Automated Storage and Retrieval System Market Size Analysis:

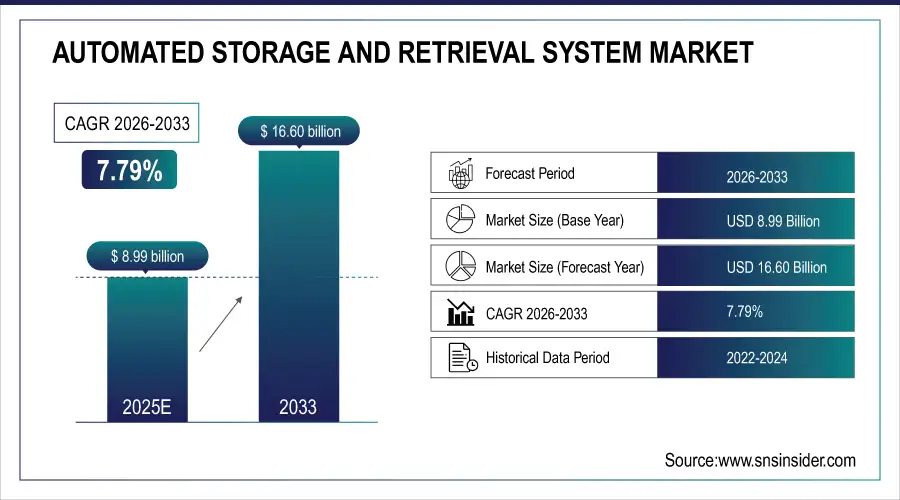

The Automated Storage and Retrieval System Market is estimated at USD 8.99 billion in 2025E and is expected to reach USD 16.60 billion by 2033, growing at a CAGR of 7.79% over 2026-2033.

The Automated Storage and Retrieval System (ASRS) Market analysis report gives a full picture of automated warehousing technologies, material handling systems, trends in the use of logistics automation, and how these systems work together in distribution, production, and fulfillment processes. ASRS adoption is being driven by more online shopping, fewer workers, higher warehouse density requirements, and a greater need for fast, error-free order fulfillment. The market is likely to grow faster throughout the forecast period as robotics, shuttle systems, warehouse execution software, and AI-driven optimization continue to improve.

Automated storage and retrieval systems are expected to be deployed across over 92,000 warehouses and distribution centers globally by 2025, driven by increasing throughput demands, urban warehouse constraints, and cost pressures on manual operations.

ASRS Market Size and Growth Projection:

-

Market Size in 2025: USD 8.99 Billion

-

Market Size by 2033: USD 16.60 Billion

-

CAGR: 7.79 % from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Automated Storage and Retrieval System Market - Request Free Sample Report

Automated Storage and Retrieval System (ASRS) Market Trends:

-

Adoption of high-density automated warehouses is increasing demand for shuttle-based and unit load ASRS, improving storage density by 30–50%.

-

Growth of e-commerce and omnichannel retail is accelerating high-speed ASRS deployment, with over 40% of large fulfillment centers using automated retrieval systems.

-

Integration of AI-enabled WES and analytics is boosting performance, improving inventory accuracy to up to 99.9% and increasing throughput by 20–30%.

-

Labor shortages and rising wages are driving automation, as ASRS can reduce labor needs by 50–65%.

-

Expansion of cold storage and pharmaceutical warehousing is supporting ASRS demand, with temperature-controlled facilities growing at over 10% CAGR.

-

Emphasis on energy efficiency is promoting lightweight shuttles and regenerative drives, cutting energy use by 15–25%.

U.S. Automated Storage and Retrieval System Market Analysis:

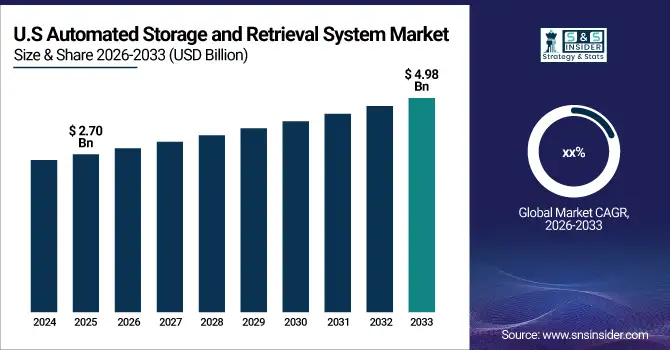

The U.S. Automated Storage and Retrieval System (ASRS) Market size is projected to grow from USD 2.70 Billion in 2025E to reach USD 4.98 Billion by 2033. Growth is being driven by a strong demand for e-commerce fulfillment, the need to modernize manufacturing and supply chain infrastructure, high labor costs that make automation more appealing, and the need to make the most of expensive industrial real estate's storage space.

