Truffles Market Report Scope & Overview:

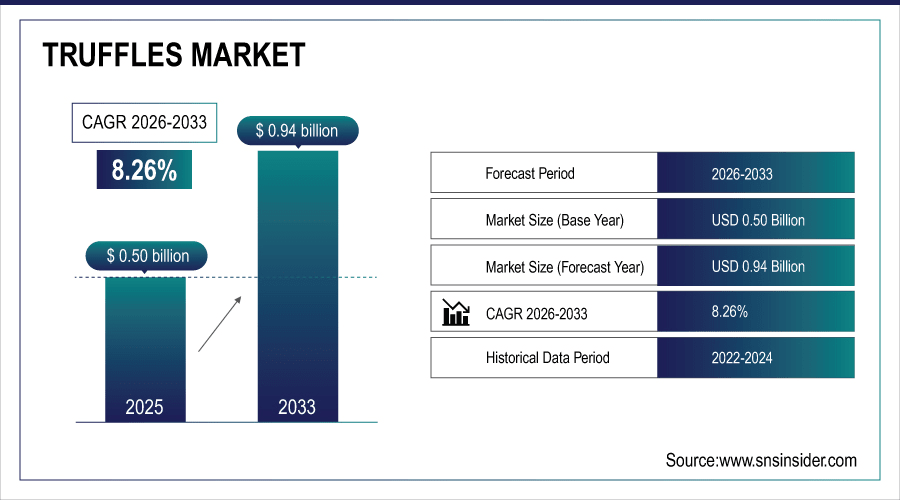

The Truffles Market size was valued at USD 0.50 Billion in 2025E and is projected to reach USD 0.94 Billion by 2033, growing at a CAGR of 8.26% during 2026-2033.

The global market includes detailed market sizing, segmentation, regional analysis, competitive landscape, pricing dynamics, production statistics, supply chain insights, and growth forecasts to 2033. It evaluates consumer trends, sustainability factors, cultivation practices, and product innovations shaping demand. Additionally, the study highlights market risks, regulatory influences, and company profiles while offering strategic recommendations. Stakeholders can leverage insights to capture opportunities in premiumization and value-added truffle products across foodservice, retail, and emerging global distribution channels.

Over 60% of gourmet restaurants in Europe and North America feature truffle-based dishes on their menus.

To Get More Information On Truffles Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 0.50 Billion

-

Market Size by 2032: USD 0.94 Billion

-

CAGR: 8.26% from 2026 to 2032

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Truffles Market Trends

-

Urban and affluent consumers increasingly demand premium, experiential dining featuring truffles, boosting restaurant and specialty retail sales.

-

Culinary innovation and menu diversification by chefs enhance truffle visibility and consumer willingness to pay.

-

Social media and food influencers amplify desirability of truffle-based products, expanding market awareness.

-

Product innovation in truffle-infused oils, sauces, condiments, cheeses, and shelf-stable formulations broadens consumption beyond fine dining.

-

Private-label collaborations, e-commerce platforms, and subscription boxes improve accessibility and sampling opportunities across regions.

-

R&D investments to stabilize truffle flavor and extend shelf-life drive repeat purchases and cross-category product expansion globally.

U.S. Truffles Market Insights

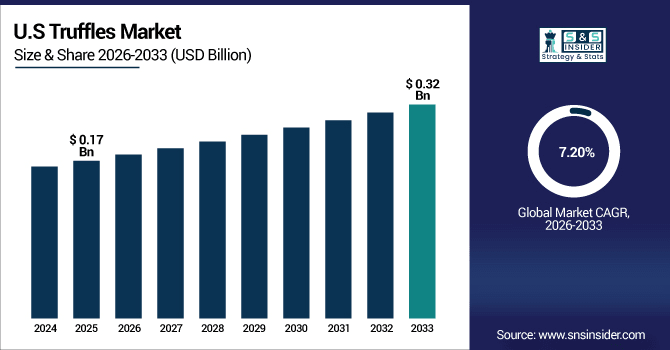

The U.S. Truffles Market size was valued at USD 0.17 Billion in 2025E and is projected to reach USD 0.32 Billion by 2033, growing at a CAGR of 7.20% during 2026-2033.

