Soil Testing Equipment Market Report Scope & Overview:

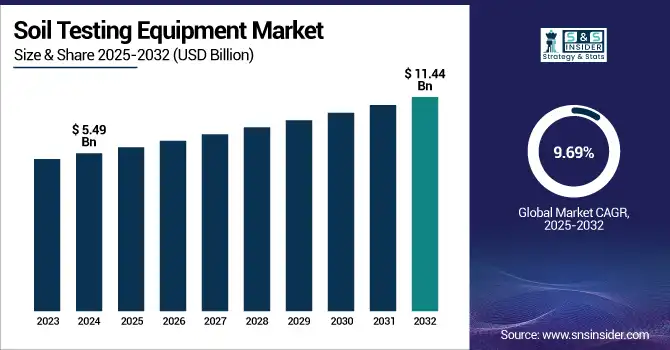

The Soil Testing Equipment Market size was valued at USD 5.49 billion in 2024 and is expected to reach USD 11.44 billion by 2032, growing at a CAGR of 9.69% over the forecast period of 2025-2032. The soil testing equipment market growth is driven by increasing demand for precision agriculture, rapid urbanization, and the rising requirement for geotechnical analysis in infrastructure development. The market is being driven by the increasing automation about technology in the market. Moreover, the expansion of the market is fuelled by the larger focus of the government on the quality of soil, along with rising knowledge among construction companies and farmers. This study provides a comprehensive soil testing equipment market analysis, providing the scope with the number of opportunities at stake and also the regional dynamics that are forming the backbone of this developmental sector.

To Get more information on Soil Testing Equipment Market - Request Free Sample Report

For instance, in March 2025, AgriTech company CropX Technologies announced the launch of its next-generation soil sensor and analytics platform designed for precision agriculture.

The U.S. Soil Testing Equipment Market size was valued at USD 1.12 billion in 2024 and is expected to reach USD 2.53 billion by 2032, growing at a CAGR of 10.83% over the forecast period of 2025-2032.

An increase in infrastructure projects and a growing emphasis on sustainability-driven farming practices, fosters the U.S. soil testing equipment market. Increasing adoption of advanced technologies by soil testing equipment companies is enhancing the testing accuracy and efficiency. Enhanced demand is also driven by measures undertaken by governments to stimulate compliance with environmental requirements, which is in line with significant soil testing equipment market trends in the agriculture and building industries.

Soil Testing Equipment Market Dynamics:

Drivers:

-

Rising Adoption of Smart Agricultural Practices and Precision Farming Techniques Drives the Growth of the Soil Testing Equipment Market

Smart agriculture practices and precision farming techniques is playing a significant role in increasing the demand for advanced soil testing technologies owing to the rising focus on precision agriculture in the U.S. and other developed regions. To obtain the most accurate analysis of the Earth, farmers have started using data along with fertilizers, pesticides, seeds, and other farming materials to maximize productivity while minimizing wastage. Changing trends of soil analysis and contamination in soil, coupled with the need to analyse nutrient levels and soil composition, are creating demand for portable, flexible, and efficient soil analysis. There is a demand for portable soil testing devices and efficient soil test instruments that meet these needs, which are being invested in. The trend is bolstered further by the government’s policies that promote sustainable agriculture and climate-smart endeavors. The trend toward intelligent agriculture is also having an overall impact on other equipment sectors, such as the floor grinding tools market due to corresponding requirements for innovation and efficiency.

In March 2024, John Deere entered into a partnership with Agilent Technologies to merge soil nutrient analysis tools with the company's precision agriculture platform. The joint effort strives to provide on-site soil health assessment through portable testing apparatuses, which will allow farmers all over the U.S. to make informed decisions regarding fertilization and irrigation.”

-

Increasing Construction Activities and Infrastructure Development Projects Fuel Demand for Soil Testing Equipment Globally

In construction, soil testing is a must to ensure that buildings, bridges, and highways are built safely and sturdily. Given the surge in infrastructure projects globally, especially in emerging economies, the need for accurate soil testing tools has become acute. These tools are used in the construction industry to help evaluate the bearing capacity of soil, its compaction, and its level of contamination. Well-advanced testing methods decrease the possibility of structural failures and delays in the project. This demand indirectly indicates the trend of adoption in its surrounding industries including concrete polishing and grinding machines, which are also witnessing significant adoption on account of growing construction activity and demand for high-performance surface preparation equipment.

