Uranium Enrichment Market Report Scope & Overview:

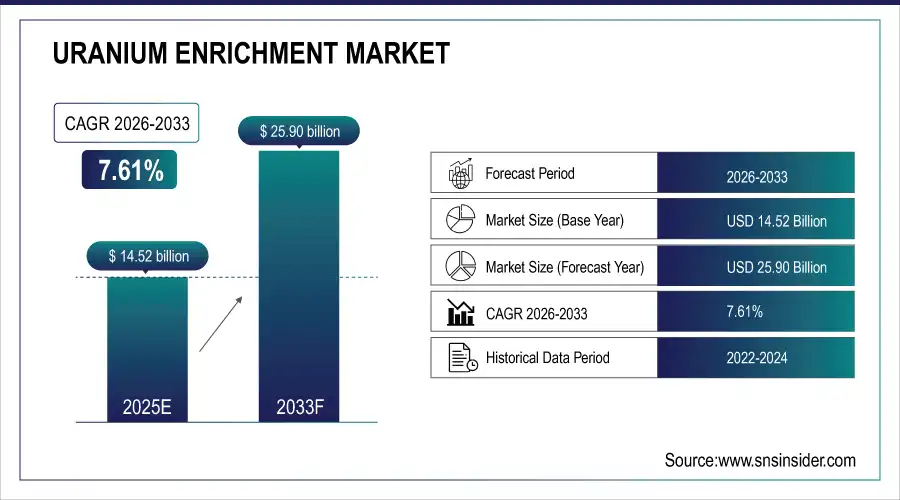

The Uranium Enrichment Market was valued at USD 14.52 billion in 2025E and is expected to reach USD 25.90 billion by 2032, growing at a CAGR of 7.61% from 2026-2033.

The Uranium Enrichment Market is growing due to rising global demand for nuclear energy and low-carbon power generation. Expansion of nuclear reactors, government support, and strategic investments in fuel cycle infrastructure drive demand. Technological advancements in enrichment methods, increasing efficiency, and adoption of advanced centrifuge and laser technologies enhance production capabilities. Additionally, growing medical and research applications for enriched uranium and the need for reliable fuel supply contribute to sustained market growth globally.

IAEA:

-

As of May 17, 2025, Iran's enriched uranium stock, including all enrichment levels and chemical forms, increased by 953.2 kg, reaching a total of 9,247.6 kg uranium mass.

-

Iran's 60% highly enriched uranium stock in uranium hexafluoride form was 408.6 kg uranium mass, showing a net increase of 133.8 kg in the reporting period.

-

Iran's monthly production of 60% enriched uranium averaged about 37.5 kg uranium mass (55.5 kg hexafluoride mass), translating to approximately 456 kg uranium mass per year.

Market Size and Forecast

-

Market Size in 2025: USD 14.52 Billion

-

Market Size by 2033: USD 25.90 Billion

-

CAGR: 7.61% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Uranium Enrichment Market - Request Free Sample Report

Uranium Enrichment Market Trends

-

Rising global demand for nuclear energy is driving the uranium enrichment market.

-

Expansion of nuclear power plants and new reactor projects is boosting market growth.

-

Adoption of advanced enrichment technologies, such as gas centrifuge and laser enrichment, is improving efficiency and output.

-

Focus on energy security, carbon emission reduction, and sustainable power generation is shaping market trends.

-

Increasing investments in nuclear fuel cycle infrastructure are supporting industry expansion.

-

Regulatory compliance, safety standards, and non-proliferation measures are influencing market operations.

-

Collaborations between governments, nuclear agencies, and technology providers are accelerating innovation and deployment.

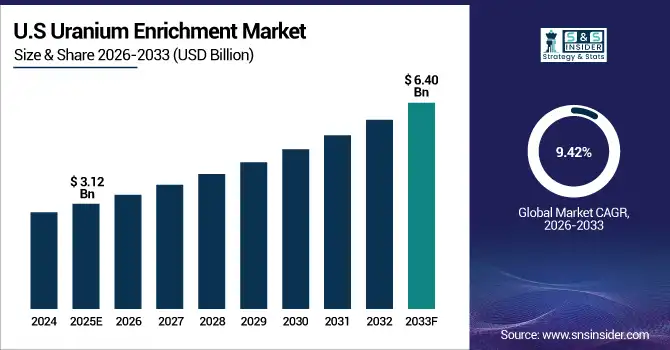

U.S. Uranium Enrichment Market was valued at USD 3.12 billion in 2025E and is expected to reach USD 6.40 billion by 2032, growing at a CAGR of 9.42% from 2026-2033.

