driven by increasing vehicle aging, replacement needs, and rising awareness of high-quality clutch components. This trend highlights a growing opportunity for suppliers to cater to both new vehicle production and replacement markets, ensuring sustained growth across sales channels.

By Transmission Type, Automatic Leads as AMT Gains Momentum

Automatic (Torque-Converter) transmissions continue to dominate the market due to their reliability and widespread adoption across vehicles. Meanwhile, Automated Manual Transmission (AMT) is the fastest-growing segment, driven by increasing demand for fuel efficiency, smoother gear shifts, and advanced drivetrain technology. This trend reflects a gradual shift toward more efficient and technologically advanced transmission systems in passenger and commercial vehicles.

By Vehicle Type, Passenger Cars Lead as Medium & Heavy Commercial Vehicles Grow Fastest

Passenger cars continue to dominate the market due to their large volume and widespread usage across regions. Meanwhile, medium and heavy commercial vehicles are the fastest-growing segment, driven by rising logistics demand, expanding infrastructure projects, and increasing commercial transport activities. This trend highlights a shift toward commercial vehicle segments that require robust, high-performance clutch systems for enhanced durability and operational efficiency.

By Clutch Component, Pressure Plate and Cover Lead as Actuation Systems Grow Fastest

Pressure plates and covers continue to dominate the market due to their critical role in clutch performance and widespread adoption across vehicle types. At the same time, actuation systems—including hydraulic, electro-hydraulic, and electronic—are the fastest-growing segment, driven by increasing demand for automation, enhanced precision, and improved driver comfort. This trend reflects a shift toward advanced clutch components that optimize vehicle efficiency and support emerging transmission technologies.

Automotive Clutch Market Regional Highlights:

-

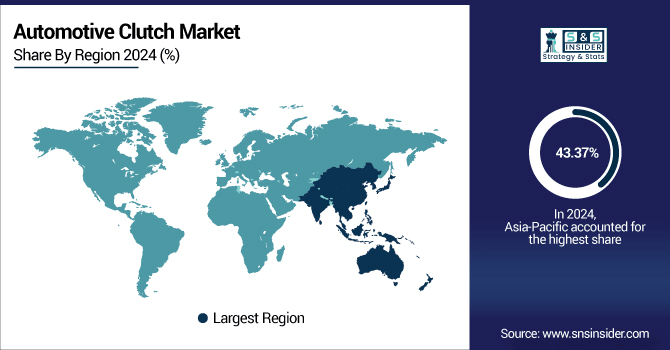

By Region – Dominating: Asia-Pacific (43.37% in 2024), Fastest: North America (25.25% in 2024 → 27.66% in 2032, CAGR 6.37%)

-

Europe: 20.25% → 21.78% (CAGR 6.14%)

-

South America: 6.13% → 5.14% (CAGR 2.88%, declining)

-

Middle East & Africa: 5.00% → 4.13% (CAGR 2.65%, declining)

Automotive Clutch Market Regional Analysis:

Asia-Pacific Automotive Clutch Market Insights

The Asia-Pacific Automotive Clutch Market dominates globally, driven by rapid industrialization, rising vehicle production, and increasing demand for passenger and commercial vehicles. Strong government support, growing urbanization, and expanding automotive infrastructure further boost market growth, making the region a key hub for clutch manufacturing, innovation, and aftermarket opportunities.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

China Automotive Clutch Market Insights

China leads the Asia-Pacific Automotive Clutch market, fueled by high vehicle production, growing domestic demand, strong OEM presence, and rapid adoption of advanced clutch technologies across passenger and commercial vehicles.

North America Automotive Clutch Market Insights

North America is the fastest-growing Automotive Clutch market, driven by increasing vehicle production, rising adoption of automated and dual-clutch transmissions, and strong aftermarket demand. Technological advancements, supportive automotive policies, and growing preference for fuel-efficient and high-performance vehicles further accelerate market growth in the region over the coming years.

-

U.S. Automotive Clutch Market Insights

The U.S. Automotive Clutch market is growing rapidly, fueled by rising vehicle production, increasing demand for advanced transmission systems, and strong aftermarket growth, supporting enhanced performance and efficiency across passenger and commercial vehicles.

Europe Automotive Clutch Market Insights

The Europe Automotive Clutch market is witnessing steady growth, supported by increasing vehicle production, adoption of advanced transmission systems, rising demand for fuel-efficient solutions, and a focus on durability and performance across passenger cars and commercial vehicles.