The U.S. market is experiencing growth driven by rising consumer spending on premium foods, the expansion of gourmet dining and foodservice channels, and the increasing popularity of truffle-infused retail products. Innovation in processed truffle offerings and wider accessibility through e-commerce platforms are broadening consumer reach. Additionally, culinary tourism and chef-driven menu innovations are fueling demand, particularly among affluent, experience-seeking diners, reinforcing the country’s position as a growing hub for luxury truffle consumption.

Truffles Market Growth Drivers:

-

Rising Demand for Premium Culinary Experiences and Growing Popularity of Gourmet Food Culture Globally

Urban consumers and affluent diners increasingly seek premium, experiential dining that showcases truffles, driving demand across restaurants, specialty retailers, and online gourmet channels. Culinary innovation by chefs and menu diversification have elevated truffle visibility, while social media and food influencers amplify desirability and willingness to pay. Rising disposable incomes in key markets enable trial and repeat purchases of truffle-infused products. Growth in experiential tourism and food festivals exposes wider audiences to truffle experiences, converting curiosity into habitual consumption. Consequently, both fresh and value-added truffle items through retail and foodservice. and drive long-term market expansion.

Around 60% of consumers report being influenced by social media and food influencers in their truffle purchases.

Truffles Market Restraints:

-

High Price Sensitivity and Limited Affordability Restricting Broader Consumer Adoption of Truffle Products

High retail prices for premium truffle varieties limit regular consumption to affluent consumers and fine-dining establishments, restricting market expansion. Many households consider truffles a luxury rather than a staple, resulting in sporadic purchases tied to special occasions. Price volatility driven by harvest variability and supply chain disruptions further weakens mainstream adoption. Even processed truffle products often carry substantial premiums that deter price-sensitive buyers, constraining volume growth. Private-label and value alternatives struggle to match authentic truffle flavor, while counterfeit or adulterated products threaten consumer trust and long-term market credibility and hamper efforts to build repeat purchasing across broader demographic segments.

Truffles Market Opportunities:

-

Growing Demand for Truffle-Infused Processed Products Across Retail, Foodservice, and E-Commerce Channels

Product innovation in truffle-infused oils, sauces, condiments, cheeses, and shelf-stable formulations presents a pathway to broaden consumption beyond fine dining. Convenient formats and lower-cost blends enable trial among mainstream consumers while preserving truffle flavor profiles. Private-label and premium retail collaborations allow retailers to offer accessible truffle experiences at varied price points. E-commerce platforms and subscription boxes facilitate sampling across geographies, reducing market entry friction. As food manufacturers invest in R&D to stabilize truffle flavor and extend shelf life, packaged goods become powerful drivers of repeat purchases and category growth globally and enable cross-category partnerships with dairy, snacks, and ready meals.

Over 60% of consumers in premium retail and foodservice try truffle-infused oils, sauces, condiments, cheeses, or shelf-stable products.

Truffles Market Segmentation Analysis

-

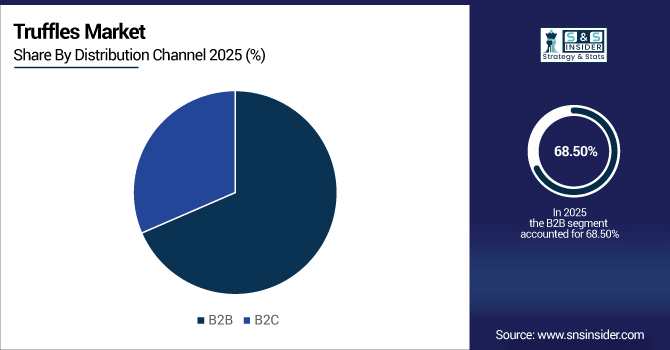

By Distribution Channel, B2B held 68.50% share in 2025E, whereas B2C is growing the fastest with a CAGR of 8.43%.

-

By Product, Black Truffles led the Truffles Market with a 56.10% share in 2025E, while White Truffles is the fastest-growing segment with a CAGR of 9.18%.

-

By Nature, the Conventional sector dominated the market with 71.80% share in 2025E, whereas the Organic segment is expected to grow fastest with a CAGR of 9.20%.

-

By Form, Fresh led the market with 62.30% share in 2025E, while Processed is registering the fastest growth with a CAGR of 8.37%.

