Fuel Cell Vehicle Market Report Scope & Overview:

Get More Information on Fuel Cell Vehicle Market - Request Sample Report

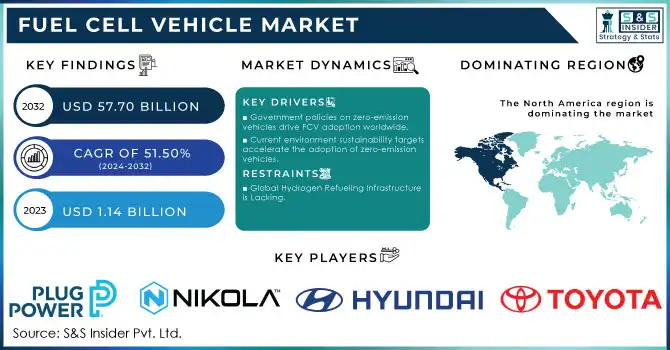

The Fuel Cell Vehicle Market Size was valued at USD 1.14 Billion in 2023 and is expected to reach USD 57.70 Billion by 2032 and grow at a CAGR of 51.50% over the forecast period 2024-2032.

Fuel Cell Vehicle Market is rising up considerably because governments, car makers, and technology companies are emphasizing the transition toward zero-emission transportation. FCVs use hydrogen to power electric motors, producing only water vapor as exhaust, making them an imperative player in reducing carbon emissions.

Hydrogen vehicles are ambitious policies launched by governments all over the world. In the United States, the Bipartisan Infrastructure Law has committed USD 9.5 billion to speed up the US hydrogen economy - infrastructure to include hydrogen fueling stations and the development of clean hydrogen production. And, California's ZEV mandate continues to drive for 100% new car and truck sales to be zero-emission by 2035, starting with FCVs.

Policies of countries like Japan, Germany, and the UK are also leading, with hydrogen strategies that align to future growth. Japan has a Strategic Roadmap for Hydrogen and Fuel Cells with a target of 200,000 FCVs by 2025, and will further continue highly subsidizing the development of hydrogen infrastructure. Germany's National Hydrogen Strategy and the UK's Hydrogen Strategy also advance the hydrogen ecosystem with strong support for innovation and market adoption. These set an excellent environment for growth related to FCVs.

Some key players like auto-giant automakers and tech firms are revolutionizing the way FCVs work about efficiency, range, and affordability. For instance, Toyota launched its second generation Mirai featuring a 650 km range on single hydrogen fill, and Hyundai's NEXO can stretch up to 800 km. In the heavy-duty sector, Nikola Motors and Hyundai announced trucks powered by hydrogen, well-suited for inter-continent travel, offering clean energy to the freight and logistics industries.

Strong government support and innovation in the U.S. market will make it form an important part of the overall hydrogen vehicle landscape worldwide. That is, further refueling infrastructure growth and R&D can readily push the U.S. to be the commercial leader in the adoption of FCVs.

Fuel Cell Vehicle Market Dynamics

Key Drivers:

-

Government policies on zero-emission vehicles drive FCV adoption worldwide.

The world governments are setting up tough policies to popularize zero-emission vehicles, including fuel cell vehicles, in order to reduce climate change. The U.S. government had already pledged more than USD 9.5 billion for hydrogen economy initiatives, mainly establishing a sustainable hydrogen ecosystem, due to the Bipartisan Infrastructure Law. Japan subsidizes the vehicles as much as USD 19,000 and plans to achieve the number of 800,000 in the road by 2030. The regulatory measures toward hydrogen roadside are to not only encourage adoption of FCVs but also to incite the producer to invest in the production of hydrogen vehicles. Government-led incentives, subsidies, and investments are on top of the growth engines in the FCV market: they help hydrogen vehicles become cheaper as well as accessible in costs both to end-users and businesses.

-

Current environment sustainability targets accelerate the adoption of zero-emission vehicles.

Being obligated to reduce carbon emissions, more countries look forward to the adoption of green energy vehicles like FCVs to meet their sustainability objectives. For instance, the European Union has committed to lowering its carbon emissions by 55% from the 1990 level by 2030 under project “Fit for 55”. Cars running on fuel cells are playing an important role in achieving this target. Currently, a car running on hydrogen emits no harmful fumes and only discharges water vapor, making it highly popular for long-term environmental sustainability. Therefore, with increasingly stringent emission standards for sectors such as logistics and public transportation, FCVs are likely to have a front-runner position in the future clean energy transportation sector. On the upswing globally in their quest for decarbonization, it is yet further creating demand for FCVs, especially in markets like Europe and Asia, which are in immediate need of clocking environmentally friendly climate outcomes.

