Pharmaceutical Glass Ampoules Market Report Scope And Overview:

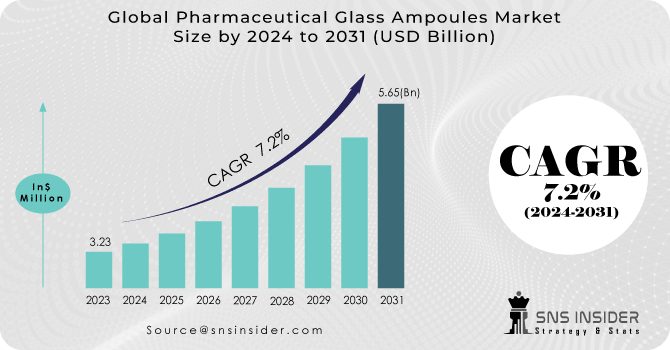

The Pharmaceutical Glass Ampoules Market Size was valued at USD 3.23 billion in 2023 and is expected to reach USD 5.65 billion by 2031 and grow at a CAGR of 7.2% over the forecast period 2024-2031.

Pharmaceutical glass ampoule manufacturers are expanding production of crushable glass ampoules using onion skin glass tubing. These single-use containers are preferred for medications, fluids, and gases due to their non-reactive nature. Emphasis is on custom-designed, tamper-resistant, and sterilizable glass ampoules, offering exceptional resistance to external elements. The market is driven by increased demand for pharmaceuticals, eco-friendly options on e-commerce platforms, and a shift to glass to reduce carbon footprint. The growth is further fuelled by the need for tamper-proof packaging and technological advancements in the pharmaceutical sector, creating lucrative opportunities for global players.

The increasing demand for pain relievers, anaesthetics, and anti-inflammatory drugs is fuelling the need for pharmaceutical glass ampoules. Manufacturers are increasingly recognizing the global imperative for top-tier medication administration standards, leading to advancements in ampoule design that provide optimal protection for drug formulations. Emphasizing patient safety, glass ampoules offer robust protection against environmental factors like moisture, oxygen, and light, ensuring the safety and efficacy of medications. With the ability to be crafted in compact and lightweight forms, glass ampoules are convenient to handle, store, and transport. This makes them particularly suitable for hospital and clinical settings where space and mobility are critical concerns. Additionally, their portability facilitates easy transportation between locations.

MARKET DYNAMICS

KEY DRIVERS:

- Increasing Demand for Injectable Drugs

The rising prevalence of chronic diseases and the growing reliance on vaccines and biologics have led to an increased demand for injectable drugs, which are commonly packaged in glass ampoules.

- Advancements in Pharmaceutical Manufacturing further fuelling the market growth.

RESTRAIN:

- Emergence of Alternative Packaging Solutions

The development of advanced polymers and plastics for pharmaceutical packaging poses a threat to the glass ampoules market, as these materials offer comparable barrier properties with reduced risk of breakage.

- Balancing standardization, customization, timely delivery, and cost-effectiveness presents a major challenge for glass ampoule manufacturers.

OPPORTUNITY:

- Growth in Biologics and Personalized Medicine

The expanding biologics sector and the rise of personalized medicine create opportunities for customized glass ampoule packaging solutions tailored to specific drugs and therapies.

- Smart packaging and serialization technologies in the pharmaceutical glass ampoules market utilize unique codes like QR or RFID tags on the ampoules.

CHALLENGES:

- The environmental impact of glass production and disposal is a growing concern.

- High costs associated with packaging and transporting pharmaceutical glass ampoules pose a significant challenge to market growth.

Impact of Russia Ukraine War

The Russia-Ukraine war has triggered disruptions in the pharmaceutical glass ampoules market supply chain, primarily impacting raw material access, such as silica sand. As key players in global raw material supply, logistical challenges and increased transportation costs have arisen, affecting ampoule production. The conflict's geopolitical tensions have also led to a surge in energy prices, impacting the energy-intensive manufacturing process and potentially raising end-user prices. Market uncertainty stemming from the regional instability is deterring investment and expansion plans, potentially hindering growth and innovation in the pharmaceutical glass ampoule sector.

Impact of Economic Slowdown

The economic crisis has introduced a heightened focus on cost sensitivity across industries, including the pharmaceutical sector, potentially impacting the demand for glass ampoules. Pharmaceutical companies, seeking more cost-effective packaging solutions during downturns, may consider alternatives that could compete with glass ampoules. Additionally, the economic downturn is likely to result in reduced investments in research and development within the Pharmaceutical Glass Ampoules Market, hampering innovation and slowing down the advancement of new designs and manufacturing processes. Despite the pharmaceutical industry's general resilience to economic downturns due to the essential nature of its products, fluctuations in demand for specific medications may still influence the overall demand for glass ampoules used in their packaging.