By Distribution Channel, B2B Leads While B2C Grows Fastest

B2B channels dominated with the highest revenue share of about 68.50% in 2025E as restaurants, foodservice companies, and processors purchase truffles in bulk. B2C channels are expected to grow at the fastest CAGR of 8.43% during 2026–2033 due to e-commerce platforms, specialty stores, and subscription boxes expanding consumer access. Gazzarrini Tartufi supplies both B2B and B2C channels, supporting dominance and growth. While B2B ensures consistent bulk demand, B2C adoption drives market expansion among individual consumers.

By Product, Black Truffles Leads Market While White Truffles Registers Fastest Growth

Black truffles dominated the market with the highest revenue share of about 56.10% in 2025E due to wider availability, better shelf life, and suitability for oils, sauces, and preserved formats, enabling easier commercialization across restaurants and retail. White truffles are expected to grow at the fastest CAGR of 9.18% during 2026–2033, driven by their premium positioning, rarity, and luxury appeal to affluent consumers. Urbani Truffles’ portfolio spans both black and white varieties, supporting dominance and growth. The combination of broad culinary versatility for black truffles and aspirational consumption for white truffles drives overall market expansion.

By Nature, Organic Dominate While Conventional Shows Rapid Growth

Conventional truffles dominated with the highest revenue share of about 71.80% in 2025E due to established supply chains, higher yields, and broader availability at varied price points. Organic truffles are expected to grow at the fastest CAGR of 9.20% during 2026–2033, driven by rising consumer preference for clean-label, sustainably produced gourmet ingredients. Monini S.p.A. sources conventional truffles for multiple culinary products, illustrating the strength of traditional supply chains. The combination of widespread conventional adoption and increasing organic awareness fuels balanced market growth across both categories.

By Form, Fresh Lead While Processed Registers Fastest Growth

Fresh truffles dominated with the highest revenue share of about 62.30% in 2025E because of premium sensory qualities and preference among restaurants and gourmet buyers. Processed truffles are expected to grow at the fastest CAGR of 8.37% during 2026–2033, supported by convenience, extended shelf life, and accessibility through retail and e-commerce. Truffle Hunter Ltd. offers both fresh and processed products, enhancing market reach. While fresh truffles retain culinary prestige, processed formats drive adoption among broader consumer segments.

Truffles Market Regional Analysis:

North America Truffles Market Insights

North America’s truffles market is driven by rising consumer preference for premium foods, expanding gourmet dining, and increasing use of truffle-infused products. The U.S. leads growth, supported by culinary innovation, online retail, and specialty stores. Experiential dining, food festivals, and chef-led menu inclusions further stimulate demand, while processed and value-added truffle products broaden accessibility, strengthening market expansion across the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Truffles Market Insights

The U.S. dominates due to high consumer spending on premium foods, widespread gourmet dining, strong foodservice networks, and growing e-commerce penetration. Culinary innovation and experiential dining trends further boost demand for both fresh and processed truffle products.

Asia-Pacific Truffles Market Insights

Asia Pacific is the fastest-growing region with a CAGR of 9.39% due to rising disposable incomes, expanding gourmet dining scenes, and increasing interest in Western culinary trends. Growing middle- and upper-income populations in China, India, Southeast Asia, and Australia are experimenting with premium ingredients, while expanding foodservice sectors introduce truffle-based dishes. Improved import channels, specialty retailers, and e-commerce platforms make truffles more accessible.

China Truffles Market Insights

China leads the Asia Pacific truffles market owing to rising disposable incomes, expanding gourmet restaurants, and growing awareness of Western culinary trends. Increased imports, specialty retailers, and online sales channels make truffles more accessible to affluent and urban consumers, driving market growth.

Europe Truffles Market Insights

Europe dominated the truffles market by 43.20% in 2025, reflecting centuries-old culinary traditions, concentrated production in Italy, France, and Spain, and strong domestic consumption. Established domestic supply chains and renowned gastronomic cultures support year-round demand from restaurants and specialty retailers. Europe hosts many truffle festivals and gastronomic events that stimulate both domestic sales and culinary tourism.

