Transparent Display Market Size & Growth Trends:

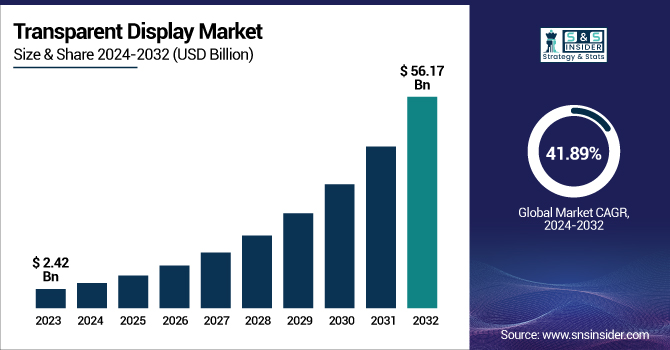

The Transparent Display Market Size was valued at USD 2.42 Billion in 2023 and is expected to reach USD 56.17 Billion by 2032 and grow at a CAGR of 41.89% over the forecast period 2024-2032.

To Get more information on Transparent Display Market - Request Free Sample Report

With the integration of 5G & IoT, transparent displays are improving now with real-time data transmission, seamless AR experiences, and interactive smart environments. Depending on the technology, lifetime and durability are different LCDs have a longer lifespan but need backlighting, while OLEDs allow better transparency but degrade faster.

According to the trends in energy consumption, Micro-LEDs are the most energy efficient by consuming less power than OLEDs and LCDs, thus making them a perfect fit for next-gen applications such as smart cities, automotive HUDs, and wearable devices. There have been some significant developments when it comes to the U.S. transparent display market, however. The reality is that Samsung launched a transparent microLED screen at CES 2024 showing that the industry is never short of pushing innovation. Moreover, the retail application segment is also expected to grow with the adoption of transparent displays for interactive retail storefronts and product showcases. For instance, BOE Technology Group has increased their patent stacks by orders of magnitude resulting in heavy backing towards R&D functions. Also, transparent OLED display innovations have reached up to 38% transparency rate which enhances applications in dense areas.

The U.S. Transparent Display Market is estimated to be USD 0.52 Billion in 2023 and is projected to grow at a CAGR of 41.86%. The U.S. Transparent Display Market is also spurred by military applications such as augmented reality HUDs, higher investments in smart home automation, increasing healthcare adoption via medical imaging, and innovation in trends like AI-driven interactive displays.

Transparent Display Market Dynamics

Key Drivers:

-

Revolutionizing Displays with OLED and Micro LED Technology for AR HUDs Smart Devices and Retail

With increasing technological advancements in OLED and Micro-LED technology, the demand for high-resolution displays with flexible form factors and greater energy efficiency is expected to propel growth within the transparent display market during the forecast period. One of the key drivers for the rise in the AR and HUD market is the greater need from the automotive, aerospace, and defense industries. With AR-based HUDs, automakers are focusing on improving safety as well as navigation, and industries such as healthcare and retail are mixing live video, transparent displays, and immersive content for a more interactive approach. Market growth is also being driven by the increasing penetration of intelligent consumer electronics such as transparent TVs, AR glasses, smart appliances, etc. Moreover, the continual increase in the utilization of digital signage in retail and hospitality sectors to improve customer experience is further projected to boost the market growth.

Restrain:

-

Challenges in High-Density Transparent Displays Including Visibility Color Accuracy Scalability and Outdoor Usability

The high-density transparent display market faces various challenges such as less brightness and contrast than ordinary opaque displays. As these displays are transmissive, they tend to have visibility issues under high light conditions which makes outdoor application quite difficult. Also, transparency may compromise color reproduction and image clarity which in turn worsens user experience with AR headsets, automotive HUDs, as well as digital signage. The second limitation comes from the difficulty of fabricating large-scale transparent displays in which structural stability and display function could be achieved. These features are what limit the adoption of these in industries whose applications need ruggedness and durability as a display solution.

Opportunity:

-

Expanding Transparent Display Applications in AR VR Automotive Smart Homes with AI IoT and Innovation

Growth areas exist in the expansion of transparent OLED and Micro-LED applications outside of consumer electronics, especially in next-generation AR/VR devices, automotive displays, and smart homes. Modern transparent displays used for interactive applications can find much-needed innovative use with the seamless integration of AI and IoT. In addition to this, the investments made by key players and startups in R&D are also expected to provide economic, scalable solutions, further boosting commercial and industrial adoption. The future of the transparent display market will be paved by new business models that are enabled by strategic partnerships and evolving technology in the industry.

