Ultrasonic Cleaning Equipment Market Report Scope & Overview:

The Ultrasonic Cleaning Equipment Market size was valued at USD 5.50 Billion in 2023 and is now anticipated to grow to USD 9.71 Billion by 2032, displaying a compound annual growth rate of 6.52% during the forecast Period (2024-2032). The ultrasonic cleaning equipment market report covers the coverage on technology innovations (like advanced ultrasonic technologies), industrial applications, etc. It examines trends in regional utilization to gain insight into the global adoption of ultrasonic cleaning equipment. This report also provides insights into relevant export/import dynamics and key global trade patterns. It explores environmental and sustainability trends such as the growing preference for environmentally-accommodating cleaning products and energy-saving systems.

Get More Information on Ultrasonic Cleaning Equipment Market - Request Sample Report

Market Dynamics:

Drivers

-

Ultrasonic cleaning is gaining momentum across industries like automotive, electronics, medical, aerospace, and manufacturing due to its efficiency in cleaning intricate parts and sensitive equipment.

The ultrasonic cleaning equipment market is experiencing significant growth due to its expanding applications across various industries such as automotive, electronics, medical, aerospace, and manufacturing. Ultrasonic cleaning is also used in the automotive sector for components like engine parts, fuel injectors, and complex geometry parts to enhance performance and service life. In electronics, it is critical to laundering delicate circuit boards and semiconductors, essential to the reliability of the products that host them. Ultrasonic cleaners placed in the medical industry for cleaning surgical tools and such as they offer contamination-free solution as well as efficient in terms of cleaning. In aerospace applications, ultrasonic cleaning is used for the cleaning of sensitive components like visuals and critical parts including turbine blades and sensors. The manufacturing sector, one of the places where small parts are professional cleaned with complex designs, is a key contributor to the market demand. As industries seek efficient, eco-friendly, and precise cleaning solutions, ultrasonic cleaning technology continues to gain traction, driven by advancements in technology, automation, and the growing focus on quality and hygiene.

Restraint

-

The high initial cost and maintenance of ultrasonic cleaning equipment limit its adoption, especially for smaller businesses, despite growing demand in precision-driven industries.

The high initial cost of ultrasonic cleaning equipment, along with ongoing maintenance expenses, remains a significant barrier to market growth, particularly for smaller businesses. Ultrasonic cleaning systems have a higher initial investment than traditional cleaning methods, which makes it a difficult technology for budget-tight companies to adopt. Such costs cover not just the procurement of the equipment but also the installation, calibration, and training of personnel. In addition, regular maintenance activities such as frequent repairs and replacements of components like transducers or tanks contribute to the operational cost as well. However, the market is growing owing to greater demand for high-precision and effective cleaning solutions in the healthcare, electronics and automotive sectors. Technological advancements, including cost savings associated with an energy-efficient model and reduced maintenance needs, are demonstrated as some of the reasons supporting the ultrasonic cleaners market growth as they alleviated cost concerns and made the ultrasonic cleaners for affordable adoption across different sectors, including the emerging markets.

Opportunities

-

The healthcare industry's growth, driven by rising demand for sterile instruments and stricter hygiene standards, fuels the adoption of ultrasonic cleaning equipment for efficient, precise cleaning.

The healthcare industry is experiencing significant growth, driven by the rising demand for clean and sterile surgical instruments, dental tools, and medical devices. Ultrasonic cleaning systems are now a critical part of the process for all the cleaning of these sophisticated and often complicated instruments, as much greater emphasis is placed on patient safety and hygiene standards. The increasing number of surgeries and medical procedures performed worldwide, as well as stricter control on sterilization are driving the demand for advanced cleaning solutions. Furthermore, the growing trend of minimally invasive surgery and increasing employment of smaller, complex devices also enhances the demand for thorough and precise cleaning which is provided by ultrasonic technology. With healthcare facilities prioritizing high-quality and contamination-free tools, ultrasonic cleaning equipment is expected to become increasingly popular over time. Furthermore, innovations in ultrasonic cleaning systems, such as automation and improved energy efficiency, are likely to drive further adoption within the healthcare sector, creating long-term growth opportunities.

Challenges

-

Energy consumption in ultrasonic cleaning systems is a concern for high-volume industries, driving the demand for energy-efficient solutions that reduce costs and environmental impact.

