Automotive Casting Market Report Scope & Overview:

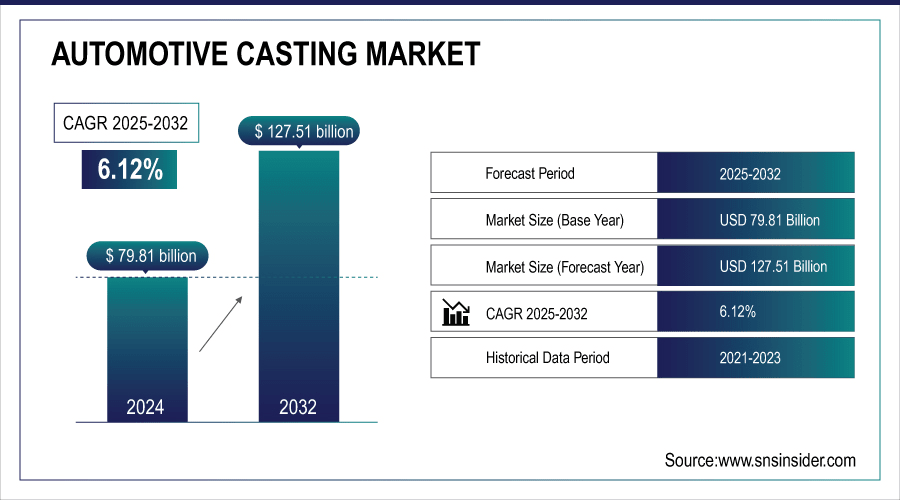

Automotive Casting Market was valued at USD 79.81 billion in 2024 and is expected to reach USD 127.51 billion by 2032, growing at a CAGR of 6.12% from 2025-2032.

The Automotive Casting Market is growing due to increasing demand for lightweight and fuel-efficient vehicles, rising production of commercial and passenger vehicles, and the adoption of advanced casting technologies. Expansion of the automotive industry in emerging economies, coupled with stringent emission regulations promoting durable and efficient components, further drives growth. Additionally, rising investment in electric vehicles and the need for high-performance engine, transmission, and suspension parts contribute significantly to market expansion.

A 2022 summary by the U.S. Department of Energy’s Advanced Manufacturing Office (via the American Foundry Society) highlights insights into global metal casting industries—including those serving the automotive sector. Although historical in nature, this provides context on production patterns in regions like the U.S., China, Europe, Japan, and Brazil.

Tesla's Giga Press, a groundbreaking high-pressure die casting technology, enables single-piece chassis casting, replacing over 70 components with one. This innovation supports approximately 1,000 castings per day at around 80–90 seconds each, significantly improving production efficiency and aligning with the trends of lightweight, fuel-efficient, and high-performance vehicle components.

To Get More Information On Automotive Casting Market - Request Free Sample Report

Automotive Casting Market Trends

-

Growing automotive production and demand for lightweight, fuel-efficient vehicles are driving casting adoption.

-

Advances in aluminum, magnesium, and hybrid metal castings are improving performance and reducing vehicle weight.

-

Increasing use of precision and high-pressure die casting is enhancing component quality and durability.

-

Rising focus on electric vehicles is boosting demand for specialized cast components.

-

Expansion of automotive aftermarket and replacement parts is supporting market growth.

-

Adoption of automation, robotics, and 3D printing in casting processes is improving efficiency.

-

Collaborations between OEMs, foundries, and material suppliers are accelerating innovation and technology development.

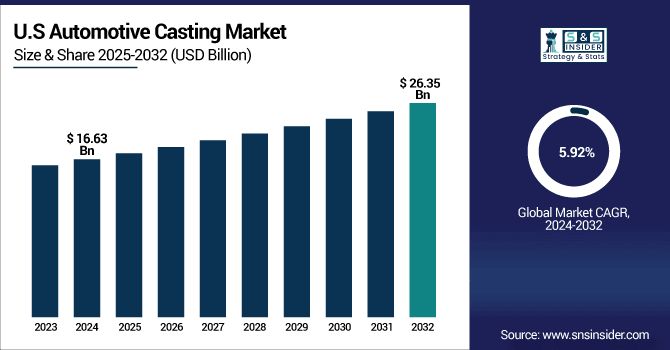

U.S. Automotive Casting Market was valued at USD 16.63 billion in 2024 and is expected to reach USD 26.35 billion by 2032, growing at a CAGR of 5.92% from 2025-2032.