Challenges:

-

Overcoming Integration Challenges in Transparent Displays for Automotive AR VR AI and IoT Ecosystems

A significant hurdle to overcome is transparent display integration with existing ecosystems. The integration with ADAS (advanced driver-assist systems) and other electronic modules in a car remains a bottleneck in the automotive domain. Likewise, transparent screens will also need to work within AR/VR ecosystems and AI interfaces along with IoT applications to become widely used in consumer electronics. In addition, less awareness and adoption in some particular industries also slow down the market penetration. Not to mention the prevailing absence of standardized manufacturing and implementation, which also creates obstacles in commercializing this technology widely, and many businesses are still looking for viable use cases for transparent displays.

Transparent Display Industry Segmentation Analysis

By Resolution

In 2023, Ultra HD held 38.8% of the total transparent display market share and is expected to see the fastest CAGR from 2024 to 2032. Various end-use industries, such as automotive, retail, and consumer electronics, demand high-resolution transparent displays due to the clarity, sharpness, and vividness required in their displays. This technology will add value to user experience in AR-based head-up displays (HUDs), digital signage, and next-gen smart devices. Advancements in OLED and Micro-LED technology are driving towards ultra-thin, high-brightness, and energy-efficient transparent displays, which could drive further adoption and market expansion in premium applications.

By Technology

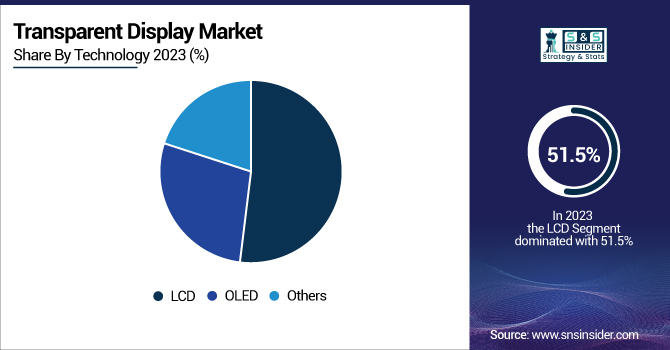

LCD held the most significant 51.5% share in the transparent display market in 2023 due to its cost-effectiveness, availability, and growing adoption for various commercial applications such as retail digital signage, automotive head-up displays (HUDs), and industrial displays. The mature manufacturing process and comparatively lower complexity make LCD technology the first choice for the bulk of large-format transparent displays, earlier limited to OLED and Micro-LED substitutes.

From 2024 to 2032, the fastest CAGR growth is expected for OLED, due to its high transparency, high contrast ratios, and energy efficiency. The unique feature that OLED is capable of providing self-emissive pixels while eliminating the additional need for a backlight is pushing its momentum in high-end applications like AR / VR headsets, high-end automotive HUDs, and next-gen consumer electronics. The shift towards flexible and bendable transparent displays and accelerated micro-OLED development will help push OLED growth momentum to the next level– Qualifying it as the most potential technology for next-generation high-end transparent displays.

By Product

In 2023, digital signage dominated the transparent display market with a 43.7% share, due to mass adoption of transparent display usage in the global retail, hospitality, corporate, and public spaces. Interactivity, involvement, and enlivened transparent displays are utilized by companies to increase customer engagement, bolster advertising efficiency, and provide an outlet for them to become stores. In addition, the growing demand for innovative visual merchandising solutions and smart displays in shopping malls, museums, and exhibitions is also contributing to the market expansion.

Head-up displays (HUDs) will have the fastest CAGR from 2024-2032, owing to the increasing use of these systems in the automotive and aviation fields. The use of AR-based heads-up displays (HUD) in vehicles can be a thrilling solution offered to the driver as automakers are designing these displays into vehicles with safety, navigation, and situational awareness being crucial elements, especially in electric and luxury cars. Increased penetration of connected and autonomous vehicles along with advancements in holographic and artificial intelligence-based Head-Up Displays (HUD) will boost the demand for HUDs, therefore will be a primary segment of growth for the transparent display line of products in the automotive space.

