Titanium Dioxide Market Report Scope & Overview:

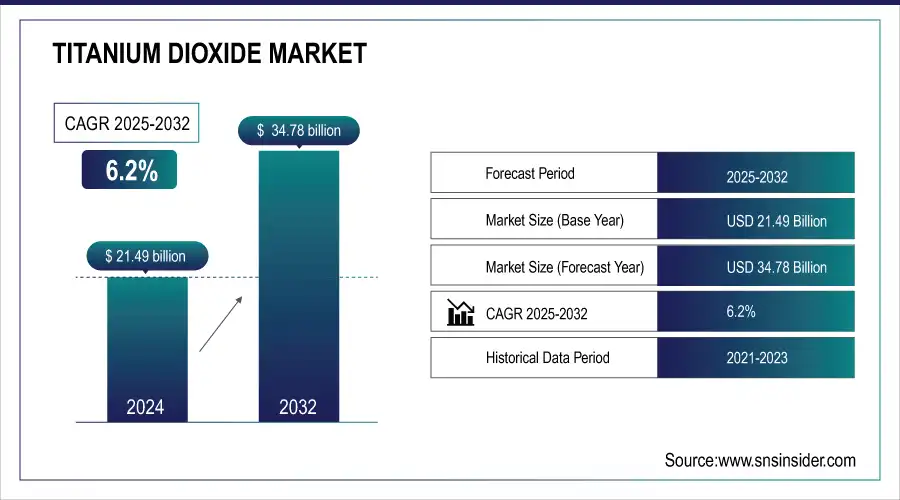

The Titanium Dioxide Market Size was valued at USD 21.49 billion in 2024 and is expected to reach USD 34.78 billion by 2032, and grow at a CAGR of 6.2% over the forecast period 2025-2032.

The Titanium Dioxide market is extremely dynamic and sensitive to changes in conditions, regulatory alterations, extraction process changes, and changes in customers' preferences. Indeed, the dynamics are so crucial that they alter the way the titanium dioxide material itself is used in various sectors: paints, coatings, plastics, and food products. Safety, sustainability, and strict compliance have become increasingly important matters of focus in this industry. These forces have been reflected in recent trends in practice, as the market shows the patterns of demand by consumers and newfound concerns for regulatory oversight.

Get More Information on Titanium Dioxide Market - Request Sample Report

Titanium Dioxide Market Size and Forecast:

-

Market Size in 2024: USD 21.49 Billion

-

Market Size by 2032: USD 34.78 Billion

-

CAGR: 6.2% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Titanium Dioxide Market Trends:

-

Growing demand for TiO₂ in paints and coatings boosts market growth, driven by rapid urbanization, infrastructure expansion, and architectural projects.

-

Increasing use of titanium dioxide in plastics enhances product durability, UV resistance, and performance across packaging, automotive, and consumer goods industries.

-

Rising demand from cosmetics and personal care products fuels TiO₂ adoption due to its UV protection and whitening properties.

-

Advancements in nanotechnology enable the development of ultrafine TiO₂ for photocatalysts, solar cells, and environmental purification applications.

-

Shift toward sustainable production methods reduces carbon footprint, aligning with global environmental regulations and green manufacturing initiatives.

-

Expansion of the automotive sector drives TiO₂ consumption in high-performance coatings and lightweight polymer components.

-

Growing demand from paper and pulp industries strengthens TiO₂ applications for brightness and opacity improvements.

Extraction Process Innovation has also emerged as a significant development within the Titanium Dioxide Market. In May 2024, Kuncai revealed a ground-breaking extraction method that integrates titanium dioxide with iron oxide, thereby helping to improve its functionality and sustainability simultaneously. This new approach will not only introduce better performance of titanium dioxide in coatings and plastics but will also serve the growing need for eco-friendly products. Since sustainability is now recognized as the unifying theme of the disparate industries, companies would rely on their capacity to produce titanium dioxide with a greater reduced environmental footprint.

The Titanium Dioxide Market is changing from within, owing to regulatory pressures, safety concerns, and technological improvements. Such responses from manufacturers would impact the market space, ensuring more emphasis on sustainable practices and the safety of products. The future direction of titanium dioxide adoption across different industries will be significantly influenced by both regulatory dynamics and innovative solutions.

Titanium Dioxide Market Drivers:

-

The growing emphasis on sustainability and eco-friendly products is driving the Titanium Dioxide market.