The U.S. Uranium Enrichment Market is growing due to modernization of nuclear facilities, increasing nuclear power demand, government support, and adoption of advanced enrichment technologies, ensuring a reliable uranium supply for energy generation, research, and medical applications.

In 2024, U.S. uranium mines produced 677,000 pounds of triuranium octoxide (U3O8), up dramatically from 50,000 pounds in 2023.

The U.S. has multiple in-situ recovery facilities and mills with combined capacities exceeding 14 million pounds U3O8 per year. Uranium production expenditures rose to USD 160 million in 2024, the highest since 2016, reflecting expanded exploration and development.

Uranium Enrichment Market Growth Drivers:

-

Rising global demand for nuclear energy and increasing number of nuclear power plants boosting uranium enrichment requirements worldwide significantly

The growing global energy demand and shift toward low-carbon energy sources are driving the need for nuclear power generation. Nuclear reactors require a steady supply of enriched uranium for fuel, and expansions in existing reactors, along with new reactor constructions, are increasing uranium enrichment requirements. Governments and private players are investing in nuclear infrastructure to ensure energy security and reduce carbon emissions. This rising demand for nuclear power directly fuels the uranium enrichment market, as both low-enriched uranium (LEU) and high-enriched uranium (HEU) are essential for reactor operations.

-

According to the World Nuclear Association, in 2024, nuclear reactors worldwide generated a record-breaking 2,667 terawatt-hours (TWh) of electricity, the highest ever delivered by nuclear energy, helping avoid 2.1 billion tonnes of CO2 emissions from coal generation equivalents.

-

There are currently about 70 nuclear reactors under construction worldwide, primarily in Asia, with approximately 110 more planned. This growing pipeline of new reactors further increases uranium enrichment needs to meet the fuel supply requirements.

Uranium Enrichment Market Restraints:

-

High capital expenditure and complex technology requirements limiting uranium enrichment facility expansions and slowing market adoption

Uranium enrichment requires highly sophisticated technology and significant upfront investment in centrifuge, gaseous diffusion, or laser isotope separation facilities. Construction, safety, regulatory compliance, and security measures contribute to enormous costs. Small and medium players often lack the financial and technical capability to enter the market. Operational complexity, high maintenance costs, and stringent licensing procedures further restrict new facility development. These financial and technological barriers slow the pace of market growth and limit the expansion of enrichment capacity, especially in emerging regions that are seeking to establish nuclear fuel cycle infrastructure.

|

Facility / Aspect |

Details |

|

U.S. Uranium Processing Facility |

NNSA is constructing a new uranium processing facility with an estimated cost of USD 6.5 billion, expected completion by 2025. Aims to modernize infrastructure and enhance nuclear security capabilities. |

|

Orano USA's Oak Ridge Facility |

New multibillion-dollar uranium enrichment facility in Oak Ridge, TN. Facility spans 750,000 sq. ft., expected to become one of the largest enrichment plants in North America. |

|

General Matter's Paducah Facility |

USD 1.5 billion uranium enrichment facility in Paducah, KY. Expected to create 140 full-time jobs, average hourly wage USD 64, largest economic development project in Western KY history. |

Uranium Enrichment Market Opportunities:

-

Advancements in enrichment technology creating opportunities to enhance efficiency and reduce operational costs significantly

Technological innovations such as next-generation centrifuges, laser isotope separation, and automation are improving efficiency, reducing energy consumption, and minimizing operational costs. Advanced monitoring systems and digital controls optimize enrichment processes and ensure safety. Adoption of these technologies allows companies to increase output, improve reliability, and meet rising demand without proportionally increasing costs. Additionally, research into new enrichment methods can unlock faster production and enhanced fuel quality. Market participants leveraging these advancements gain competitive advantage, expand capacity, and improve profitability while addressing environmental and regulatory concerns effectively.