Restrain:

-

Global Hydrogen Refueling Infrastructure Is Lacking.

One of the most significant barriers to increasing fuel cell vehicle demand is the few hydrogen refueling stations available in broad regions. Since FCVs cannot be refueled at home and are less dependent on a still-growing public charging infrastructure compared with BEVs, specific hydrogen refueling stations are generally expensive and challenging to build. According to H2stations.org by Ludwig-Bölkow-Systemtechnik (LBST), as of the end of 2023, there were only 921 hydrogen refueling stations in the world. Most of them are concentrated in regions such as Japan, Germany, California, and China. The implication of this is that consumer confidence is greatly affected because FCV drivers look forward to refueling options for such extensive travels.

Fuel Cell Vehicle Market Segmentation Overview

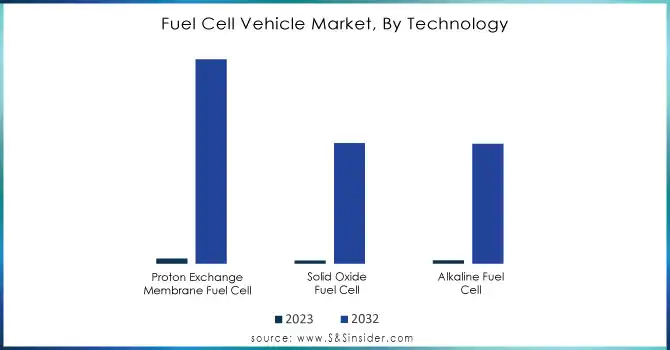

By Technology

In that, in 2023, the market was dominated by Proton Exchange Membrane Fuel Cell (PEMFC) accounting for 44% of market share. Most importantly, this dominance comes from the fact that it has a higher power density and quicker start-up time, together with more efficiency in automotive applications, making it suitable for passenger cars and buses. The temperatures at which PEMFCs operate are relatively low. That enables the refueling to be a lot faster, which becomes an important factor in making the FCVs commercially viable.

Technologically, growth is expected in the PEMFC segment to record a very high CAGR of 52% during the period from 2024 to 2032, owing to its compact, cost-effective, and efficient performance. In contrast, SOFCs and AFCs are gaining acceptance in niche applications such as heavy-duty vehicles and stationary power solutions, despite problems like high working temperatures, lower efficiency, and expensive material requirements.

Need Any Customization Research On Fuel Cell Vehicle Market - Inquiry Now

By Vehicle Type

Of these, in 2023, the SUV segment led by capturing 51% of the market share. The overall global popularity of SUVs also has its effect on requiring larger vehicles, but the target of zero emissions is never compromised, and consumers are opting increasingly for larger, hydrogen-powered utility-type vehicles that offer much more space for long-distance travel with minimal refueling.

Along with this, the SUV segment is expected to grow at the fastest CAGR of 52.65% during the forecast period 2024-2032 due to launches of new hydrogen-powered SUVs, such as Hyundai's NEXO and hydrogen power-based SUVs of Toyota. Compared to other vehicles, the versatility offered by FCVs in the SUV category makes them perfectly applicable for family and commercial usage, leading to their swift adoption in the significant markets of North America, Europe, and Asia.

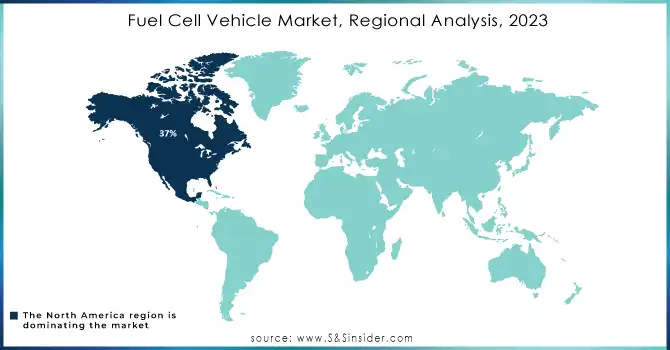

Fuel Cell Vehicle Market Regional Analysis

The regional analysis for 2023 reveals North America as the largest market for Fuel Cell Vehicle (FCV) with 37% market share. This dominance is primarily due to strong governmental support, particularly in the United States, because California is one of the leading markets for hydrogen vehicle sales and infrastructure. Besides, the Bipartisan Infrastructure Law in the United States, specifically focusing on hydrogen fuel infrastructure development, also significantly supported the market.