The main growth driver for the Titanium Dioxide market has been the demand for greener and more environmentally friendly products. With companies such as Asian Paints etc, developing green-friendly paint coatings among other formulations, increasingly such companies consume more titanium dioxide in an increasingly large number of 'green' formulations that are said to have a lesser adverse environmental impact. This in turn has been driven by consumer preference for sustainable products, which then influences industry practice and promotes innovation. Eco-friendly products have experienced increased demand as consumers and regulators prioritize sustainability further. This has led the paints, coatings, and plastics industry to prefer more environment-friendly titanium dioxide formulations. For instance, water-based paints with titanium dioxide can have VOCs greatly reduced during and after use, hence promoting cleaner air. The automotive and construction industries are also shifting to environmentally friendly coatings based on titanium dioxide that deliver opacity and brightness but cause less damage to the environment. This trend is supported by legislations implemented to minimize harmful substances. Thus, the demand for titanium dioxide as an environmentally friendly substance will increase further. The research and development spending by manufacturers is indeed used to come up with more innovative products meeting such requirements that would make them highly competitive in the market to deal with sensitive consumers about the environment. Hence, this driver will go a long way in shaping the growth curve for the market for Titanium Dioxide shortly.

-

The expansion of the construction and automotive industries is a significant driver for the Titanium Dioxide market.

Construction and automobile industries are steadily augmenting the market; thus, an increase is being seen in the Titanium Dioxide market. Titan dioxide is used in paints, coatings, plastics, and other applications in the above industries, which is allowing the expansion of the market. Construction industry, in recent times, has achieved an extremely high rise due to urbanization and population growth. Titanium dioxide is one of the important raw materials in the preparation of high-grade paints and coatings for painting and decoration of dwelling houses and commercial establishments. Construction work is growing so rapidly worldwide and therefore, is in addition boosting the demand for titanium dioxide. With higher development in the automobile industries and the demand for more exquisite coatings, the growth in the automobile market is causing an increase in this market as well. Titanium dioxide makes paints aesthetically pleasing in addition to allowing it to perform better by keeping it resistive to the weather and UV radiation. The more intense competition within manufacturers in the development of longer-lasting, more attractive products, the more critical a component of such formulations Titanium dioxide will remain. As the coverage of electric vehicles and sustainability solutions go up in the automotive industry, the demand for this product also increases as improved coating technologies build up such enormous pressure on the market of Titanium Dioxide. If all of these sectors are combined together, they will virtually add a hike to the growth of the Titanium Dioxide market.

Titanium Dioxide Market Restraints:

-

Health concerns regarding titanium dioxide, particularly its potential toxicity when inhaled, pose a significant restraint on the market.

Significant health issues are associated with titanium dioxide primarily by the potential toxicity of the substance if inhaled. The regulatory scrutiny has also increased and called for tighter safety assessments as well as bans on applications in some areas. Lately, public attention has been drawn to various studies that have alerted people to the health implications of exposure to titanium dioxide, particularly in its fine powder form meant for inhalation. These have raised public regulatory concerns, and hence various health organizations are re-evaluating its safety in consumer products. The European Union has recently been suggesting the banning of titanium dioxide in food products as it may cause carcinogenic effects. This type of regulatory issue can escalate compliance costs for firms and consequently change market dynamics due to reduced availability of a product. There could also be a demand for companies to spend more on research and development coming up with safer alternatives or enhancing the safety profile of their existing products. This may only further weaken the company's bottom line but also slow down the rate of innovation. Even higher awareness levels among the public concerning health issues may shift consumer preference and move demand away from the products made using titanium dioxide. As such, the laws and regulations get sterner with time. This may pose major market barriers for the industry, and hence, demand may come down in many applications for titanium dioxide.

Titanium Dioxide Market Opportunities:

-

Emerging markets present significant growth opportunities for the Titanium Dioxide market.

Emerging markets reflect immense growth prospects for the Titanium Dioxide market. The regions of Asia-Pacific, Latin America, and Africa reflect industrialization and urbanization taking place at an extremely rapid speed. This reflects a massive demand for construction materials and coatings, which generates a wide market for titanium dioxide. Economic growth in developing regions reflects the need to develop infrastructure, which directly influences the demand for paints, coatings, and other construction materials. For instance, India and China have recently witnessed a massive tide of urbanization that results in increased construction work. The increase results in a higher demand for superior-quality coatings made with titanium dioxide for durability and aesthetic reasons. At the same time, the markets in these places are changing towards sustainable construction practices, which heightens the demand for the eco-friendly use of titanium dioxide. The automotive coatings market is also growing in emerging markets due to sector growth, and rising disposable incomes are raising vehicle ownership and corresponding demand. In this scenario, the ball is in the court of titanium dioxide manufacturers to expand their presence in the said operations and markets. Companies can capture growth potential in this way by strategically targeting emerging markets, and building competitiveness and profitability in the global market.

