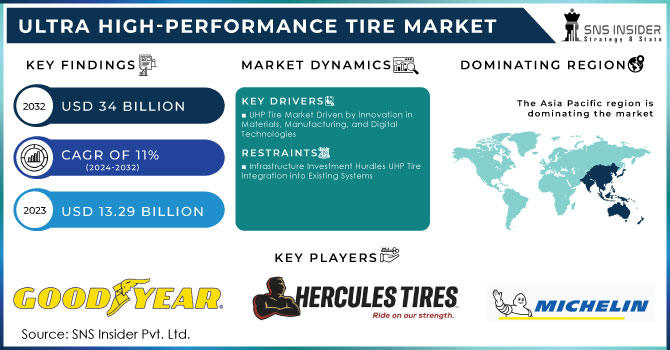

Ultra High-Performance Tire Market Size Analysis:

The Ultra High-Performance Tire Market Size was USD 13.29 billion in 2023 & will reach USD 34 billion by 2032 and grow at a CAGR of 11% by 2024-2032. The Ultra High Performance tire market caters to high-performance vehicles like luxury sedans, sports cars, and powerful SUVs. These tires prioritize exceptional handling, traction, and responsiveness in various weather conditions. UHP tires utilize advanced materials and technologies to deliver superior grip and stability on dry, wet, or even snowy roads. The UHP market is driven by advancements in tire technology, such as innovative tread designs, improved rubber compounds, and lightweight materials. These advancements enhance performance and fuel efficiency. The growing popularity of high-performance vehicles among car enthusiasts and the increasing demand for customization options are further propelling market growth.

Get More Information on Ultra High-Performance Tire Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

UHP Tire Market Driven by Innovation in Materials, Manufacturing, and Digital Technologies

Manufacturers constantly develop new materials, manufacturing techniques, and even digital technologies to improve UHP tires. These advancements can take the form of enhanced tread designs for better grip, improved rubber compounds for longer wear and lower rolling resistance, or even integrating digital sensors for real-time tire monitoring. This focus on continuous improvement ensures UHP tires remain at the forefront of performance and efficiency, fueling market growth.

RESTRAINTS:

-

Infrastructure Investment Hurdles UHP Tire Integration into Existing Systems

UHP tires offer numerous benefits, their widespread adoption might face hurdles due to infrastructure limitations. Integrating UHP tires with existing energy systems could necessitate substantial investments in upgrades. This could involve bolstering the power grid to handle potential changes in energy consumption patterns caused by UHP tires. Additionally, building storage facilities might be necessary to compensate for any fluctuations in energy use. These infrastructure upgrades can be expensive, potentially slowing down the widespread adoption of UHP tires.

OPPORTUNITIES:

-

The growing popularity of SUV performance variants creates an opportunity for UHP makers to develop specialized tires for this high-growth segment.

-

UHP brands can tap into the increasing focus on sustainability by developing eco-friendly UHP tires with lower rolling resistance and longer lifespans.

CHALLENGES:

-

High costs of raw materials and manufacturing can limit the affordability of UHP tires.

-

Rapid advancements in technology can make UHP tires quickly outdated, requiring constant innovation.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has significantly disrupted the UHP tire market, impacting production, logistics, and consumer spending. Sanctions on Russia, a major supplier of raw materials like synthetic rubber and carbon black, caused price hikes of up to 25% for these materials. Disruptions in global supply chains due to the conflict further exacerbated these issues, leading to production slowdowns and potential shortages of UHP tires in some regions. The rising fuel costs, another consequence of the war, might lead consumers to delay or forgo purchases of high-performance vehicles that typically rely on UHP tires, potentially causing a decline in demand of around 5-10%.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can slowdown the UHP tire market, potentially causing a decline in growth rates. This is because these high-performance tires are often seen as a premium product, and consumers might tighten their spending belts during economic hardships. Industry analysts predict a flattening of export growth for UHP tires, particularly to regions like the US and Europe that are susceptible to slowdowns. This could translate to a moderation in overall market growth, with some estimates suggesting a shift from the robust growth rates witnessed earlier to a more mid-single digit increase of around 6-8%. Thus, the impact might not be as severe as expected. Replacement demand, which constitutes a significant portion of the UHP tire market, is likely to remain stable.

KEY MARKET SEGMENTS:

By Tire Type:

-

Summer

-

Winter

-

All-Season

Summer Tires is the dominating sub-segment in the Ultra High-Performance Tire Market by tire type holding around 60-70% of market share. Summer tires are designed for optimal performance in warm and dry conditions. They offer superior handling, grip, and responsiveness, which are crucial for high-performance driving. While winter and all-season tires offer advantages in colder weather, their performance sacrifices some of the handling and responsiveness that UHP summer tires prioritize.