By Vertical

Automotive & Transportation accounted for the highest share of the transparent display market at 27.6% in 2023, owing to the growing adoption of head-up displays (HUDs) and augmented reality (AR) dashboards in vehicles. Automakers are adopting transparent displays to improve safety, navigation, and real-time data visualization for drivers. An increasing demand for electric vehicles (EVs) and self-driving cars has also led to the more rapid introduction of advanced HUD and interactive transparent displays in both high-end and new-generation vehicles.

Consumer Electronics is poised to grow at the fastest CAGR between 2024 and 2032 due to the increasing demand for transparent OLED TVs, AR smart glasses, and interactive home appliances. From wearables to gaming and home automation, next-generation display technologies are now being rolled out for customers by a growing number of companies. Consumer Electronics will be one of the segments driving growth, with transparent displays in smart mirrors, smartphones, and futuristic home devices as AI and IoT integration rise over the forecast period.

Transparent Display Market Regional Outlook

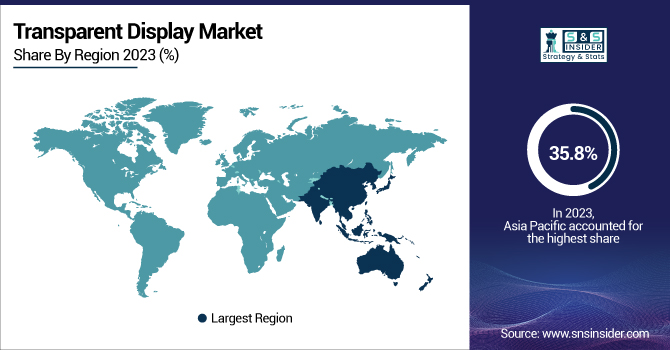

In 2023, the transparent display market was led by Asia Pacific with a share of 35.8%, and it is predicted to exhibit the fastest CAGR from 2024 to 2032. With top-tier display makers like Samsung Display, LG Display, and BOE Technology paving the way for innovations in OLED, Micro-LED, and AR-based transparent displays, the region remains a hotbed for display technology. The proliferation of smart consumer electronics in China, Japan, and South Korea is driving the need for transparent OLED TVs, AR smart glasses, and home appliances in 15–20 years. Next-generation EVs driven by augmented reality represent an integration of Augmented Reality HUD into Smart dashboards in the automotive industry in China and Japan, which continues to amplify this market expansion. Also, retail giants, Alibaba and SoftBank are gearing up to invest in transparent digital signage for immersive advertising experiences. With increasing demand for smart transportation solutions in countries such as India and South Korea, along with local government support for smart cities and AI-driven technologies, Asia Pacific is anticipated to be the fastest-growing market for transparent displays over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Transparent Display Market are:

Some of the major players in the Transparent Display Market are:

-

LG Electronics (Signature OLED T)

-

Xiaomi (Mi TV LUX Transparent Edition)

-

Panasonic (Transparent OLED Display)

-

Samsung (Transparent OLED Signage)

-

Hisense (116-inch Transparent TV)

-

Toshiba (Transparent Photoluminescent Phosphor)

-

Sharp (High-Transmittance Liquid Crystal Display)

-

Sony (Transparent OLED Display)

-

Microsoft (Transparent Display Prototypes)

-

BMW (Interactive Transparent Windshield)

-

Continental (Transparent Hood Display)

-

Saint-Gobain (Transparent Display Glass)

-

Gauzy (LCG (Light Control Glass) Technology)

-

Planar (LookThru Transparent OLED Display)

-

Crystal Display Systems (Transparent LCD Showcase)

Transparent Display Market Trends

-

In December 2024, LG Electronics globally launched the 77-inch LG SIGNATURE OLED T, the world’s first transparent and true wireless 4K OLED TV.

-

In September 2024, Samsung unveiled its Transparent MICRO LED Display at CES 2024, offering enhanced brightness, color accuracy, and a glass-like design for seamless integration.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.42 Billion |

| Market Size by 2032 | USD 56.17 Billion |

| CAGR | CAGR of 41.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resolution (Ultra HD, Full HD, HD, Others) • By Technology (LCD, OLED, Others) • By Product (HMD, HUD, Digital Signage, Smart Appliance) • By Vertical (Consumer Electronics, Retail & Hospitality, Sports and Entertainment, Aerospace and Defense, Healthcare, Automotive & Transportation, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

LG Electronics, Xiaomi, Panasonic, Samsung, Hisense, Toshiba, Sharp, Sony, Microsoft, BMW, Continental, Saint-Gobain, Gauzy, Planar, Crystal Display Systems. |