Energy consumption remains a key concern for the Ultrasonic Cleaning Equipment Market, particularly in industries with high-volume cleaning needs. Such systems are power-hungry, consuming the energy needed to produce the ultrasonic waves and applying requisite temperatures, both of which can become costly in the longer run. In these years where sectors such as automotive, aerospace, and electronics industry are progressively adopting ultrasonic cleaning techniques for complex components, the need for energy-efficient systems is on the rise. As a result, manufacturers have started doing R&D to establish more energy-efficient ultrasonic cleaners that consume less power and still deliver high performance. This is coupled with the growing implementation of green technologies as well as sustainability initiatives across various sectors, driving the market towards developments that reduce environmental footprint. It is becoming increasingly popular to integrate energy-saving features like adjustable power settings and smart sensors. These advancements not only help lower energy costs but also align with the growing demand for eco-friendly solutions in industrial operations, ensuring both performance and sustainability.

Market Segmentation:

By Type

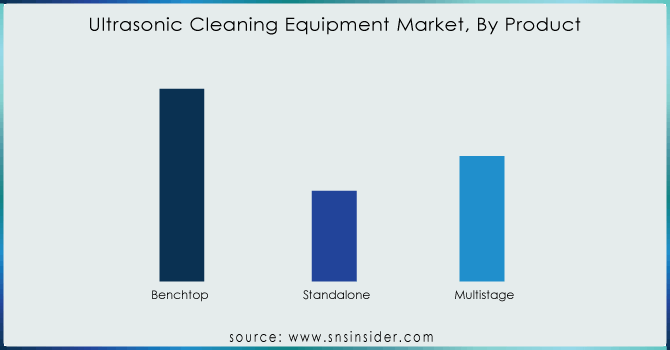

The Benchtop segment dominated with a market share of over 48% in 2023, due to its extensive use across various industries, particularly in laboratories, medical settings, and industrial applications. As a result, ultrasonic cleaners for benchtops are small, low-cost, effective devices that can be used in sensitive environments, such as labs, clinics, and hospitals, to clean tools as well as metal pieces. They have become the preference in these industries because of their capability of supplying high-frequency sound waves that eradicate impurities without harming fragile surfaces. Moreover, their increasing adoption in benchtop models that allow for simple integration into workstations has increased their usage even further.

By Power Output

The 1000–2000 W segment dominated with a market share of over 28% in 2023, due to its versatility and effectiveness across numerous industries. Chamber ultrasonic cleaners above a certain power and frequency are no longer necessary, as they become overkill, and fall outside the low-frequency range useful for gentle and complex items, such as jewelry, dental instruments, surgical devices, industrial components, and scientific samples and in this frequency range, ultrasonic cleaners can clean grease, oil, rust, dust, flux agents, and other contaminants without causing damage. The great success of this segment is also due to its evolution it fits in small applications and big, more intense cleaning jobs alike. Consequently, the 1000–2000 W segment leads the market, providing reliable performance at a competitive cost, and supporting diverse industrial needs.

By Industry

The Healthcare segment dominated with a market share of over 32% in 2023. The healthcare sector demands rigorous sanitation standards for cleaning medical instruments and devices to prevent cross-contamination and ensure patient safety. One factor that makes ultrasonic cleaning systems preferred in healthcare is their ability to clean intricate and delicate equipment with precision, removing dirt, debris, and contaminants efficiently without causing damage. High-frequency sound waves are used by these systems to produce microscopic bubbles that gently scrub the surfaces of instruments, resulting in a higher level of cleanliness than can be achieved through traditional methods. Due to the steadily rising demand for infection control, sterilization, and quality of maintenance of medical tools, ultrasonic cleaning equipment have become essential in the medical field, keeping up to standards of hygiene and standards of safety in hospitals healthcare organizations.

By Frequency Range

The 20-50 kHz segment dominated with a market share of over 34% in 2023. This frequency range is particularly effective for general cleaning tasks across various industries, including automotive, electronics, and jewelry. It achieves a sweet spot between cleaning power and the capacity to accommodate plumage minimal high and low attachment pieces. As for the 20-50 kHz range, it is extremely versatile, capable of cleaning oils, dust and other contaminants from electronic circuit boards and components, as well as larger, tougher objects such as auto parts. This is due to its efficacy and dependability, which is why it is the preferred option for manufacturers and service providers that must maintain excellent cleanliness and precision in many different industrial applications.

Key Regional Analysis:

North America region dominated with a market share of over 38% in 2023, primarily due to its advanced industrial infrastructure and widespread adoption of precision cleaning technologies. It's balancing a presence of the leading manufacturers for innovation/technological advancement. Ultrasonic cleaning equipment is widely used in industries including healthcare, aerospace, automotive, and electronics because of its ability to clear contaminants from fragile components. Moreover, strict regulatory norms regarding cleanliness in medical and manufacturing sectors boost the market growth. Its existing, highly developed research and development ecosystem facilitates the growth of advanced ultrasonic cleaning systems with improved efficiency and energy efficiency. North America is also likely to continue its leadership in this market with high investments across automation and industrial cleaning solutions.

