Blast Furnace Market Report Scope & Overview:

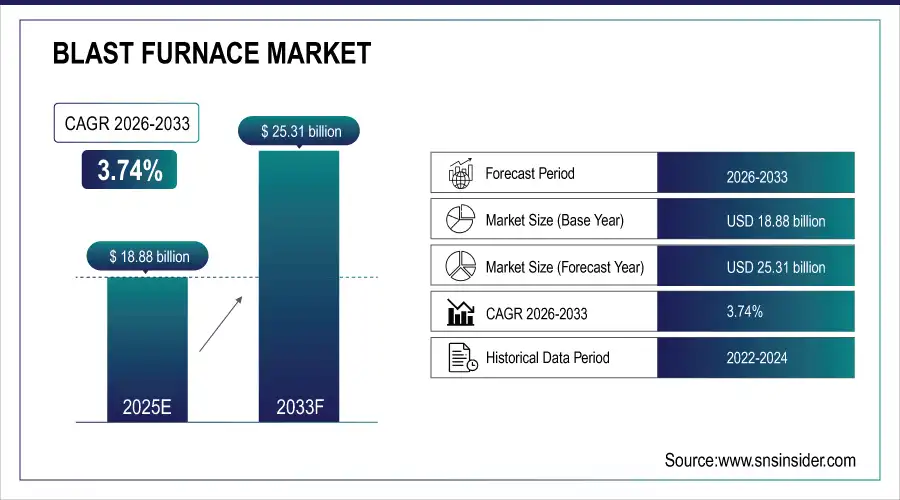

The Blast Furnace Market size was valued at USD 18.88 Billion in 2025E and is expected to reach USD 25.31 Billion by 2033, growing at a CAGR of 3.74% over the forecast period 2026–2033.

The market is witnessing strong demand driven by steelmaking needs, efficiency upgrades, and environmental compliance. Advanced furnace designs, energy recovery systems, and flexible operations are driving adoption. The Blast Furnace Market is being transformed by modernization efforts, digital integration, and stricter global carbon regulations, pushing manufacturers toward sustainability-driven production and higher output efficiency.

Blast Furnace Market Size and Forecast:

-

Market Size in 2025E: USD 18.88 Billion

-

Market Size by 2033: USD 25.31 Billion

-

CAGR: 3.74% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Blast Furnace Market - Request Free Sample Report

Key Blast Furnace Market Trends:

-

Growing adoption of energy-efficient blast furnace designs is reducing fuel consumption and lowering emissions.

-

Rising demand for low-carbon steel is pushing integrated steelmakers toward greener furnace technologies.

-

Digitalization, AI, and IoT integration enhance furnace monitoring, predictive maintenance, and output reliability.

-

Expansion of urban infrastructure projects drives global steel demand, fueling furnace installations.

-

Circular economy initiatives are encouraging the use of recycled iron ore and slag by-products.

-

Government pressure on carbon intensity is accelerating investments in sustainable blast furnace upgrades.

U.S. Blast Furnace Market Insights:

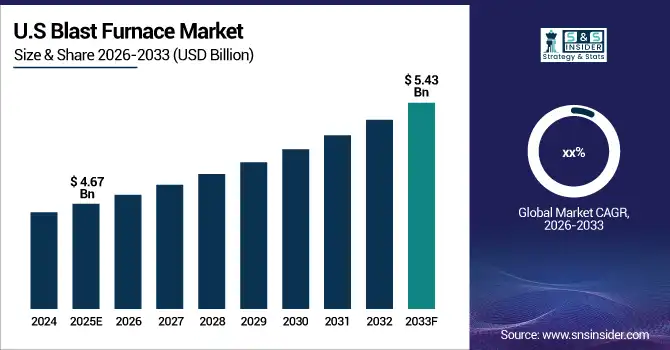

The U.S. Blast Furnace Market size was USD 4.67 Billion in 2025E and is expected to reach USD 5.43 Billion by 2033. According to a study, rising infrastructure spending and industrial steel demand are driving higher blast furnace utilization, particularly in construction and automotive sectors. This cause, increasing investment in metallurgical capacity, effects modernization of U.S. furnace fleets, reducing downtime by ~20%. Advanced sensors and AI-based automation support operational efficiency and sustainability compliance.

Blast Furnace Market Drivers:

-

Growing Adoption of Green Steel Initiatives Accelerates Blast Furnace Market Modernization.

The global shift toward low-carbon and environmentally sustainable production is emerging as a major driver for the Blast Furnace Market. Steelmakers are increasingly adopting carbon capture systems, hydrogen-based reduction methods, and advanced heat recovery technologies. This cause, mounting carbon emission regulations, effects higher investments in energy-efficient blast furnaces worldwide. With nations implementing net-zero initiatives, demand for eco-friendly steelmaking processes is creating a surge in modernization projects. Integrating AI and IoT technologies into furnaces further improves operational precision, safety, and lifecycle efficiency, aligning steel manufacturing with global climate commitments.

