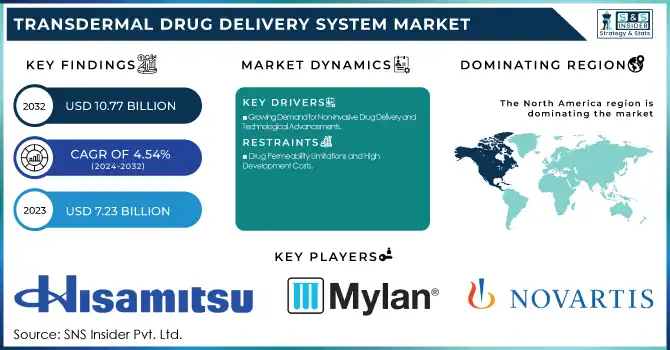

Transdermal Drug Delivery System Market Size & Overview:

The Transdermal Drug Delivery System Market size was USD 7.23 Billion in 2023 and is projected to grow to USD 10.77 Billion by 2032, with a CAGR of 4.54% over the forecast period 2024-2032. This report highlights prescription and utilization trends by region, focusing on the increasing demand for non-invasive drug delivery methods and the expanding adoption of transdermal systems in various therapeutic areas. The study examines production and supply trends for transdermal drug delivery devices, noting innovations in manufacturing and the increasing availability of these devices across global markets. Additionally, the report explores technological advancements and R&D investments, emphasizing the ongoing developments in transdermal systems, such as enhanced drug penetration techniques and the integration of smart technology, which are driving improvements in patient compliance and treatment efficacy.

To Get more information on Transdermal Drug Delivery System Market - Request Free Sample Report

Transdermal Drug Delivery System Market Dynamics:

Drivers

-

Growing Demand for Non-Invasive Drug Delivery and Technological Advancements

There is a steadily increasing incidence of chronic diseases; among the many are diabetes, cardiovascular diseases, and arthritis. The number of cases of diabetes globally is projected to rise to 700 million by 2045, leading to increased use of lifelong medications. There is increasing interest in non-invasive drug delivery systems like TDDS as it would be ideal to allow for the controlled and sustained release of the drug with decreased frequency of dosing. Advances in technology have led to the development of innovative techniques like microneedles and iontophoresis, which enhance the permeability of the skin, enabling better drug absorption. Studies have shown that microneedles can improve the transdermal delivery of large molecules such as insulin, offering a promising alternative to traditional injections.

Additionally, the elderly population, which is rapidly growing, faces challenges in taking oral medications or undergoing injections. For these patients, TDDS is relatively simpler and even more accessible. Regulatory bodies such as the FDA have also realized the potential of TDDS and issued guidelines on the quality and safety that should be followed in product development. For example, the FDA guidance on the development of transdermal systems addresses issues such as drug permeability, dosage forms, and the stability of the formulations, supporting innovation and patient safety.

Restraints

-

Drug Permeability Limitations and High Development Costs

The skin's natural barrier function limits the range of drugs available to be used in TDDS, which somewhat limits its applicability only to specific molecules that possess certain physicochemical properties. Potential skin irritation or allergic reactions can deter patient acceptance and compliance. The complexity and cost associated with developing and manufacturing transdermal systems can be higher than traditional dosage forms, causing economic challenges for manufacturers. Besides, achieving constant drug delivery rates is difficult due to interpatient variability in skin properties.

Opportunities

-

Expanding Therapeutic Applications and Digital Health Integration

The scope of drugs that can be delivered via the transdermal route will grow by adding biologics and large molecules to the list with the help of advanced formulations. A personalized medicine approach by tailoring transdermal therapy to individual needs enhances treatment efficacy and promotes patient satisfaction. Integration with digital health technologies, including wearable devices to monitor and control drug delivery, can help open new avenues for innovation. With the growth in both access and awareness for healthcare in emerging markets, there is tremendous potential to adopt TDDS.

Challenges

-

Overcoming Skin Barriers and Regulatory Hurdles for Growth

Continued research and development are required to overcome the skin's barrier to administer a more comprehensive range of drugs. Adherence by the patient to transdermal therapies needs user-friendly designs and minimizing the discomfort that might be perceived in applying patches. Regulatory hurdles in the form of stringent approval procedures and conformity with quality standards add to the delay in achieving the time-to-market for new products. TDDS market share faces competition from other drug delivery technologies, like oral sustained-release formulations and injectable depots.

Transdermal Drug Delivery System Market Segmentation Insights:

By Technology

Iontophoresis accounted for the largest share in 2023, with a market share of 19.1%. Its ability to penetrate drugs with the help of mild electrical currents contributes to this massive market share. This is why it has vast applications in the management of pain, delivery of hormones, and neurological treatment through controlled administration with minimal side effects. Demand for non-invasive drug delivery systems and the development of iontophoresis technology have further promoted it in the market. Additionally, iontophoresis is gaining traction in dermatology and ophthalmology for its precise drug delivery mechanism.

