Ultrasonic Sensor Market Report Scope & Overview:

Get more information on Ultrasonic Sensor Market - Request Sample Report

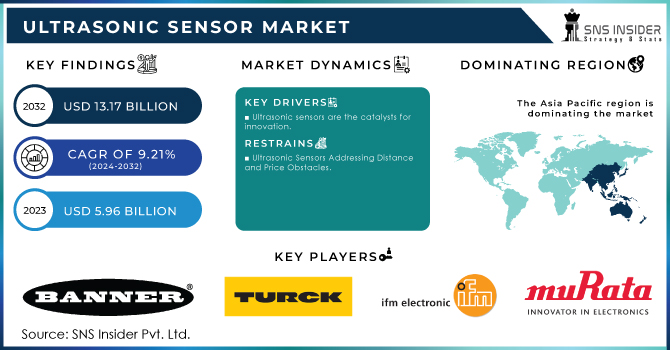

Ultrasonic Sensor Market size was valued at USD 5.96 billion in 2023 and is expected to grow to USD 13.17 billion by 2032 and grow at a CAGR of 9.21% over the forecast period of 2024-2032.

There is a major growth opportunity for ultrasonic sensor technology. Increased AMR adoption for logistics and manufacturing results in the strong growth of the Autonomous Mobile Robots market. The demand for safe, efficient, and cost-effective navigation solutions drives further development of the given field. Because Sonair’s ADAR system offers precise 3D spatial data at a lower cost and power usage, the product has a perspective of utilizing these trends. The AMR market is also expected to grow by 30% yearly, and the demand for ultrasonic sensors should increase accordingly. Since in AMR ultrasonic sensors are used to navigate and detect obstacles in warehouses and smart factories. The given market is promising due to the cost, power efficiency, and compact size advantages of this technology. They may be used for a variety of applications in different AMRs, which should foster growth in the ultrasonic sensor market. Lastly, another app showcases the potential for ultrasonic sensors in the medical industry. The ultrasound navigation solution for needle insertions illustrates how advancements may transform minimally invasive procedures. A temporary accessory is proposed, which offers real-time anatomical imaging and tracking of instruments. The uses of ultrasonic technology are many, and these examples demonstrate that it has the potential to drive growth in multiple industries.

A main driver for the ultrasonic sensor industry is the increased use of ADAS. The systems are designed to enhance road safety and driving pleasure and rely heavily on ultrasonic sensors to detect nearby objects, obstacles, and help with parking. The proposed V2V communication system focuses on improving overtaking safety and detecting over speed, which is also a good fit. The auto industry is rushing to develop self-transforming technology, which means the need for strong and reliable sensors is quickly growing. Furthermore, due to their affordability, precision, and low energy usage, ultrasonic sensors have become indispensable parts of ADAS.

Market Dynamics

Drivers

-

Ultrasonic sensors are the catalysts for innovation.

The continuous need for the automobile industry to install advanced driver assistance systems (ADAS) and autonomous driving is a key factor for the growing market. Ultrasonic sensors with their accuracy, speed, and cost are indispensable for object detection, parking helping, and blind-spot monitoring. Moreover, the automation and robotics market is becoming a critical sector for the ultrasonic sensor market. Robots and autonomous vehicles require these sensors to travel through even the most complex environments with utmost precision. In addition to these, the healthcare industry is increasingly using ultrasonic technology for various purposes, like non-invasive diagnosis and treatment. The greatest advantage of these sensors is that one can immediately visualize the inner organs and tissues. The ultrasonic sensor market has a robust future since it is supported by fast-growing sectors and the advantages of the sensor. Ultrasonic sensors are one of the closely related devices to which the development of automotive technology leads. The precise distance measurement characteristic and the object detection ability are becoming indispensable for parking assist systems, collision avoidance, and object detection systems of cars. The need for range-doubling ultrasonic sensors is provoked by the prospective rise in self-driving technology in the automotive industry. Long-range radar sensors, such as ultrasonic sensors, prompted a rise in road safety; they provide functions for automotive vehicles such as adaptive control and handling of cruise systems and emergency braking.

-

Ultrasonic sensors are driving forward the progression of automotive technology.