In May 2025, a major Japanese steel company upgraded its blast furnaces with hydrogen injection technologies, achieving a 30% reduction in CO₂ emissions while maintaining production volumes for automotive-grade steel.

Blast Furnace Market Restraints:

- High Operational and Maintenance Costs Limit Blast Furnace Market Expansion.

Despite their industrial importance, blast furnaces require massive capital investments, high maintenance, and uninterrupted raw material supply. This cause, heavy cost burden and resource dependency, effects slower adoption among small and mid-tier players. Energy expenses account for nearly 40% of blast furnace operations, forcing operators to balance efficiency with costs. Any disruption in iron ore and coking coal supply causes significant operational risks. Additionally, extended downtime during relining and refurbishment can last several months, impacting revenue streams. These financial and operational burdens are a major restraint in market scalability across emerging economies.

In 2024, several mid-sized furnaces in Latin America reported shutting operations temporarily due to soaring coke costs, causing a 15% regional decline in annual output despite rising steel demand.

Blast Furnace Market Opportunities:

-

Integration of AI-Based Predictive Analytics and IoT Connectivity Creates New Growth Opportunities.

A key opportunity is the integration of digital technologies with blast furnace operations. This cause, Industry 4.0 adoption, effects enhanced process visibility, predictive maintenance, and optimized fuel consumption. AI-driven models can identify heat loss, slag chemistry variations, and potential failures well before breakdowns. IoT sensors enable real-time data-driven decision-making, improving furnace efficiency by up to 18%. Cloud-based analytics platforms further allow remote operations monitoring, reducing downtime and improving lifecycle costs. These developments make digital integration a breakthrough opportunity in furnace modernization.

In June 2025, a European steel giant launched an AI-enabled blast furnace monitoring solution powered by cloud data systems, which improved energy efficiency by 15% and reduced unplanned downtime.

Blast Furnace Market Segmentation Analysis:

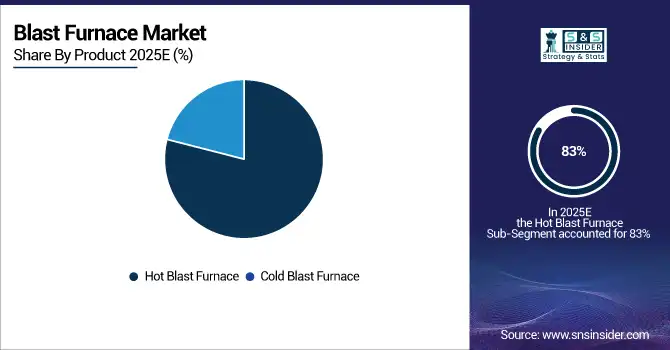

By Product, Hot Blast Furnaces Dominate Market While Cold Blast Furnaces Grow Fastest.

Hot blast furnaces lead the market with an estimated 83% revenue share in 2025E, driven by their high efficiency in large-scale steel production. This causes reliance on pre-heated air, which effects greater fuel economy and improved melting rates, supporting continuous, high-volume output. Technological upgrades in air preheaters, regenerative systems, and energy recovery further strengthen the dominance of hot blast furnaces in integrated steel mills worldwide.

Cold blast furnaces are the fastest-growing segment, projected to expand at a 7.16% CAGR, supported by niche adoption in non-ferrous smelting and smaller, localized operations. This causes demand from small-scale mills and regions with limited infrastructure, which effects broader utilization of simpler, low-cost furnace technologies. As industrial diversification and regional steel or metal production needs increase, cold blast furnaces are gaining traction in specialized markets and developing economies.

By Application, Steel Production Leads While Non-Ferrous Metal Production Grows Fastest.

The steel production application dominates with an estimated 64% market share in 2025E, driven by urbanization, infrastructure development, and rising demand for automotive-grade steel. This causes growing industrial expansion, which effects higher reliance on large integrated blast furnaces, reinforcing the segment’s dominance. Continuous high-volume production, combined with energy efficiency and emission-reduction initiatives, ensures that steelmaking remains the primary application for blast furnace operations globally.

Non-ferrous metal production is the fastest-growing application, expected to expand at a 10.33% CAGR, supported by rising demand for copper, aluminum, and other metals. This causes increased adoption of blast furnaces in smelting operations, which effects broader utilization beyond traditional steelmaking. Growth in non-ferrous and ferroalloy industries, coupled with technological advancements in low-carbon furnace designs, drives the diversification of blast furnace applications across emerging industrial and specialty metal markets.

