Transparent Electronics Market Size & Trends:

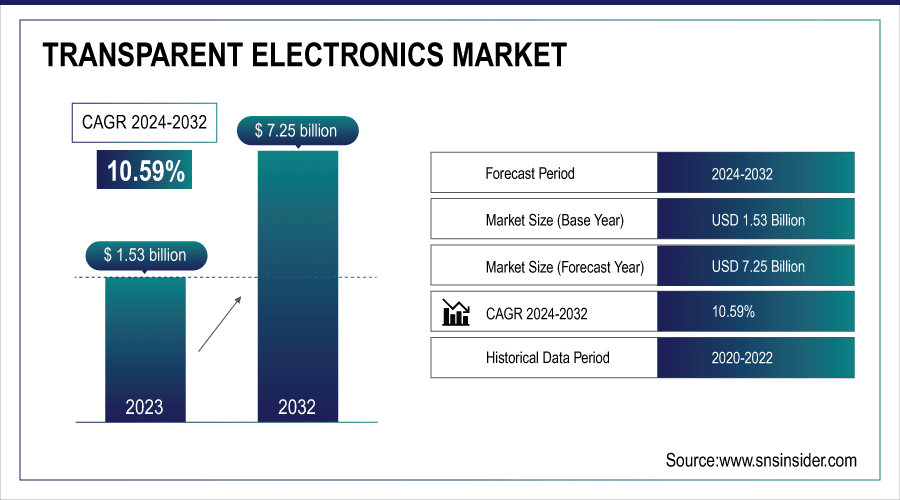

The Transparent Electronics Market was valued at USD 1.53 billion in 2023 and is expected to reach USD 7.25 billion by 2032, growing at a CAGR of 10.59% over the forecast period 2024-2032.

Innovation in the transparent electronics market is advancing swiftly through the adoption of transparent solar panels as well as Building Integrated Photovoltaics (BIPV) in sustainable architecture. It is also getting integrated into EVs (Electric Vehicles), which complements HUDs and Smart Windows. Energy efficiency, design, and IoT compatibility are key adoption drivers in the construction and smart building sectors. Finally, new displays based on OLEDs and Micro LEDs are stretching limits to offer seamless, futuristic applications in automotive, commercial, and consumer electronics. The 2024 U.S. transparent electronics market shows remarkable progress in all fields. The construction sector also took a liking to transparent solar panels, especially with the rise of building-integrated photovoltaics (BIPV) and trends toward sustainable architecture.

To Get More Information On Transparent Electronics Market - Request Free Sample Report

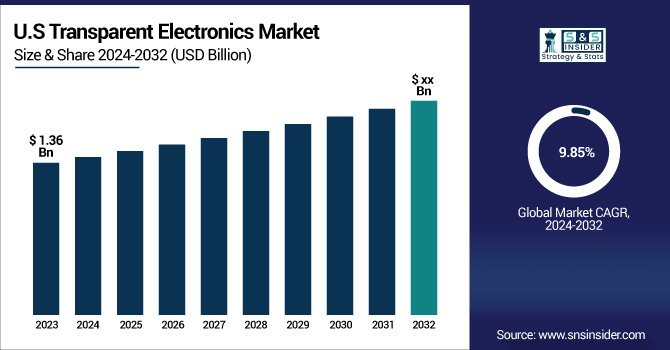

The U.S. Transparent Electronics Market is estimated to be USD 1.36 billion in 2023 and is projected to grow at a CAGR of 9.85%. The increase in investments related to smart infrastructure and government initiatives aimed at promoting clean energy technologies, also, the change in R&D through nanomaterials and conductive films for the U.S. transparent electronics market, are projected to gain traction as the need for futuristic design in consumer devices will increase.

Transparent Electronics Market Dynamics

Key Drivers:

-

Emerging Applications and Material Innovations Fuel Growth in the Transparent Electronics Market Across Key Regions

The transparent electronics market is mainly driven by the increasing demand for next-generation display technologies in consumer electronics and automotive applications. The usage of transparent displays in augmented reality (AR) devices, smart wearables, and heads-up displays (HUDs) is growing, which is expected to spur additional growth in the market. Furthermore, growing smart cities and green architecture may also increase the transparent solar panels and smart windows across Europe and the Asia Pacific. Recent advancements in material science, like transparent conductive oxides (TCOs) and graphene-based components, are improving product efficiency and transparency, thus aiding market growth.