Ultrasonic sensors are now essential in the automotive industry, supporting the advancement of ADAS and self-driving cars. Ultrasonic sensors are one of the closely related devices to which the development of automotive technology leads. The precise distance measurement characteristic and the object detection ability are becoming indispensable for parking assist systems, collision avoidance, and object detection systems of cars. The need for range-doubling ultrasonic sensors is provoked by the prospective rise in self-driving technology in the automotive industry. Long-range radar sensors, such as ultrasonic sensors, prompted a rise in road safety; they provide functions for automotive vehicles such as adaptive control and handling of cruise systems and emergency braking.

Restraints

-

Ultrasonic Sensors Addressing Distance and Price Obstacles

There are various obstacles to the growth of the ultrasonic sensor market. Notably, the sensors’ limited range for detection is a major obstacle. The reduction in signal intensity caused by the fall of ultrasonic waves over distance impacts the precision of measurements. Additionally, high-precision ultrasonic sensors may be too expensive for some applications, especially where the budget is limited. These factors may hinder the wide acceptance and restrain market expansion.

-

Challenges that are restricting the growth of the ultrasonic sensor market.

Despite the fact that ultrasonic sensors have a lot to offer, there are several restrictions preventing the market from growing. One disadvantage is their lower detection of distance quality and reduced image quality than LIDAR and RADAR technology. It makes it not very useful in places where long-distance measurements need to be accurate or where objects need to be detected accurately. These include primarily advanced autonomous driving systems and high-precision industrial automation. Therefore, the use of advanced sensing solutions in these sectors may limit the growth of ultrasonic sensors or severely restrict their acceptance. In addition, the upper limit of the sensor’s reliable operation is its vulnerability to the ambient environment. This environment includes such variables as air temperature and humidity and various particles. Their presence can reduce the reliability of the ultrasonic sensor. In more challenging environments, these issues are more likely to occur, which may restrict their application in critical situations.

Segment Analysis

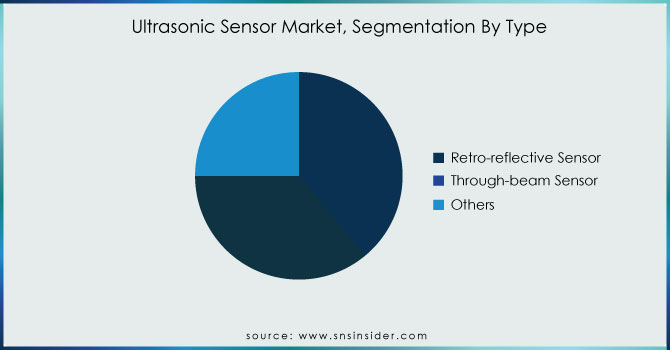

By Type

Based on Type, Retro reflective Sensors dominated the ultrasonic sensors market with 39% of share in 2023. Retro-reflective sensors are experiencing robust growth due to their increasing integration into various sectors. Their compact design has made them a staple in smartphones, with features like fingerprint scanners driving demand. Companies like Apple and Samsung incorporate these sensors into their devices. Beyond consumer electronics, retro-reflective sensors are indispensable in industrial automation, where they are employed for tasks such as object detection on conveyor belts. Key players in this space include Omron, Banner Engineering, and SICK. The life sciences and automotive industries also leverage these sensors for precise measurements and safety systems. Ongoing R&D efforts by companies such as Keyence and Panasonic are further propelling the development of advanced retro-reflective sensors, expanding their applications across diverse markets.

Need any customization research on Ultrasonic Sensor Market - Enquiry Now

By Structure Type

Based on Structure Type, Open-type Ultrasonic Sensor market is expected to dominate the ultrasonic sensor market with 58% of share in 2023. The rising adoption of open-type ultrasonic sensors is primarily driven by the increasing use of the devices in homes. These devices are deployed in a range of household items such as in motion controllers, automatic doors, vacuum cleaners, range finders, and light beam sensors and burglar alarms. The growth in this case is also propelled by the increasing consumer disposable income, with a fraction of consumers adopting lavish lifestyles and in the process upping the investment in updating home infrastructure. The increase in investment in home automation and smart technologies will further contribute to increasing the demand for open-type ultrasonic sensors.