Restraints:

-

High Initial Investment and Equipment Costs Limit the Adoption of Soil Testing Solutions in Small and Medium Enterprises

Soil testing equipment is essential for agricultural and construction applications, but remains a barrier due to high capital expenses, especially for small-scale businesses and farmers. Well-designed systems that incorporate automation, real-time analytics, and digital connectivity technologies can carry a prohibitive price tag. Then there is the expense of maintenance and trained professionals to run them. This limitation prevents a more widespread adoption in lower-cost economies or with users with low capital. This is a challenge which, in turn, is recurring in several markets, such as the floor polishing machine segment, wherein the cost of equipment hinders penetration among small contractors even as the domestic floor grinding machine market size racks up industrial demand.

Soil Testing Equipment Market Segmentation Outlook:

By Test Type

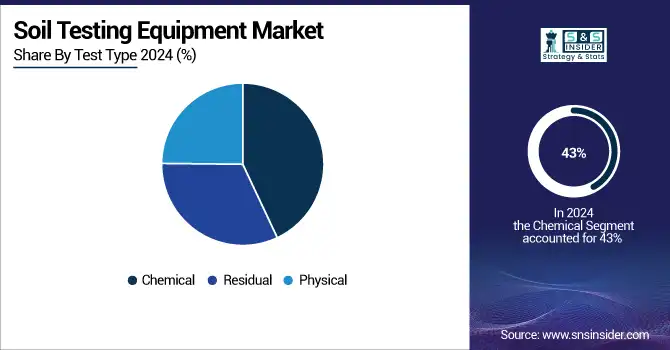

The chemical sector held the largest share of the soil testing equipment market, which was about 43%, and accounted for the greatest revenue share of the soil testing equipment market in 2024, as it is essential to decide the nutrient levels, pH balance, and contamination in soil. This segment is primarily used for the prediction of soil condition in agriculture and environmental science, as it provides accurate data necessary for effective management of soil. This organic material detection, and the ability of chemical residues and pollutants, also detects infertility, which provides the demand for the market to act in compliance with the standards set by regulatory authorities, and based on this, it increases market demand.

In February 2024, Eurofins Scientific, a global leader in testing services, announced the expansion of its soil chemistry testing capabilities across Europe and North America.

The residual segment is predicted to be the fastest-growing in terms of CAGR of over 10.90% during 2025–2032, due to the growing concern regarding the presence of pesticide, herbicide, and heavy metal residuals in soil. These reasons continue this growth due to growing scrutiny over regulations, high consumer awareness of food safety, and demand for clean agriculture. Improvements in detection technologies and portability of analyzers also allow for more accessible and rapid residual testing for a broader range of applications.

By Degree of Automation

The semi-automatic segment accounted for the maximum revenue share of 37%, making it the most lucrative sub-segment owing to its cost-effectiveness, operators' preferences, and operational convenience. The system provides improved throughput over manual systems and can sit in the middle ground where no significant capital is required for high-budget and fully automated equipment. It is also the practical solution of choice in many regions, especially in developing and transitional economies, due to the demand in mid-sized laboratories and institutions for a consistently performing, low complexity instrument.

The automatic segment is anticipated to grow at the highest CAGR over 2025-2032, due to the rising demand for high-throughput and error-free testing across commercial farms and research institutes operating at a large scale. It lowers reliance on humans, increases the accuracy of results, and provides integration with underlying data systems for live actions. The innovation of precision farming technologies leads to a higher demand for soil testing systems that provide the quality of soil test needed and save time, ultimately, it attracts commercial growers and soil testing facilities as well.

By Site

The laboratory segment accounted for the largest revenue share in 2024 and is further anticipated to hold its dominance over the forecast period as it provides high accuracy and detailed analysis. Labs, particularly ones with advanced instruments, can do a variety of soil tests, all under regulated environments. Such facilities enable large-scale agricultural testing, environmental monitoring, and research activities in more controlled and potentially more precise conditions compared to field or pilot site systems, which can be subjected to fluctuating conditions. Demand from regulations for standardized and validated results also drives the preference for laboratory-based testing services.

The on-site segment is anticipated to grow at a lucrative rate during 2025-2032. Farmers and construction engineers are demanding portable testing kits that will give them prompt feedback to make the right move at the right time. Greater diversity within this trend is driven by technology improvements in more compact and cheaper digital testing devices, and a growing global acceptance of precision agriculture. On-site solutions minimize the time and costs associated with transporting samples to a lab for analysis, and thus improve operational efficiency.

