Luxury Fashion Market Report Scope & Overview:

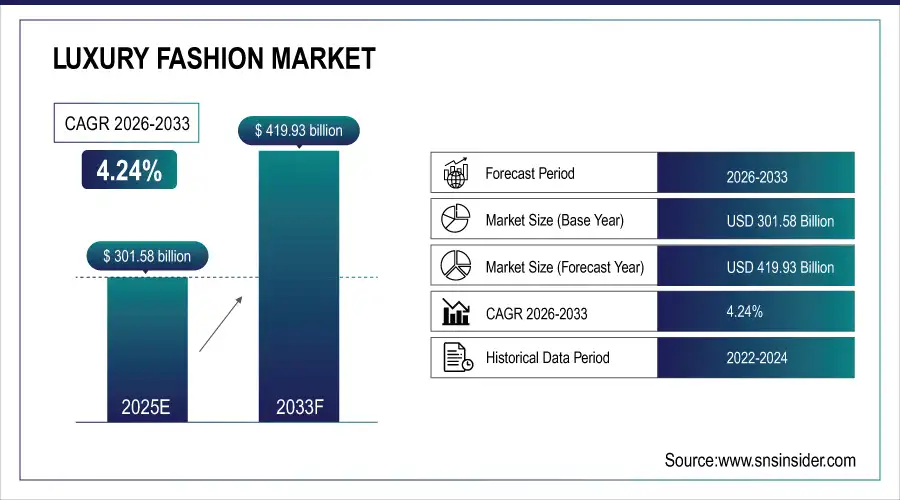

The Luxury Fashion Market Size was valued at USD 301.58 Billion in 2025E and is expected to reach USD 419.93 Billion by 2033 and grow at a CAGR of 4.24% over the forecast period 2026-2033.

The Luxury Fashion Market analysis, driven by higher disposable incomes alongside growth in high-net-worth individuals’ population, primarily in North America and Europe. Driven by a rising awareness towards brand, aspirational lifestyle and need for premium quality products, consumers are splurging on luxury apparel, footwear and accessories. According to study, social media and influencer marketing boost brand engagement by up to 30%, encouraging frequent purchases of seasonal and limited-edition collections.

Market Size and Forecast:

-

Market Size in 2025: USD 301.58 Billion

-

Market Size by 2033: USD 419.93 Billion

-

CAGR: 4.24% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Luxury Fashion Market - Request Free Sample Report

Luxury Fashion Market Trends

-

Rising disposable incomes driving demand for premium luxury fashion globally.

-

Growing high-net-worth population increases aspiration for exclusive and branded products.

-

Digital channels expanding accessibility to luxury goods among younger consumers.

-

E-commerce platforms enabling personalized shopping experiences and virtual try-on services.

-

Social media and influencer marketing significantly boosting brand engagement and awareness.

-

Asia-Pacific emerging as fastest-growing market due to rising internet penetration.

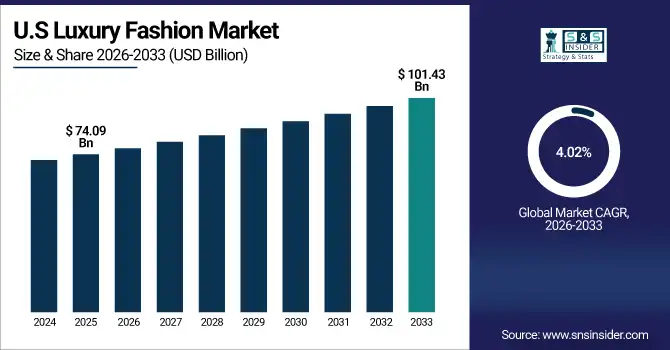

The U.S. Luxury Fashion Market size was USD 74.09 Billion in 2025E and is expected to reach USD 101.43 Billion by 2033, growing at a CAGR of 4.02% over the forecast period of 2026-2033, driven by high consumer purchasing power, brand loyalty, and premium retail experiences. E-commerce growth, omnichannel strategies, and influencer marketing further enhance accessibility and engagement, sustaining steady expansion of apparel, footwear, and accessories.

