Trim Tabs Market Key Insights:

Get More Information on Trim Tabs Market - Request Sample Report

The Trim Tabs Market Size was valued at USD 2.82 billion in 2023 & is expected to reach USD 5.84 billion by 2032, with a growing at CAGR of 8.46% over the forecast period of 2024-2032.

The trim tabs market is witnessing substantial growth across various sectors, driven by the rising demand for enhanced performance and stability in marine, aviation, and other applications. In marine applications, trim tabs play a critical role in optimizing vessel performance by adjusting the hull position, which contributes to improved fuel efficiency, stability, and speed. The demand for trim tabs has been bolstered by the increasing popularity of recreational boating and water sports, particularly in key markets such as North America and Asia-Pacific.

In the marine sector, trim tabs are integral to enhancing the performance of both personal and commercial vessels. Recreational boating has surged in North America, achieving a regional growth rate of 9% annually, especially in hotspots like Florida and the Great Lakes. Asia-Pacific is also experiencing notable demand growth, with the marine tourism sector expanding at an impressive 12% annual rate. This has spurred the production of luxury yachts and recreational boats equipped with advanced trim tab systems. Additionally, the adoption of adjustable trim tabs for commercial vessels such as fishing boats has risen by 15% year-over-year, underscoring their versatility and efficiency.

Technological advancements, particularly in electric and hydraulic trim tabs, are transforming the marine industry. Companies like Lenco Marine reported a 20% surge in demand in 2023, highlighting the market's robust growth. Hydraulic systems have been particularly impactful, reducing fuel consumption in commercial vessels by up to 17%.

In aviation, trim tabs are essential for stabilizing aircraft and ensuring flight safety. With increasing air traffic and stringent safety regulations, the sector is innovating more sophisticated trim tab technologies. The global fleet of active aircraft grew by 3% in 2023 to 28,674 aircraft, driving demand for trim tabs that enhance fuel efficiency, with reductions in fuel consumption ranging from 2% to 5%.

Military aviation is also leveraging advanced trim tab technologies for better maneuverability and operational efficiency. The growing focus on sustainability is evident, with approximately 17% of new trim tabs incorporating eco-friendly materials. Furthermore, the defense sector’s budget growth of 5.5% has spurred a 9% increase in the demand for trim tabs for military naval vessels.

The rising emphasis on energy efficiency and sustainability has steered the market towards eco-friendly manufacturing processes. Innovative trim tabs with automated controls and sustainable materials are gaining traction, catering to both commercial and military applications. These advancements align with global efforts to minimize environmental impact while enhancing operational efficiency.

Market Dynamics

KEY DRIVERS:

-

Advancements in Automation and Materials Science Driving Efficiency and Sustainability in Trim Tabs Market

Trim tabs have evolved with the use of smart technologies such as automated control systems that allow for automatic and/or real-time control of trim tabs. This may be useful for someone who knows what his or her boat needs, but some systems measure what a boat needs and then recommend a trim angle, also with the help of sensors and artificial Intelligence, optimizing for technological roles, whether for beginners or professional regattas. Adaptive use of high-strength low-weight corrosion-resistant materials in trim tabs such as advanced composites and aluminum alloys adds to the performance and durability aspects of trim tabs. These innovations are mechanically easier to maintain and, as a result, cheaper to service over time, while meeting emissions and environmental standards, attracting eco-friendly buyers. The constant R&D by leading manufacturers has made trim tabs that are more efficient, reliable, and user-friendly and are rapidly being adopted in several sectors. Zipwake systems featuring GPS and 3D accelerometers were able to reduce fuel consumption by as much as 15%. Holeshot Mode / Domestic SeaStar Holeshot Mode helps with fuel efficiency by between 5-8% during acceleration and 10% during rapid acceleration. Interceptor-style trim tabs. These Teflon-based composites save up a 40% in drag compared to conventional plates. In addition, trim tabs built using aluminum alloys and advanced materials have had up to 30% enhancements in durability and corrosion resistance, leading to lower maintenance costs.

