Gear Motor Market Report Scope & Overview:

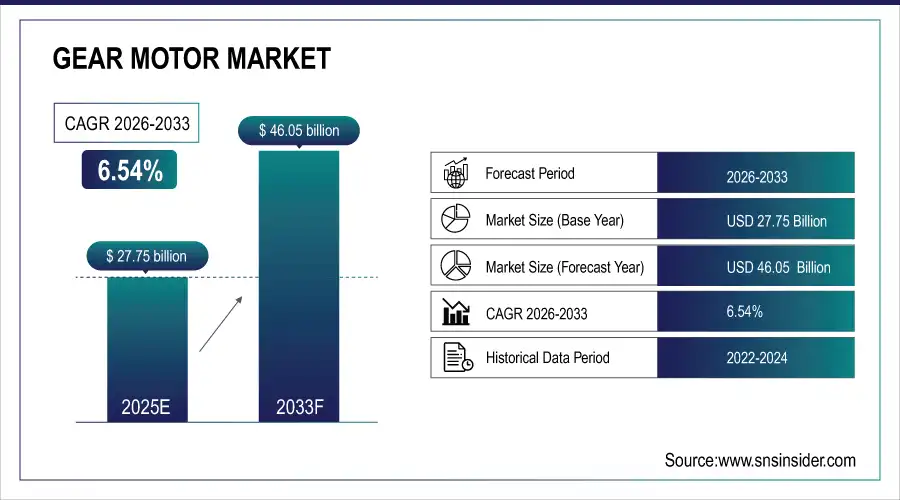

The Gear Motor Market Size was valued at USD 27.75 billion in 2025E and is expected to reach USD 46.05 billion by 2033, growing at a CAGR of 6.54% over the forecast period of 2026-2033.

The Gear Motor Market is witnessing significant growth, fueled by rising automation across industries and increasing adoption of energy-efficient solutions. Gear motors are widely used in automotive, robotics, manufacturing, and material handling applications. Innovations in smart, IoT-enabled, and modular gear motors enhance performance, efficiency, and customization, catering to evolving industrial demands.

Market Size and Forecast:

-

Gear Motor Market Size in 2025E: USD 27.75 Billion

-

Gear Motor Market Size by 2033: USD 46.05 Billion

-

CAGR: 6.59% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Gear Motor Market - Request Free Sample Report

Key Gear Motor Market Trends

-

Rising adoption of automation and robotics across manufacturing and industrial sectors.

-

Increasing demand for energy-efficient and low-maintenance gear motor solutions.

-

Growing integration of IoT-enabled and smart gear motors for predictive maintenance and remote monitoring.

-

Expanding use of gear motors in electric vehicles (EVs) and hybrid mobility solutions.

-

Surge in modular and customizable gear motor designs to meet specific industrial application needs.

-

Growing investments in renewable energy systems, boosting demand for specialized gear motors.

-

Increasing focus on reducing carbon footprint and lifecycle energy costs in industrial operations.

U.S. Gear Motor Market Insights

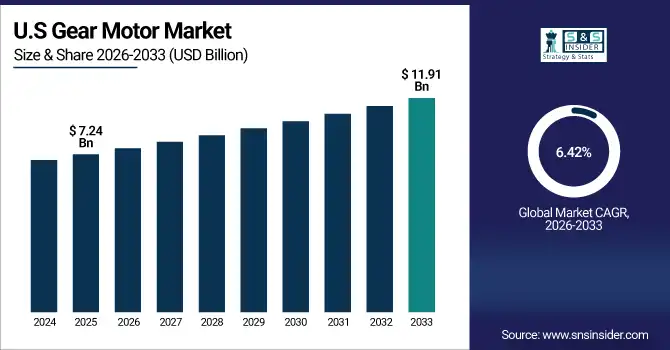

The U.S. Gear Motor Market size was USD 7.24 billion in 2025 and is expected to reach USD 11.91 billion by 2033 growing at a CAGR of 6.42% over the forecast period of 2026-2033. The growth is driven by rising adoption of industrial automation, robotics, and electric vehicles, which require precise and efficient motion control. Integration of IoT-enabled gear motors and predictive maintenance solutions is enhancing operational efficiency. Increased demand from automotive, material handling, and manufacturing sectors, accounting for over 60% of installations, further accelerates market expansion.