Automated Storage and Retrieval System Market Growth Drivers:

-

Rapid Expansion of E-commerce and High-Volume Fulfillment Operations

The Automated Storage and Retrieval System market is growing quickly as e-commerce and omnichannel distribution are growing so quickly. Warehouse operators are being forced to deploy high-speed, automated storage and retrieval systems as orders are getting bigger, more SKUs are being added, and customers want their orders delivered faster. ASRS makes it possible to process orders faster, pick items more accurately, rely less on human labor, and make better use of space. More and more retailers and logistics companies are using shuttle-based, robotic cube, and vertical lift systems to manage a lot of work while keeping their operations running smoothly.

ASRS investments are projected to increase by over 14% in 2025, supported by large-scale fulfillment center expansions and automation retrofits.

Automated Storage and Retrieval System Market Restraints:

-

High Capital Costs and Complex System Integration Challenges

The high initial capital investment and the difficulty of integrating the system are still major barriers to ASRS deployment. Setting up large-scale automated systems costs a lot of money for equipment, software, facility changes, and professional implementation. Integrating with current warehouse management systems and operational workflows might be hard from a technical standpoint, which can make deployment take longer. Small and medium-sized businesses may have limited budgets, and downtime during installation may adversely affect operations. These problems make it harder for cost-sensitive and low-volume warehouse businesses to use these technologies.

Automated Storage and Retrieval System Market Opportunities:

-

Growing Demand for High-Density and Urban Warehousing Solutions

The ASRS industry has a lot of room to develop because more and more people want high-density storage solutions in cities and places with limited space. As land prices rise and warehouse space becomes harder to find, more people are using vertical lift modules, shuttle-based systems, and robotic cube solutions that make the most of cubic storage space. These solutions help businesses cut down on the space they use while also increasing throughput and inventory control. Automation companies can take advantage of this trend by developing ASRS systems that are scalable and adaptable, and that work best for urban logistics and micro-fulfillment centers.

High-density ASRS deployments are expected to account for over 31% of new installations in 2025.

Automated Storage and Retrieval System Market Segmentation Analysis:

-

By Type: Unit Load Cranes held the largest market share of 28.94% in 2025, while Robotic Cube-Based Systems are expected to grow at the fastest CAGR of 10.42% during 2026–2033.

-

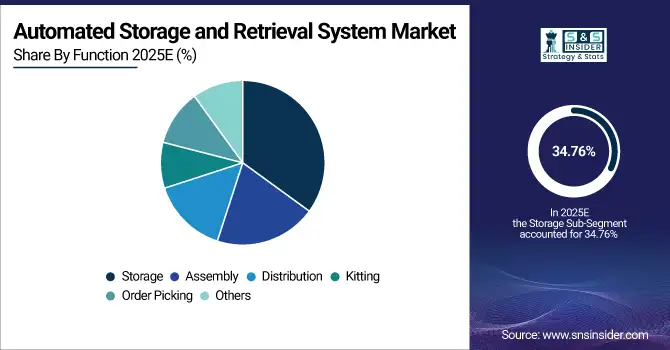

By Function: Storage dominated with a 34.76% share in 2025, while Order Picking is projected to expand at the fastest CAGR of 9.68% during the forecast period.

-

By Vertical: Retail & E-commerce accounted for the highest market share of 38.21% in 2025, while Healthcare is expected to grow at the fastest CAGR of 9.21% through 2026–2033.

By Function, Storage Dominates While Order Picking Expands Rapidly:

Storage functions dominate ASRS deployment as enterprises seek to optimize space utilization and inventory organization. Automated storage systems enable higher stacking density, improved inventory accuracy, and reduced manual handling. Over 58,000 warehouses relied on ASRS primarily for storage operations in 2025.

Order Picking is the fastest-growing function, fueled by increasing demand for rapid, error-free fulfillment. In 2025, ASRS-enabled order picking systems were deployed across 27,000 facilities, significantly improving picking speed and accuracy.

By Type, Unit Load Cranes Dominate While Robotic Cube-Based Systems Expand Rapidly:

Unit Load Cranes dominate the ASRS market due to their extensive use in palletized storage, high-bay warehouses, and large distribution centers. These systems offer high load capacity, reliability, and seamless integration with warehouse control systems. In 2025, over 41,000 warehouses globally utilized unit load crane systems for bulk storage and distribution efficiency.