The U.S. Automotive Casting Market is growing due to rising demand for lightweight, fuel-efficient vehicles, increasing production of electric and passenger vehicles, adoption of advanced casting technologies, and stringent emission regulations driving the need for durable, high-performance automotive components.

Automotive Casting Market Growth Drivers:

-

Lightweight vehicle production is increasing globally due to stricter emission regulations and fuel efficiency targets driving automotive casting demand

Automotive manufacturers are increasingly prioritizing lightweighting strategies to meet stringent emission norms and fuel economy standards, which has accelerated the demand for advanced casting techniques. Aluminum and magnesium castings are being widely adopted to replace heavy steel components, significantly reducing vehicle weight without compromising strength. This shift not only improves fuel efficiency but also enhances overall performance and sustainability. Governments worldwide are enforcing regulatory compliance, which further compels OEMs to invest in casting innovations. The growing preference for lighter vehicles across passenger and commercial segments ensures consistent demand for automotive casting technologies in the coming years.

-

European CO₂ Targets: The European Union mandates a reduction in average CO₂ emissions for new passenger cars to 95 g/km by 2021, with further reductions of 15% by 2025 and 37.5% by 2030, under regulations such as Regulation No 443/2009 and Euro 6 standards. These regulations drive demand for lighter, more efficient automotive components.

-

Forging & Casting Innovations:

-

Ford and Honda have explored forged aluminum connecting rods, achieving up to 30% weight savings over traditional steel or cast designs.

-

Grede, a casting firm within the American Lightweight Materials Manufacturing Innovation Institute, achieved 40% weight reduction and 50% thickness reduction in differential-case components using thin-wall lost-foam casting on existing production lines.

-

Automotive Casting Market Restraints:

-

Fluctuating raw material prices and rising input costs significantly reduce profit margins across global automotive casting industry supply chain

Raw material costs, especially for aluminum, steel, and magnesium, account for a major portion of automotive casting production expenses. Frequent volatility in metal prices creates instability in supply chains and makes cost forecasting difficult for manufacturers. This price fluctuation directly affects profit margins for casting companies, particularly small and medium-scale foundries. In addition, geopolitical factors and global trade disruptions amplify the problem by creating shortages and uneven availability of critical raw materials. These rising costs also limit manufacturers’ ability to invest in R&D, automation, and sustainability initiatives, restricting the long-term growth potential of the market.

Automotive Casting Market Opportunities:

-

Expanding use of additive manufacturing and 3D printing in prototyping creates new opportunities for innovation in automotive casting industry

Automotive manufacturers are increasingly leveraging additive manufacturing and 3D printing to create prototypes and molds for casting with greater efficiency. This integration reduces design-to-production time, lowers tooling costs, and allows for more complex component geometries. Foundries are using hybrid approaches that combine casting with 3D printing to deliver lightweight, high-performance parts. As demand for customization and precision engineering grows, 3D printing opens pathways for innovation in both mass production and niche markets. This synergy between traditional casting and advanced manufacturing technologies strengthens competitiveness and enables suppliers to capture new market opportunities globally.

| Company / Institution | Technology / Innovation | Key Achievements / Stats | Impact on Automotive Casting |

|---|---|---|---|

|

GM – Warren Tech Center |

3D Printing (Various Materials) |

~30,000 prototype parts 3D-printed annually; 3D-printed stainless steel seat bracket 40% lighter and 20% stronger than traditional |