Gear Motor Market Growth Driver

-

Growing Adoption of Industrial Automation and Robotics Drives Gear Motor Market Expansion Globally

The increasing deployment of industrial automation and robotics is a primary driver for the Gear Motor Market, as factories and warehouses seek precise, reliable, and energy-efficient motion solutions. Automated machinery, conveyor systems, and robotic arms require gear motors to ensure accurate torque, speed control, and operational efficiency. This surge in automation is particularly notable in the automotive, manufacturing, and material handling sectors, which account for significant market consumption. Advancements in IoT-enabled gear motors, predictive maintenance solutions, and energy-efficient designs are further accelerating adoption, enabling manufacturers to reduce downtime, optimize performance, and lower operational costs. The integration of smart sensors, AI-driven analytics, and modular configurations allows industries to customize gear motor solutions for specific production requirements, fueling consistent market growth across regions.

For instance, In March 2025, ABB Ltd. launched a series of IoT-enabled servo gear motors for industrial automation applications, enhancing predictive maintenance capabilities and enabling real-time performance monitoring, which helped manufacturers reduce operational downtime by over 15% and improve energy efficiency in automotive assembly lines.

Gear Motor Market Restraint

-

High Initial Costs and Complex Integration Hinder Widespread Gear Motor Adoption Across Industries

Despite growing demand, high upfront costs and complex integration requirements act as a major restraint for the Gear Motor Market. Advanced gear motors, including servo and planetary types, require substantial capital investment, along with specialized installation and maintenance expertise. Small- and medium-sized enterprises may face budgetary limitations or lack technical resources to implement sophisticated gear motor systems, slowing market penetration. Additionally, integration with existing equipment and retrofitting older machinery can be challenging, creating operational disruptions and increased expenses. These factors collectively delay adoption, particularly in developing regions, and reduce the pace of market expansion, even as industries recognize the long-term benefits of automation and energy efficiency.

In June 2024, a mid-sized manufacturing plant in Brazil postponed upgrading to servo gear motors due to prohibitive equipment costs and a lack of skilled personnel to integrate the new systems, delaying operational improvements and ROI realization.

Gear Motor Market Opportunity

-

Rising Electric Vehicle Production and Renewable Energy Deployment Presents Significant Growth Opportunity for Gear Motor Market

The surge in electric vehicle (EV) production and renewable energy applications presents a significant opportunity for the Gear Motor Market, as these sectors demand high-performance, compact, and energy-efficient motor solutions. EVs, hybrid vehicles, wind turbines, and solar trackers rely on precision gear motors for propulsion, energy conversion, and tracking efficiency. Gear motors in these applications require durability, reliability, and modular design to withstand variable loads and environmental conditions. Growing government incentives for clean mobility and renewable energy adoption are driving investments in green technologies, enabling manufacturers to innovate with specialized gear motor systems tailored to EV drivetrains and sustainable energy infrastructure. The increasing focus on carbon footprint reduction and energy efficiency further strengthens long-term market potential.

In January 2025, Mitsubishi Electric Corporation introduced a compact helical gear motor series for electric vehicles, supporting enhanced torque control and energy efficiency, and securing contracts with leading EV manufacturers in Europe and Asia.

Gear Motor Market Segment Highlights:

-

By Type: AC Gear Motors – 28%, DC Gear Motors – 22%, Servo Gear Motors – 15%, Planetary Gear Motors – 12%, Helical Gear Motors – 13%, Worm Gear Motors – 10%

