Aseptic Packaging Market Key Insights:

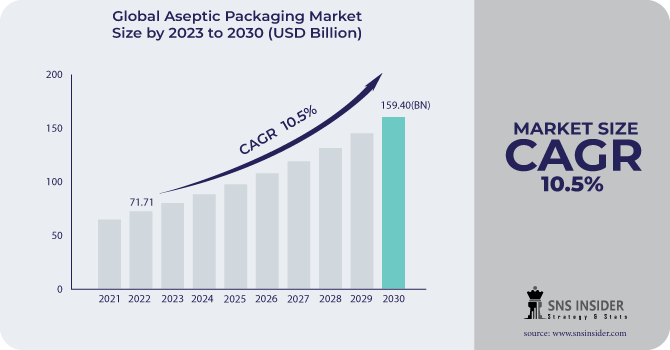

The Aseptic Packaging Market size was USD 79.19 billion in 2023 and is expected to Reach USD 178.74 billion by 2031 and grow at a CAGR of 10.68 % over the forecast period of 2024-2031.

Aseptic packaging is the process of sterilizing food, beverages, pharmaceuticals and other products separately from their packaging. This content is further filled into a packaging container in an aseptic state. Aseptic packaging is usually done at very high temperatures to preserve product freshness.

Get More Information on Aseptic Packaging Market - Request Sample Report

Rapid growth in end-use industries such as food, beverages, and pharmaceuticals in economies such as China, India, Brazil, and South Africa is expected to drive industry growth during the forecast period.

Increasing demand for processed foods such as instant meals, dairy products, frozen foods, cake mixes and snack foods is expected to have a positive impact on industry growth during the forecast period. Additionally, this type of packaging eliminates the need for refrigeration, making it convenient for on-the-go consumers. However, the higher acquisition costs associated with this technology compared to traditional processes are likely to slow growth during the forecast period.

Especially in countries such as China and India, urbanization is progressing and the demand for processed foods is increasing. In addition, growth in the milk and dairy market is also driving the aseptic packaging market.

The presence of alternative processes such as hot-fill technology, ESL, and pasteurization may hamper the market growth. However, the longer shelf life and safety of aseptic packaging are expected to give this technology a competitive advantage over the forecast period.

MARKET DYNAMICS

KEY DRIVERS:

-

Changing consumer preferences for the use of food preservatives may actually act as a driving force for the aseptic packaging market.

Consumer demand for clean label and natural foods is growing. Consumers are increasingly concerned about the potential health risks associated with artificial preservatives and additives in food and beverages. Therefore, preference is given to products with little or no preservatives.

-

Aseptic packaging offers consumers convenience and portability.

RESTRAIN:

-

Technical Complexity during aseptic packaging production acts as restrain

Aseptic packaging involves complex processes such as sterilization, filling under aseptic conditions, and sealing. Maintaining strict aseptic conditions throughout the process requires advanced equipment, trained personnel, and strict quality control measures. Aseptic packaging systems are technically complex and can present challenges in operation, maintenance, and troubleshooting.

-

Lack of consumer awareness regarding the benefits of aseptic packaging.

OPPORTUNITY:

-

Growing demand for organic and natural products

Consumers are increasingly demanding organic, natural products without artificial additives or preservatives. Aseptic packaging meets consumer preferences by providing a solution for packaging organic and natural products without the need for traditional preservatives. The market can benefit from the demand for aseptically packaged organic food and beverages that offer longer shelf life and maintain product quality.

-

Expanding Market for Ready-to-Drink (RTD) Beverages

CHALLENGES:

-

Aseptic packaging needs to comply with stringent regulatory requirements across various regions

Complying with these regulations can be complicated, especially operating in multiple jurisdictions with different legal frameworks. For manufacturers, complying with these regulations and obtaining the necessary certifications can be time-consuming and costly. Additionally, maintaining consistent quality standards and ensuring regulatory compliance across the supply chain can be challenging.