-

Rising Investments in Maritime Infrastructure Boosting Trim Tabs Demand in Asia Pacific and Middle East

Due to increasing disposable incomes and the emergence of luxury waterfronts and marinas, recreational boating activities are on the rise in several regions including Asia-Pacific and the Middle East. The demand for trim tabs is directly boosted by the increase in maritime infrastructure that is primarily supported by huge investments from both public and private players to explore the tourism potential in marine and coastal regions. In addition, an increasing number of commercial shipping and fishing businesses in these areas is fuelling the usage of trim tabs for improved efficiency and safety of vessels. Continuous growth in both the developed and developing regions due to better awareness of the advantages of trim tabs amongst consumers will provide continued business for the market. Demand for recreational boating will also benefit from increasing international visitor arrivals (IVAs) in Asia-Pacific, forecasted to reach 158.7 million to 437.5 million additional annual IVAs between 2023 and 2025.

RESTRAIN:

-

Challenges in Trim Tab Installation and Maintenance Hindering Market Growth and Innovation

Both marine and aviation applications are spoiled by a reduction of efficiency due to incorrect installation or even complete loss of the system, which has kept take-up rates low for more novice users. Additionally, learning about new features like automated controls and smart technologies also requires a unique skill set that is not readily available in remote or underdeveloped regions. Another limitation is that regulatory and safety standards differ across the regions. Compliance with requirements is very high for aviation and military applications, increasing product certification time and effort. This means that new products take time to be available on the market. Moreover, environmental legislations, especially concerning marine applications, necessitate the utilization of environment-friendly materials creating hurdles for smaller manufacturers who do not have the potential to innovate rapidly along with industry leaders.

Key Segmentation Analysis

BY TYPE

Fixed Trim Tabs segment held a market share of 58% in 2023, as they are widely adopted in small to medium-sized marine vessels. This simplicity, cost-effectiveness, and low upkeep make it attractive to personal vessels, recreational users, and small commercial operators. Fixed tabs therefore naturally have predictable performance results and do not require the sort of complex mechanisms as adjustable trim tabs so they are reliable at steady-state operating conditions. The widespread usage in markets with price-sensitive customers, including smaller marine industries and developing maritime infrastructure, enhances their standing. In addition, fixed trim tabs are simple to install and easy to use compared to their movable counterparts, making them more readily adopted within emerging and secondary markets where the technical know-how may not yet be fully developed.

The Adjustable Trim Tabs segment is expected to grow at the fastest CAGR during the forecast period from 2024 to 2032 due to technological developments and rising demand for precision in performance. Under changing conditions, adjustable tabs, especially electric or hydraulic tabs, allow for adjustments to be made in real-time to ensure optimal levels of running stability, speed, and fuel economy. The ability to tailor the systems is essential for high-performance yachts and aircraft. Combined with high automation and intelligent controls, they also have a natural fit with the increasing demand for energy-saving and convenient operation. High investments in recreational boating to tide over the acute shortage of marinas and infrastructure as well as the boom in marine tourism in markets such as Asia-Pacific and the Middle East will continue raising the demand for adjustable trim tabs, especially in the premium-end and performance sectors.

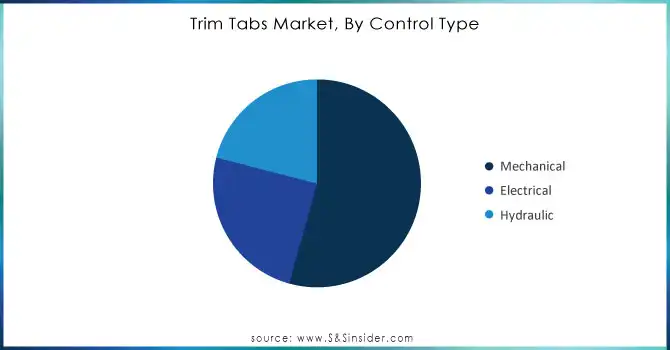

BY CONTROL TYPE

The Mechanical Trim Tab segment captured 47% of the 2023 market share due to its simplicity, affordability, and pool of reliability. Such systems are being deployed in personal and commercial marine vessels, especially in smaller or mid-sized boats where the operational work can be managed by mere manual controls. Well, that's one of the reasons why they're really popular among consumers in places where few sober designs are offered and among cost-conscious consumers because that means the expenses involved in maintaining an SUV will not be too high, especially since they're low maintenance cars. In addition, there are few moving parts in mechanical trim tabs, which minimizes the risk of failure, and they will deliver consistent performance in widely varied operating conditions. For one, they have a very attractive reliability factor which makes them an ideal choice for users who want something functional rather than any advanced tech.