-

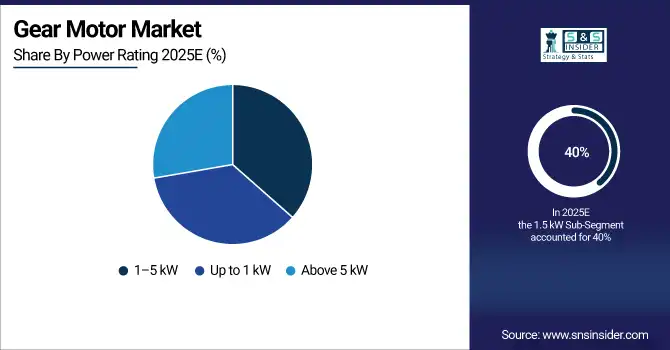

By Power Rating: Up to 1 kW – 35% (largest), 1–5 kW – 40%, Above 5 kW – 25%

-

By Mounting Type: Foot Mounted – 45% (largest), Flange Mounted – 35%, Shaft Mounted – 20%

-

By End-User Industry: Automotive – 25%, Manufacturing – 20%, Material Handling – 15%, Robotics & Automation – 10%, Food & Beverage – 10%, Mining & Metals – 8%, Packaging – 7%, Others – 5%

Gear Motor Market Segment Analysis

By Type

AC Gear Motors dominate the market with a 28% share, driven by their versatility, efficiency, and widespread adoption across industrial, automotive, and manufacturing applications. DC Gear Motors hold 22%, preferred for precise speed control and robotics integration. Servo Gear Motors (15%) and Planetary Gear Motors (12%) are used in automation and compact high-torque applications, while Helical Gear Motors (13%) and Worm Gear Motors (10%) serve specialized industrial and material handling requirements. The growing demand for efficient and reliable power transmission continues to boost the adoption of AC and DC gear motors globally.

By Power Rating

The 1–5 kW segment dominates with a 40% share, fueled by industrial machinery, manufacturing equipment, and robotics applications requiring moderate power. Up to 1 kW, at 35%, is widely used in smaller automation systems, packaging, and light-duty applications, whereas Above 5 kW (25%) serves heavy industrial and mining applications. Rising automation and electrification trends are driving the selection of power ratings based on operational efficiency and torque requirements, influencing market growth across sectors.

By Mounting Type

Foot Mounted gear motors hold the largest share at 45%, due to their ease of installation, stability, and suitability for heavy machinery. Flange Mounted (35%) is popular for compact spaces and precise alignment in automation, while Shaft Mounted (20%) is selected for conveyor systems and material handling equipment. End-user preferences, machinery design, and space constraints influence mounting type selection, directly impacting deployment strategies and market growth globally.

By End-User Industry

Automotive leads with 25% share, driven by EVs, manufacturing automation, and assembly line applications. Manufacturing follows at 20%, adopting gear motors for process optimization and material handling. Material Handling (15%) and Robotics & Automation (10%) grow with increased industrial automation, while Food & Beverage (10%), Mining & Metals (8%), and Packaging (7%) leverage gear motors for operational efficiency. Other industries hold 5%, reflecting niche applications. Industry-specific requirements, reliability, and energy efficiency drive gear motor adoption globally.

Gear Motor Market Regional Analysis

North America Gear Motor Market Insights

North America leads the Gear Motor Market with a 35% share in 2025, driven by widespread industrial automation, high adoption of EV production lines, and investments in smart manufacturing technologies. The U.S. dominates regional growth through extensive deployment of AC and DC gear motors across automotive, manufacturing, and material handling sectors. Rising focus on energy efficiency, predictive maintenance, and regulatory incentives accelerates adoption, while collaborations between gear motor manufacturers and industrial integrators enhance operational efficiency, reliability, and cost optimization, making North America a pivotal hub for gear motor innovations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Gear Motor Market Insights

Europe holds 30% of the Gear Motor Market in 2025, supported by stringent energy efficiency regulations, industrial automation adoption, and sustainability-focused manufacturing initiatives. Germany, France, and the U.K. are leading contributors, emphasizing smart factories, robotics, and modular automation systems. Government incentives, compliance with EU energy standards, and collaborations between industrial firms and gear motor manufacturers promote the adoption of high-efficiency motors, reinforcing Europe’s drive toward decarbonization, reduced energy consumption, and technologically advanced industrial operations.