By End-Use

The agriculture segment accounted for the highest revenue share of 47% in 2024 due to the high adoption of precision farming practices. Accurate soil data is crucial for farmers in order to balance nutrients, optimize yield, and maintain soil health. Investment in soil testing equipment is also driven by an increase in government support towards sustainable agriculture and increasing food demand globally. The segment is benefiting with high level of consciousness among farmers exists about the economic benefits and environmental significance of soil testing.

The construction segment will grow with the highest CAGR over 2025–2032. Soil testing is an essential process in the construction industry as it determines the characteristics as well as the qualities of the soil to be built on for suitability, safety, and structural integrity and is made mandatory by various regulation norms. Ironically, the rising need can be observed in urban projects, roadworks, and commercial properties that heavily rely on soil composition and stability to determine site for groundwork design and construction scheduling.

Soil Testing Equipment Market Regional Analysis:

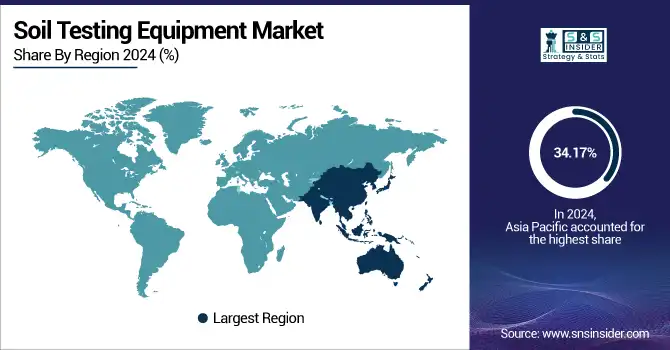

In 2024, Asia Pacific held the largest market share for soil testing equipment, contributing approximately 34.17% of the revenue owing to a burgeoning agricultural base, a growing population, and aforementioned government initiatives focused on managing soil health in the region. Growing demand for reliable soil testing solutions is also being driven by countries, such as China and India, where the agriculture industry is investing heavily in modernizing farming practices. The region also boasts rapid urbanization and infrastructure development that demands the entire land to be under geotechnical soil analysis, thereby quickening the adoption of soil testing equipment for both agriculture and construction applications alike.

North America is estimated to experience the fastest growth over 2025–2032, at around 10% CAGR, owing to the rising adoption of precision agriculture techniques, coupled with growing awareness toward sustainable agriculture practices. Farmers and agribusiness, particularly in the U.S. are seeking automated and portable soil testing equipment. Moreover, environmental legislation and the increasing drive toward climate-smart investments are creating the demand for reliable and frequent soil measurements.

A major factor pushing the European soil testing equipment market is the stringent environmental regulations and sustainable agricultural initiatives. Due to advanced farming technologies and sophisticated infrastructure, Germany spearheads the region. Certain inventions, such as soil analysers using AI, offer faster and more accurate soil analysis data processing, making it an important invention that enable real-time data analysis, assists in precision farming, and also helps accelerate the adoption of precision agriculture in commercial agricultural enterprises.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Soil Testing Equipment Market are:

The key players operating in the market are Humboldt Mfg. Co., Sun Labtek Equipments Pvt. Ltd., S.W. Cole, Agilent Technologies, Martin Lishman Ltd., LaMotte Company, Ele International Controls S.p.A, Merck Group, Geotechnical Testing Equipment UK Ltd., and PerkinElmer Inc.

Recent Developments:

-

February 2024 - Humboldt announced an upgrade to its HM-5030 Tri-Flex Materials Testing Machine, which now includes advanced software for more precise soil compaction and CBR testing.

-

January 2024 - Sun Labtek Equipments Pvt. Ltd. company introduced a modular soil testing kit aimed at educational institutions, with enhanced digital sensors and real-time data output for better training.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.49 Billion |

| Market Size by 2032 | USD 11.44 Billion |

| CAGR | CAGR of 9.69% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Physical, Residual, Chemical) • By Degree of Automation (Manual, Semi-Automatic, Automatic) • By Site (Laboratory, On-Site) • By End Use (Agriculture, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Humboldt Mfg. Co., Sun Labtek Equipments Pvt. Ltd., S.W. Cole, Agilent Technologies, Martin Lishman Ltd., LaMotte Company, Ele International Controls S.p.A, Merck Group, Geotechnical Testing Equipment UK Ltd., PerkinElmer Inc. |