The Asia-Pacific region is experiencing significant growth in the ultrasonic cleaning equipment market, primarily fueled by rapid industrialization and expanding manufacturing activities. The countries which drive the most implementation of ultrasonic cleaning solutions are China, India, and Japan, and the key industries being automotive, healthcare, and electronics. Growing demand for precision cleaning of automotive parts and components along with strict cleanliness requirements from the healthcare sector is further stimulating market growth. Furthermore, growth of advanced cleaning technologies for microelectronics across the electronics industry is another factor fostering the growth of the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players of the Ultrasonic Cleaning Equipment Market:

-

SharperTek (U.S.) – (Ultrasonic Cleaning Systems, Cavitation Ultrasonic Cleaners)

-

Mettler Electronics Corp. (U.S.) – (Ultrasonic Cleaners, Medical Ultrasonic Equipment)

-

L&R Manufacturing (U.S.) – (Quantrex Ultrasonic Cleaners, SweepZone Technology)

-

Elma Schmidbauer GmbH (Germany) – (Elmasonic Ultrasonic Cleaners, Industrial Cleaning Systems)

-

Steelco S.p.A. (Italy) – (Industrial and Medical Ultrasonic Cleaning Equipment)

-

Emerson Electric Co. (U.S.) – (Branson Ultrasonic Cleaners, Industrial Cleaning Solutions)

-

GT Sonic (China) – (Benchtop Ultrasonic Cleaners, Multi-tank Systems)

-

Kemet International Limited (U.K.) – (Ultrasonic Cleaning Systems, Precision Cleaning Solutions)

-

Crest Ultrasonics Corporation (U.S.) – (CPX Series Ultrasonic Cleaners, Industrial Ultrasonic Systems)

-

Ultrasonic LLC (U.S.) – (Ultrasonic Cleaning Machines, Custom Ultrasonic Systems)

-

Blue Wave Ultrasonics (U.S.) – (Aqueous Ultrasonic Cleaners, Precision Cleaning Equipment)

-

Branson Ultrasonics (U.S.) [Subsidiary of Emerson] – (Branson Digital Ultrasonic Cleaners, Industrial Tanks)

-

Kaijo Corporation (Japan) – (Ultrasonic Cleaning Transducers, Semiconductor Cleaning Systems)

-

Skymen Cleaning Equipment Shenzhen Co., Ltd. (China) – (Tabletop Ultrasonic Cleaners, Large Industrial Systems)

-

FinnSonic Oy (Finland) – (Sonic Industrial Ultrasonic Cleaners, Medical & Aerospace Cleaning Equipment)

-

Mecasonic (France) – (Ultrasonic Cleaning Systems, Welding & Bonding Solutions)

-

Sonixtek (Canada) – (Portable Ultrasonic Cleaners, High-Precision Cleaning Equipment)

-

Ultrawave Ltd. (U.K.) – (Industrial & Laboratory Ultrasonic Cleaning Machines)

-

Anmasi A/S (Denmark) – (Automated Ultrasonic Cleaning Systems, Customized Solutions)

-

Telsonic AG (Switzerland) – (Ultrasonic Cleaning Transducers, Metal Cleaning Systems)

Suppliers for (ultrasonic cleaning machines and vapor degreasing systems) in Ultrasonic Cleaning Equipment Market

-

Supersonics India

-

Mak Technosys

-

IMECO Ultrasonic Cleaning Machine Manufacturer

-

Sonicor

-

Leela Electronics

-

Crest Ultrasonics India Pvt. Ltd.

-

Nuristaa Pvt. Ltd.

-

ActOn Finishing India

-

Samarth Electronics

-

Ecoclean India

Recent Development:

-

In August 2023: Emerson Electric Co. acquired Sonics & Materials to enhance its market position and expand its offerings in industrial cleaning applications.

-

In May 2024: Sodexo Group began incorporating ultrasonic cleaning equipment into its healthcare and hospitality service contracts. Emphasizing sustainability, the company is collaborating with cleaning solution providers to develop eco-friendly cleaning agents tailored for ultrasonic cleaning.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 5.50 Billion |

|

Market Size by 2032 |

USD 9.71 Billion |

|

CAGR |

CAGR of 6.52% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Benchtop, Standalone, Multistage) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

SharperTek, Mettler Electronics Corp., L&R Manufacturing, Elma Schmidbauer GmbH, Steelco S.p.A., Emerson Electric Co., GT Sonic, Kemet International Limited, Crest Ultrasonics Corporation, Ultrasonic LLC, Blue Wave Ultrasonics, Branson Ultrasonics, Kaijo Corporation, Skymen Cleaning Equipment Shenzhen Co., Ltd., FinnSonic Oy, Mecasonic, Sonixtek, Ultrawave Ltd., Anmasi A/S, Telsonic AG. |