Luxury Fashion Market Growth Drivers:

-

Rising Wealth Fuels Global Demand For Premium Luxury Fashion Products

The Luxury Fashion Market growth driven by, consumers need for personalisation and separation from everyone who love luxury articles. Luxury consumers also want personalized services, private catwalks and tailored wardrobes that reflect their unique lifestyle and prestige in addition to high-quality apparel, footwear and accessories. Brands that provide personalization, exclusivity and experience are attracting loyal customers and able to charge a premium over competitors. At the same time, digital luxury experiences, such as virtual try-ons, AI-driven recommendations, and interactive online engagement, also promote the growth of the market with younger, technology-oriented consumers all around the world.

Brand consciousness and aspirational lifestyles continue to drive repeat purchases, accounting for roughly 30% of annual sales globally.

Luxury Fashion Market Restraints:

-

High Prices And Economic Uncertainty Limit Luxury Fashion Market Growth

A major challenge for the Luxury Fashion Market is the high cost of a premium product which makes luxury Fashion Market-parenting products accessible to only the affluent consumers. Discounted infuses luxury apparel, footwear and accessories of mask adoption positive mass outlay as the adapted price sensitivity particularly in emerging markets. Sales can be affected due to economic fluctuations, inflation, or global financial instability which can result in decreased discretionary spending. Moreover, fake items dilutes the exclusivity of a brand and impact the consumer perception about their values; All these factors combined hinder the growth of the market thereby making it essential to strike a balance between unique price, profit and market presence.

Luxury Fashion Market Opportunities:

-

E-Commerce Expansion Unlocks New Markets And Digital Engagement Potential

The rapid growth of e-commerce and digital platforms presents a huge opportunity for the Luxury Fashion Market. Luxury brands have an opportunity to connect with younger, digitally native consumers through online retail, where personalized experiences that favor convenience complement eCommerce systems. Virtual try-ons, AI-targeted product recommendations, and interactive social media campaigns are just few features that boost engagement and sales. In addition, as internet penetration and mobile-first consumers increase in the Asia-Pacific region, this may provide even more room for future growth. Utilising omnichannel strategies and digital innovations, luxury brands have the opportunity to reach new markets, strengthen brand loyalty and grow overall market share.

Features such as virtual try-ons and AI-driven recommendations influence nearly 35% of online purchase decisions, while interactive social media campaigns boost engagement by up to 30% per campaign.

Luxury Fashion Market Segmentation Analysis:

-

By Group: In 2025, Women led the market with a share of 58.50%, while Men is the fastest-growing segment with a CAGR of 7.80%.

-

By Type: In 2025, Clothing & Apparel led the market with a share of 52.40%, while Accessories is the fastest-growing segment with a CAGR of 7.60%.

-

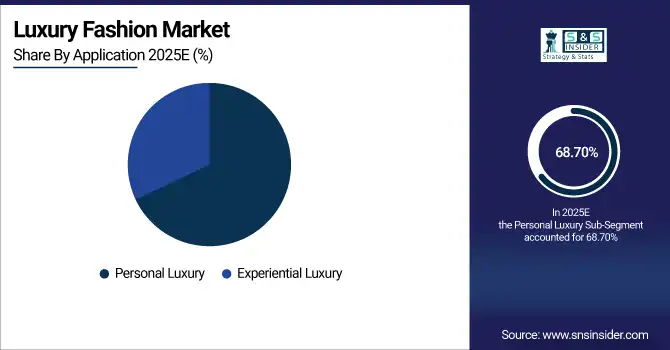

By Application: In 2025, Personal Luxury led the market with a share of 68.70%, while Experiential Luxury is the fastest-growing segment with a CAGR of 7.80%.

-

By Distribution Channel: In 2025, Store-Based led the market with a share of 62.50%, while Non-Store-Based is the fastest-growing segment with a CAGR of 7.04%.

By Group, Women Leads Market and Men Fastest Growth

The Women leads the market in 2025, owing to High consumption of premium apparel, footwear, and accessories, among female consumers are fuelling the market demand, supported by high disposable incomes, aspirational lifestyles, and brand consciousness, especially in North America and Europe. This dominance is made more certain as luxury continues to announce women’s collections with the seasonal, limited edition and personalisation strategies that drive them. Meanwhile, Men is the fastest-growing segment supported by rise in fashion consciousness, grooming culture and interest in luxury lifestyle products among male consumers is increasing rapidly on global scale with emerging markets like Asia-Pacific region.

