UAV Satellite Communication Market Size & Trends:

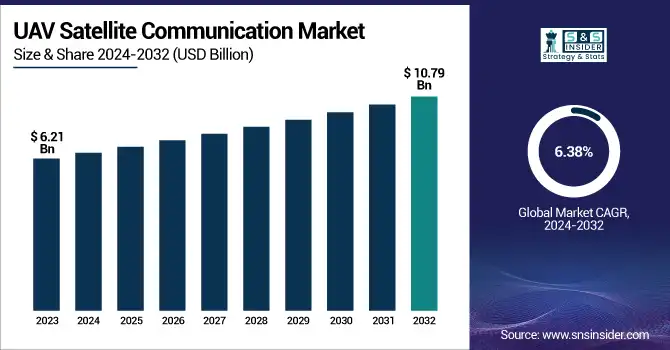

The UAV Satellite Communication Market was valued at USD 6.21 billion in 2023 and is expected to reach USD 10.79 billion by 2032, growing at a CAGR of 6.38% over the forecast period 2024-2032.

To Get more information on UAV Satellite Communication Market - Request Free Sample Report

Huge developments are taking place in the UAV Satellite Communication (SATCOM) market, and the UAV fleet distribution is getting bigger with the growing availability of commercial and military UAVs as well, which are employing SATCOM systems to transmit data in real-time. Increasing demand for reliable connectivity is boosting the shipment volumes of SATCOM components, which is further propelling the terminal, antenna, and modem components market growth with it. The same goes for the deployment of ground stations, with fab-equivalent facilities supporting more optimal data relay and sole-communications infrastructure. Not only this, but advancements in battery life and efficiency of UAVs are ensuring that battery timeliness is perfected and more missions can be accomplished without the need for constant charging, which makes UAVs even more effective when it comes to satellite communication.

The U.S. made major strides with UAV satellites in 2024 and the Star Shield program by SpaceX. This effort includes a USD 1.8 billion contract with the National Reconnaissance Office that will launch a resilient network of low Earth orbit (LEO) satellites for near-continuous coverage of the whole Earth. By 2029, more than 100 satellites will operate within the program, which aims to improve military communications and data processing capabilities. The drone communication market, too, is advancing quickly in the U.S. for applications across infrastructure inspection, logistics, and emergency response sectors.

The U.S. UAV Satellite Communication Market is estimated to be USD 1.68 billion in 2023 and is projected to grow at a CAGR of 5.85%. The growth of the U.S. UAV Satellite Communication Market can be attributed to increasing demand for UAVs in the commercial sector, including logistics, agriculture, and disaster management. Furthermore, relations at the goals of satellite miniaturization and the enlargement of 5G networks, seamless and low-latency conversation are feasible, boosting UAV features in army and civil applications.

UAV Satellite Communication Market Dynamics

Key Drivers:

-

Rising Demand for Reliable UAV Satellite Communication Drives Market Growth in Multiple Sectors Worldwide

Growing requirements for reliable and high-band communication capability in remote and hostile environments are expected to be the major driving factor for the global UAV Satellite Communication market. The deployment of UAVs in multiple sectors, such as military and defense, agriculture, and logistics, is forcing the need for real-time data transmission and secure communications. The growing application of UAVs for military reconnaissance, border control, search and rescue, and disaster response will drive satellite communication technology uptake. Also, progress in the miniaturization of devices, like antennas and transceivers, is contributing to the efficiency and low cost of satellite communication systems for small and large UAVs.

Restrain:

-

Regulatory Challenges and Airspace Management Hinder Growth of Global UAV Satellite Communication Market

The most important factor restraining the growth of the global UAV satellite communication market is the regulatory challenges related to UAV operations, such as airspace management and communication protocols. Since UAVs will operate in different areas, satellite communication systems must have global regulations to promote the speed of adoption and facilitate performance, but such regulations are still immature. UAV operators find it hard to ensure fine communication because several autonomous aviation networks are regulated uniquely by frequency allocation, signal strength, and airspace control of each country. Such interdependencies render compliance with these regulatory frameworks quite difficult and sometimes can even make it difficult to deploy UAV systems across borders, thereby affecting the market growth.