Uranium Enrichment Market Segment Highlights

-

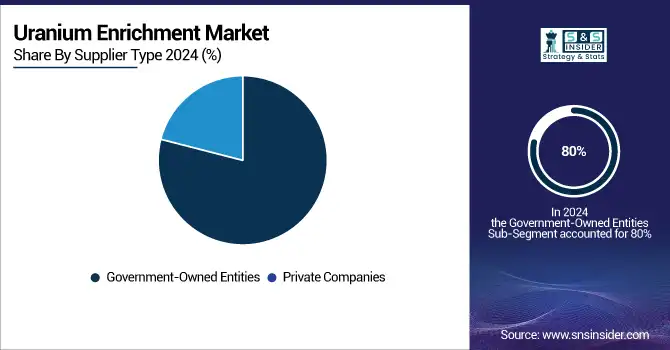

By Supplier Type, Government-Owned Entities dominated with ~80% share in 2025; Private Companies fastest growing (CAGR)

-

By Technology, Centrifuge Enrichment dominated with ~72% share in 2025; Laser Isotope Separation fastest growing (CAGR)

-

By Application, Nuclear Power Generation dominated with ~64% share in 2025; Medical Isotopes fastest growing (CAGR)

-

By Enrichment Level, Low Enriched Uranium (LEU) dominated with ~71% share in 2025; Depleted Uranium (DU) fastest growing (CAGR)

Uranium Enrichment Market Segment Analysis

By Supplier Type, Government-Owned Entities segment dominated in 2025; Private Companies segment projected fastest growth 2026–2033

Government-Owned Entities segment dominated the Uranium Enrichment Market with the highest revenue share in 2025. This is due to strong government control over strategic nuclear fuel production, established infrastructure, and long-term supply agreements. These entities have the expertise, regulatory approvals, and resources to operate large-scale enrichment facilities efficiently.

Private Companies segment is expected to grow at the fastest CAGR from 2026-2033. Growth is driven by increased investments, technological innovations, and flexibility in operations. New entrants focus on niche technologies, cost optimization, and partnerships, enabling faster adoption of advanced enrichment methods and expansion in emerging markets.

By Technology, Centrifuge Enrichment segment led in 2025; Laser Isotope Separation segment expected fastest growth 2026–2033

Centrifuge Enrichment segment dominated the Uranium Enrichment Market with the highest revenue share in 2025. Its efficiency, lower energy consumption, and established technology make it the preferred method for large-scale uranium enrichment. Centrifuges provide reliable, scalable, and cost-effective enrichment solutions, supporting both domestic and international nuclear fuel supply.

Laser Isotope Separation segment is expected to grow at the fastest CAGR from 2026-2033. The growth is attributed to its potential for higher enrichment efficiency, lower energy requirements, and precise isotope separation, attracting investment for research and pilot facilities aiming for next-generation enrichment technology adoption.

By Application, Nuclear Power Generation segment dominated in 2025; Medical Isotopes segment projected fastest growth 2026–2033

Nuclear Power Generation segment dominated the Uranium Enrichment Market with the highest revenue share in 2025. The dominance is driven by the global expansion of nuclear reactors and the requirement of enriched uranium as fuel. Stable demand from energy generation ensures consistent market growth and long-term contracts with enrichment providers.

Medical Isotopes segment is expected to grow at the fastest CAGR from 2026-2033. Growth is fueled by increasing demand for radioisotopes in diagnostics, cancer treatment, and research. Expansion of healthcare infrastructure and rising investments in nuclear medicine drive higher consumption of enriched uranium for isotope production.

By Enrichment Level, Low Enriched Uranium (LEU) segment led in 2025; Depleted Uranium (DU) segment expected fastest growth 2026–2033

Low Enriched Uranium (LEU) segment dominated the Uranium Enrichment Market with the highest revenue share in 2025. LEU is widely used in commercial nuclear reactors for power generation. Its demand is supported by established nuclear energy programs and long-term fuel supply contracts, ensuring steady market dominance.

