Automotive Electronic Brake System Market Report Scope & Overview:

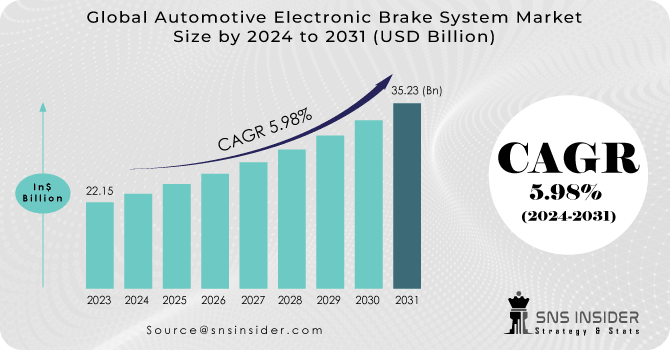

Automotive Electronic Brake System Market size was valued at USD 22.15 billion in 2023 and is expected to reach USD 35.23 billion by 2031 and grow at a CAGR of 5.98% over the forecast period 2024-2031.

The automotive electronic brake system market is witnessing a notable surge, driven by a convergence of factors including heightened safety concerns, technological advancements, and regulatory mandates. A significant catalyst is the growing public consciousness regarding road safety, compelling consumers to seek vehicles equipped with features such as Anti-lock Braking Systems (ABS) and Electronic Brake-force Distribution (EBD). These systems prevent wheel lockup and ensure better control of the vehicle during emergency braking situations. Additionally, stringent government regulations worldwide are mandating the incorporation of such technologies in new vehicle models, further propelling market expansion.

Get More Information on Automotive Electronic Brake System Market - Request Sample Report

This emphasis on safety transcends basic braking functionalities, with the proliferation of Advanced Driver-Assistance Systems (ADAS) driving demand for sophisticated electronic brake systems. These systems are instrumental in supporting features like Automatic Emergency Braking (AEB), which autonomously applies brakes to prevent collisions, thereby significantly reducing accidents and injuries. Beyond safety considerations, the increasing popularity of luxury and high-performance vehicles is fueling demand for more advanced braking systems. These systems promise shorter stopping distances and enhanced handling capabilities, catering to the discerning preferences of consumers.

MARKET DYNAMICS:

KEY DRIVERS:

-

The industry is gaining traction due to the rising electrification of automobiles.

-

Modern automobiles' electronic components have been shown to improve their overall performance.

-

The vehicle industry has benefited from electrification by developing better engines, brakes, and safety systems.

-

The use of market-available high-end and luxury automobiles.

The rapid expansion of the high-end and luxury automobile sector serves as a pivotal catalyst for the evolution of electronic brake systems (EBS). Within this niche market, there's a strong emphasis on innovative safety features, positioning it as a primary arena for testing and implementing the latest EBS advancements. In response, manufacturers are integrating cutting-edge disc brake systems into luxury vehicles, utilizing lighter and more heat-resistant materials to enhance performance and reliability.

RESTRAINTS:

-

Electronic and mechanical systems are intertwined in the latest braking technology.

-

The installation of brake systems on cars can be done for as little as $50 USD per unit of transportation.

-

One of the restrictions is that there is inconsistency in the positioning of the system.

OPPORTUNITIES:

-

Business vehicles' increasing use of air disc brakes.

-

Technological advancement in the braking systems.

The automotive industry is experiencing a transformative shift in brake technology, propelled by electronics. Conventional hydraulic systems are being replaced by Electronic Brake Systems (EBS), which integrate a complex network of sensors, control units, and actuators. This transition heralds a future characterized by exceptional braking performance and safety standards. EBS boasts significantly faster response times compared to traditional systems, enabling precise distribution of braking force to individual wheels.

CHALLENGES:

-

Electronic brake system expansion will be hampered by their high development and maintenance costs.

-

Market development is projected to be limited by the high costs of electronic brake systems.

IMPACT OF RUSSIA-UKRAINE WAR:

The conflict in Ukraine has cast a dark cloud over the automotive sector, with the Electronic Brake System (EBS) market feeling its effects. Disruptions began prior to the February 2022 invasion as tensions escalated. S&S Insider forecasted a 2.3% decrease in global light vehicle production in 2022 due to the chip shortage, a problem exacerbated by the war. Russia and Ukraine are major neon gas producers, crucial for chip manufacturing. This shortage has constrained Electronic Brake System production, heavily reliant on semiconductor technology. Bosch, a prominent EBS manufacturer, recently announced production slowdowns at multiple plants due to chip shortages, impacting car manufacturers such as Volkswagen, which rely on their EBS technology.