By Type, Clothing & Apparel Leads Market and Accessories Fastest Growth

The Clothing & Apparel lead the market in 2025, driven by growing demand for made to order collections, seasonal fashion, and tailored quality goods. This segment is fuelled by repeat, brand-loyal and, in many cases, status- and style-hungry affluent customers and seasonal launches. Meanwhile, Accessories is the fastest-growing category, driven by rising cravings for luxury handbags, watches, jewellery and footwear. Social media influence, the home-story trend, as well as wanting to keep exclusive statement pieces are all contributing to this growth. Moreover, escalating demand for personalization and gifting also helps this certainly contribute to growth of accessories segment in international marketspace.

By Application, Personal Luxury Leads Market and Experiential Luxury Fastest Growth

The Personal Luxury leads the market in 2025, driven by consistent demand for premium apparel, footwear, and accessories that reflect status, personal style, and lifestyle aspirations. Consumers increasingly prefer exclusive, high-quality products that combine craftsmanship, brand heritage, and modern trends. Meanwhile, Experiential Luxury is the fastest-growing segment, driven by increasing consumer demand for fashion experiences like private showings, bespoke styling, unique events, and immersive brand experiences. More than ever, millennials and Gen Z are leaning towards experiences instead of owning objects hence the reason for this trend.

By Distribution Channel, Store-Based Leads Market and Non-Store-Based Fastest Growth

The Store-Based leads the market in 2025, fueled by flagship stores, boutiques and outlets which focus on luxury brands, combining the famous experience of a store-type or well-built business with a face-to-face service and interaction with the brand. Consumers would still rather go visit stores to experience how products are crafted, the quality and exclusivity of the product, thus reinforcing loyalty to the brand and improving customer satisfaction. Meanwhile, Non-Store-Based channels are the fastest-growing, riven by booming e-commerce, mobile shopping, and social commerce platforms. By leveraging digital innovations virtual try-ons, AI-powered recommendations, interactive online campaigns luxury brands can access youth and tech-savvy consumers who are eager to expand into emerging markets across the world.

Luxury Fashion Market Regional Analysis:

North America Luxury Fashion Market Insights:

The North America dominated the Luxury Fashion Market in 2025E, with over 34.10% revenue share, fueled by robust consumer demand for luxury apparel, footwear and fashion accessories. A developed luxury retail ecosystem with flagship stores, boutiques, and experiential in-store services. Growing brand awareness, aspirational lifestyle, and high purchasing capacity continue to drive demand for luxury goods. The use of omnichannel retail tactics further followed by the rise of e-commerce site helps the brand to approach to the users who are more comfortable with using the technology.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S and Canada Luxury Fashion Market Insights

China and India lead the Luxury Fashion Market driven by high disposable incomes, strong brand consciousness, and a preference for premium apparel, footwear, and accessories. E-commerce growth, omnichannel retail strategies, and influencer marketing further enhance accessibility and engagement, sustaining steady market expansion across both countries.

Asia Pacific Luxury Fashion Market Insights:

The Asia Pacific region is expected to have the fastest-growing CAGR 4.98%, driven by increasing disposable incomes, rising urbanization, and a growing middle-class population. The region is experiencing new levels of brand-consciousness and aspiration among consumers who are driving demand for premium apparel, footwear and accessories. With the boom of e-commerce and mobile commerce, luxury products took quite a significant leap in accessibility for all consumers, especially millennial and Gen Z consumers who are highly digitally savvy, along with social media channels, influencer marketing, and a personalized experience on various digital platforms.

China and India Luxury Fashion Market Insights

The luxury market in China and India is growing at extreme rates as people become more aware of luxury brands and as disposable incomes increase, reality of having a middle class is now taking shape. Premium apparel, footwear and accessories are being adopted with open arms by young, aspirational consumers. E-commerce adoption, mobile shopping, and social media influence also contribute to the growing consumption demand, making both countries as the global consumption growth engine.

Europe Luxury Fashion Market Insights

The Europe Luxury Fashion Market is witnessing steady growth, due to having numerous heritage luxury brands and a deeper appreciation of luxury apparel, footwear and accessories. Established retail networks, including flagship stores, boutiques, and high-end shopping districts, provide immersive brand experiences to the market. The demand is spurred by increasing brand awareness, aspirational lifestyles, and higher attraction towards customized and limited-edition items. Moreover, the utilization of e-commerce platforms, social networks and influencer marketing is creating new opportunities for luxury brands to be accessible to a wider demographic.

