Automotive Grille Market Report Scope & Overview:

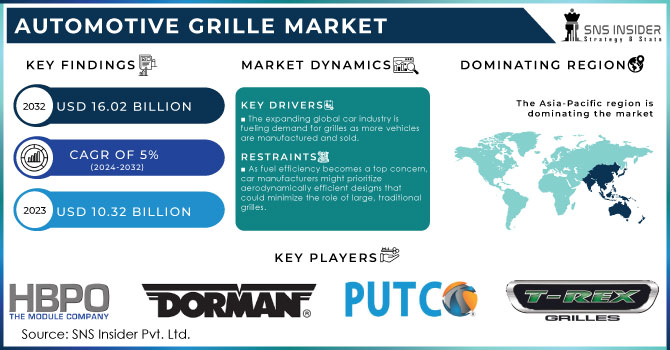

The Automotive Grille Market Size was $10.32 billion in 2023 and is expected to reach USD 16.02 billion by 2032 and grow at a CAGR of 5% by 2024-2032.

Get More Information on Automotive Grille Market - Request Sample Report

The automotive grille market is experiencing a positive outlook due to several converging factors. The global expansion of the automotive industry is the main component, as more vehicles are produced and being sold worldwide. The rising disposable income and increasing urbanization are leading consumers to prioritize aesthetics alongside functionality when purchasing cars. This translates to a growing demand for stylish and attractive grilles that enhance the overall vehicle design. The technological advancements are playing the role in market growth. The introduction of lightweight materials like carbon fibre and aluminium offers car manufacturers benefits such as improved fuel efficiency and reduced CO2 emissions, making these materials increasingly popular choices for grille construction. The rise of electric vehicles presents exciting opportunities for grille manufacturers as electric vehicles require efficient cooling systems to manage battery and electric motor temperatures, creating a demand for specialized grilles designed to meet these unique needs. The growing trend of autonomous vehicles is expected to drive the demand for grille-integrated sensors and other advanced features.

MARKET DYNAMICS:

KEY DRIVERS:

-

The expanding global car industry is fueling demand for grilles as more vehicles are manufactured and sold.

-

Rising disposable income and urbanization are leading consumers to prioritize stylish grilles that enhance car design.

The rise in disposable income, coupled with increasing urbanization, is significantly impacting consumer preferences in the automotive grille market. As people have more money to spend and drifted towards city living, aesthetics are becoming increasingly important alongside functionality when purchasing a car. This shift in priorities translates to a growing demand for stylish and visually appealing grilles. These grilles elevate the overall design of the vehicle, creating a sense of individuality and reflecting the owner's taste.

RESTRAINTS:

-

As fuel efficiency becomes a top concern, car manufacturers might prioritize aerodynamically efficient designs that could minimize the role of large, traditional grilles.

The Fuel efficiency is becoming a concern for car manufacturers, leading them to prioritize aerodynamically efficient designs. This focus on well-organized airflow could potentially minimize the role of large, traditional grilles. As air resistance is a major contributor to fuel consumption, car designs might evolve to reduce the size or even close off grilles altogether. This shift could pose a challenge for the traditional automotive grille market, potentially leading to a demand for smaller grilles or even entirely new grille functionalities that prioritize both aesthetics and aerodynamics.

-

The high cost of advanced materials like carbon fibre could limit their widespread adoption in grille construction.

OPPORTUNITIES:

-

Growing consumer preference for stylish vehicles opens doors for innovative and visually appealing grille designs.

-

Technological advancements with lightweight materials like carbon fibre offer a chance to create more fuel-efficient grilles.

CHALLENGES:

-

Balancing safety regulations that require impact-absorbing grilles with the need for maximum airflow for engine cooling presents a design hurdle.

-

The growing emphasis on aerodynamics in EVs, potentially leading to smaller or closed grilles, could disrupt traditional grille manufacturers.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the previously optimistic outlook of the automotive grille market. Ukraine was a source of certain auto parts, and the conflict has stopped their production and export. This has caused delays in vehicle production worldwide, with estimates suggesting a shortfall of 400,000 units. This has affected the rise in the prices of car, both new and used, due to limited supply. Sanctions imposed on Russia have significantly impacted the market. Several automakers like Toyota, Ford, and BMW, have ceased exports to Russia which is leading to a decline in demand. Russia itself houses 34 auto manufacturing facilities that have suspended operations due to parts shortages and sanctions. This translates to a significant drop in grille production within Russia, further impacting the global supply chain. The immediate disruptions, of the war, have also exacerbated the ongoing chip shortage that has plagued the auto industry. Russia is a major supplier of key minerals necessary for semiconductor manufacturing and the war has disrupted the export of these materials, potentially leading to further delays in vehicle production and impacting the demand for grilles.

IMPACT OF ECONOMIC SLOWDOWN

During the economic downturn, consumer spending typically contracts, impacting various industries, including automotive. This can directly affect the grille market in several ways. The decline in car sales translates to a decrease in demand for new grilles as past recessions have shown a drop in car sales by as much as 20%. This translates to a similar or slightly lower decrease in demand for grilles, as some replacement parts might still be needed. The economic hardship can make consumers more cautious about discretionary spending. Grilles, while often contributing to a car's aesthetics, are primarily functional. In such a scenario, consumers might prioritize essential car maintenance over grille upgrades or customizations, potentially leading to a further 5-10% decline in demand for non-essential grilles. The sales of high-end, customized grilles might be hit harder, the demand for replacement grilles for essential repairs could remain relatively stable. Thus, an economic slowdown can lead to a combined decline of 25-30% in the automotive grille market, with a potential for faster recovery as economic conditions improve.

