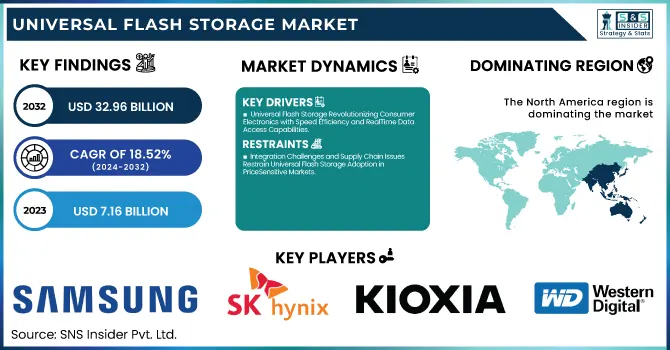

Universal Flash Storage Market Size Analysis:

The Universal Flash Storage Market Size was valued at USD 7.16 Billion in 2023 and is expected to reach USD 32.96 Billion by 2032 and grow at a CAGR of 18.52% over the forecast period 2024-2032.

To Get more information on Universal Flash Storage Market - Request Free Sample Report

The UFS market continues to gain traction as improvements in wafer production volumes and enhancements in fab capacity utilization allow for the faster and more effective turn of chips out of the floor. Manufacturers are focusing on reduced cycles for product development and launch to address the growing need for devices with advanced capabilities. By enabling intelligent data processing and low-latency performance among various mobile and embedded applications, ASU is also an important differentiator as UFS solutions integrate AI and edge computing capabilities. The U.S. semiconductor industry is forecasted to expand chip asic capacity at a rate of 6% year-over-year in 2024, taking production capacity up to around 3.1 million wafers per month, as six new fabs go into production. The expansion helps meet the demand for Universal Flash Storage (UFS) technologies, particularly as AI & edge computing applications increase the need for faster, more efficient storage solutions. UFS products are integrated with the capabilities of AI, enhancing development cycles and continually adapting to the latest requirements of the market.

The U.S. Universal Flash Storage Market is estimated to be USD 1.94 Billion in 2023 and is projected to grow at a CAGR of 18.33%. Growing U.S. demand for high-speed data transfer from consumer electronics like smartphones, automotive electronics, and IoT devices drives the U.S. Universal Flash Storage market. The growing deployment of AI and edge computing, together with increasing fab capacity, and fast-evolving semiconductor technologies, increase the demand for next-generation UFS solutions.

Universal Flash Storage (UFS) Market Dynamics

Key Drivers:

-

Universal Flash Storage Revolutionizing Consumer Electronics with Speed Efficiency and RealTime Data Access Capabilities

Increasing consumer electronics applications, primarily in smartphones, form the backbone driver for the Universal Flash Storage (UFS) market and it is expected to rapidly expand, mainly due to rising demand for high-speed data transfer and enhanced performance using less number of chips in mobiles, tablets, laptops, and consumer electronics. Compared to older technologies such as embedded MultiMediaCard (eMMC), UFS provides many benefits such as faster sequential and random read and write speeds (raw bandwidth), reduced latency, and better concurrency. UFS has established itself as a ubiquitous technology, as OEMs steadily embrace UFS for mid and high-end devices. The proliferation of 5G networks and AI-enabled applications also demands quicker access to, and processing of, large amounts of data, which drives the need for storage solutions such as UFS. Another important growth driver is the automotive sector where UFS is increasingly used in ADAS, digital clusters, and infotainment systems that require real-time access to data.

Restrain:

-

Integration Challenges and Supply Chain Issues Restrain Universal Flash Storage Adoption in PriceSensitive Markets

Limited compatibility with legacy systems & devices is one of the key restraints impacting the Universal Flash Storage (UFS) market. Although UFS is a better-performing technology it is also often more difficult to integrate into existing hardware and software that can cope with the limitations of older flash technologies or devices aimed at the lower end of the market. This impedes uptake, specifically in price-sensitive consumer segments, or markets majorly populated by low-end smartphones. Moreover, noninherent semiconductor manufacturing supply chain intricacies and global chip shortages can delay the production and rollout of UFS components, hampering the market growth spurt.