Opportunity:

-

Expansion of Civil and Commercial UAV Applications Drives Demand for Advanced Satellite Communication Systems

Another significant potential market is in the growing validation of civil and commercial UAV applications. As sectors such as agriculture, oil & gas, and infrastructure monitoring continue to utilize UAVs in their critical missions, the need for satellite communications systems that enable beyond visual line of sight (BVLOS) operations is expanding. Meanwhile, next-gen satellite constellations and especially LEO (low Earth orbit) satellites are paving the way for significantly faster and more resilient connectivity for UAVs over an extended range of locations around the world. This creates huge scope for enterprises to innovate communication technologies, thus indicating the substantial demand for satellite-connected UAVs for existing and developing markets.

Challenges:

-

Technical Challenges in Signal Reliability and Latency Limit UAV Communication in Harsh Environments

A challenge is the technical limitations regarding the assurance of signals and the communication latency problem in remote areas, especially when UAVs are being implemented in harsh environmental conditions. In some places, satellite signals can be vulnerable to interference, especially when the satellite has to communicate with people living in regions with thick forests, mountainous terrains, or urban canyons. Furthermore, transmitting consistent data throughput over large distances remains a technical challenge too, in particular for time-sensitive applications where high-bandwidth communication is needed, e.g., video streaming or flight control for UAVs. Such challenges demand continuous innovations in satellite technology as well as signal processing to provide reliable and secure communication solutions to UAVs.

UAV Satellite Communication Market Segmentation Overview

By UAV Type

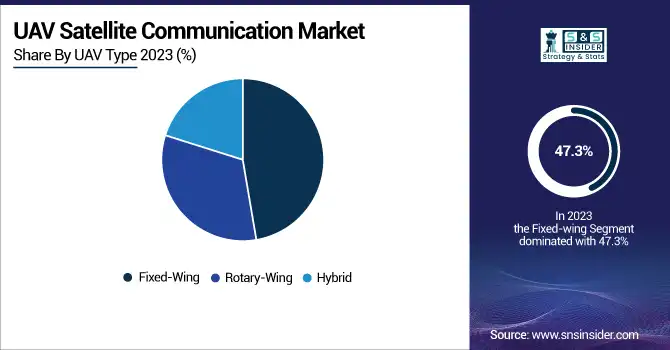

The UAV satellite communication market was dominated by the fixed-wing UAV segment, which accounted for 47.3% of total market share in 2023 due to high aerodynamic efficiency, long-range capability, and endurance suitable for military surveillance of large areas, border patrol operations, and strategic reconnaissance missions. Such UAVs are generally meant for BVLOS missions, with heavy dependence on satellite comms for real-time data transfer and long-range control.

The hybrid UAV segment is expected to grow at the fastest CAGR from 2024 to 2032. By using both rotary-wing and fixed-wing capabilities, hybrid UAVs combine the vertical take-off and landing (VTOL) aspect of a rotary-wing drone and the long-range and endurance capabilities of more traditional fixed-wing types. Due to this versatility, they are highly attractive for various civilian and defence applications, such as calamity response, infrastructure monitoring, and long-range deliveries. Hybrid platforms are expected to find significant traction in markets across the globe, owing to the increasing demand for multi-mission UAVs.

By Component

Transceivers accounted for 36.1% of total revenue in the UAV satellite communication market in 2023. This dominance is due to their key role in setting up and maintaining communication connections between UAVs and satellites. Transceivers (Tx / Rx) transmit and receive both the signals; as such, it is critical for real-time data transmission, navigation, and control of drones operating beyond visual line of sight (BVLOS), such as military and long-range surveillance missions.

The antenna segment is expected to grow at the highest of from 2024 to 2032, owing to the rising demand for compact, lightweight, and high-performance antenna systems. As for direction, strength, and clarity of signal, antennas are mentioned as a key area of advancement with phased-array and low-profile antennas further maximizing UAV capabilities for those commercial as well as defense use cases. As LEO satellite networks expand across the globe, the increasing reliance on BVLOS and satellite-dependent UAV missions will create additional demand for advanced antenna offerings.

By Application

The UAV Satellite Communication Market by Application, Military & Defense has a share of 46.5% in 2023. These dominate include an increasing UAV application for surveillance, reconnaissance, border security, and tactical communication. Satellite Operations gives access to real-time, long-distance command and control of mission-critical assets for national defense. SATCOM systems have played a crucial role, and the advent of SATCOM-enabled UAVs has greatly improved the operational capabilities of armed forces, particularly in remote and dangerous regions.

From 2024 to 2032, the segment of civil & commercial is anticipated to experience rapid growth at the highest CAGR. The growing applications in infrastructure inspection, agriculture monitoring, disaster management, and logistics, among others, are boosting the need for background low-power wide-area network (LPWAN) communication. Satellite Communication will be key for BVLOS (beyond visual line of sight) operations, which will grow in use with commercial UAV operations. Subsequent advances in technology, plus support from regulatory agencies driving the commercial utilization of SATCOM-enabled UAVs.