KEY MARKET SEGMENTS

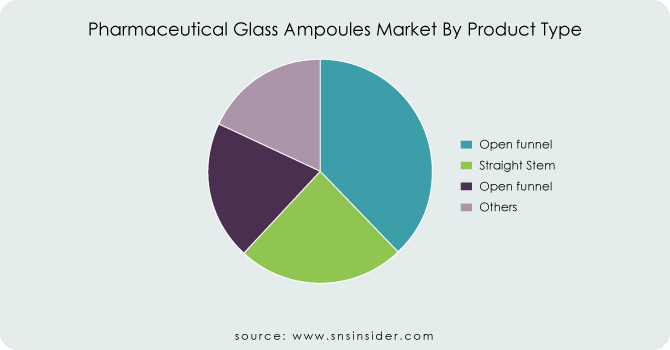

By Product Type

- Open funnel

- Closed Funnel

- Straight Stem

- Others

The open funnel product type dominates the pharmaceutical glass ampoules market with share 33%, mainly because of its user-friendly and adaptable design, securing the largest market share. Open-funnel ampoules excel in accommodating diverse drug formulations, driving their popularity and market dominance. Meanwhile, straight stem ampoules experience rapid growth in the pharmaceutical glass market due to their alignment with modern trends. They streamline production with automated processes and enhance aseptic packaging, minimizing contamination risks.

By Capacity

- Up to 2ml

- 3ml-5ml

- 6ml-8ml

- Above 8ml

The 3 ml - 5 ml capacity range dominates the pharmaceutical glass ampoules market with a 37% share, owing to its versatility and wide usage in vaccines, injectable, and diagnostics. This range strikes a balance between volume and compactness, making it preferred by manufacturers. Meanwhile, the 6 ml - 8 ml segment sees the fastest growth due to rising demand for specialized drug formulations, especially biologics and vaccines requiring slightly larger volumes.

By End Use

- Hospitals

- Pharmaceuticals

- Biotech Companies

- Others

REGIONAL ANALYSIS

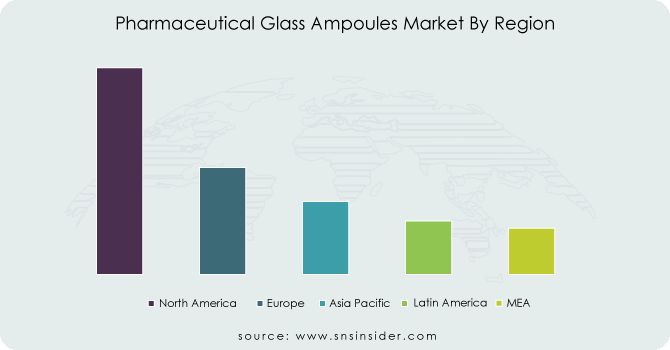

North America leads the pharmaceutical glass ampoules market with share 47.5%, due to its strong pharmaceutical industry with robust R&D, consistent demand for high-quality packaging, stringent regulatory standards, and the presence of major pharmaceutical companies. Additionally, the region's proactive stance on sustainability aligns well with the eco-friendly nature of glass packaging, further enhancing its popularity. In Europe, the proximity and economic relations with the Russia-Ukraine conflict have a significant impact. European nations might encounter difficulties in sourcing raw materials and managing higher energy expenses, possibly resulting in elevated prices and disruptions in the pharmaceutical glass ampoules supply chain.

The Asia Pacific region is witnessing rapid growth in the pharmaceutical glass ampoules market due to factors such as increased pharmaceutical production and consumption, rising demand for vaccination and freeze-dried formulations, expanding middle-class population, growing healthcare awareness, and cost-effective manufacturing capabilities such as China and India, and the rising demand for vaccination and freeze-dried formulations.

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

Key Players

Some of the major players in the Pharmaceutical Glass Ampoules Market are Schott AG, Gerresheimer AG, Nipro Corporation, Stevanato Group, Becton Dickinson and Company, West Pharmaceutical Services, Inc., Corning Incorporated, SGD Pharma, Piramal Glass, Triveni Polymers Pvt. Ltd., and other players.

Schott AG-Company Financial Analysis

RECENT DEVELOPMENTS

- In November 2023, Borosil, a glassware brand, aims to achieve a revenue milestone of INR 500 crore by 2025, propelled by a steady annual growth rate of 16–17%. This growth is anticipated to be largely fuelled by its key segments: pharmaceutical packaging, laboratory benchtop equipment, and process sciences.

- In October 2023, Siseecam entered into a letter of intent to invest in the Turkish technology company ICRON, known for its operational and strategic decision optimization services. Through this partnership agreement, Sisecam aims to deepen its collaboration with ICRON, taking its efforts to the next level.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.23 Billion |

| Market Size by 2031 | US$ 5.65 Billion |

| CAGR | CAGR of 7.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Open Funnel, Closed Funnel, Straight Stem, Others) • By Capacity (Up To 2ml, 2-10 Ml, Above 10 Ml) • By End Use (Hospitals, Pharmaceuticals, Biotech Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schott AG, Gerresheimer AG, Nipro Corporation, Stevanato Group, Becton Dickinson and Company, West Pharmaceutical Services, Inc., Corning Incorporated, SGD Pharma, Piramal Glass, Triveni Polymers Pvt. Ltd. |

| Key Drivers | • Increasing Demand for Injectable Drugs • Advancements in Pharmaceutical Manufacturing further fuelling the market growth. |

| Restraints | • Emergence of Alternative Packaging Solutions • Balancing standardization, customization, timely delivery, and cost-effectiveness presents a major challenge for glass ampoule manufacturers. |