-

Germany Automotive Clutch Market Insights:

Germany dominates the European Automotive Clutch market, driven by strong automotive manufacturing, advanced transmission technology adoption, high demand for reliable clutches, and a focus on efficiency and performance in both passenger and commercial vehicles.

Latin America Automotive Clutch Market Insights:

The Latin America Automotive Clutch market is expanding steadily, supported by growing vehicle production, rising demand for commercial and passenger vehicles, increasing aftermarket opportunities, and gradual adoption of advanced clutch technologies across the region, contributing to overall market growth and enhanced automotive performance.

-

Brazil Automotive Clutch Market Insights:

Brazil leads the Latin America Automotive Clutch, driven by strong automotive manufacturing, increasing commercial vehicle demand, and rising adoption of advanced clutch technologies across both OEM and aftermarket segments.

Middle East & Africa Automotive Clutch Market Insights:

The Middle East & Africa Automotive Clutch market is growing steadily, driven by increasing vehicle production, rising demand for commercial and passenger vehicles, adoption of advanced clutch technologies, expanding aftermarket services, and investments in automotive infrastructure across the region.

-

Saudi Arabia Automotive Clutch Market Insights:

Saudi Arabia is dominating the Middle East & Africa Automotive Clutch market, driven by its strong automotive industry, growing commercial vehicle demand, and increasing adoption of advanced vehicle technologies.

Automotive Clutch Market Competitive Landscape:

Established in 1915, ZF Friedrichshafen is a global leader in driveline, chassis, and automotive technologies, providing innovative solutions across passenger cars and commercial vehicles. Its SACHS brand, founded in 1895, offers OE-quality clutches, shock absorbers, and suspension components, enhancing vehicle performance, reliability, driver comfort, and long-term maintenance efficiency while supporting next-generation mobility worldwide.

-

Feb 1, 2024 – ZF Aftermarket expands in India, strengthening local manufacturing of TRW shock absorbers, SACHS clutches, and other OE-quality products, enhancing customer-centric solutions and supporting next-generation mobility.

BorgWarner, established in 1928, is a global automotive technology leader specializing in powertrain solutions, including dual-clutch transmissions, electric drive systems, and turbochargers. The company delivers innovative, efficient, and durable components that enhance vehicle performance, fuel efficiency, and emission reduction. With a strong presence in North America, Europe, and Asia, BorgWarner supports OEMs worldwide with advanced drivetrain and mobility solutions.

-

09 May 2025 – BorgWarner strengthens its dual-clutch transmission business in China, securing a new contract with a Chinese OEM and extending a seven-year partnership with a German OEM, enhancing production in Tianjin and Taicang.

Eaton, established in 1911, is a global power management company providing innovative automotive and industrial solutions. Its Advantage clutches and Cummins flywheel kits for automated manual transmissions enhance vehicle performance, reliability, and driveline protection, supporting efficient maintenance and long service life across commercial, industrial, and mobility applications worldwide.

-

Oct 22, 2024 – Eaton now offers its Advantage automated series clutch and Cummins flywheel kits for the Endurant AMT together for the first time, improving installation efficiency, vehicle performance, and driveline protection

Automotive Clutch Market Key Players:

-

Clutch Auto Ltd

-

LuK

-

Maruyasu Industries

-

Valeo

-

Nisshinbo Holdings

-

BorgWarner

-

Schaeffler

-

Sachs

-

Wabco

-

ZF Friedrichshafen

-

Bendix

-

Exedy Corporation

-

Aisin Seiki

-

EBC Brakes

-

Eaton Corporation

-

F.C.C. Co., Ltd.

-

Haldex

-

NSK Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 13.62 Billion |

| Market Size by 2032 | USD 20.38 Billion |

| CAGR | CAGR of 5.17% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transmission Type (Manual, Automatic (Torque-Converter), Automated Manual Transmission (AMT), Dual-Clutch Transmission (DCT), Others (e-Clutch, CVT Clutch Packs, etc.)) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Off-Highway (Agricultural and Construction)) • By Clutch Component (Clutch Disc and Hub, Pressure Plate and Cover, Release Bearing/Slave Cylinder, Flywheel (Single and Dual-Mass), Actuation Systems (Hydraulic, Electro-Hydraulic, Electronic)) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Clutch Auto Ltd, ICER Brakes, LuK, Maruyasu Industries, FTE Automotive, Valeo, Nisshinbo Holdings, BorgWarner, Schaeffler, Sachs, Wabco, ZF Friedrichshafen, Bendix, Exedy Corporation, Aisin Seiki, EBC Brakes, Eaton Corporation, F.C.C. Co., Ltd., Haldex, and NSK Ltd. |