The overall impact highlights anticipation of slowdown in EBS market growth, particularly in Europe, which heavily depended on Ukrainian wiring harnesses, another component disrupted by the conflict. While the long-term consequences remain uncertain, the immediate effect of the Russia-Ukraine conflict is a ripple effect throughout the supply chain, causing a shortage of critical components and potentially impeding the Electronic Brake System market's growth.

IMPACT OF ECONOMIC SLOWDOWN:

An economic downturn can set off a chain reaction within the Automotive Electronic Brake System (EBS) market. Decreased consumer spending results in fewer new car purchases, directly reducing the demand for EBS systems from automakers. Moreover, weakened consumer confidence increases price sensitivity, prompting car manufacturers to seek ways to lower production costs. This may impact the EBS market in two main ways. Firstly, manufacturers may opt for lower-cost EBS versions, potentially sacrificing some advanced features, such as Autonomous Emergency Braking (AEB), which could hinder the growth of premium EBS segments.

Secondly, pressure to cut overall vehicle prices may lead manufacturers to negotiate aggressively with EBS suppliers, potentially straining supplier profit margins. This could particularly affect components with high upfront research and development costs, such as the millimeter-wave radar sensor used in AEB systems, which typically range from $100 to $250 per unit. Should suppliers be compelled to significantly lower their prices, it could impede innovation and slow down the advancement of even more sophisticated EBS features.

MARKET SEGMENTATION ANALYSIS:

Market, By Product:

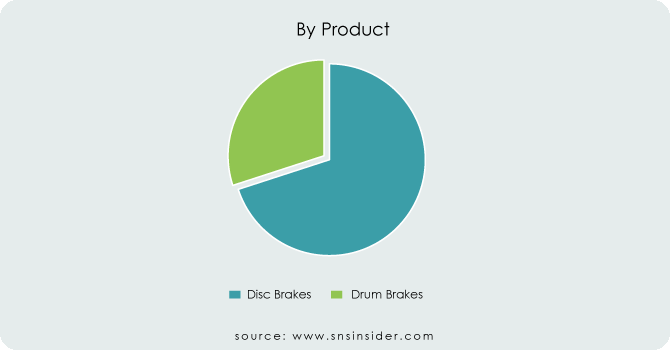

The automotive electronic brake system market is primarily categorized into two product segments: disc brakes and drum brakes. Disc brakes, which employ calipers to clamp a disc against the wheel hub, are the dominant force in the market, holding over 70% of market share. This supremacy stems from their superior stopping power and ability to dissipate heat efficiently, making them particularly favored for high-performance vehicles. This trend is anticipated to persist, propelled by stringent safety regulations and the growing prominence of electric vehicles, which heavily rely on disc brakes for regenerative braking. In contrast, drum brakes, although cheaper to produce, are progressively confined to lower-tier vehicles due to their performance limitations. Consequently, their market share is projected to dwindle further in the forthcoming years.

Market, By Technology:

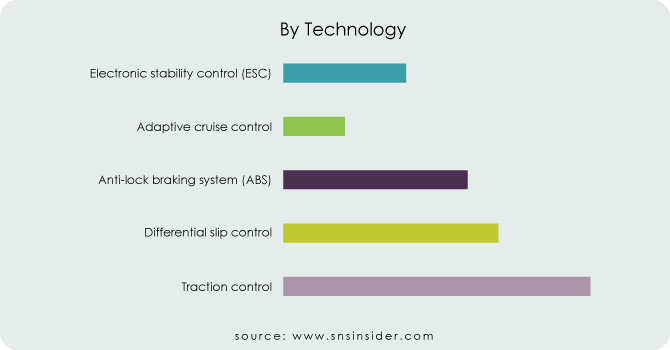

The automotive electronic brake system market is divided into several key technological segments, each serving a crucial role in enhancing vehicle control and safety. Among these, electronic stability control (ESC) is anticipated to dominate the market share owing to its effectiveness in preventing skidding and rollovers. Projections indicate that ESC could exhibit the highest compound annual growth rate (CAGR) within its segment.

Meanwhile, the anti-lock braking system (ABS) continues to remain pivotal, likely maintaining a significant portion of the market due to its widespread adoption and proven effectiveness. Traction control and differential slip control also play significant roles, aiding in maintaining traction during acceleration and on slippery surfaces. However, their market share might be slightly lower compared to ESC and ABS. This market landscape showcases a dynamic environment where established technologies like ABS coexist with emerging functionalities such as ESC, creating opportunities for both steady growth and rapid advancements.