KEY MARKET SEGMENTS:

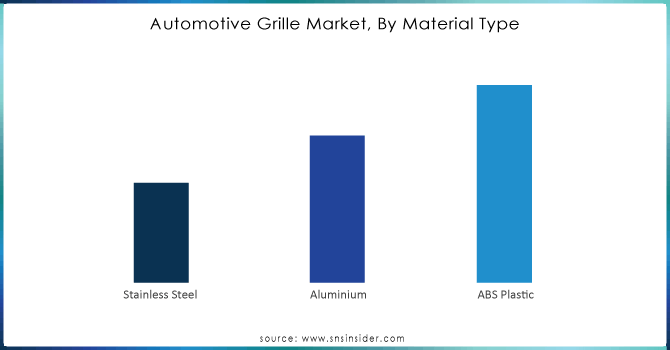

By Material Type:

-

Stainless Steel

-

Aluminium

-

ABS Plastic

The ABS Plastic is the dominating sub-segment in the Automotive Grille Market by material type holding around 60% of the market share. The ABS plastic offers a compelling balance of affordability, lightweight properties and design flexibility. It is simple to shape into a variety of shapes and styles, which makes it fit for many car models. ABS plastic is a cost-effective option compared to metals like aluminium and stainless steel.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Product:

-

CNC Automotive Grille

-

Billet Automotive Grille

-

Mesh Automotive Grille

The Mesh Automotive Grille is the dominating sub-segment in the Automotive Grille Market by product type holding around 45% of market share. Mesh grilles provide a good balance between airflow and protection for the radiator. They are also popular for their sporty and stylish appearance, catering to a large segment of car buyers. Additionally, mesh grilles are generally lighter than other options, contributing to fuel efficiency.

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

Passenger Cars is the dominating sub-segment in the Automotive Grille Market by vehicle type holding around 70% of market share. The passenger car segment is the fastest-growing segment as it naturally translates to a higher demand for grilles for passenger cars compared to light commercial vehicles and heavy commercial vehicles.

By Sales Channel:

-

OEM

-

Aftermarket

The Original Equipment Manufacturer is the dominating sub-segment in the Automotive Grille Market by sales channel holding around 80% of market share. OEM grilles are factory-installed grilles that come standard with the vehicle. As car manufacturers produce the high volume of vehicles, the demand for OEM grilles significantly increases than the aftermarket segment.

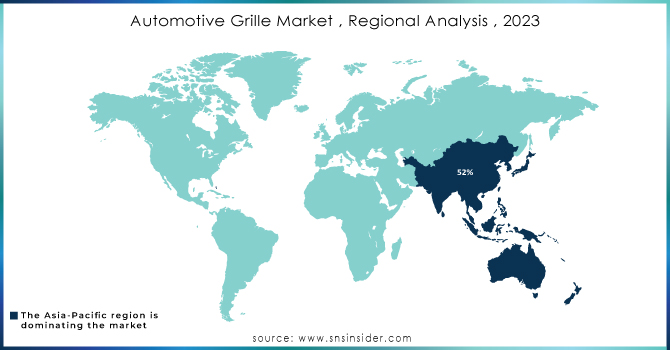

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the automotive grille market holding around 52% market share. This dominance is fueled by China's growing car manufacturing industry and a rising middle class with more disposable income to spend on personal vehicles, including grilles. Europe is the second highest region in this market with an estimated 20-25% of market share, leveraging its long-established automotive industry and focus on premium vehicles that often sport intricate and expensive grilles. The North America is experiencing the rapid growth of 4-5%. This can be attributed by the ongoing demand for replacing the vehicles, the popularity of the larger vehicles like pickup-trucks and SUVs and the emerging trend of electric vehicles, which could create the new opportunities for grille manufacturers.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are T-REX Grille (US), Putco (US), Dorman Products (US), HBPO GmbH (Germany), SRG Global (US), Magna International (Canada), Roush Performance (US), Westin Automotive Products (US), Toyoda Gosei Co, Ltd. (Japan), Kirin Auto Parts Co, Ltd (China). and other key players.

RECENT DEVELOPMENTS:

-

In March 2023 - Dorman Products, Inc. announced the release of 200 new motor vehicle parts, including 80 exclusive options and components specifically designed for popular electric vehicles. This expansion reinforces their commitment to offering repair solutions for all vehicle types, from gas-powered to electric.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.32 Billion |

| Market Size by 2032 | US$ 16.02 Billion |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material Type (Aluminum, Stainless Steel, ABS Plastic) • by Product (Mesh Automotive Grille, CNC Automotive Grille, Billet Automotive Grille) • by Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | T-REX Grille (US), Putco (US), Dorman Products (US), HBPO GmbH (Germany), SRG Global (US), Magna International (Canada), Roush Performance (US), Westin Automotive Products (US), Toyoda Gosei Co, Ltd. (Japan), and Kirin Auto Parts Co, Ltd (China). |

| Key Drivers | •Improved performance is becoming more widely recognized. •The importance of aerodynamics in fuel efficiency has shifted, and it has proven to be a critical driver. |

| RESTRAINTS | •Due to the current slump in the automotive industry, the automotive grille can expect a downturn. •Premium manufacturers' production rates are being slashed on a regular basis. |