Electrical trim tabs segment is anticipated to gain the fastest growth rate during 2024-2032 owing to supreme accuracy, low power consumption, and integration with automated systems. Those electronically adjustable tabs provide for on-the-fly tuning and help regulate pitch, wingtip vortex, fuel economy, and rider comfort. As technology progresses and end-user demand for energy-saving systems has increased, particularly in high-end luxury yachts, so has the adoption of electric-powered systems in other commercial marine sectors. Moreover, the inclusion of smart technology such as AI-enabled systems and sensor-based control has brought electrical trim tabs into play concerning high-performance vessels. Demand for these systems is also due to stringent environmental regulations which additionally provide an efficient option compared to traditional systems along with lesser environmental cost.

Need Any Customization Research On Trim Tabs Market - Inquiry Now

BY APPLICATION

Aviation segment led the market share in 2023, accounting for 64.1%, and continues to be the fastest-growing CAGR from 2024-2032. The reason behind this supremacy is the vital function that trim tabs perform in the stability and safety of the aircraft. Trim tabs are used to augment aircraft performance, and enhance stability while minimizing drag and are worn frequently during critical phases of flight in aviation applications. With air traffic escalating worldwide, and new codes on aviation safety regulations, the requirement for accurate, high-performing, and reliable trim tabs is ever-growing. The segment is witnessing growing momentum in terms of the increasing adoption of trim tabs in commercial and private aircraft, which is augmenting the market leadership of the segment in 2023.

BY END USE

In 2023, Commercial segment accounted for the largest share of 34.5% of the market. The commercial segment led the market in 2023 due to the installation of trim tabs on commercial boats, ships, and other large vessels where stability as well as a requirement for optimal fuel efficiency and increased operational performance are vital. Many commercial vessels, ranging from cargo vessels, ferries, and fishing boats, use trim tabs widely to enhance maneuverability, lower the drag, and improve fuel utilization. The demand is even more strengthened due to the liberalization of global trade and shipping activities, as well as the rising technology for operational efficiency.

The Personal segment will expand at the fastest CAGR between 2024 and 2032. The growth comes as interest in recreational boating increases in both the developed world, particularly North America and Europe, and developing regions of the Asia-Pacific region. Growing disposable income has enabled consumers ranging from families with kids to yacht enthusiasts to invest in their own personal boats and recreational vessels, helping propel the demand for trim tabs that improve performance and comfort. Furthermore, rising demand for integrated, easy-to-use, and energy-efficient technologies is also projected to offer ample growth opportunities for the key players in the personal boat owner segment which will further influence the overall market. Considering these factors boat owners are switching to trim tabs which offer better stability, less fuel consumption, and easy customization.

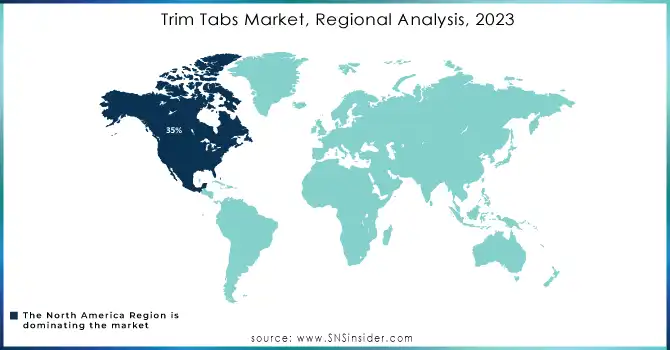

Regional Overview

North America holds 35% market share in 2023 primarily driven by the region's well-developed maritime infrastructure, high adoption of recreational boating, and the presence of key market players including Bennett Marine, and Lenco Marine. The U.S. especially is a driving force, because of the large number of marinas it has, the increasing segment of recreational boating, and its strong commercial maritime sector. Companies like Brunswick Corporation and Sea Ray are constantly innovating to meet the demands of people and commercial vessels. Moreover, the trim tabs market has also been boon by the presence of densely populated boaters and commercial shipping regions such as that of the Great Lake and the Gulf Coast which has increased the demand for trim tabs to assist the performance and fuel efficiency.