Germany and U.K. Luxury Fashion Market Insights

High purchasing power of the consumer in Germany and the U.K., along with great brand loyalty continue to make these markets a key luxury fashion market. For apparel, footwear, and accessories, consumers value quality, heritage, and exclusivity. Continued e-commerce growth, omnichannel strategies and influencer marketing additionally contribute to continued growth of the market and higher involvement for premium brands.

Latin America (LATAM) and Middle East Africa (MEA) Luxury Fashion Market Insights

The Luxury Fashion Market in Latin America (LATAM) and the Middle East & Africa (MEA) is experiencing steady growth, driven by increasing disposable incomes, improving urbanization, and greater demand for premium apparel, footwear and accessory over time. Growing retail infrastructure, high brand awareness and a young, aspiring consumer base in LATAM is driving demand, while in MEA, demand is supported by affluent populations, tourism and high cultural affinity towards high-end products. Increasing e-commerce, mobile shopping, and social media engagement is improving market access and company visibility. Finally, demand for limited-edition collections and customized and experiential luxury services is driving purchasing decisions, making both regions attractive markets for growth.

Luxury Fashion Market Competitive Landscape

Burberry continues to strengthen its position in the Luxury Fashion Market through a combination of classic British style and modern innovation. With its Summer 2025 collection and “scarf bar” retail concept, the brand emphasizes functional luxury and immersive in-store experiences. Burberry’s strategy highlights the growing consumer preference for personalized, premium products and experiential shopping, reinforcing the importance of brand heritage and in-store engagement in driving consistent demand in the luxury fashion segment.

-

In April 2025, Burberry unveiled its Summer 2025 collection at London Fashion Week, featuring a blend of classic British style with modern elements. The collection emphasized functional luxury, incorporating deconstructed trench coats and lightweight fabrics like silk poplin and linen.

Rolex exemplifies the Luxury Fashion Market’s focus on exclusivity, craftsmanship, and innovation. The launch of the Land-Dweller and GMT-Master II in 2025 demonstrates strong demand for high-quality, limited-edition timepieces. Rolex’s continued investment in precision engineering and iconic design underlines the market’s appeal among high-net-worth consumers seeking status, heritage, and long-term value. The brand’s performance reflects how innovation and exclusivity remain key growth drivers in the luxury fashion sector.

-

In April 2025: Rolex also unveiled the GMT-Master II with a new green ceramic dial, complementing the two-color green and black Cerachrom bezel insert. This update continues Rolex's tradition of combining innovation with iconic design.

Michael Kors highlights the role of digital innovation and technology in shaping the Luxury Fashion Market. By integrating augmented reality and AI-powered retail assistants, the brand enhances personalized online shopping experiences, targeting younger, digitally savvy consumers. Its contemporary product lines combined with immersive technology-driven engagement illustrate the growing trend of omnichannel retail strategies, where digital tools complement traditional luxury offerings to expand reach and drive brand loyalty in a competitive market.

-

In June 2024: Michael Kors introduced an AI-powered retail assistant named "Shopping Muse" on its U.S. website. This assistant uses generative AI to help customers choose items such as accessories or shirts, enhancing the online shopping experience.

Luxury Fashion Market Key Players:

Some of the Luxury Fashion Market Companies are:

-

Chanel

-

Hermès

-

Prada Group

-

Burberry

-

Cartier

-

Rolex

-

Valentino

-

Dolce & Gabbana

-

Michael Kors

-

Ralph Lauren

-

Salvatore Ferragamo

-

Hugo Boss

-

Versace

-

Armani

-

Ermenegildo Zegna

-

Tiffany & Co.

-

Moncler

-

Brunello Cucinelli

-

Tod’s

-

Bulgari

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 301.58 Billion |

| Market Size by 2033 | USD 419.93 Billion |

| CAGR | CAGR of 4.24% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Group (Women, Men, Unisex) • By Type (Clothing & Apparel, Footwear, Accessories) • By Application (Personal Luxury, Experiential Luxury) • By Distribution Channel (Store-Based, Non-Store-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Chanel, Hermès, Prada Group, Burberry, Cartier, Rolex, Valentino, Dolce & Gabbana, Michael Kors, Ralph Lauren, Salvatore Ferragamo, Hugo Boss, Versace, Armani, Ermenegildo Zegna, Tiffany & Co., Moncler, Brunello Cucinelli, Tod’s, Bulgari, and Others. |