Robotic Cube-Based Systems are the fastest-growing segment in the market, driven by demand for ultra-high-density storage and flexible goods-to-person operations. In 2025, more than 9,500 facilities deployed robotic cube solutions, reflecting rising adoption in e-commerce and micro-fulfillment applications.

By Vertical, Retail & E-commerce Dominates While Healthcare Expands Rapidly:

Retail & E-commerce dominates the ASRS market due to high order volumes, SKU diversity, and the need for fast turnaround times. Major retailers and fulfillment operators are investing heavily in automated warehouses to maintain competitiveness. Over 35,000 retail and e-commerce facilities deployed ASRS solutions in 2025.

Healthcare is the fastest-growing vertical, driven by demand for precise inventory control, traceability, and compliance in pharmaceutical and medical supply storage. In 2025, more than 6,800 healthcare facilities adopted ASRS to improve efficiency and safety.

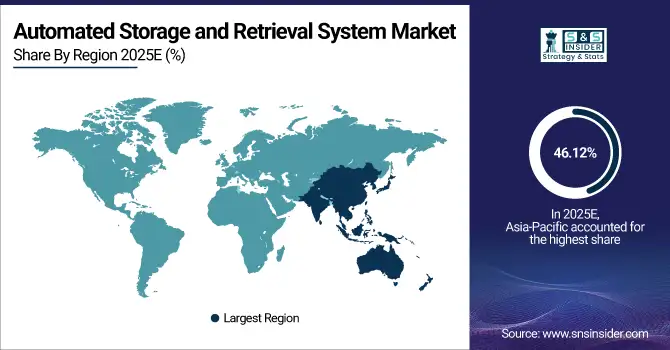

Asia Pacific Automated Storage and Retrieval System Market Insights:

Asia Pacific dominated the Automated Storage and Retrieval System (ASRS) market, accounting for 46.12% of global market share in 2025. Rapid industrialization, the growth of manufacturing hubs, the rise of e-commerce, and big investments in warehouse automation across China, Japan, South Korea, and Southeast Asia are all driving growth. Government backing for smart logistics, Industry 4.0 acceptance, and rules that make automation easier are all speeding up the deployment of ASRS in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Automated Storage and Retrieval System Market Insights:

China is the largest contributor in Asia Pacific, accounting for over 50% of regional ASRS demand. Huge growth in e-commerce, large-scale manufacturing, and government programs that promote smart logistics infrastructure are all driving market growth. China is a major driver of global ASRS adoption since it has a lot of fulfillment centers and factories that use shuttle-based, robotic cube-based, and mini-load ASRS technologies.

North America Automated Storage and Retrieval System Market Insights

North America is the fastest-growing ASRS market, projected to expand at a CAGR of 8.74% during the forecast period. Modernizing warehouses, growing labor expenses, and high adoption of goods-to-person and robotic automation technologies all help growth. The area benefits from early adoption of technology, a large number of ASRS vendors, and more money being spent on automation in retail, e-commerce, and third-party logistics.

U.S. Automated Storage and Retrieval System Market Insights:

The U.S. dominates North America, contributing approximately 70% of regional ASRS revenue. Big retailers and 3PL providers are investing heavily in automation, building large networks of fulfillment centers, and improving logistics infrastructure are all driving the market in the U.S. The U.S. market is still in the lead due to high use in unit-load cranes, shuttle systems, and robotic ASRS solutions.

Europe Automated Storage and Retrieval System Market Insights:

Europe holds a significant share of the ASRS market, driven by advanced manufacturing, strong automotive production, and well-developed logistics networks. Countries, such as Germany, France, the U.K., and Italy are major contributors. Industry 4.0 initiatives, labor efficiency requirements, and sustainability-driven warehouse optimization are accelerating ASRS adoption across the region.

Germany Automated Storage and Retrieval System Market Insights:

Germany is Europe’s leading ASRS market, accounting for nearly 25% of regional demand. A strong industrial base, innovative automobile manufacturing, and a high rate of use of automated production and logistical systems all help growth. ASRS solutions are used a lot in the automotive, electronics, and distribution industries to make things run more smoothly and save money.

Latin America Automated Storage and Retrieval System Market Insights:

The ASRS market in Latin America is growing steadily because more stores are opening, more money is being invested in manufacturing, and logistical infrastructure is being updated. More and more businesses are using automation in Brazil and Mexico because they want to make their warehouses more efficient and their orders more accurate.