The Asia-Pacific region will witness the fastest CAGR during the forecast period of 2024 to 2032, driven by the booming recreational boating and commercial maritime industries. Leading the pack are countries like China, Japan and Australia. Specifically, China has started to develop a class of leisure boating with an expanding middle class and this is causing manufacturers such as Zhejiang and Weihai to have confidence in boat equipment like trim tabs. Its rapid growth across the small ship sector further boosts the Australian market which is equally developing quickly with an exceptional focus on high-performance trim tabs for the new luxury yacht sector centered on the likes of Sydney and Gold Coast. Furthermore, the trim tabs adoption in a commercial vessel is propelled by the advanced transportation and fishing industries in Japan.

Key Players in Trim Tabs Market

Some of the major players in the Trim Tabs Market are:

-

Volvo Penta (Trim Tabs, Marine Engines)

-

Bennett Marine (Hydraulic Trim Tabs, Electric Trim Tabs)

-

Lenco Marine (Electric Trim Tabs, Trim Tab Control Systems)

-

Nauticus Inc. (Automatic Trim Tabs, Stabilizing Systems)

-

Zipwake (Dynamic Trim Control, Trim Tab Systems)

-

Aviat Aircraft Inc. (Trim Tabs, Aircraft Parts)

-

Linear Devices Corporation (Lecrotab, Trim Tabs)

-

Trim Master Marine Inc. (Trim Tabs, Marine Equipment)

-

McFarlane Aviation Inc. (Trim Tabs, Aviation Components)

-

Textron Aviation (Aircraft Trim Tabs, Aviation Parts)

-

LORD Corporation (Trim Tabs, Vibration Control)

-

Livorsi Marine Inc. (Trim Tabs, Marine Instruments)

-

Raymarine (Trim Tabs, Marine Electronics)

-

3M (Adhesives, Trim Tab Mounting Solutions)

-

L3Harris Technologies (Control Systems, Trim Tabs for Aviation)

-

BAE Systems (Marine Trim Tabs, Military Systems)

-

Leonardo S.p.A. (Trim Tabs for Aircraft, Avionics)

-

Rockwell Collins (Aircraft Trim Tabs, Control Systems)

-

Honeywell Aerospace (Trim Tabs, Aircraft Safety Systems)

-

Parker Hannifin Corporation (Hydraulic Trim Tabs, Aircraft Components)

Some of the Raw Material Suppliers for Trim Tabs Companies:

-

Alcoa Corporation

-

ArcelorMittal

-

Thales Group

-

Kaman Corporation

-

GKN Aerospace

-

Meggitt PLC

-

FACC AG

-

Triumph Group

-

Spirit AeroSystems

-

Woodward Inc

RECENT TRENDS

-

In September 2024, Lenco unveiled its industry-leading Pro Control™ Auto auto-leveling solution, offering boaters enhanced precision and control, alongside the Pro Control Assist, a manual control option with a superior user interface for optimal performance.

-

In June 2024, Dometic launched its next-gen Smart Trim Tab, offering enhanced precision, connectivity, and fuel efficiency for modern boats.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.82 Billion |

| Market Size by 2032 | USD 5.84 Billion |

| CAGR | CAGR of 8.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed Trim Tabs, Adjustable Trim Tabs) • By Control Type (Mechanical, Electrical, Hydraulic) • By Application (Aviation, Marine) • By End Use (Personal, Commercial. Military, Sports) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Volvo Penta, Bennett Marine, Lenco Marine, Nauticus Inc., Zipwake, Aviat Aircraft Inc., Linear Devices Corporation, Trim Master Marine Inc., McFarlane Aviation Inc., Textron Aviation, LORD Corporation, Livorsi Marine Inc., Raymarine, 3M, L3Harris Technologies, BAE Systems, Leonardo S.p.A., Rockwell Collins, Honeywell Aerospace, Parker Hannifin Corporation. |

| Key Drivers | • Advancements in Automation and Materials Science Driving Efficiency and Sustainability in Trim Tabs Market • Rising Investments in Maritime Infrastructure Boosting Trim Tabs Demand in Asia Pacific and Middle East |

| Restraints | • Challenges in Trim Tab Installation and Maintenance Hindering Market Growth and Innovation |