Restrain:

-

Performance Limitations of Transparent Materials Hinder Widespread Adoption in High Demand Application Areas

The transparent electronics market is expected to be restrained by the lower performance efficiency of transparent materials available today in comparison with conventional alternatives. While widely used, materials such as indium tin oxide (ITO) are limited in their flexibility and durability, which makes them impractical for use in dynamic or extreme environments. This can result in high transparency and/or conductivity, but can reduce the ability of the device to perform, especially in high-performing applications such as military or industrial systems. These technical compromises are not well-suited for ubiquitous adoption across all relevant sectors.

Opportunity:

-

Transparent Electronics Unlock Opportunities in Automotive Construction and Emerging Applications Through Smart Sustainable Innovations

Potential growth opportunities will be observed for these applications in the automobile and construction sectors. Autonomous vehicles: Transparent electronics for EV infotainment, windshield displays, and smart glass technology are in the pipeline. The use of transparent solar panels and smart windows for energy-efficient buildings is an attractive opportunity in the construction industry. It has also opened doors for R&D needed for flexible and stretchable transparent electronics, and additional research efforts could lead to breakthroughs in healthcare devices, military applications, and next-gen security systems. With a growing demand for sustainable, smart technologies within these industries, transparent electronics are likely to impact multiple verticals positively.

Challenges:

-

Challenges in Scalability and Standardization Hinder Widespread Adoption of Transparent Electronics Across Industries

Transparent electronic switching devices are still far from being scalable and mass-produced. The intricate processes for deposition of layers of transparent conductive materials to a very high degree of precision require advanced techniques that are yet to be established as a common pathway. In addition, embedding transparent electronics within the architecture of existing devices, e.g., automotive dashboards or large-scale building facades, requires extensive cross-industry collaboration and innovation in design and engineering. Also, new entrants and startups that want to commercialize emerging technologies have to clear existing barriers to enter the market, such as regulatory compliance and no universal standards for transparent electronic components. Overcoming these challenges is essential for realizing the full potential of transparent electronics in a broad range of applications.

Transparent Electronics Industry Segment Analysis

By Product

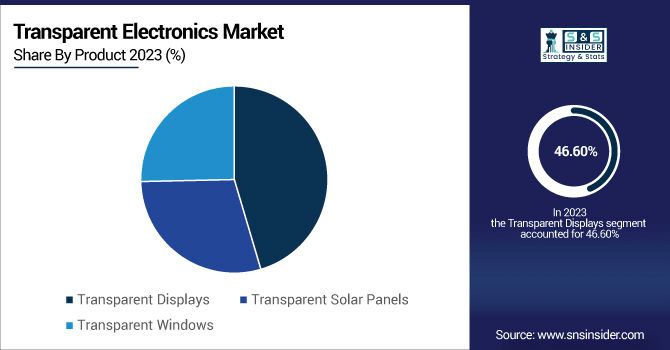

Transparent Displays held a significant 46.6% share of the transparent electronics market in 2023. This is due to their high alignment in consumer electronics, automotive heads-up displays (HUDs), and retail advertising solutions. The excellent balance of visibility and informative visual content that transparent displays offer makes them the perfect candidate system for next-gen AR solutions, smart wearables, and signage systems.

The Transparent Solar Panels segment is expected to hold the highest CAGR from 2024-2032. This property is fuelling the demand for these materials in the construction sector and the automotive sector, particularly in energy-efficient buildings and electric vehicles, as they can generate electricity while showing transparency. With green building trends rising around the world, transparent solar panels are also gradually being used in windows, facades, and skylights.

By Application

In 2023, Consumer Electronics dominated the transparent electronics market and captured nearly 36.5% of the overall revenue, research firm FindMarketResearch.com said on Tuesday. The other will aid in the domination of transparent displays for smartphones, smart wearables, AR devices, and high-end televisions. Due to the overwhelming need for modern-day, design-oriented and interactive, and visually aesthetic-oriented devices, transparent electronics are being integrated massively, particularly within high-end consumer tech goods.