Market, By Vehicle Type:

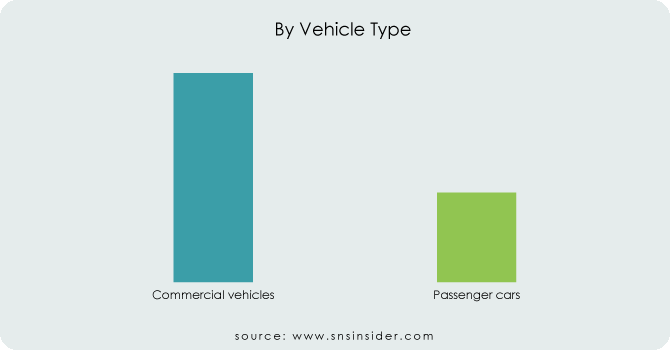

Passenger cars dominate the global vehicle sales market, significantly surpassing commercial vehicles in terms of market size. The imposition of strict safety regulations by governments, requiring the integration of advanced electronic braking systems such as ESC and ABS in passenger cars, is propelling market expansion. Growing consumer insistence on safety features is fueling an uptick in the demand for electronic brake systems in vehicles.

Get Customized Report as per Your Business Requirement - Request For Customized Report

MARKET SEGMENTATION:

By Product:

-

Disc Brakes

-

Drum Brakes

By Technology:

-

Electronic stability control (ESC)

-

Adaptive cruise control

-

Anti-lock braking system (ABS)

-

Differential slip control

-

Traction control

By Vehicle Type:

-

Commercial vehicles

-

Passenger cars

REGIONAL ANALYSIS:

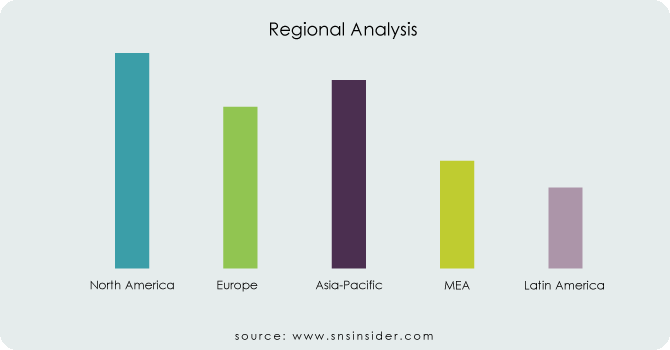

North America has the biggest market share of approx. 40% due to the US, Canada, and Mexico, which drive market demand. Higher per capita income and rising demand for fuel-efficient vehicles boost market demand. Asia-Pacific, the fastest-emerging region, holds the second-largest market share in the global market due to highly populous countries like India, China, Japan, South Korea, Australia, and others that fuel market demand. Increasing investment, sales, production, and government policies also boost market demand. The European region holds the third-largest market share in the global industry due to its technologically advanced infrastructure, which increases the demand for automotive cars. Increasing investment by big firms promotes market demand in this region.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Continental AG (Germany), Robert Bosch GMBH (Germany), Delphi Automotive Plc (US), Advics Group (US), Autoliv Inc. (Sweden), Denso Corporation (Japan), Haldex AB (Sweden), Knorr Bremse AG (Germany), Wabco Holdings Inc. (US), ZF TRW Automotive (US) are some of the affluent competitors with significant market share in the Ride Sharing Market.

RECENT DEVELOPMENTS:

-

Bosch, a pioneering force, has unveiled its next-generation EBS solutions integrating advanced sensor technologies and predictive analytics, ushering in a new era of predictive maintenance and real-time brake performance monitoring.

-

Continental's breakthrough lies in its development of intelligent EBS platforms that seamlessly integrate with autonomous driving systems, ensuring unparalleled precision and adaptability in varying road conditions.

-

Meanwhile, ZF Friedrichshafen's commitment to sustainability is evident through its eco-friendly regenerative braking systems, aimed at reducing emissions and enhancing energy efficiency. Aisin Seiki has introduced groundbreaking advancements in brake-by-wire technology, redefining the driving experience with smoother, more responsive braking control.

| Report Attributes | Details |

|---|---|

| Market Size in 20223 | US$ 22.15 Billion |

| Market Size by 2031 | US$ 35.23 Billion |

| CAGR | CAGR of 5.98% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Disc Brakes, Drum Brakes) • by Technology (Electronic stability control (ESC), Adaptive cruise control, Anti-lock braking system (ABS), Differential slip control, Traction control) • by Vehicle Type (Commercial vehicles, Passenger cars) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), Robert Bosch GMBH (Germany), Delphi Automotive Plc (US), Advics Group (US), Autoliv Inc. (Sweden), Denso Corporation (Japan), Haldex AB (Sweden), Knorr Bremse AG (Germany), Wabco Holdings Inc. (US), ZF TRW Automotive (US) |

| Key Drivers | •The industry is gaining traction due to the rising electrification of automobiles. •Modern automobiles' electronic components have been shown to improve their overall performance. |

| RESTRAINTS | •Electronic and mechanical systems are intertwined in the latest braking technology. •The installation of brake systems on cars can be done for as little as $50 USD per unit of transportation. |