Electric Parking Brake Market Report Scope & Overview:

Get More Information on Electric Parking Brake Market - Request Sample Report

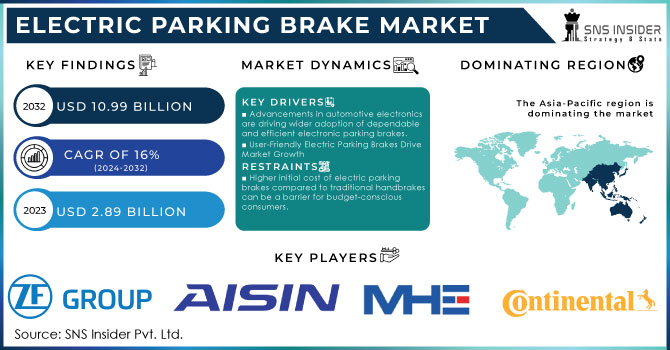

The Electric Parking Brake Market Size was valued at USD 2.89 billion in 2023 and is expected to reach USD 10.99 billion by 2032 and grow at a CAGR of 16% over the forecast period 2024-2032.

An electric parking brake is an automatic parking brake in which a small switch replaces the manual parking brake lever. This technique gives designers of vehicles more leeway to express their creativity by making automobiles roomier and improving their vehicles' gas mileage as a result of the decreased mass of their systems. Thus, there are no mechanical hand brake elements, there are benefits such as a decrease of up to 7.3 kilograms in the overall weight of the car. Electric parking brakes are becoming increasingly common in high-end and luxury vehicles. To keep a moving car from moving while it is parked on roads, electric parking brakes are utilized. In addition, an alternative to the traditional handbrake lever is the use of electric brakes, which are activated by pressing a button. When the button of the electric parking brake is pressed or pulled, the motors force the pads onto the back brakes.

MARKET DYNAMICS:

KEY DRIVERS:

-

Advancements in automotive electronics are driving wider adoption of dependable and efficient electronic parking brakes.

The advancements in car electronics are making electronic parking brakes more attractive option for the manufacturers. Due to these improvements, EPBs are becoming more reliable, efficient, and affordable to integrate into these vehicles. This wider adoption allows carmakers to equip a larger variety of cars with EPBs. This shift benefits the drivers as well, as EPBs and offers a more convenient parking experience and can even integrate with safety features like hill-hold assist.

-

User-friendly electric parking brakes are fueling market growth as consumers seek comfort and luxury features in their cars.

RESTRAINTS:

-

Higher initial cost of electric parking brakes compared to traditional handbrakes can be a barrier for budget-conscious consumers.

-

In very cold climates, the performance of electric parking brakes might be affected, requiring additional testing and potential adaptations.

OPPORTUNITIES:

-

Rising consumer demand for comfort and convenience features like electric parking brakes is creating a boom in the market.

-

Advancements in electronic car systems are making electric parking brakes more affordable and reliable, opening doors to wider vehicle adoption.

CHALLENGES:

-

Higher costs and complexity of electric parking brakes compared to traditional brakes limit market growth, especially in budget-conscious regions.

Although the electronic parking brakes have many benefits, their initial cost may prevent them from being widely used. The car manufacturers incur higher production costs because these systems are more complex than traditional mechanical brakes. This ultimately raises the cost for customers, which may reduce their attractiveness in marketplaces where affordability is a key consideration. Thus, the initial cost of electric parking brakes can be a barrier, particularly in markets for cars where buyers are tight on funds.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has impacted the electric parking brake (EPB) market, creating the worse effect that is expected to disrupt growth. The conflict has impacted the production and export of vital car parts, including the semiconductors essential for EPB function. This shortage could lead to a 20-30% decline in EPB production in the short term. The sanctions imposed on Russia, a significant producer of raw materials like palladium used in electronic components, could further restrict supply and potentially inflate material costs by 5-10%. Car manufacturers, especially in Europe which has strong ties to both Russia and Ukraine, are likely to face production slowdowns due to parts shortages. This could lead to a 7-10% decrease in the overall demand for EPBs.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can affect the electric parking brake (EPB) market's growth. Limited budgets leads to a drop in discretionary spending, particularly on feature-rich new cars with EPBs. Automakers, facing shrinking profits, may also become hesitant to introduce new features like EPBs. They might prioritize cost-cutting and delay investments in these sophisticated technologies, potentially stagnating or even causing a temporary decline in EPB adoption rates. Thus, economic downturns can disrupt global supply chains, leading to shortages of critical components for EPB production. This can cause production slowdowns or price hikes for EPBs, further dampening market enthusiasm. A 5% supply chain disruption could potentially lead to a 3% rise in EPB prices.