Titanium Dioxide Market Challenges:

-

The Titanium Dioxide market faces challenges from intense competition and price volatility, impacting profit margins and market stability.

The Titanium Dioxide market had factors like high competition and price volatility that battered the profit margins and hampered the market's stability. When infinite players share the market, it becomes very complicated to maintain competitive pricing without losing quality. There are a few major players and numerous small manufacturers dominating the titanium dioxide market, which results in cutthroat competition. Firms have to persistently innovate and continue to offer superior quality, pushing their products above their peers to gain maximum ground in the market. For one, this competition will breed competitive price wars. That may further compress already thin margins and make survival for smaller firms even tougher. It will also affect production costs because of higher prices of raw materials caused by shifts in world markets. Such commodities may expose manufacturers' or companies' pricing plans to volatility brought about by geopolitical tension, broken supply chains, or shifts in demand. Companies have to evolve strategies to handle such situations, be it diversification of supply sources, optimizing the processes of production, or exploring new markets. An ability to respond to pressures of competition and prices will effectively assist companies in retaining their growth and profitability in the Titanium Dioxide market

Titanium Dioxide Market Segmentation Outlook

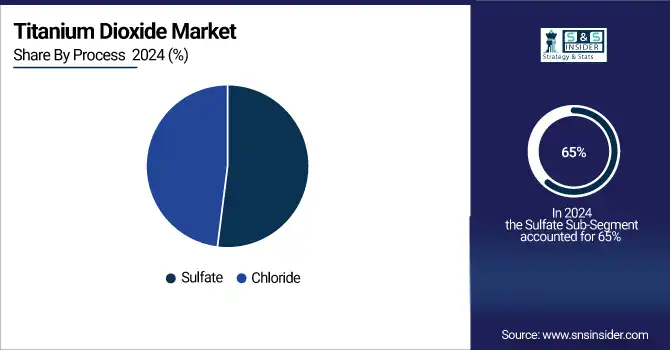

By Process, Sulfate Segment Leads Titanium Dioxide Market in 2023

In 2023, the sulfate segment dominated the Titanium Dioxide market with an approximate market share of 65%. This is so because it is inexpensive and can still produce high-grade pigment, hence being as widely adopted as possible in the industrial production of titanium dioxide. It gets titanium dioxide from ore through the use of sulfuric acid, which is economical for massive production. For instance, the two largest producers, The Chemours Company and Tronox Limited, have recently adapted to the sulfate process to utilize their titanium dioxide to capitalize on some of the enormous orders witnessed in markets like paints, coatings, and plastics. Furthermore, a strong history of technological growth through well-established supply chains benefits the sulfate segment; hence, it is the most followed method to produce titanium dioxide in the market.

By Grade, Rutile Grade Dominates the Titanium Dioxide Market with Superior Performance

The rutile segment dominated the Titanium Dioxide market with nearly 70% share in 2023. The primary cause behind this dominance is related to the superior properties rutile enjoys, such as a higher durability level and better opacity and UV resistance, making it widely used in paints, coatings, and plastics. For instance, manufacturers like DuPont and Tronox Limited focus on the rutile-grade production of titanium dioxide because it offers excellent performance for high-end applications. Automotive coatings as well as premium paints include rutile. In addition, growing demand for high-performance coatings in construction as well as the automobile sector has increased the growth of the rutile segment. Rutile exhibits a full range of variability and performance enhancement over anatase to ensure that it retains its position of being the highest grade in the Titanium Dioxide market.

By Product, Pigmentary Titanium Dioxide Holds Largest Market Share

The pigmentary segment is the largest in the Titanium Dioxide market, with an estimated market share of around 80%. This is primarily because the pigmentary form of titanium dioxide has a wide range of applications, including paints, coatings, plastics, and paper, for which excellent opacity, brightness, and weather resistance are valued. Some major companies, like The Chemours Company and Huntsman International LLC, have invested heavily in making high-quality pigmentary titanium dioxide to serve the increasing need in the construction and automotive sectors. For example, in the automotive sector, pigmentary titanium dioxide is one of the most important additives to ensure bright colors along with strong finish characteristics in auto-coatings. Pigmentary titanium dioxide's acceptance across various industries presents how vitally essential it is in enhancing the performance of such products- thus the well-deserved leadership it has in the market.

