Fixed-wing VTOL UAV Market Report Scope & Overview:

To get more information on Fixed-wing VTOL UAV Market - Request Free Sample Report

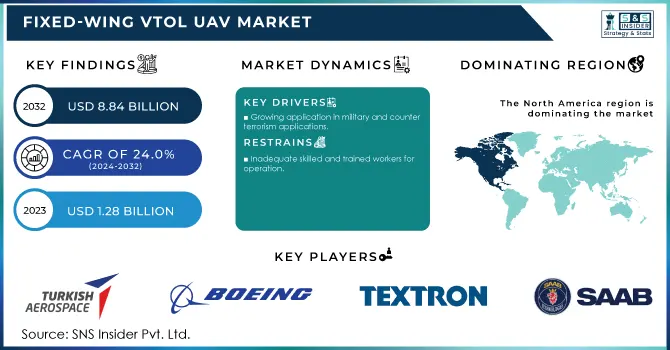

The Fixed-Wing VTOL UAV Market was valued at USD 1.28 billion in 2023 and is projected to reach USD 8.84 billion by 2032, growing at a remarkable CAGR of 24.0% during the forecast period of 2024-2032.

A fixed-wing VTOL, UAV is a fixed-wing drone with the ability to take off, fly, and land vertically, as well as hover in open space. Since their inception, fixed-wing drones have chosen to transform the way experts map the world. However, due to the attached belly landings, they are also expected to have reliability and safety issues. Fixed-wing VTOL UAV’s are in high demand for both military and commercial operations because they combine the cruising flight efficiency of fixed-wing aircraft with the appropriate angle of vertical landing of multi-rotors.

Summary of VTOL Vertical Takeoff aircraft and Landing Airplane, any unusual aircraft with rotating wings, such as a helicopter and auto giro. They can also be fitted with rotating jet systems that can fly straight up and stay in places larger than the full size of the plane. A UAV, commonly referred to as a drone, automated airplane framework, or by various other names, is a non-passenger aircraft. Aerial vehicle, a military aircraft that is self-controlled, remote, or both, and carrying sensors, targeted designers, assault weapons, or electronic transmitters intended to disrupt or destroy targeted enemies.

UAV can be incredibly efficient, delivering a much wider range and tolerance than similar human-powered systems as they can be loaded with personnel, life support materials, or aircraft design safety requirements. The Multi rotor VTOL (Vertical Take-off and Landing) and UAV (Vacant Air Vehicles) can take off, landing, and roaming the area. A basic vertical UAV can be based on the design of a helicopter or incorporate a multi rotor design with four or more helicopters. Flight propellers provide both lift and movement. Multi copter drones are the most popular form of VTOL UAV.

MARKET DYNAMICS

KEY DRIVERS

-

Growing application in military and counter-terrorism applications

-

The need for safe and accurate inspection and monitoring

RESTRAINTS

-

Limited political and social acceptability of UAVs

-

Inadequate skilled and trained workers for operation

OPPORTUNITIES

-

Use in cargo delivery for military and commercial purposes.

-

expanded deployment for aerial remote sensing

CHALLENGES

-

UAVs have limited consumer acceptance and cause auditory disruption.

-

Possible safety risks and invasions of privacy

IMPACT OF COVID-19

The outbreak of the novel corona virus pandemic has been a major challenge, causing problems for the Vertical Take-off and Landing UAV Market revenue that has been predicted for the current forecast period, which will end in 2028. The reduction in investments and the lockdown have caused numerous operational issues. However, markets are returning to normalcy, and thus there is potential for market rate acceleration following the pandemic.

The market is divided into three types: helicopters, multi copters, and hybrids. One of the most important factors likely to propel the growth of the fixed-wing VTOL UAV Market is the increased adoption of technically sophisticated runway-less unmanned aerial military platforms by defence forces.

The market is divided into three segments based on application: military, homeland security, and civil and commercial. Rising demand for VTOL UAVs in the civil and commercial sectors will propel this market forward. The market is being propelled forward by the demand for 3D mapping, oil and gas pipeline inspections, recreation, safety, and monitoring operations.

KEY MARKET SEGMENTATION

By Propulsion

-

Electric

-

Hybrid

-

Gasoline

By Mode of operation

-

VLOS

-

EVLOS

-

BVLOS

By Type

-

Multi copter

-

Hybrid

By Payloads

-

ISR

-

Cameras

-

Telemetry

By Application

-

Military

-

Government & Law Enforcement

-

Commercial

REGIONAL ANALYSIS

In 2022, North America is expected to be the largest market for fixed-wing VTOL UAVs. Vertical Take-off and Landing The UAV market is divided worldwide based on the North American region, the Asia-Pacific region, the European region, the Latin American region, and the Middle East and the African region. The largest market share in the global market is occupied by the North American region due to the presence of countries such as Mexico, Canada, and the US with high rates of urbanization and that is why it creates a great demand for this region. The presence of various key players is another factor driving the market demand.

As the fastest growing region, the largest Vertical Take-off and Landing share of the UAV Market in the global market is dominated by the Asia-Pacific region due to the presence of populations such as China, India and Japan, in the South. Korea, and many others who drive market demand in the region. In addition, commercial and residential growth is another factor driving market demand.

The third largest market share in the global market is dominated by the European region due to the availability of well-developed infrastructure that requires the UAV Vertical Take-off and Landing market to develop and create further growth. opportunities in this region.

The Middle East and Africa region and the Latin American region show a very small market share due to the existence of low infrastructure in both regions. Low per capital income is another factor that hinders market growth in these regions.

Need any customization research on Fixed-wing VTOL UAVMarket - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Turkish Aerospace Industries Inc., The Boeing Company, Textron Inc., Saab Group, AeroVironment Inc., Schiebel Elektronische Gerate GmbH, Israel Aerospace Industries Ltd., Lockheed Martin Corporation, DJI Innovations, Northrop Grumman Corporation, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.28 Billion |

| Market Size by 2032 | US$ 8.84 Billion |

| CAGR | CAGR of 24% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Propulsion (Electric, Hybrid, Gasoline) • By Mode of operation (VLOS, EVLOS, BVLOS) • By Type (Helicopter, Multi copter, Hybrid) • By Payloads (ISR, Cameras, Telemetry) • By Application (Military, Government & Law Enforcement, Commercial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Turkish Aerospace Industries Inc., The Boeing Company, Textron Inc., Saab Group, AeroVironment Inc., Schiebel Elektronische Gerate GmbH, Israel Aerospace Industries Ltd., Lockheed Martin Corporation, DJI Innovations, Northrop Grumman Corporation, and other players. |

| DRIVERS | • Growing application in military and counter-terrorism applications • The need for safe and accurate inspection and monitoring |

| RESTRAINTS | • Limited political and social acceptability of UAVs • Inadequate skilled and trained workers for operation |