Supports rapid prototyping and integration of additive manufacturing (AM) into casting workflows |

|

Foundry Lab & Eaton |

Digital Metal Casting System (Microwave + Additive Manufacturing) |

Cast aluminum parts with stainless steel pins using hybrid method |

Enables complex internal features, faster turnaround, and merges traditional casting with AM flexibility |

|

Stratasys & Materialise |

Neo Build Processor for SLA 3D Printers |

Up to 50% faster file processing/print speeds; cuts casting pattern lead times by up to 75% |

Accelerates master pattern development for investment casting tooling and prototyping |

|

Waupaca Foundry |

3D-printed cores and molds |

Launch parts faster at reduced cost; improve dimensional control; replace traditional core box tooling; shorten design-to-casting by 2–3 weeks; support reshoring |

Enhances hybrid casting efficiency, precision, and industrial viability for low-volume production |

|

Industry-wide Survey |

Hybrid 3D sand printed cores (binder-jet) |

>90% of foundries have adopted this approach |

Blends conventional green-sand molds with digital cores for high-precision complex assemblies |

|

ZF Friedrichshafen |

Metal filament + Desktop 3D Printers (Prusa, Ultimaker) |

Fabricated large-scale press-dies at North American HQ; implementation expanded globally in Germany |

Accelerates sheet metal forming tooling and supports global manufacturing operations |

Automotive Casting Market Segment Highlights

-

By Material, Aluminium dominated with ~48% share in 2024; Aluminium fastest growing (CAGR).

-

By Vehicle Type, Passenger Vehicles dominated with ~62% share in 2024; Passenger Vehicles fastest growing (CAGR).

-

By Casting Type, Die Casting dominated with ~47% share in 2024; Investment Casting fastest growing (CAGR).

-

By Component, Engine dominated with ~41% share in 2024; Brakes and Wheels fastest growing (CAGR).

-

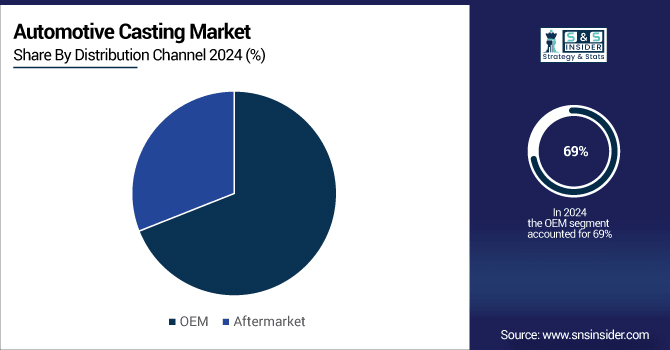

By Distribution channel, OEM dominated with ~69% share in 2024; Aftermarket fastest growing (CAGR).

Automotive Casting Market Segment Analysis

By Distribution channel, OEM dominated while Aftermarket is projected to lead growth

OEM dominated the Automotive Casting Market in 2024 because original equipment manufacturers prefer high-quality, reliable, and durable components. Their focus on stringent quality standards, large-scale production requirements, and long-term partnerships with casting suppliers ensures OEMs contribute the highest revenue share, maintaining dominance in the automotive casting sector.

Aftermarket is expected to grow at the fastest rate from 2025-2032 due to rising vehicle maintenance, refurbishment, and replacement demands. Increasing vehicle lifespan, growing consumer preference for upgraded components, and expansion of independent service providers contribute to rapid growth in aftermarket automotive casting products during the forecast period.

By Process, Die Casting dominated while Investment Casting is projected to lead growth

Die Casting dominated the Automotive Casting Market in 2024 due to its ability to produce complex, high-precision components with excellent strength and surface finish. Its efficiency, low production cost, and suitability for mass production in engines, transmissions, and structural automotive parts made it the preferred choice for manufacturers, driving significant market revenue.

Investment Casting is expected to grow at the fastest rate from 2025-2032 as it allows intricate designs, superior dimensional accuracy, and high-quality finishes. Its adoption is increasing for specialized engine parts, aerospace-grade components, and electric vehicle applications, where precision, durability, and performance are critical, fueling rapid growth in the automotive casting market.