By Application, Paints & Coatings Segment Drives Titanium Dioxide Demand

In 2023, the paints & coatings segment dominated the Titanium Dioxide market, holding an estimated market share of around 45%. This dominance is driven by the wide use of titanium dioxide in architectural and industrial coatings on account of its excellent opacity, brightness, and UV resistance properties. High demand from this end-user market, thereby pushing through factors like the construction and automotive industries, is what leading companies like The Chemours Company and Tronox Limited are capitalizing on. Such industrial coatings that have high-quality and aesthetic value as well as protect against natural environmental aspects, such as weathering in the case of construction, are in significant demand; for example, titanium dioxide-based paints are widely used in the construction industry to brighten up the exterior and interior surfaces of buildings, thus offering long-lasting color and protection. Titanium dioxide, therefore assumes importance in the automotive sector for tough and shiny finishes that account for one more reason for the segment's leadership in the market.

Titanium Dioxide Market Regional Analysis:

North America Dominates the Titanium Dioxide Market in 2024

North America accounts for an estimated 37% share of the Titanium Dioxide Market in 2024, supported by robust demand across construction, automotive, and industrial applications. Titanium dioxide’s superior opacity, durability, and UV resistance make it essential for architectural coatings, automotive paints, and high-performance plastics. Ongoing infrastructure projects, home renovation activities, and a thriving automotive sector further fuel market expansion. Additionally, strong manufacturing capabilities and the presence of key producers such as The Chemours Company and Tronox Limited reinforce North America’s leadership in this market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

-

United States Leads North America’s Titanium Dioxide Market

The U.S. dominates due to its advanced manufacturing base, large-scale automotive production, and growing construction activities. Titanium dioxide is heavily used in architectural coatings, automotive paints, plastics, and paper, supporting consistent demand. Renovation projects and government-backed infrastructure investments further strengthen the U.S. market position. Leading producers like The Chemours Company and Tronox Limited are headquartered here, ensuring reliable supply chains and advanced pigmentary product development. With strong R&D, innovation, and an established customer base, the U.S. continues to lead North America’s Titanium Dioxide Market in 2024.

Asia Pacific is the Fastest-Growing Region in the Titanium Dioxide Market in 2024

The Asia Pacific Titanium Dioxide Market is projected to grow at a CAGR of 7.8% from 2025 to 2032, supported by rapid industrialization, urbanization, and strong demand for paints, coatings, plastics, and paper products. Expanding construction activities, infrastructure projects, and rising automotive production further drive consumption. Additionally, the growing middle-class population and increasing demand for high-quality consumer goods contribute to the region’s dominance. With abundant raw materials and cost-efficient manufacturing, the Asia Pacific is positioned as the fastest-growing market for titanium dioxide globally.

-

China Leads Asia Pacific’s Titanium Dioxide Market

China dominates due to its massive industrial base, large-scale construction activities, and position as a global hub for titanium dioxide production. With abundant raw materials and cost-efficient manufacturing, China exports titanium dioxide worldwide while meeting huge domestic demand in paints, plastics, and paper. Government-backed infrastructure projects, real estate expansion, and automotive sector growth are further accelerating demand. Local and global manufacturers invest in upgrading technologies to meet rising quality standards. China’s scale, cost leadership, and export strength firmly establish it as the top market in Asia Pacific.

Europe Titanium Dioxide Market Insights, 2024

Europe shows steady growth in the Titanium Dioxide Market in 2024, fueled by sustainability mandates, strong demand in construction coatings, and advanced automotive applications. Stricter EU environmental regulations are pushing industries to adopt high-grade titanium dioxide in paints and plastics. Germany’s strong automotive and construction industries boost demand for high-performance coatings, causing increased adoption of titanium dioxide across multiple applications.

-

Germany Leads Europe’s Titanium Dioxide Market

Germany dominates due to its globally recognized automotive industry, high-quality construction sector, and advanced engineering base. Titanium dioxide is widely used in automotive coatings for durability, finish quality, and UV resistance, as well as in construction paints that meet environmental standards. Strong R&D investments and adoption of innovative pigment technologies support steady market expansion. Germany’s technological leadership, focus on eco-friendly solutions, and global export strength cement its position as the top contributor to Europe’s Titanium Dioxide Market.