Asia-Pacific Gear Motor Market Insights

Asia-Pacific accounts for 24% of the market in 2025 and is the fastest-growing region due to rapid industrialization, expanding manufacturing hubs, and increasing EV production. China, India, Japan, and Australia are key contributors, leveraging IoT-enabled, connected gear motors for predictive maintenance and industrial automation. Government-backed programs for energy efficiency, renewable integration, and smart manufacturing further support market expansion. Adoption of modular and customizable gear motors across automotive, robotics, and material handling sectors is accelerating growth across the region.

Latin America and Middle East & Africa (MEA) Gear Motor Market Insights

Latin America holds 5% and MEA 6% of the Gear Motor Market in 2025, emerging as high-potential regions. Brazil, Mexico, UAE, and Saudi Arabia are investing in industrial automation, manufacturing modernization, and renewable energy-driven applications. Public-private partnerships, government initiatives promoting energy efficiency, and rising adoption of IoT-based monitoring solutions are driving steady market growth. Increasing industrial infrastructure development, energy-conscious manufacturing, and focus on operational efficiency support the regional expansion of gear motor applications.

Competitive Landscape for Gear Motor Market:

ABB Ltd.

ABB Ltd. is a multinational corporation specializing in electrification, automation, and digitalization technologies, including energy-efficient gear motor solutions for industrial and commercial applications.

-

In April 2025, ABB announced a $120 million investment to expand its low-voltage electrification and gear motor production facilities in the U.S., enhancing manufacturing capacity and supporting growing demand for energy-efficient gear motors across North America.

Mitsubishi Electric Corporation

Mitsubishi Electric Corporation is a global leader in industrial automation, electric motors, and drive systems, offering high-performance gear motors for manufacturing, robotics, and energy sectors.

-

In May 2025, Mitsubishi Electric partnered with Tramec to provide complete gear motor drive systems in Europe, combining IE5+ ultra-efficient motors with high-performance gearboxes to enhance energy efficiency and meet rising industrial automation demand.

Nidec Corporation

Nidec Corporation is a global manufacturer of electric motors, including gear motors, with applications in industrial, automotive, and renewable energy sectors.

-

In September 2025, Nidec expanded its Mena, Arkansas facility with a $19 million investment to increase production of electric motors, including gear motors, catering to rising demand from industrial automation and manufacturing industries.

Gear Motor Market Key Players

Some of the GEAR MOTOR Companies

-

ABB Ltd

-

Siemens AG

-

Schneider Electric SE

-

Eaton Corporation PLC

-

General Electric (GE)

-

Mitsubishi Electric Corporation

-

Nidec Corporation

-

Toshiba Corporation

-

Regal Beloit Corporation

-

Rockwell Automation

-

Crompton Greaves Limited

-

WEG S.A.

-

Baldor Electric Company

-

SEW-Eurodrive GmbH & Co KG

-

Lenze SE

-

Bonfiglioli Riduttori S.p.A.

-

Rexnord Corporation

-

Nord Drivesystems

-

Bosch Rexroth AG

-

Emerson Electric Co.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 27.75 Billion |

| Market Size by 2033 | USD 46.05 Billion |

| CAGR | CAGR of6.54% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (AC Gear Motors, DC Gear Motors, Servo Gear Motors, Planetary Gear Motors, Helical Gear Motors, Worm Gear Motors) • By Power Rating: (Up to 1 kW, 1–5 kW, Above 5 kW) • By Mounting Type: (Foot Mounted, Flange Mounted, Shaft Mounted) • By End-User Industry: (Automotive, Manufacturing, Material Handling, Robotics & Automation, Food & Beverage, Mining & Metals, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | ABB Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, General Electric (GE), Mitsubishi Electric Corporation, Nidec Corporation, Toshiba Corporation, Regal Beloit Corporation, Rockwell Automation, Crompton Greaves Limited, WEG S.A., Baldor Electric Company, SEW-Eurodrive GmbH & Co KG, Lenze SE, Bonfiglioli Riduttori S.p.A., Rexnord Corporation, Nord Drivesystems, Bosch Rexroth AG, Emerson Electric Co. |