UAV Satellite Communication Market Regional Outlook

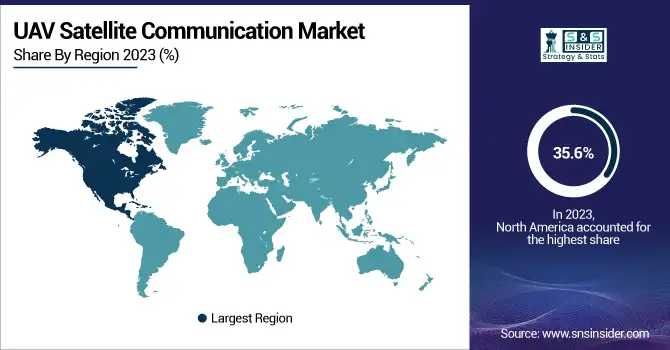

North America led the UAV satellite communication market in 2023, capturing 35.6% of the market share, owing to high government expenditure on defense modernization, high utilization of UAVs for military applications, and the presence of advanced satellite infrastructure. This leading position can be attributed to the presence of crucial players, such as General Atomics, Northrop Grumman, Lockheed Martin, and strong R&D activities. In real life, we have seen an example where U.S. Department of Defense has made use of MQ-9 Reaper drones with the necessary satellite communication systems which prepare them to pass-on a good amount of information at ISR (Intelligence, Surveillance, and Reconnaissance) missions in theatres of operations since it provides real-time data-communication to the air vehicle with facilitating control at very long distances.

The Asia Pacific region is projected to register the highest CAGR during the forecast period, due to rising defense spending, growing demand for commercial UAV applications, as well as investments in satellite communication infrastructure. UAV capabilities are ramping up rapidly among countries such as China, India, and Japan, spanning across sectors. To illustrate, India is leveraging its GAGAN (GPS Aided GEO Augmented Navigation) system built by the Indian Space Research Organisation (ISRO) and the Airports Authority of India (AAI) to improve satellite communication for civil aviation and commercial use of UAVs. The increasing emphasis on border surveillance, smart farming, and disaster management in the region will be another factor contributing to the market expansion of SATCOM-enabled UAVs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in the UAV Satellite Communication Market are:

-

Inmarsat (SwiftBroadband)

-

Viasat Inc. (VR-12 Ku-band Antenna System)

-

Iridium Communications Inc. (Iridium Certus)

-

Hughes Network Systems (Hughes 9450-C10 BGAN Terminal)

-

SES S.A. (O3b mPOWER)

-

Thales Group (FlytLINK Certus 200)

-

Cobham Aerospace Communications (AVIATOR UAV 200)

-

L3Harris Technologies (Lynx UAV SATCOM)

-

Honeywell Aerospace (JetWave MCX SATCOM)

-

General Dynamics Mission Systems (TACLANE-FLEX)

-

Northrop Grumman (Freedom Radio SATCOM System)

-

Airbus Defence and Space (Proteus UAV SATCOM)

-

SpaceX (Starlink for Government)

-

Blue Sky Network (SkyLink 7100)

-

Orbit Communications Systems (MPT 30WG Airborne SATCOM Terminal)

Recent Development

-

In February 2024, Viasat, in partnership with Gotonomi, successfully demonstrated its Velaris SATCOM terminal for UAVs in a BVLOS powerline inspection trial in Canada.

-

In April 2025, Hughes and Eutelsat partnered to expand high-speed, low-latency LEO satellite connectivity across Europe. The collaboration leverages OneWeb’s satellite network and Hughes’ ground infrastructure to enhance broadband access for enterprises and governments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.21 Billion |

| Market Size by 2032 | USD 10.79 Billion |

| CAGR | CAGR of 6.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By UAV Type (Fixed-wing, Rotary-wing, Hybrid) • By Component (Transceivers, Antennas, Modems, Power amplifiers, Others) • By Application (Military & defense, Civil & commercial, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Inmarsat, Viasat Inc., Iridium Communications Inc., Hughes Network Systems, SES S.A., Thales Group, Cobham Aerospace Communications, L3Harris Technologies, Honeywell Aerospace, General Dynamics Mission Systems, Northrop Grumman, Airbus Defence and Space, SpaceX, Blue Sky Network, Orbit Communications Systems. |