Car Alarm System Market Report Insights:

Get More Information on Car Alarm System Market - Request Sample Report

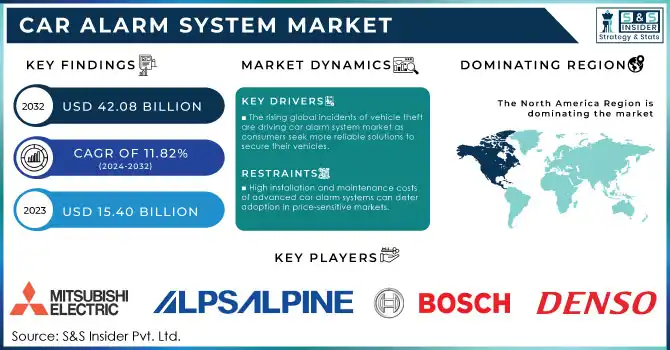

The Car Alarm System Market Size was valued at USD 15.40 Billion in 2023 and is expected to reach USD 42.08 Billion by 2032 and grow at a CAGR of 11.82% over the forecast period 2024-2032.

The car alarm system market has seen significant growth due to increasing concerns over vehicle theft, advancements in automotive technology, and growing demand for enhanced vehicle security. Modern car alarm systems offer more than just a loud sound when triggered; they now integrate features like remote keyless entry, motion sensors, GPS tracking, and smartphone connectivity, making them more sophisticated and efficient. The surge in vehicle thefts worldwide, especially in urban areas, has driven the demand for more advanced alarm systems that offer real-time alerts and location tracking, which help in recovering stolen vehicles faster. One of the key trends in the market is the shift towards the integration of car alarm systems with smart technologies. Many car owners now prefer alarm systems that can be controlled and monitored through mobile apps, allowing them to check their vehicle's security status remotely. Additionally, there is a growing emphasis on the integration of car alarm systems with other vehicle safety technologies like anti-theft immobilizers and driver assistance systems. This convergence of security technologies is making alarm systems more versatile, adding a layer of convenience and safety.

Another notable trend is the rise in aftermarket installations, as more car owners seek to upgrade their existing security systems. With the increasing adoption of electric vehicles (EVs), the market is also witnessing a demand for alarm systems that are compatible with electric car models, which may have different wiring and power management needs. Moreover, advancements in sensor technology, including motion detectors and shock sensors, are making car alarm systems more sensitive and responsive to unauthorized tampering or attempts to break into a vehicle. As vehicle theft continues to be a concern, particularly in emerging markets, car alarm systems are expected to play a crucial role in enhancing security. The growing focus on convenience, customization, and technological integration will further drive the evolution of the market. Overall, the car alarm system market is expected to see steady growth as consumers prioritize vehicle security and convenience.

Car Alarm System Market Dynamics

DRIVERS

-

The rising global incidents of vehicle theft are driving car alarm system market as consumers seek more reliable solutions to secure their vehicles.

Vehicle theft is a significant global issue, with millions of cars stolen each year, leading to substantial financial losses for consumers and insurance companies. This rising threat has become a key driver in the demand for advanced car alarm systems. As incidents of vehicle theft continue to rise, consumers are becoming more concerned about the safety and security of their vehicles, prompting them to invest in sophisticated security systems. The growing incidents of vehicle theft worldwide, especially in urban areas and regions with high crime rates, are pushing consumers to seek more reliable and effective ways to protect their cars. Traditional car alarm systems, while still useful, often fail to deter thieves due to their limited features. As a result, there is a shift toward advanced systems that incorporate features such as GPS tracking, real-time alerts, remote immobilization, and smartphone connectivity.

The demand for these modern car alarm systems is further fueled by the increasing adoption of connected technologies and the Internet of Things (IoT). Consumers are looking for solutions that offer not just sound alerts but also the ability to track their vehicle's location and control alarm systems remotely, making theft prevention more proactive and responsive. With vehicle theft showing no signs of decreasing, the car alarm system market is poised for continued growth. As security technologies evolve, car alarm systems are expected to become even more advanced, helping reduce theft rates and providing consumers with peace of mind. The increasing threat of vehicle theft, coupled with the rise in consumer demand for enhanced security, will drive the market's expansion in the coming years.

RESTRAIN

-

High installation and maintenance costs of advanced car alarm systems can deter adoption in price-sensitive markets.

The high installation and maintenance costs of advanced car alarm systems, particularly those incorporating smart or integrated technologies, present a significant challenge to market growth. Systems featuring GPS tracking, remote access, and mobile app integration often come with premium prices, making them less accessible to price-sensitive consumers. Additionally, the complexity of installation, especially for systems with advanced features, may require professional services, adding to the overall cost. Maintenance costs, including updates, repairs, and replacements of components, further increase the long-term financial burden for vehicle owners. These high upfront and ongoing costs can discourage adoption, particularly in emerging markets where consumers are more focused on affordability. As a result, while demand for advanced car alarm systems is growing, this financial barrier limits market penetration, especially in regions where budget-conscious consumers dominate. Manufacturers may need to offer more affordable, entry-level options or flexible pricing models to overcome this challenge.

Car Alarm System Market Segment Analysis

By Application

The Passenger Car segment dominated with the market share over 62% in 2023. This dominance is largely due to the growing demand for advanced security features in personal vehicles, as car owners seek enhanced protection against theft and unauthorized access. With increasing concerns over vehicle safety, the adoption of car alarm systems has become a priority among consumers. Passenger cars, being the most commonly used vehicles globally, naturally hold a larger share of the market for alarm systems. Furthermore, advancements in alarm technologies, such as GPS tracking, remote notifications, and integration with mobile apps, have made these systems even more appealing to individual car owners.