Depleted Uranium (DU) segment is expected to grow at the fastest CAGR from 2026-2033. Growth is driven by its applications in research, radiation shielding, and advanced nuclear technologies. Increasing interest in DU for industrial, defense, and medical applications is creating new opportunities for enrichment and processing.

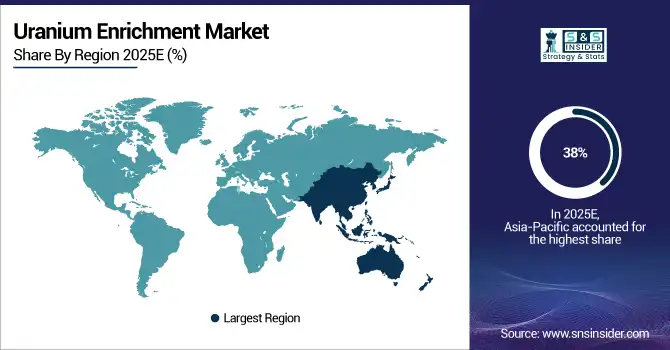

Uranium Enrichment Market Regional Analysis

Asia Pacific Uranium Enrichment Market Insights

Asia Pacific dominated the Uranium Enrichment Market with the highest revenue share of about 38% in 2025. This dominance is driven by rapid nuclear power expansion, increasing energy demand, and government support for clean energy initiatives. Growing investments in nuclear infrastructure, establishment of new reactors, and partnerships with global enrichment companies further strengthen the region’s position. Rising industrialization and urbanization also contribute to the consistent demand for enriched uranium.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Uranium Enrichment Market Insights

North America segment is expected to grow at the fastest CAGR of about 9.34% from 2026-2033. The growth is fueled by modernization of nuclear facilities, strong government support for nuclear energy, and technological advancements in enrichment processes. Increasing adoption of next-generation enrichment technologies, strategic investments by private and government entities, and expanding nuclear power programs drive rapid market growth in the region, ensuring a competitive and sustainable uranium enrichment sector.

Europe Uranium Enrichment Market Insights

Europe in the Uranium Enrichment Market is witnessing steady growth due to established nuclear energy programs, high energy demand, and strong government support. Advanced enrichment technologies, well-developed infrastructure, and strategic collaborations with global players enhance efficiency and supply reliability. Focus on low-carbon energy, safety regulations, and research initiatives drive consistent uranium enrichment requirements. Expansion of nuclear reactors and modernization of existing facilities further contributes to market stability and long-term growth across the region.

Middle East & Africa and Latin America Uranium Enrichment Market Insights

Middle East & Africa and Latin America in the Uranium Enrichment Market are experiencing moderate growth driven by emerging nuclear energy programs and increasing electricity demand. Investments in nuclear infrastructure, collaborations with established enrichment companies, and government initiatives support market development. Rising awareness of clean energy, coupled with efforts to diversify energy sources, fuels demand for enriched uranium. These regions are gradually expanding capacity and adopting advanced enrichment technologies to meet future energy needs.

Uranium Enrichment Market Competitive Landscape:

Orano

Orano is a leading global nuclear fuel cycle company, specializing in uranium enrichment, spent fuel recycling, and nuclear logistics. Headquartered in France, Orano provides safe and efficient solutions for the full nuclear fuel cycle while focusing on sustainability, innovation, and regulatory compliance. Its Georges Besse II enrichment facility plays a key role in supplying low-enriched uranium for nuclear power plants worldwide.

-

2023: Orano announced a USD 1.8 billion investment to increase the Georges Besse II enrichment facility's capacity by 30%, adding four new modules to meet growing global demand for low-enriched uranium.

-

2025: The European Investment Bank and Orano signed a €400 million loan agreement to support the expansion of the Georges Besse II uranium enrichment plant, aiming for initial operations by 2028 and full commissioning by 2030.

Global Laser Enrichment

Global Laser Enrichment (GLE) develops innovative uranium enrichment technologies using advanced laser-based methods. Focused on efficiency and diversification in the nuclear fuel supply chain, GLE aims to provide competitive and environmentally responsible enrichment solutions. Its laser enrichment technology is designed to complement conventional processes while supporting secure and sustainable nuclear energy production in the U.S.