IMPACT OF RUSSIA-UKRAINE WAR

Due to the conflict various industries has a negative impact on their businesses. The aseptic packaging market was also affected due to the war. The major problem faced by aseptic packaging industries was in the supply of raw materials in the form of plastic, polyethylene, or other materials including metals.

Oil and gas prices went up due to which production cost across the European region went high. Oil prices went up to $ 120/Barrel during March 2022. Prices of natural gas went up to Euro 270/MW hr.

Russia has an exporting capacity of 5 million barrels per day, half of which is exported to the European region. The war caused a decrease in exports of oil and gas.

Metal prices went high at the time of war such as aluminium. Aluminium price went to $ 4100/tonne, which highest till now. This affected production across the globe.

IMPACT OF ONGOING RECESSION

The recession has dramatically changed the buying habits of consumers around the world. American spending rose by 40 %. Panic buying, combined with factory closures and global shortages of cardboard and polymers, has caused raw material prices to rise. Operating and labor costs also increased, and food prices soared.

At times of recession Companies’ investment in R & D fell by 13 %, due to which there is a delay in technological advancements in new products. This will restrain the growth of the overall market. New innovations and advancements in any industry give a boost to the market. Hence at times of recession market growth reduces or shows a significant rise.

KEY MARKET SEGMENTATION

By Raw Material

-

Plastic

-

Wood

-

Glass

-

Metal

-

Others

By Product Type

-

Bags & Pouches

-

Cartons

-

Ampoules

-

Prefilled Syringes

-

Others

By End use

-

Food & Beverages

-

Pharmaceutical

-

Others

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

Asia Pacific region is dominating the market due to the high demand for convenience food products. There is also the rise of the pharmaceutical industry in this region which is also adding to the growth of the market. Population increase in this region is a major reason for increasing demand for foods and beverages.

North American region is showing growth due to an increase in demand from the pharmaceutical industry. The ability to produce technologically advanced medical products is driving the market in this region.

Aseptic Packaging consumption in Europe is growing due to investment in beverage packaging solutions. Europe region has a huge demand for beverages. For the protection of beverages, aseptic packaging is needed giving growth to the market in this region.

The market in Latin America will show a significant rise giving rise to food and beverage consumption in this region. The growing population in this region is increasing the need for food and beverage consumption, ultimately rising the need for the aseptic packaging market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major key players in the Aseptic Packaging market are Sealed Air Corporation, DS Smith, IMA Group, Amcor Limited, Tetra Pak International SA, Berry Global Inc, Krones AG, International Paper, Great View Aseptic Packaging Company Ltd, LiquiBox and other players.

Tetra Pak International SA-Company Financial Analysis

RECENT DEVELOPMENTS

-

Aseptic food manufacturer FirstWave , has partnered with ProAmpac to commercialize aseptic spouted pouches.

-

SIG, Opens New Aseptic Carton Production Facility in Mexico.

-

Greatview Aseptic Packaging is expanding its operations in Europe. The company, currently operates its European plant in Germany.

| Report Attributes | Details |

| Market Size in 2023 | US$ 79.19 Bn |

| Market Size by 2031 | US$ 178.74 Bn |

| CAGR | CAGR of 10.68% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Plastic, Paper & Paperboard, Wood, Glass, Metal, Others) • By Product Type (Bags & Pouches, Cartons, Ampoules, Prefilled Syringes, Others) • By End Use (Food & Beverages, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Sealed Air Corporation, DS Smith, IMA Group, Amcor Limited, Tetra Pak International SA, Berry Global Inc, Krones AG, International Paper, Great View Aseptic Packaging Company Ltd, LiquiBox |

| Key Drivers | • Changing consumer preferences for the use of food preservatives may actually act as a driving force for the aseptic packaging market. • Aseptic packaging offers consumers convenience and portability. |

| Market Restraints | • Technical Complexity during aseptic packaging production acts as restrain • Lack of consumer awareness regarding benefits of aseptic packaging. |