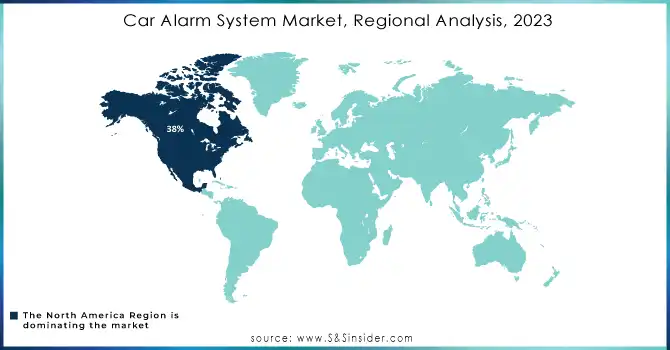

Car Alarm System Market Regional Overview

North America region dominated with the market share over 38% in 2023, largely due to the region's robust automotive sector and heightened consumer awareness about vehicle security. The continuous advancements in car alarm technologies, such as the integration of GPS tracking, remote access, and smart device connectivity, have significantly boosted the market. Furthermore, the increasing adoption of connected car technologies, which allow for enhanced vehicle monitoring and control through mobile apps, has contributed to greater demand for advanced alarm systems. The presence of key players in the automotive and security system industries in North America, along with stringent vehicle safety regulations, has also reinforced the market's growth.

Asia-Pacific is the fastest-growing region in the Car Alarm System Market, driven by several dynamic factors. Rapid urbanization and increasing disposable income in countries such as China and India are significantly boosting automotive sales. As more people can afford vehicles, the demand for enhanced vehicle security systems, including car alarms, is rising. Additionally, the growing number of vehicles on the road has heightened the need for effective protection against theft and vandalism. Technological advancements in car alarm systems, such as the integration of GPS tracking, mobile app connectivity, and advanced sensors, are further propelling this demand.

Need Any Customization Research On Car Alarm System Market - Inquiry Now

Some of the major key players of Car Alarm System Market

-

Mitsubishi Electric Corporation (Car alarm systems, security sensors)

-

ALPS ALPINE CO. LTD (Alarm modules, vehicle safety systems)

-

Robert Bosch GmbH (Car security systems, electronic control units)

-

Denso Corporation (Vehicle security systems, remote keyless entry systems)

-

Stoneridge Inc. (Vehicle alarm systems, telematics)

-

Atech Automotive (Wuhu) Co., Ltd. (Car alarm systems, electronic control modules)

-

Aptiv plc (Security systems, advanced vehicle alarm systems)

-

Tokai Rika Co., Ltd. (Keyless entry systems, car security alarm systems)

-

ALPHA Corporation (Automotive alarm systems, car security solutions)

-

Valeo S.A. KGaA (Vehicle anti-theft systems, car security technology)

-

HELLA GmbH & Co. (Alarm systems, sensor solutions for car security)

-

Marquardt GmbH (Keyless entry, car alarm systems, vehicle control units)

-

I Car Srl (Car alarm systems, remote starters)

-

Huf Hülsbeck & Fürst GmbH & Co. KG (Vehicle access control systems, security modules)

-

Continental AG (Car alarm systems, security modules, remote keyless entry)

-

Directed Inc. (Car alarm systems, remote starters, vehicle tracking systems)

-

Viper (Directed Inc.) (Car alarm systems, remote start systems, vehicle tracking)

-

Smarteye Ltd. (Security cameras, alarm systems)

-

Cobra Electronics Corporation (Car alarm systems, GPS tracking systems)

-

Clarion Co., Ltd. (Car alarm systems, security and multimedia solutions)

Suppliers (Well-regarded for offering advanced car security systems, including remote starters and GPS tracking) Car Alarm System Market

-

Viper (Directed Electronics)

-

Compustar (Firstech)

-

Clifford Electronics

-

Scytek Electronics

-

Python

-

Avital (Directed Electronics)

-

Tadiran Batteries

-

Mongoose

-

OEM Systems (OEM Car Alarms)

-

Omega Research & Development, Inc.

RECENT DEVELOPMENT

-

In September 2023: Mitsubishi Electric announced its FLEXConnect in-cabin system will use BlackBerry IVY, an edge-to-cloud vehicle data platform.

-

In April 2023: Mitsubishi Electric unveiled a contactless Driver Monitoring System (DMS) to detect serious health conditions like loss of consciousness by analyzing biometric data.

-

In October 2023: KOITO MANUFACTURING and DENSO began collaborating to enhance vehicle image sensors' object recognition by integrating lamps and sensors, aiming to improve nighttime driving safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.40 Billion |

| Market Size by 2032 | USD 42.08 Billion |

| CAGR | CAGR of 11.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Central Locking System, Car Alarm, Immobilizer, Remote Keyless Entry, Others) •By Vehicle Type (Passenger Car, Light Commercial Vehicle), By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mitsubishi Electric Corporation, ALPS ALPINE CO. LTD, Robert Bosch GmbH, Denso Corporation, Stoneridge Inc., Atech Automotive (Wuhu) Co., Ltd., Aptiv plc, Tokai Rika Co., Ltd., ALPHA Corporation, Valeo S.A. KGaA, HELLA GmbH & Co., Marquardt GmbH, I Car Srl, Huf Hülsbeck & Fürst GmbH & Co. KG, Continental AG, Directed Inc., Viper (Directed Inc.), Smarteye Ltd., Cobra Electronics Corporation, Clarion Co., Ltd. |

| Key Drivers | •The rising global incidents of vehicle theft are driving demand for advanced car alarm systems as consumers seek more reliable solutions to secure their vehicles. |

| Restraints | • High installation and maintenance costs of advanced car alarm systems, particularly those with smart technologies, can deter adoption in price-sensitive markets. |