Europe will be the fastest-growing region in the FCV market, projecting 54.96% CAGR from 2024 to 2032. Countries like Germany, France, and the UK invest heavily in hydrogen infrastructure and are involving the use of hydrogen-powered vehicles in their zero-emission strategies. Europe's goal in reducing carbon emissions, coupled with a commitment to switch to green energy, added momentum to the demand for FCVs, thereby promoting growth in both passenger and commercial use, hence increased market growth in the near future.

Key Players in Fuel Cell Vehicle Market

Some of the major players in the Fuel Cell Vehicle Market are

-

Toyota Motor Corporation (Mirai, FCV buses)

-

Hyundai Motor Company (NEXO, XCIENT Fuel Cell Truck)

-

Honda Motor Co., Ltd. (Clarity FCV, FCV systems)

-

Nikola Corporation (Tre FCEV, Hydrogen Fuel Cell trucks)

-

Ballard Power Systems (Fuel cell stacks, PEMFC systems)

-

Plug Power Inc. (ProGen fuel cells, Electrolyzers)

-

Daimler AG (Mercedes-Benz GLC F-Cell, Hydrogen-powered trucks)

-

BMW Group (iX5 Hydrogen, Hydrogen fuel cell technology)

-

General Motors (Hydrotec, Hydrogen-powered trucks)

-

Audi AG (H-Tron, FCV prototypes)

-

Tata Motors (Hydrogen-powered buses, Fuel cell R&D)

-

Proton Motor Power Systems (Fuel cell engines, Hydrogen solutions)

-

Doosan Fuel Cell (Hydrogen fuel cell solutions, Power generation systems)

-

Cummins Inc. (Hydrogen fuel cells, Hydrogen production technologies)

-

Hyundai Mobis (Hydrogen fuel cell systems, Hydrogen storage)

-

ElringKlinger AG (Fuel cell stacks, Hydrogen storage components)

-

PowerCell Sweden AB (Fuel cell systems, Hydrogen solutions)

-

Intelligent Energy (Fuel cell systems, UAV applications)

-

Bosch (Fuel cell technologies, Hydrogen solutions)

-

Mitsubishi Motors (Hydrogen vehicle R&D, Hydrogen fuel technologies)

Major Suppliers

-

Ballard Power Systems

-

Hydrogenics (Cummins Inc.)

-

Hyundai Mobis

-

Plug Power Inc.

-

Bosch

-

PowerCell Sweden AB

-

ElringKlinger AG

-

Proton Motor Power Systems

-

Doosan Fuel Cell

-

Intelligent Energy

Major Clients

-

Amazon

-

Walmart

-

Volvo Group

-

Mercedes-Benz

-

Volkswagen Group

-

Indian Oil Corporation

-

Skoda Electric

-

Siemens

-

Korea Hydro & Nuclear Power

-

SK E&S

-

Kia Motors

-

JCB

-

Nissan Motor Company

Recent Trends

October 2024: SFC Energy has agreed to purchase several fuel cell assets from Ballard Power Systems Europe's Scandinavian business, BPSE, for an undisclosed amount. H2 View understands that the acquisition will cost at least €1m but not more than €10m, as this will enable SFC to expand its internal power range with two 1.7kW and 5kW PEM hydrogen fuel cell solutions. In addition, the acquisition will include BSPE's customer base, sales pipelines, and maintenance contracts covering around 400 sites in Denmark, Norway, Sweden, and Finland – pending customer consent. It will also receive Ballard employees.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.14 Billion |

| Market Size by 2032 | US$ 57.70 Billion |

| CAGR | CAGR of 51.50 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Proton Exchange Membrane Fuel Cell, Solid Oxide Fuel Cell, Alkaline Fuel cell) • By End User (Commercial Vehicle, Passenger Vehicle) • By Vehicle Type (Sedan, SUV, Others) • By Range (0-250 Miles, 251-500 Miles, Above 500 Miles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., Nikola Corporation, Ballard Power Systems, Plug Power Inc., Daimler AG, BMW Group, General Motors, Audi AG, Tata Motors, Proton Motor Power Systems, Doosan Fuel Cell, Cummins Inc., Hyundai Mobis, ElringKlinger AG, PowerCell Sweden AB, Intelligent Energy, Bosch, Mitsubishi Motors. |

| Key Drivers | • Government policies on zero-emission vehicles drive FCV adoption worldwide. • Current environment sustainability targets accelerate the adoption of zero-emission vehicles. |

| Restraints | • Global Hydrogen Refueling Infrastructure Is Lacking. |