Opportunity:

-

Universal Flash Storage Unlocks Growth Opportunities in Emerging Tech Premium Devices and Global Digital Expansion

There is a high growth potential in the market such as autonomous vehicles, IoT devices, and augmented reality (AR)/virtual reality (VR) applications. All these technologies require high-speed, reliable, and energy-efficient storage and hence UFS has become a choice of storage solutions. High uptake of UFS 256 GB and higher (for premium devices) is another key factor that is expected to create significant opportunities for manufacturers. Emerging markets, especially Asia-Pacific and Latin America, are going to be the area of opportunity as smartphone penetration grows along with digital transformation efforts. Looking forward, continued advancements in UFS 4.0 and beyond will keep technology evolving as the landscape opens new doors for market growth.

Challenges:

-

Universal Flash Storage Faces Tough Competition and Technical Challenges Amid Rapid Memory Technology Evolution

The UFS market is also a competitive battleground against other storage technologies like NVMe SSDs and the latest eMMC, especially in some form factors like laptops and embedded applications. And even though UFS is speedier, OEMs may still opt for standbys based on their microscopic application particulars. In addition, as UFS continues to evolve (for example UFS 3.1 and 4.0), backward compatibility and specification standardization for diverse platforms present a technical challenge among developers and manufacturers. The fast-evolving nature of memory and storage technology also adds to the burden, pushing companies to fuel in-house research, development, testing, and even ecosystem readiness to stay afloat amid constant competition and demands for new consumer experiences.

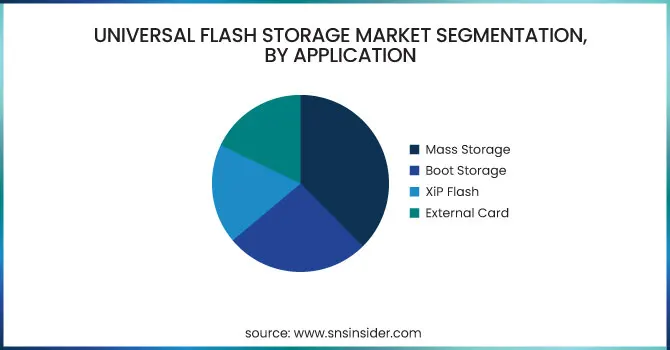

Universal Flash Storage Industry Segmentation Overview

By Application

Mass Storage had the highest share of Universal Flash Storage (UFS), 43.8% in 2023, due to the prevalent use of mass storage in smartphones, tablets, and laptops. This is due to the growing need for speedy data access, continuous multitasking, and high-capacity storage in consumer electronics. The UFS-based mass storage offers noticeable performance gains over other conventional storage technologies such as eMMC, enabling better user experiences in app loading, media streaming, and gaming.

From 2024 to 2032, XiP (Execute-in-Place) Flash is anticipated to showcase the highest CAGR attributed to its increasing incorporation in real-time applications which comprise automotive electronics, embedded systems, and IoT devices. XiP allows the devices to directly execute code from flash memory, so it gives shorter boot-up time and better efficiency. With the rise of edge computing and smart systems, XiP Flash represents a significant growth opportunity for us, delivering low-latency performance in smaller hardware form factors.

By Capacity

The most common capacity segment in the UFS market in 2023 was the 128 GB segment with a share of 29.6%, due to the capability to meet the flexibility of user needs in mid-range smartphones, tablets, and laptops in addition to premium phones and devices. With a balance of performance, cost, and storage requirements, this amount of capacity is the most favorable among consumers looking for reliable and sufficient storage overhead for applications, media, and system updates. The increasing need for devices with better multimedia handling and faster data processing has also contributed to its popularity.

The 256 GB segment is expected to gain traction the fastest during the forecast period (2024-2032). This type of capacity is anticipated to be in higher demand as storage requirements will increase for high-performance applications, mostly 5G smartphones, gaming phones, ultrabooks, automotive, etc. With more and more high-resolution content including 4K videos, AR/VR applications, and larger software packages being consumed and created by users, the demand for more, faster, and energy-efficient storage capacity is skyrocketing which, according to the research office, will make 256GB UFS the main driver of growth in the years to come.

By Configuration

Embedded configuration accounted for 77.5% of the Universal Flash Storage (UFS) market in 2023. The reason for this dominance is rooted in NAND flash storage being integral to the operation of smartphones, tablets, laptops, and the infotainment systems of the vast majority of cars, all of which need storage that is fast, physically small, and low-power. It said that Embedded UFS outperforms traditional solutions, providing faster times, enhanced multitasking, and improved user experience. To further accelerate its adoption, high-end mobile devices and connected automotive applications have greatly benefited from it.

The Removable UFS segment is projected to register the highest CAGR from 2024 to 2032, due to an increasing preference for flexible and expandable storage solutions in a range of portable electronic devices like professional cameras and drones. As media-rich and data-heavy applications demand quicker data transfer and more secure data storage, we are seeing the emergence of removable UFS cards. It opens new avenues for growth across industrial and consumer markets, with the potential to marry UFS-level speeds with portability.