By Application, Engine dominated while Brakes and Wheels are projected to lead growth

Engine dominated the Automotive Casting Market in 2024 because engines require durable, high-performance, and heat-resistant components, which casting processes efficiently provide. The rising production of fuel-efficient and electric engines, along with stringent emission standards, further drives demand for cast engine parts, ensuring high revenue contribution and market dominance.

Brakes and Wheels are expected to grow at the fastest rate from 2025-2032 due to increasing demand for lightweight, high-strength components to improve vehicle safety and efficiency. Growing vehicle production, adoption of advanced materials, and the need for better performance in commercial and passenger vehicles are driving rapid growth in this segment.

By Material Type, Aluminium dominated while Aluminium is projected to lead growth

Aluminium dominated the Automotive Casting Market in 2024 due to its lightweight, corrosion-resistant properties, and excellent strength-to-weight ratio, making it ideal for engines, transmission components, and structural parts. It is expected to grow at the fastest rate from 2025-2032 as manufacturers increasingly adopt aluminium to improve fuel efficiency, reduce emissions, and meet stringent environmental regulations, while supporting the rising demand for electric and high-performance vehicles.

By Vehicle Type, Passenger Vehicles dominated while Passenger Vehicles are projected to lead growth

Passenger Vehicles dominated the Automotive Casting Market in 2024 because of the high global production and sales volume, driving demand for cast components in engines, brakes, wheels, and transmissions. The segment is expected to grow at the fastest rate from 2025-2032 due to increasing vehicle ownership, expanding urbanization, rising consumer preference for lightweight, fuel-efficient vehicles, and growing adoption of electric and hybrid passenger cars worldwide.

Automotive Casting Market Regional Analysis

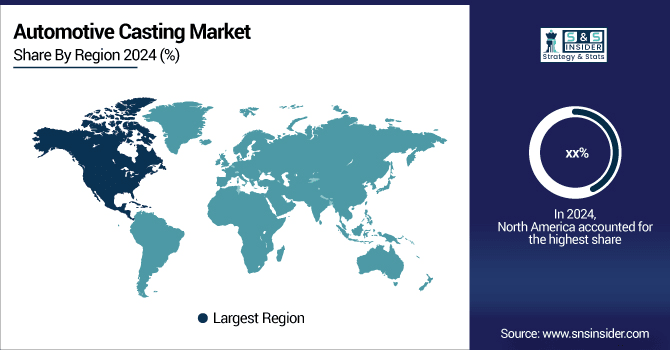

North America Automotive Casting Market Insights

North America held a significant share in the Automotive Casting Market in 2024 due to advanced manufacturing infrastructure, high adoption of innovative casting technologies, and strong presence of major automotive OEMs. Rising demand for lightweight, fuel-efficient, and electric vehicles, coupled with stringent emission and safety regulations, is driving the need for high-quality cast components. Technological advancements and investments in electric mobility further support market growth in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Automotive Casting Market Insights

Asia Pacific dominated the Automotive Casting Market with about 41% revenue share in 2024 due to rapid industrialization, growing automotive manufacturing facilities, and high demand for passenger and commercial vehicles. The region benefits from cost-effective labor, advanced production technologies, and strong supply chains. Additionally, increasing vehicle exports, rising investments in electric vehicles, and supportive government initiatives for automotive growth contributed significantly to securing the highest market revenue.

Europe Automotive Casting Market Insights

Europe accounted for a substantial share in the Automotive Casting Market in 2024 due to the presence of leading automotive manufacturers, advanced casting technologies, and stringent emission and safety regulations. Growing demand for lightweight, fuel-efficient, and electric vehicles drives the adoption of high-quality cast components. Investments in electric mobility, government incentives, and a focus on sustainable manufacturing practices further support market expansion across the European region.

Middle East & Africa and Latin America Automotive Casting Market Insights

Middle East & Africa held a moderate share in the Automotive Casting Market in 2024 due to growing automotive production, increasing demand for commercial vehicles, and investments in industrial infrastructure. Rising urbanization, economic development, and adoption of advanced casting technologies are driving market growth.