The mechanical array segment is expected to grow exponentially throughout the forecast period because of superior efficiency in bypassing the skin barrier without irritating it. Some of the other advantages of microneedles and other innovative transdermal technologies include drug administration without causing pain, improving bioavailability, and rapid action. Rising R&D in the field of biologics and vaccines, in addition to significant investment in novel drug delivery techniques, is helping this segment experience rapid growth.

By Application

The largest application area was the pain management segment in 2023, with a high market share because of the increasing prevalence of chronic pain conditions, including arthritis, migraines, and post-surgical pain. Fentanyl and lidocaine patches have become highly accepted because of their long-acting effects, ease of use, and lower risk of gastrointestinal complications as compared to oral analgesics. The growing geriatric population and a growing preference for opioid-alternative pain management solutions also enhanced the dominance of the segment.

The hormone therapy segment is anticipated to be the fastest-growing segment throughout the forecast period. The increasing prevalence of hormonal disorders, menopause-related symptoms, and thyroid imbalances has increased the demand for transdermal HRT. HRT provided via transdermal patches maintains consistent levels of hormones, minimizes the occurrence of systemic side effects, and increases patient compliance compared with oral formulations. Increasing awareness about BHRT and growing elderly demographics preferring estrogen and testosterone transdermal patches are also significant drivers behind the massive growth of the market.

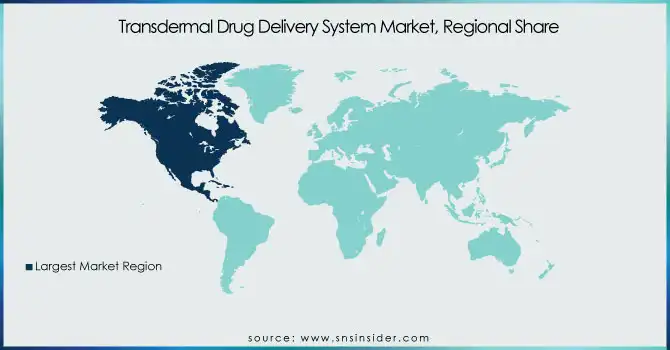

Transdermal Drug Delivery System Market Regional Analysis:

North America region dominated the TDDS market in 2023, supported by a well-established healthcare infrastructure, high adoption of advanced drug delivery technologies, and a strong presence of leading pharmaceutical companies. The United States contributed the largest share, driven by the growing prevalence of chronic diseases such as pain disorders, cardiovascular diseases, and neurological conditions. The market in the region was further supported by favorable regulatory policies from the FDA, besides increasing investments in biopharmaceutical R&D.

The Asia-Pacific is expected to register the highest growth over the projected period due to rapid urbanization, growing expenditures on health care, and increased awareness among patients for advanced drug delivery systems. China, India, and Japan are experiencing demands for self-administered, non-invasive remedies along with expanding bases of chronic disease patients. Moreover, further enlargements in pharmaceutical manufacturing capabilities coupled with overall government policies positively facilitate the growth of the TDDS market in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Products Offered by Them Related to The Transdermal Drug Delivery System

-

Hisamitsu Pharmaceutical Co., Inc. – Salonpas, MOHRUS TAPE, MOHRUS PAP, MOHRUS PAP XR, Estrana

Tape, Feitas -

Mylan Pharmaceuticals, Inc. – Xulane

-

Novartis AG – Exelon Patch

-

UCB – Neupro

-

GlaxoSmithKline – Nicorette, Nicoderm CQ

-

Boehringer Ingelheim GmbH – Butrans Patch

-

Johnson & Johnson – Duragesic

-

Endo International – Lidoderm

-

Purdue Pharma – Butrans, Hysingla ER

-

Grünenthal – Transtec

-

3M Company – Transderm Scop

-

Noven Pharmaceuticals, Inc. – Vivelle-Dot, Minivelle

-

4P Therapeutics, LLC – 4P-005

Recent Developments:

In Jan 2025, Alvogen, Inc. initiated a voluntary nationwide recall of one lot of its Fentanyl Transdermal System 25 mcg/h patches due to a defect in the delivery system. The issue arises from the potential for patches to be multi-stacked and adhered together in a single product pouch. The product is manufactured by Kindeva Drug Delivery L.P. and a private-label distributor as an Alvogen.

In April 2024, Biotts, a biopharmaceutical company based in Wrocław, Poland, became the first to successfully deliver insulin through the skin using its patented transdermal technology. The Proof-of-Concept project, conducted in collaboration with Bioton, Warsaw, has shown promising results, paving the way for the next phase of development.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 7.23 Billion |

|

Market Size by 2032 |

USD 10.77 Billion |

|

CAGR |

CAGR of 4.54% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Technology (Electroporation, Radio Frequency, Iontophoresis, Microporation, Thermal, Mechanical arrays, Ultrasound, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Hisamitsu Pharmaceutical Co., Inc., Mylan Pharmaceuticals, Inc., Novartis AG, UCB, GlaxoSmithKline, Boehringer Ingelheim GmbH, Johnson & Johnson, Endo International, Purdue Pharma, Grünenthal, 3M Company, Noven Pharmaceuticals, Inc., 4P Therapeutics, LLC. |