By Process, Continuous Furnaces Lead While Batch Furnaces Grow Fastest.

The continuous process dominates with an estimated 73% market share in 2025E, driven by its high reliability and efficiency in industrial-scale steel production. This causes strong demand for uninterrupted 24/7 steel output, which effects widespread adoption of continuous furnaces in integrated steel plants. Their ability to maintain consistent temperature, reduce downtime, and support large-volume operations makes them essential for meeting global demand in construction, automotive, and infrastructure applications.

Batch furnaces are witnessing steady growth, supported by the expansion of niche and specialized operations. This causes increased demand for flexibility and smaller melting runs, which effects broader adoption among small-scale foundries producing specialty alloys and tailored steel grades. Their capacity to handle variable production requirements and allow precise control over steel composition makes batch furnaces a preferred choice for custom applications and markets with lower-volume or highly specialized steel needs.

By Capacity, Large Furnaces Lead While Medium Furnaces Grow Fastest.

Large furnaces are estimated to hold a 55% market share in 2025E, as they support large-scale integrated steel mills requiring continuous, high-volume production. This causes economies of scale, which effect the dominance of large furnaces in meeting global industrial-grade steel demand. Their ability to efficiently process significant raw material volumes while maintaining operational stability makes them the preferred choice for major construction, automotive, and infrastructure-related steel production worldwide.

Medium furnaces are the fastest-growing segment, driven by mid-sized steel plants across Asia and Africa. This causes industrial regionalization, which effects increased reliance on medium furnaces for flexible and cost-effective capacity expansion. Their adaptability allows producers to scale output according to regional demand while minimizing energy consumption and investment costs. As emerging markets expand, medium furnaces play a critical role in meeting localized industrial steel needs without requiring large-scale integrated facilities.

By End-User, Construction Leads While Automotive Grows Fastest.

The construction segment accounts for an estimated 42% of revenue share in 2025E, driven by large-scale steel consumption across residential housing, bridges, rail networks, and infrastructure projects. This causes sustained demand for blast furnace steel as global urbanization continues to expand, requiring reliable, high-volume steel supply. Rapid development in emerging economies and ongoing infrastructure renewal in developed nations further reinforces the need for robust, energy-efficient blast furnace operations to meet construction industry requirements.

The automotive segment is the fastest-growing in 2025E, supported by rising demand for lightweight, high-strength steel used in passenger vehicles, commercial trucks, and electric vehicles (EVs). This causes blast furnace operations to accelerate production tailored for automotive-grade steel, as vehicle safety standards and emission reduction goals drive innovation. Adoption of EVs and advanced automotive materials further fuels furnace modernization and low-carbon steel production to meet the evolving needs of the global automotive industry.

Blast Furnace Steel Market Regional Analysis:

North America Dominates Blast Furnace Steel Market in 2025E

North America holds an estimated 35% market share in 2025E, driven by large-scale infrastructure projects, advanced furnace modernization, and federal decarbonization initiatives. This causes steel producers to adopt eco-friendly blast furnace technologies, improve operational efficiency, and reduce emissions, thereby sustaining steady market growth across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

United States Leads North America’s Blast Furnace Steel Market

The U.S. dominates due to its extensive steelmaking capacity, rapid infrastructure renewal, and government-backed carbon neutrality programs. Federal funding and private investments in hydrogen-ready furnaces and carbon capture solutions increase low-emission steel production. Advanced industrial infrastructure, R&D support, and strict environmental regulations ensure high operational efficiency and reinforce the U.S. as the largest contributor to North America’s blast furnace market leadership.

Asia Pacific is the Fastest-Growing Region in Blast Furnace Steel Market in 2025E

The region is expected to grow at a CAGR of 7.85%, driven by rapid urbanization, industrial expansion, and rising steel intensity. This causes producers to adopt modernized, low-carbon blast furnaces, increase output for construction and automotive sectors, and improve overall operational efficiency.

-

China Leads Asia Pacific’s Blast Furnace Steel Market

China dominates the Asia Pacific market due to its massive steelmaking capacity, large-scale furnace modernization, and government-backed carbon neutrality programs. Investments in hydrogen-based technologies and digital monitoring systems reduce emissions while sustaining high-volume production. Rapid infrastructure development and strong demand from construction and automotive industries further boost steel output. Strategic adoption of low-carbon processes and green steel technologies ensures China drives regional market growth and maintains global leadership.

Europe Blast Furnace Steel Market Insights, 2025E

Europe maintains a steady market trajectory in 2025, supported by EU carbon neutrality mandates, circular economy policies, and green steel initiatives. This causes producers to innovate in hydrogen-based blast furnaces, implement emission-reduction solutions, and optimize energy efficiency, maintaining stable growth in the regional market.