Automotive segment is expected to represent the fastest CAGR during the forecast period. (2024 — 2032) Transparent electronics is getting into the fast lane at the automotive end, specifically of electric and luxury vehicles, as well. Applications, like heads-up displays (HUDs), smart windows and even invisible infotainment panels are redefining the in-car user experience.

Transparent Electronics Market Regional Outlook

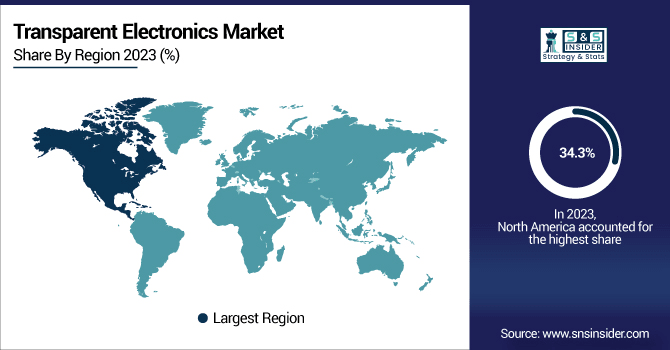

North America held a leading transparent electronics market share of 34.3% in 2023, owing to increasing demand for consumer electronics, defense, and automotive. The region is prominent at the forefront of advanced technology development, along with high R&D investments in the transparency displays, smart windows, and AR-enabled devices, which have resulted in early adoption of such technology in the markets. Such as companies like Apple or Microsoft bringing transparent technologies into their AR headsets or concepts of future devices. Regional market growth will also be increased due to transparent HUDs and smart glass that are being studied by General Motors and Ford, among other next-gen electric vehicles. Moreover, large research institutions and the supportive government also give North America to have a stronger hand in the market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The Asia Pacific is projected to register the largest CAGR from 2024 to 2032. Countries including China, Japan and South Korea are leading the way in innovations relating to transparent solar panels and flexible transparent displays. Samsung and LG Display are developing transparent OLED, while transparent display concept phones have also been unveiled by a couple of companies including Xiaomi. In addition, increasing preference towards green buildings as well as BIPV (building-integrated photovoltaics) in China related to green architecture is likely to offer considerable profit-generating opportunities for transparent solar panels, with Asia Pacific being the leading region for growth in the coming years.

Key Players Listed in the Transparent Electronics Market are:

-

Samsung Electronics (Transparent OLED Display)

-

LG Display (Transparent OLED Signage)

-

BOE Technology Group (55-inch Transparent OLED Panel)

-

Sharp Corporation (See-Through Display)

-

Panasonic Corporation (Transparent OLED TV)

-

Sony Corporation (Transparent Display Prototype)

-

AU Optronics (Transparent MicroLED Display)

-

Tianma Microelectronics (Transparent AMOLED Display)

-

Universal Display Corporation (UDC) (Transparent OLED Materials)

-

Zebra Imaging (Holographic Display)

-

Corning Incorporated (Gorilla Glass for Transparent Electronics)

-

Planar Systems (a Leyard company) (LookThru Transparent OLED Display)

-

OLEDWorks (Transparent OLED Lighting Panels)

-

Visionox (Transparent OLED Screens)

-

E Ink Holdings (E Ink Kaleido – Transparent ePaper Technology)

Recent News:

-

In January 2024, Samsung unveiled its Transparent MICRO LED display at Samsung First Look, ahead of CES 2024, highlighting next-gen display technology with impressive transparency and image quality.

-

In December 2024, LG introduced the world's first transparent and true wireless 4K OLED TV, delivering a groundbreaking screen experience that blends cutting-edge visuals with an immersive, cable-free design.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.53 Billion |

| Market Size by 2032 | USD 7.25 Billion |

| CAGR | CAGR of 10.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Transparent Displays, Transparent Solar Panels, Transparent Windows) • By Application (Consumer Electronics, Automotive, Construction, Healthcare, Military and Defense, Security Systems, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Display, BOE Technology Group, Sharp Corporation, Panasonic Corporation, Sony Corporation, AU Optronics, Tianma Microelectronics, Universal Display Corporation, Zebra Imaging, Corning Incorporated, Planar Systems, OLEDWorks, Visionox, E Ink Holdings. |