Italy Truffles Market Insights

Italy leads due to its centuries-old truffle cultivation tradition, especially for prized white truffles from Alba and black truffles from Umbria and Piedmont. The country has well-established production, harvesting, and export infrastructure, strong domestic consumption in gourmet restaurants, and globally recognized truffle festivals, all of which reinforce its market dominance over France, Germany, the UK, and Spain.

Latin America (LATAM) and Middle East & Africa (MEA) Truffles Market Insights

In the Middle East & Africa, the UAE dominates due to high disposable incomes, luxury dining demand, and strong import networks. In Latin America, Brazil leads with growing gourmet food awareness, rising urban incomes, and expanding fine-dining and retail channels, driving premium truffle consumption across both regions.

Truffles Market Competitive Landscape:

Sabatino Tartufi is a renowned Italian truffle company specializing in high-quality gourmet truffle products for global markets. Its White Truffle Oil delivers rich aroma and flavor, ideal for enhancing fine-dining dishes, while its Black Truffle Sauce offers a versatile, preservable option for culinary applications. Committed to sustainable sourcing and artisanal methods, Sabatino Tartufi caters to restaurants, specialty retailers, and luxury foodservice markets, ensuring premium-quality truffle experiences globally.

-

In December 2024, Sabatino Tartufi expanded its warehouse and production facility by 40% to meet growing demand. The company also opened a retail presence in New York City's Grand Central Terminal on November 13, 2024, offering a range of truffle products, including their White Truffle Infused Olive Oil.

Urbani Truffles, based in Italy, is a leading provider of premium fresh and processed truffle products globally. Its Fresh White Alba Truffles are prized for their rare aroma and culinary prestige, while Truffle-infused Cheese combines authentic truffle flavor with gourmet dairy appeal. The company focuses on authenticity, quality control, and international distribution, serving restaurants, retail, and luxury foodservice, making Urbani synonymous with high-end truffle excellence.

-

In April 2025, Urbani Truffles launched a new 8.45 fl oz (250 ml) bottle of White Truffle Oil, emphasizing its all-natural and vegan ingredients. This product is crafted with cold-pressed olive oil and white truffles, catering to the growing consumer preference for clean-label gourmet ingredients.

La Maison Plantin, a French truffle company, offers an extensive range of gourmet truffle products rooted in traditional expertise. Its Black Summer Truffle Paste provides chefs with rich, preservable truffle flavor, while the White Truffle Oil enhances premium dishes with aromatic intensity. Known for sustainable sourcing and rigorous quality standards, La Maison Plantin supplies fine-dining establishments, specialty retailers, and international markets, maintaining a reputation for luxury and culinary excellence.

-

In March 2025, La Maison Plantin introduced a new line of truffle-infused oils and condiments, including Black Summer Truffle Paste, to appeal to both professional chefs and home cooks. This expansion aligns with the increasing demand for truffle products in various culinary applications.

Truffles Market Key Players:

Some of the Truffles Market Companies are:

-

Sabatino Tartufi

-

Urbani Truffles

-

La Maison Plantin

-

Truffle Hunter Ltd.

-

Arotz Food S.A.

-

Monini S.p.A.

-

Conservas Ferrer S.A.

-

Gazzarrini Tartufi

-

Tartufi Morra

-

Savitar Tartufi

-

Sabores de la Conca

-

Trufarome

-

The Truffle & Wine Co.

-

Truff Co.

-

Appennino Food Group

-

Les Frères Jaumard

-

Tartufi Jimmy

-

Black Boar Truffles

-

Plantin SAS

-

Gennaro Auricchio S.p.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 0.50 Billion |

| Market Size by 2033 | USD 0.94 Billion |

| CAGR | CAGR of 8.26% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Black Truffles, White Truffles and Others) • By Nature (Organic and Conventional) • By Form (Fresh and Processed) • By Distribution Channel (B2B and B2C) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Sabatino Tartufi, Urbani Truffles, La Maison Plantin, Truffle Hunter Ltd., Arotz Food S.A., Monini S.p.A., Conservas Ferrer S.A., Gazzarrini Tartufi, Tartufi Morra, Savitar Tartufi, Sabores de la Conca, Trufarome, The Truffle & Wine Co., Truff Co., Appennino Food Group, Les Frères Jaumard, Tartufi Jimmy, Black Boar Truffles, Plantin SAS, and Gennaro Auricchio S.p.A. |