Brazil Automated Storage and Retrieval System Market Insights:

Brazil represents the largest ASRS market in Latin America, contributing approximately 40% of regional demand. Growth is fueled by retail expansion, growing e-commerce penetration, and modernization of distribution centers. Adoption of vertical lift modules and shuttle-based ASRS systems is increasing to improve storage density and fulfillment efficiency.

Middle East & Africa Automated Storage and Retrieval System Market Insights:

The Middle East & Africa ASRS market is growing due to improvements in logistics infrastructure, the fast rise of e-commerce, and more people using automated warehousing. The GCC countries and South Africa are important growth markets, thanks to government-led efforts to diversify logistics and industry.

United Arab Emirates Automated Storage and Retrieval System Market Insights:

The UAE is a leading ASRS adopter in the Middle East, accounting for over 30% of regional market share. Growth is driven by logistics hub development, e-commerce fulfillment expansion, and smart warehouse investments. High adoption of automated storage solutions in ports, free zones, and distribution centers supports sustained market growth.

Automated Storage and Retrieval System Market Competitive Landscape:

Dematic (KION Group AG), Founded in 1819, this company is a global leader in automated material handling and intralogistics solutions. Its main products include automated storage and retrieval systems (AS/RS), conveyor systems, sortation, and warehouse execution software. Dematic works with the retail, food and drink, manufacturing, and e-commerce industries. Its main areas of concentration include high-throughput automation and digital supply chains.

-

In June 2023, Dematic expanded its AutoStore and robotic picking portfolio to support scalable, high-density fulfillment operations.

Daifuku Co., Ltd., founded in 1937 and based in Japan, it is a top provider of material handling and automation systems, such as AS/RS, conveyors, cleanroom automation, and airport baggage handling systems. The company works with a lot of different industries, including automotive, logistics, e-commerce, and semiconductor production. They focus on reliability and integrating massive systems.

-

In August 2023, Daifuku strengthened its semiconductor automation capabilities with new cleanroom-compatible automated transport solutions.

Kardex, founded in 1948 and based in Switzerland, the company specializes in automated storage and retrieval solutions such vertical lift modules, vertical carousels, and automated small parts systems. The organization helps businesses in manufacturing, healthcare, retail, and distribution by focusing on making the most of space and streamlining workflows.

-

In April 2023, Kardex launched an upgraded software platform enhancing real-time inventory visibility and system connectivity across automated warehouses.

Murata Machinery, Ltd., founded in 1935 and based in Japan, this company offers automation, logistics, and clean industrial solutions around the world. These include AS/RS, automated guided vehicles, and material transport systems. The company works with the logistics, textile, electronics, and semiconductor industries, focusing on high-speed automation and accuracy.

-

In September 2023, Murata Machinery introduced next-generation automated transport systems tailored for high-throughput e-commerce and smart factory environments.

Automated Storage and Retrieval System Companies are:

-

Dematic (KION Group AG)

-

Kardex

-

Murata Machinery, Ltd.

-

SSI SCHAEFER Group

-

Mecalux, S.A.

-

KNAPP AG

-

BEUMER Group

-

KUKA AG

-

Bastian Solutions, LLC

-

System Logistics S.p.A.

-

Flexe Inc.

-

Green Automated Solutions

-

Kubo Systems

-

Swisslog Holding AG

-

Vanderlande Industries

-

Honeywell Intelligrated

-

Demag Cranes & Components

-

Interroll Group AG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.24 Billion |

| Market Size by 2033 | USD 13.18 Billion |

| CAGR | CAGR of 7.97% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Unit Load Cranes, Mini Load Cranes, Robotic Shuttle Based, Carousel Based, Vertical Lift Module, Robotic Cube Based) • By Function (Assembly, Distribution, Kitting, Order Picking, Storage, Others) • By Vertical (Retail & E-commerce, Healthcare, Automotive, Aerospace & Defense, Electronics & Semiconductors, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Dematic (KION Group AG), Daifuku Co., Ltd., Kardex, Murata Machinery, Ltd., SSI SCHAEFER Group, TGW Logistics Group, Mecalux, S.A., KNAPP AG, BEUMER Group, KUKA AG, Bastian Solutions, LLC, System Logistics S.p.A., Flexe Inc., Green Automated Solutions, Kubo Systems, Swisslog Holding AG, Vanderlande Industries, Honeywell Intelligrated, Demag Cranes & Components, Interroll Group AG |