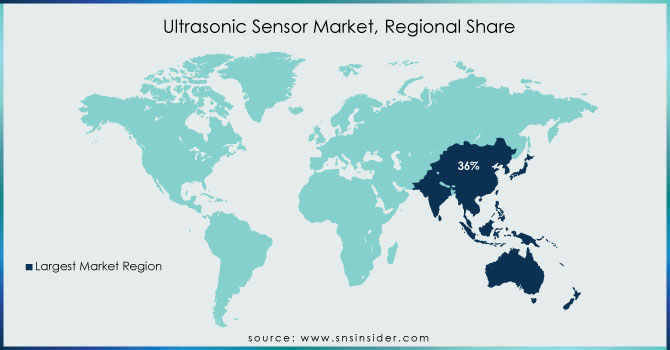

Regional Analysis

Asia Pacific dominated the Ultrasonic Sensor market with 36% of share in 2023. The ultrasonic sensor market in the Asia-Pacific region is prominent, driven mainly by technological advancements and the increasing footprint of technology companies like Xiaomi and Xinhua. The expectation of a significant increase in demand for ultrasonic sensors in the region is due to the booming manufacturing industries in China and India. China has set very ambitious goal of having a smart manufacturing system in place by 2025, with significant amounts of government funding being channeled towards the digitization of infrastructure. this is expected to result in a rise in the use of ultrasonic sensors across a multifaceted spectrum of applications, especially for automotive and industrial uses. Companies in the region are also actively engaged on the innovation front, such as Ursalink’s ultrasonic-level sensors. Similarly, Japan’s focus on the production of self-driving cars is being catalyzed by looser restrictions being placed on the vehicles, which are currently being used in certain limited environments. In India, the “Make in India” initiative, aimed at boosting the country’s manufacturing industries and making them USD 1 trillion strong by 2025, is expected to drive demand for ultrasonic sensors within the region.

North America is expected to be the fastest-growing segment with 26% of share in 2023. The US is the biggest market for ultrasonic sensors in North America. The region is witnessing striking growth due to high degrees of interest from the healthcare, oil and gas, and agriculture sectors, and particularly the automotive industry. The role of these sensors in critical cutting-edge capacities such as parking aid and driver assistant systems is a critical factor fueling demand in the ultrasonic sensors market. In addition, the expanding application of automation and Io T technologies within manufacturing and healthcare sectors is also aiding the growth of the ultrasonic sensors market across North America.

Key Players:

The prominent players in the market are Banner Engineering Corp., Hans Turck GmbH & Co. KG, Ifm Electronic GmbH, Murata Manufacturing Co., Balluff Inc., Ltd., Pepperl+Fuchs GmbH, Baumer, SICK AG, Siemens, Honeywell International Inc. and others in final Report.

Recent Development:

-

August 2023: Siemens declared acquisition with Heliox for the growing e-Truck and e-Bus fast charging solutions. This acquisition adds value to Siemens mobility charging portfolio solutions and products in the fast-growing mobility charging businesses.

-

June 2023: Honeywell International Inc. announced the launch of the DG Smart Sensor, a solution intended to enhance the reliability and efficiency of controlling and monitoring low-pressure combustion fuel gases and air. This product bids exact monitoring capabilities and holds the digitalization trends united with Industry 4.0, providing a chance to improve combustion system performance and change the operational dynamics for end users, OEMs, and system integrators.

-

June 2023: Murata Manufacturing Co. Ltd. declared the introduction of MA48CF15-7N, a new ultrasonic sensor device envisioned for distribution in automotive applications and has great sensitivity and fast responsiveness in a hermetically-sealed set to defend against liquid ingress.

-

March 2023: Rockwell Automation Inc. announced the acquisition of Knowledge Lens. The acquisition between the firms increases the ability to aid more manufacturers globally to discover and use unseen insights in their information to drive game-changing value for their businesses.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.96 Billion |

| Market Size by 2032 | USD 13.17 Billion |

| CAGR | CAGR of 9.21 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology, (Retro-reflective Sensor, Through-beam Sensor, and Others) • by Type, (Level Measurement, Distance Measurement, Obstacle Detection, Others) • by End-use (Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Banner Engineering Corp., Hans Turck GmbH & Co. KG, Ifm Electronic GmbH, Murata Manufacturing Co., Balluff Inc., Ltd., Pepperl+Fuchs GmbH, Baumer, SICK AG, Siemens, Honeywell International Inc |

| Key Drivers |

|

| Market Restraints |

|