Latin America contributed significantly to the Automotive Casting Market in 2024, supported by expanding vehicle production, rising demand for passenger and commercial vehicles, and growing industrialization. Favorable government policies, infrastructure development, and increasing adoption of lightweight, fuel-efficient components further enhance market growth in the region.

Automotive Casting Market Competitive Landscape:

Aisin Corporation

Aisin Corporation is a key player in the Automotive Casting Market, recognized for producing high-precision, durable components for engines, transmissions, and electric drivetrains. Its focus on lightweight, fuel-efficient, and electrified vehicle parts, combined with a global manufacturing footprint and advanced casting technologies, enables it to meet growing demand for performance, sustainability, and innovation, reinforcing its leadership in the automotive casting sector.

-

2025: Aisin, alongside Toyota Group partners, launched the Toyota Software Academy and Global AI Accelerator (GAIA) to upskill over 100 engineers in AI and software—all toward advancing smart mobility and electrification.

-

2024: Aisin partnered with BMW to co-produce e-axles (build-to-print) in China and Europe, aligning with BMW’s electrification strategy and using Aisin’s global manufacturing footprint.

-

2025: Aisin Takaoka began field trials using Bio-M-Coke, a palm kernel shell–derived biofuel, to replace traditional coke in iron melting—achieving carbon-neutral casting operations with 100% part replacement at partner facilities.

-

2024: Exhibiting at the Automotive Engineering Exposition, Aisin showcased the Xin1 integrated eDrive, a future-ready electric drivetrain, plus advanced safety and convenience solutions like the Intelligent Pillar Unit and AI-powered boarding systems.

Nemak

Nemak is a prominent player in the Automotive Casting Market, specializing in lightweight aluminum and magnesium components for engines, transmissions, and structural automotive parts. Its focus on innovation, sustainability, and high-precision manufacturing enables it to meet the growing demand for fuel-efficient and electric vehicles. Strategic expansions and advanced production technologies strengthen Nemak’s position, supporting global growth and reinforcing its leadership in automotive casting solutions.

-

2025: Nemak agreed to acquire GF Casting Solutions' automotive division for USD 336 million, adding advanced aluminum/magnesium structural component capabilities and production capacity across Europe, China, and the U.S.

-

2023: Nemak completed a major USD 18 million facility expansion in Sheboygan, Wisconsin, adding 35,300 ft² of die-casting production with two 4,500-ton machines to support growth and sustainability in EV components.

Key Players

Some of the Automotive Casting Market Companies

-

Nemak

-

Ryobi Die Casting

-

Rheinmetall Automotive

-

Robert Bosch GmbH

-

Dynacast

-

Pace Industries

-

Gibbs Die Casting

-

Martinrea Honsel

-

Aisin Group

-

Bocar Group

-

Shiloh Industries

-

Endurance Technologies

-

Koch Enterprises

-

Linmar Corporation

-

Sunbeam Lightweighting

-

Cast Products, Inc.

-

Casteks Metal Science Co., Ltd.

-

Bedford Machine & Tool Inc.

-

Alcast Technologies

-

Meridian Lightweight Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 79.81 Billion |

| Market Size by 2032 | USD 127.51 Billion |

| CAGR | CAGR of 6.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process(Die Casting, Sand Casting, Investment Casting) • By Application(Transmission and Suspension, Engine, Brakes and Wheels) • By Material Type(Steel, Iron, Aluminium) • By Vehicle Type(Commercial Vehicles, Passenger Vehicles) • By Distribution Channel(OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nemak, Ryobi Die Casting, Rheinmetall Automotive, GF Casting Solutions, Dynacast, Pace Industries, Gibbs Die Casting, Martinrea Honsel, Aisin Group, Bocar Group, Shiloh Industries, Endurance Technologies, Koch Enterprises, Linmar Corporation, Sunbeam Lightweighting, Cast Products, Inc., Casteks Metal Science Co., Ltd., Bedford Machine & Tool Inc., Alcast Technologies, Meridian Lightweight Technologies |