-

Germany Leads Europe’s Blast Furnace Steel Market

Germany dominates due to its leadership in hydrogen-based blast furnace trials, strong automotive steel demand, and commitment to emission reduction. Advanced industrial infrastructure and high R&D investment enable German steelmakers to adopt sustainable technologies efficiently, reinforcing Germany’s position as Europe’s leading blast furnace operator.

Middle East & Africa and Latin America Blast Furnace Steel Market Insights, 2025E

The Blast Furnace Market in these regions is expanding steadily, supported by growing industrial modernization, infrastructure projects, and construction demand. In MEA, the UAE leads by adopting advanced, energy-efficient furnace designs aligned with national development programs. In Latin America, Brazil dominates due to integrated steel mills and high demand from construction and automotive sectors. Investments in resource optimization and modernization further enhance operational efficiency, ensuring consistent contributions to the global blast furnace steel market across both regions.

Competitive Landscape for the Global Blast Furnace Steel Market:

ArcelorMittal

ArcelorMittal is the world’s largest steelmaker, with an extensive network of blast furnace operations across Europe, the Americas, and Asia. The company integrates advanced carbon capture technologies and energy recovery systems into its production facilities, reducing emissions while sustaining high-volume steel output. ArcelorMittal plays a pivotal role in the global steel market, pioneering low-carbon innovations and ensuring a reliable steel supply chain.

-

In May 2025, ArcelorMittal launched a hydrogen-based blast furnace pilot in France, achieving notable efficiency gains in low-emission steel production.

Nippon Steel Corporation

Nippon Steel, Japan’s largest steel manufacturer, is recognized for its innovative furnace upgrades aligned with national carbon reduction policies. The company emphasizes hydrogen injection technologies and advanced automation to maximize energy efficiency across its operations. Its role in the market is significant, advancing Japan’s green steel transition while maintaining global competitiveness.

-

In April 2025, Nippon Steel began commercial-scale tests of hydrogen-based blast furnace operations in collaboration with Japan’s Green Innovation Fund.

Tata Steel Limited

Tata Steel is one of India’s leading steel producers, operating a robust blast furnace fleet across Asia and Europe. The company invests heavily in digital twin technologies and smart furnace monitoring systems to optimize operational efficiency and minimize downtime. Tata Steel strengthens the global steel market by driving digital transformation and operational resilience.

-

In February 2025, Tata Steel deployed AI-driven monitoring systems across its Jamshedpur blast furnaces, reducing downtime by 15%.

POSCO

POSCO, headquartered in South Korea, operates one of the world’s most advanced steelmaking facilities, with blast furnaces optimized for energy recovery and sustainability. The company focuses on furnace redesigns and predictive digital solutions that align with global low-carbon steel demand. POSCO’s role is central to advancing smart, sustainable steel production.

-

In March 2025, POSCO introduced an AI-predictive maintenance system across its Pohang blast furnaces, significantly improving fuel efficiency.

Blast Furnace Market Key Players:

-

ArcelorMittal

-

Nippon Steel Corporation

-

Tata Steel Limited

-

POSCO

-

China Baowu Steel Group Corporation Limited

-

JFE Steel Corporation

-

Thyssenkrupp AG

-

United States Steel Corporation

-

Nucor Corporation

-

Hyundai Steel Company

-

Gerdau S.A.

-

Severstal

-

JSW Steel Ltd.

-

Ansteel Group Corporation Limited

-

Shougang Group

-

Evraz Group S.A.

-

Hebei Iron and Steel Group Co., Ltd.

-

Voestalpine AG

-

SAIL (Steel Authority of India Limited)

-

Benxi Steel Group Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 18.88 Billion |

| Market Size by 2032 | US$ 25.31 Billion |

| CAGR | CAGR of 3.74 % From 2025 to 2032 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Hot Blast Furnace, Cold Blast Furnace) • By Application (Steel Production, Iron Production, Non-Ferrous Metal Production, Others) • By Process (Continuous, Batch) • By Capacity (Small, Medium, Large) • By End-User (Metallurgy, Construction, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ArcelorMittal, Nippon Steel Corporation, Tata Steel Limited, POSCO, China Baowu Steel Group Corporation Limited, JFE Steel Corporation, Thyssenkrupp AG, United States Steel Corporation, Nucor Corporation, Hyundai Steel Company, Gerdau S.A., Severstal, JSW Steel Ltd., Ansteel Group Corporation Limited, Shougang Group, Evraz Group S.A., Hebei Iron and Steel Group Co., Ltd., Voestalpine AG, SAIL (Steel Authority of India Limited), Benxi Steel Group Corporation. |