U.S. Packaged Food Market Size & Overview:

The U.S. Packaged Food Market size was valued at USD 1128 billion in 2023 and is expected to reach USD 1734.95 billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2024-2032. Busy lifestyles continue to fuel the demand for convenient food options. Consumers are seeking out for packaged foods which are easy to prepare and store. This rise of e-commerce platforms has further boosted the sales by making packaged foods readily available for online purchases and deliveries. The food manufacturers are constantly developing the new and exciting products to cater the changing consumer preferences. This includes the focus on healthier ingredients, with a rise in demand for organic, natural, and minimally processed options. The plant-based alternatives to meat and dairy products are gaining the significant traction. Thus, there is a growing interest in bold flavours and ethnic cuisines, prompting the manufacturers to introduce the new varieties that cater to these trends.

Get More Information on US Packaged Food Market - Request Sample Report

The sustainable packaging solutions are another area of advancement. As consumers become more environmentally conscious, the packaged food industry is responding with eco-friendly packaging materials and recyclable options. This focus on sustainability is driven by the consumer preferences and also by government initiatives which promotes the responsible waste management and resource utilization. These factors combined are shaping the future of the U.S. Packaged Food Market, ensuring a dynamic and ever-evolving landscape in future.

U.S. Packaged Food Market Dynamics:

Key Drivers:

- Busy lifestyles are driving demand for convenient, ready-to-eat or heat-and-serve options.

- Food science advancements are leading to innovative products like plant-based alternatives.

- E-commerce growth is making packaged foods readily available for home delivery.

The explosive growth of e-commerce is significantly impacting how Americans obtain their packaged food. In the past, grocery shopping often involved a physical trip to the store to browse shelves and select items. Today, however, consumers can conveniently shop for a vast array of packaged foods from the comfort of their own homes. User-friendly e-commerce platforms allow customers to browse virtual aisles stocked with everything from pantry staples to specialty snacks. Once a selection is made, the chosen packaged foods are delivered directly to the customer's doorstep, eliminating the need for a physical shopping trip. This convenience factor is a major driver for the U.S. packaged food market. Busy individuals and families with limited time appreciate the ability to have their groceries delivered, saving them valuable time and effort. The e-commerce platforms often offer features like subscription services and targeted promotions, further enhancing the appeal of online packaged food shopping. As e-commerce continues to grow and evolve, it's likely to play an even greater role in shaping how Americans obtain and consume packaged food products.

Restraints:

- Increasing consumer preference for fresh, locally-sourced products may challenge packaged food sales.

- Fluctuations in commodity prices can affect the affordability and profitability of packaged food production.

The cost of raw ingredients like grains, sugar, and oils can fluctuate significantly, impacting both affordability for consumers and profitability for manufacturers. When commodity prices rise, packaged food companies may face pressure to raise their own prices, potentially leading to sticker shock for consumers and reduced sales. If commodity prices fall, companies may struggle to maintain profit margins, impacting their ability to invest in innovation and marketing. This price volatility creates uncertainty for both businesses and consumers, making it difficult to plan and budget effectively. Thus, these fluctuations can disrupt supply chains, as companies struggle with securing raw materials at stable prices.

U.S. Packaged Food Market Segments:

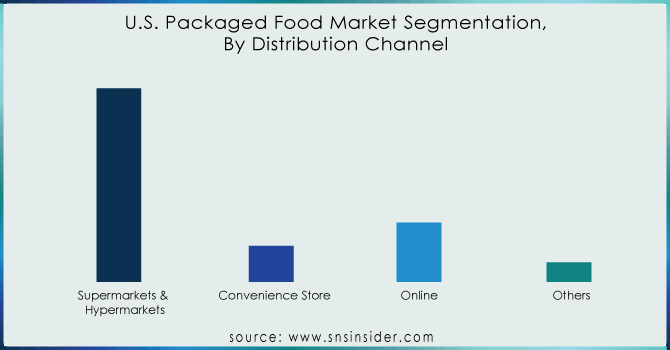

By Distribution Channel

-

Supermarkets & Hypermarkets

-

Convenience Store

-

Online

-

Others

Supermarkets and hypermarkets is the dominating sub-segment in the U.S. Packaged Food Market by distribution channel holding above 67% of market share. They offer a one-stop-shop experience, allowing consumers to purchase a wide variety of packaged goods alongside fresh produce and other household essentials. This convenience factor is crucial for busy consumers who value time-saving solutions. These stores have the physical space to accommodate a large selection of national and regional brands, catering to diverse consumer preferences. The supermarkets and hypermarkets often leverage bulk buying power to negotiate competitive prices for packaged foods, making them a cost-effective option for many consumers.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Product

-

Bakery & Confectionary Products

-

Dairy Products

-

Snacks & Nutritional Bars

-

Beverages

-

Sauces, Dressings, & Condiments

-

Ready-to-Eat Meals

-

Breakfast Cereals

-

Processed Meats

-

Rice, Pasta, & Noodles

-

Ice Creams & Frozen Novelties

-

Others

Beverages is the dominating sub-segment in the U.S. Packaged Food Market by product holding above 16% of market share. The beverages are a necessity, consumed throughout the day to quench thirst and stay hydrated. This regular consumption drives consistent demand. The beverage category offers a vast array of options, from bottled water and juices to soft drinks, coffee, and tea. This variety caters to diverse taste preferences and caters to different consumption occasions. The advancements in packaging technology have led to a proliferation of single-serve and portable beverage options, perfectly aligned with the on-the-go lifestyles of many consumers.

U.S. Packaged Food Market Country Analyses:

The West Coast is experiencing the strongest growth in this market. The region boasts a large health-conscious population, driving demand for organic, plant-based, and functional packaged foods. The presence of a thriving tech industry with a young, busy workforce fuels the market for convenient, ready-to-eat options. The government initiatives in these states often focus on promoting healthy eating habits, which can indirectly benefit the sales of packaged foods catering to these preferences. For example, California has implemented various programs to encourage access to fresh fruits and vegetables in underserved communities, potentially influencing the demand for healthy packaged alternatives in these areas.

U.S. Packaged Food Market Key Players

The major key players are Nestlé, The Coca-Cola Company, yson Foods, Inc., Mars, Incorporated, Cargill, Incorporated, The Kraft Heinz Company, PepsiCo, General Mills Inc., Conagra Brands, Inc., Kellogg Co. and other key players.

U.S. Packaged Food Market Recent Development

-

In June 2024: Kraft Heinz grew its partnership with Chile-based NotCo to launch plant-based Oscar Mayer hot dogs and sausages, now available in approximately 4,000 stores across the United States, including retailers such as Albertson's, Safeway, and Mayer.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1128 Billion |

| Market Size by 2032 | US$ 1734.95 Billion |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Distribution Channel (Supermarkets & Hypermarkets, Convenience Store, Online, Others) • By Product ( Bakery & Confectionary Products, Dairy Products, Snacks & Nutritional Bars, Beverages, Sauces, Dressings, & Condiments, Ready-to-Eat Meals, Breakfast Cereals, Processed Meats, Rice, Pasta, & Noodles, Ice Creams & Frozen Novelties, Others ) |

| Regional Analysis/Coverage | USA |

| Company Profiles | Nestlé, The Coca-Cola Company, yson Foods, Inc., Mars, Incorporated, Cargill, Incorporated, The Kraft Heinz Company, PepsiCo, General Mills Inc., Conagra Brands, Inc., Kellogg Co. |

| Key Drivers | • Busy lifestyles are driving demand for convenient, ready-to-eat or heat-and-serve options. • Food science advancements are leading to innovative products like plant-based alternatives. • E-commerce growth is making packaged foods readily available for home delivery. |

| Restraints | • Increasing consumer preference for fresh, locally-sourced products may challenge packaged food sales. • Fluctuations in commodity prices can affect the affordability and profitability of packaged food production. |