By Vehicle Type:

-

Sports Car

-

SUV/MUV

-

Light Trucks

Sports Cars is the dominating sub-segment in the Ultra High-Performance Tire Market by vehicle type. Sports cars are specifically engineered for high-performance driving, making UHP tires a natural choice. These tires maximize the car's capabilities by providing exceptional handling, braking, and cornering at speed. While SUVs and light trucks can benefit from UHP tires, their focus might lean more towards all-season capability or specific needs like off-roading.

By Sales Channel:

-

OEM

-

Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Ultra High-Performance Tire Market by sales channel. High-performance and luxury car manufacturers often equip their vehicles with UHP tires as standard equipment. This showcases the car's performance capabilities and caters to driving enthusiasts who prioritize performance from the start.

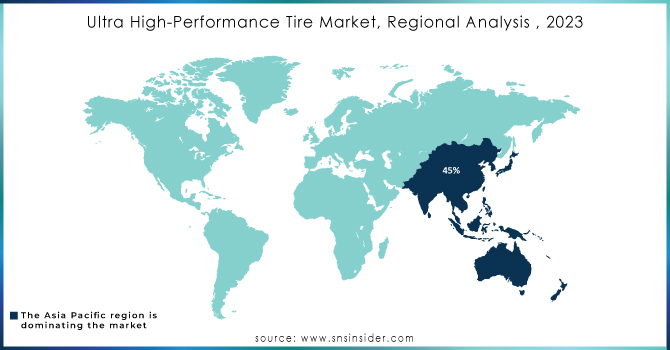

REGIONAL ANALYSIS:

The Asia Pacific is the dominating region in this market holding around 45% of market share. This region leads the market due to the rising demand for high-performance vehicles across developing economies within Asia Pacific. The growing disposable incomes are allowing consumers to invest in premium tires. Government regulations promoting fuel efficiency and safety standards are further driving the UHP tire market.

Europe is the second highest region in this market, boasting a long history of established car manufacturers and a culture of high-performance driving. This translates to a steady demand for UHP tires.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

MICHELIN (France), The Hercules Tire and Rubber Company, The Goodyear Tire and Rubber Co. (US), Sumitomo Rubber Industries (Dunlop Tires), Continental AG (Germany), Bridgestone Corp. (Japan), Hankook Tire and Technology Co. Ltd. (South Korea), Pirelli (Italy), Toyo Tire Corporation (Japan), Chaoyang Tires, Yokohama Rubber Co. Ltd. (Japan), Cooper Tire, NEXEN TIRE, Rubber Co. (US), and Kumho Tire Co. Inc. (South Korea) are some of the affluent competitors with significant market share in the Ultra High-Performance Tire Market.

RECENT DEVELOPMENTS:

-

In Sept. 2022: Bridgestone introduced the Firestone Firehawk AS V2, an all-season tire promising year-round sporty handling inspired by their INDYCAR racing tires.

-

In May 2022: ZC Rubber launched the Westlake ZuperAce Z-007, UHP tires for passenger cars. Their nano-silica construction improves grip and fuel efficiency, making them ideal for drivers seeking performance and eco-friendliness.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.29 Billion |

| Market Size by 2032 | US$ 34 Billion |

| CAGR | CAGR of 11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Tire Type (Summer, All-Season, Winter) • By Demand Category (OEM, Replacement) • By Vehicle Type (Sports Cars, Light Truck, SUVs/MUVs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MICHELIN (France), The Hercules Tire and Rubber Company, The Goodyear Tire and Rubber Co. (US), Sumitomo Rubber Industries (Dunlop Tires), Continental AG (Germany), Bridgestone Corp. (Japan), Hankook Tire and Technology Co. Ltd. (South Korea), Pirelli (Italy), Toyo Tire Corporation (Japan), Chaoyang Tires, Yokohama Rubber Co. Ltd. (Japan), Cooper Tire, NEXEN TIRE, Rubber Co. (US), and Kumho Tire Co. Inc. |

| Key Drivers | • The rise in crude oil costs is causing a shift in the public's demand for more fuel-efficient vehicles. • The ultra-high performance tire industry is growing due to the rising demand for tire replacement for maintenance. • Due to increased customer awareness and supplier concentration. |

| Restraints | • Raw material prices are rising in tandem with transportation & labor expenses, further limiting the market's expansion. • As enterprises have ceased production, owing to a lack of skilled personnel due to social distancing rules. • The growth of the automotive tire industry is being stifled by strict regulations relating to non-biodegradable concerns. |