By End Use

In 2023 Smartphones hold a 54.6% share of the UFS market. This leadership is powered by a growing demand for mobile devices that provide fast data access, multitasking, and enhanced user experiences. From a functionality standpoint, UFS technology has emerged as the standard in most mid-to-high-end smartphones, displacing older storage types such as eMMC, primarily due to its higher read/write speeds, power efficiency, and the performance headroom to handle heavy workloads such as 4K video recording, gaming, and AI workloads, among others.

Automotive Electronics is expected to post the highest CAGR during the forecast period between 2024 and 2032. The more vehicles become software-driven and connected the more high-performance, reliable storage solution is needed. Introduction UFS is steadily gaining traction in ADAS (advanced driver-assistance systems), infotainment platforms, and digital instrument clusters. They are known for their ability to provide low-latency, real-time data processing that is essential for modern automotive applications, especially in electric and autonomous vehicles, it offers high growth potential.

Universal Flash Storage (UFS) Market Regional Analysis

North America accounted for the largest share of the Universal Flash Storage (UFS) market, at 34.7% in 2023, due to significant consumer electronics (including smartphones) as well as automotive and enterprise demand. Its lead over the competition was leveled to some extent due to the advanced technological infrastructure, purchasing power, and high smartphone penetration of the region, it's also among the first regions to adopt next-gen storage solutions. Key manufacturers, such as Apple (smartphone) and Tesla (automotive), are implementing UFS to meet high-speed data processing and the improvement of user experience. Meanwhile, North American OEMs and Tier 1 suppliers are investing in cost-optimized AI-driven devices and infotainment systems that can leverage the speed and efficient performance of UFS.

Asia Pacific is anticipated to increase at the fastest growth rate throughout the prediction period (2024-2032), due to rapid urbanization, expanding electronics production, and rising user demand for high-performance devices. China, South Korea, and India are major players in this game, and smartphones and tablets from such brands as Samsung, Xiaomi, and Vivo have UFS integrated into them. In automotive, Hyundai and BYD are upgrading digital cockpit systems and ADAS capabilities with UFS-based storage. In addition, the strong semiconductor ecosystem in the region such as South Korea and Taiwan has made the market a hot spot for UFS production and technology developments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Universal Flash Storage Market are:

-

Samsung Electronics (UFS 4.0 Storage)

-

SK Hynix (UFS 3.1 NAND Flash)

-

Kioxia Corporation (UFS Embedded Memory)

-

Western Digital (iNAND MC EU551 UFS)

-

Micron Technology (UFS 3.1 Mobile Memory)

-

Toshiba Memory (UFS 2.1 Embedded Storage)

-

Silicon Motion (UFS Controller SM2750)

-

Phison Electronics (UFS Controller PS8311)

-

Synopsys (DesignWare UFS IP)

-

Cadence Design Systems (UFS Host Controller IP)

-

Arasan Chip Systems (UFS 3.1 PHY + Controller IP)

-

Marvell Technology (UFS Storage Controller)

-

Rambus (UFS PHY IP)

-

UNISOC (UFS 3.1 Flash Interface)

-

MediaTek (Dimensity SoC with UFS 3.1 Support)

Universal Flash Storage Market - Recent Trends

-

In September 2024, Samsung launched 512GB versions of its BAR Plus, FIT Plus, and USB Type-C flash drives, offering read speeds up to 400 MB/s and enhanced durability.

-

In March 2025, SK Hynix unveiled UFS 4.1 storage in 512GB and 1TB variants and introduced ZUFS 4.0 to boost AI application performance. ZUFS 4.0 offers 45% faster app launches and is set for mass production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.16 Billion |

| Market Size by 2032 | USD 32.96 Billion |

| CAGR | CAGR of 18.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Mass Storage, Boot Storage, XiP Flash, External Card) • By Capacity (32 GB, 64 GB, 128 GB, 256 GB, 512 GB) • By Configuration (Embedded, Removable) • By End Use (Automotive Electronics, Digital Cameras, Gaming Consoles, High-Resolution Displays, Laptops, Smartphones, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, SK Hynix, Kioxia Corporation, Western Digital, Micron Technology, Toshiba Memory, Silicon Motion, Phison Electronics, Synopsys, Cadence Design Systems, Arasan Chip Systems, Marvell Technology, Rambus, UNISOC, MediaTek. |