Middle East & Africa and Latin America Titanium Dioxide Market Insights, 2024

The Titanium Dioxide Market in the Middle East & Africa and Latin America is experiencing steady growth in 2024, supported by construction and automotive sector expansion. In the Middle East, countries like Saudi Arabia and the UAE are driving demand through large-scale real estate, smart city, and industrial projects requiring durable coatings. In Latin America, Brazil and Mexico lead with increasing residential construction, automotive production, and modernization of infrastructure. Growing foreign investments and strong industrialization trends across both regions continue to support rising titanium dioxide adoption.

Competitive Landscape for the Titanium Dioxide Market

Argex Titanium Inc.

Argex Titanium Inc. is a Canada-based company focused on producing high-purity titanium dioxide using its patented extraction technology. Specializing in cost-efficient and environmentally friendly processes, Argex offers titanium dioxide for applications in paints, coatings, plastics, and specialty products. Its role in the titanium dioxide market is significant, as it delivers sustainable solutions while reducing environmental impact compared to traditional processes. By emphasizing innovation, Argex continues to strengthen its position as a competitive supplier in the global titanium dioxide industry.

-

In 2024, Argex Titanium Inc. advanced its proprietary eco-efficient production technology, enhancing output capacity while lowering carbon emissions and production costs.

CRISTAL

CRISTAL is one of the leading global producers of titanium dioxide, with a strong portfolio that includes widely used grades such as R-900 and R-746. The company serves diverse industries, including paints, plastics, paper, and inks, offering high-quality pigments known for durability, opacity, and brightness. Its role in the titanium dioxide market is vital, with a global supply network and strong manufacturing expertise ensuring consistent product delivery across regions. CRISTAL continues to drive market demand with innovative solutions tailored for industrial applications.

-

In 2024, CRISTAL expanded its product line by introducing advanced high-opacity TiO₂ grades designed for premium paints and coatings.

DuPont

DuPont is a pioneer in the titanium dioxide industry, recognized globally for its Ti-Pure line, including high-performance grades like R-900 and R-101. Known for exceptional product quality, opacity, and brightness, DuPont serves industries ranging from construction to automotive and packaging. Its role in the titanium dioxide market is foundational, as it sets benchmarks for pigment innovation and application performance. DuPont’s continued focus on sustainable production and advanced technology reinforces its leadership position in the global titanium dioxide industry.

-

In 2024, DuPont unveiled a new Ti-Pure grade engineered for enhanced UV resistance, catering to growing demand in automotive coatings.

Evonik Industries

Evonik Industries is a global specialty chemicals company producing titanium dioxide and related products, such as Aerosil 200 and Tiona 590. With a diverse portfolio, Evonik serves paints, plastics, cosmetics, and specialty applications requiring high performance and reliability. Its role in the titanium dioxide market is central, as it leverages innovation, R&D, and sustainability to develop products meeting evolving customer demands. Evonik’s strong global presence and partnerships position it as a key player driving the titanium dioxide industry forward.

-

In 2024, Evonik introduced next-generation titanium dioxide solutions with improved dispersibility, supporting high-performance coatings and environmentally friendly formulations.

Titanium Dioxide Market Key Players:

-

Argex Titanium Inc.

-

CRISTAL

-

DuPont

-

Evonik Industries

-

Huntsman International LLC.

-

Tayca Corporation

-

NL Industries, Inc.

-

Shandong Doguide Group Co., Ltd

-

The Chemours Company

-

Tronox Limited

-

Acron

-

CPI (Chemical Products Industries)

-

Ferro Corporation

-

Huanggang Jiyuan Chemical Co., Ltd

-

Ishihara Sangyo Kaisha, Ltd

-

Kronos Worldwide, Inc.

-

Lomon Billions Group

-

National Titanium Dioxide Co. (Cristal)

-

Tayca Corporation

-

Venator Materials PLC

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 21.49 Billion |

| Market Size by 2032 | US$ 34.78 Billion |

| CAGR | CAGR of 6.2% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process (Sulfate, Chloride) • By Grade (Rutile, Anatase) • By Product (Pigmentary, Ultrafine) • By Application (Food, Paints & coatings, Paper & pulp, Textiles, Plastics & rubber, Cosmetics, Printing inks, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DuPont, mTayca Corporation, Argex Titanium Inc., CRISTAL, Shandong Doguide Group Co., Ltd, The Chemours Company Chemours, Tronox Limited, Evonik Industries, Huntsman International LLC., NL Industries, Inc, and other players. |