-

2023: Global Laser Enrichment received approval from the U.S. Nuclear Regulatory Commission to begin construction of a laser-based uranium enrichment facility, aiming to diversify enrichment technologies.

Framatome

Framatome is a leading French nuclear technology company providing reactor design, fuel assembly production, and nuclear services. The company focuses on safety, efficiency, and sustainability across the nuclear energy sector. Its expertise in fuel manufacturing and enrichment supports global nuclear power operations, while partnerships with other nuclear firms enhance operational efficiency and reduce environmental impact.

-

2024: Framatome partnered with Orano to enhance uranium enrichment capabilities at the Georges Besse II facility, focusing on improving efficiency and reducing environmental impact.

Eurodif

Eurodif specializes in uranium enrichment and nuclear fuel supply for global energy demands. The company aims to modernize its facilities to increase production capacity and meet evolving energy requirements while ensuring safety and regulatory compliance. Eurodif’s focus is on providing reliable enriched uranium for civil nuclear power generation.

-

2023: Eurodif announced plans to modernize its uranium enrichment plant in Tricastin, France, to increase production capacity and meet future energy demands.

Urenco

Urenco operates advanced uranium enrichment facilities in the U.S. and Europe, supplying low-enriched uranium for nuclear power plants. The company focuses on innovation, efficiency, and sustainability, using centrifuge technology to provide a secure and environmentally responsible fuel supply. Urenco supports both conventional nuclear reactors and advanced reactor designs.

-

2024: Urenco USA began installing new centrifuges at its Eunice, New Mexico facility, marking the first phase of a 15% capacity increase, expected to produce an additional 700,000 SWU annually starting in 2025.

-

2024: Urenco USA achieved a milestone of 50 million SWU produced, supplying nearly one-third of the U.S. enriched uranium needs, with plans to produce up to 10% enriched uranium for advanced reactors.

Cameco

Cameco is a major Canadian uranium producer, specializing in mining, refining, and fuel supply for the global nuclear energy market. With a focus on operational excellence and sustainability, Cameco ensures reliable fuel delivery while supporting clean energy initiatives worldwide. The company provides enriched uranium products to utilities, contributing to energy security in multiple regions.

-

2023: Cameco signed a contract to supply 100% of Energoatom's UF6 requirements for Ukraine's nuclear reactors, ensuring fuel supply continuity amid geopolitical tensions.

Key Players

Some of the Uranium Enrichment Market Companies

-

Rosatom

-

Orano

-

Urenco

-

China National Nuclear Corporation (CNNC)

-

Cameco

-

Centrus Energy

-

Energy Fuels Inc.

-

Uranium Energy Corp

-

NexGen Energy

-

IsoEnergy Ltd.

-

ConverDyn

-

Orano Federal Services

-

General Atomics

-

Laser Isotope Separation Technologies

-

Global Laser Enrichment

-

Lanzhou Uranium Enrichment Plant

-

Techsnabexport (TENEX)

-

Framatome

-

Eurodif

-

Franco-Belge de Fabrication du Combustible

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 14.52 Billion |

| Market Size by 2033 | USD 25.90 Billion |

| CAGR | CAGR of 7.61% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Enrichment Level(Low Enriched Uranium (LEU), High Enriched Uranium (HEU), Depleted Uranium (DU)) • By Application(Nuclear Power Generation, Medical Isotopes, Research and Development) • By Technology(Centrifuge Enrichment, Gaseous Diffusion, Laser Isotope Separation) • By Supplier Type(Government-Owned Entities, Private Companies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Rosatom, Orano, Urenco, China National Nuclear Corporation (CNNC), Cameco, Centrus Energy, Energy Fuels Inc., Uranium Energy Corp, NexGen Energy, IsoEnergy Ltd., ConverDyn, Orano Federal Services, General Atomics, Laser Isotope Separation Technologies, Global Laser Enrichment, Lanzhou Uranium Enrichment Plant, Techsnabexport (TENEX), Framatome, Eurodif, Franco-Belge de Fabrication du Combustible |