KEY MARKET SEGMENTS:

By System Type

-

Cable Pull System

-

Electric-Hydraulic Caliper Systems

Electric-Hydraulic Caliper Systems is the dominating sub-segment in the Electric Parking Brake Market by system type holding around 75-80% of market share. Electric-hydraulic caliper systems offer a combination of electric and hydraulic technology. Electric systems provide advanced features and easy integration with other electronic controls, while hydraulic systems deliver powerful braking and precise control. This combination translates to superior braking performance, responsiveness, and driver confidence, making electric-hydraulic caliper systems the preferred choice.

By Vehicle Type

-

Light Commercial Vehicle

-

Passenger Vehicle

-

Heavy Commercial Vehicle

Passenger Vehicles is the dominating sub-segment in the Electric Parking Brake Market by system type holding around 60-65% of market share. Passenger cars are the most produced and widely used vehicle type globally. The growing demand for comfort and convenience features in passenger vehicles is a major driver for EPB adoption. Features like automatic activation/deactivation, hill-hold assist, and a streamlined interior design with no bulky handbrake lever are highly appealing to passenger car buyers.

REGIONAL ANALYSES

The Asia-Pacific is the dominating region in the Electric Parking Brake Market, holding about 45-50% of market share. This dominance is fueled by the rising automotive industry and growing middle class as they want new vehicles with advanced features like EPBs. Government regulations in some APAC countries further accelerate EPB adoption by prioritizing improved vehicle safety.

North America is the second highest region in this market with a 30-35% share. Major car manufacturers are catering to consumer demand for comfort and convenience by incorporating EPBs into their vehicles. Additionally, North America's focus on advanced driver-assistance systems creates a natural synergy with EPBs, pushing their adoption even further.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are ZF Friedrichshafen AG (Germany), Continental AG (Germany), Aisin Seiki Co., Ltd. (Japan), Mando-Hella Electronics Corp. (South Korea), DURA Automotive Systems (US), Küster Holding GmbH (Germany), TBK Co., Ltd. (Tokyo), Svenska Kullagerfabriken AB (Sweden), Hyundai Mobis Co., Ltd. (South Korea), Wuhu Bethel Automotive Safety Systems Co., Ltd (China), Zhejiang Wanchao Electric Appliance Co., Ltd. (China) and other key players.

RECENT DEVELOPMENT

In Jan. 2024: Tata Motors began delivering their new electric Punch.ev featuring a redesigned front fascia, digital displays, and a sunroof. Built on a new platform supporting various drivetrains and fast charging, it boasts an extended electric range of 300-600 km.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.89 Billion |

| Market Size by 2032 | US$ 10.99 Billion |

| CAGR | CAGR of 16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Cable Pull System, Electric-Hydraulic Caliper Systems) • By Vehicle Type (Light Commercial Vehicle, Passenger Vehicle, Heavy Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ZF Friedrichshafen AG (Germany), Continental AG (Germany), Aisin Seiki Co., Ltd. (Japan), Mando-Hella Electronics Corp. (South Korea), DURA Automotive Systems (US), Küster Holding GmbH (Germany), TBK Co., Ltd. (Tokyo), Svenska Kullagerfabriken AB (Sweden), Hyundai Mobis Co., Ltd. (South Korea), Wuhu Bethel Automotive Safety Systems Co., Ltd (China), Zhejiang Wanchao Electric Appliance Co., Ltd. (China) |

| Key Drivers | • Advancements in automotive electronics are driving wider adoption of dependable and efficient electronic parking brakes. • User-friendly electric parking brakes are fueling market growth as consumers seek comfort and luxury features in their cars. |

| Restraints | • Higher initial cost of electric parking brakes compared to traditional handbrakes can be a barrier for budget-conscious consumers. • In very cold climates, the performance of electric parking brakes might be affected, requiring additional testing and potential adaptations. |