Veterinary Lab Automation Market Report Scope & Overview:

Veterinary Lab Automation Market was valued at USD 1.34 billion in 2025E and is expected to reach USD 2.60 billion by 2033, growing at a CAGR of 8.71% from 2026-2033.

The Veterinary Lab Automation Market is growing due to increasing demand for rapid, accurate diagnostic testing driven by rising companion animal ownership and growing awareness of animal health. Expanding livestock populations and the rising prevalence of zoonotic diseases are pushing veterinary clinics and diagnostic centers to adopt automated systems.

Veterinary Lab Automation Market Size and Forecast

-

Veterinary Lab Automation Market Size in 2025: USD 1.34 Billion

-

Veterinary Lab Automation Market Size by 2033: USD 2.60 Billion

-

CAGR: 8.71% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Veterinary Lab Automation Market - Request Free Sample Report

Veterinary Lab Automation Market Trends

-

Rising adoption of automated diagnostic analyzers for faster and more accurate testing.

-

Growing integration of AI and machine learning in veterinary diagnostic workflows.

-

Increasing demand for high-throughput systems in large veterinary hospitals and labs.

-

Expansion of molecular diagnostic automation driven by zoonotic disease surveillance.

-

Shift toward fully integrated lab automation platforms with streamlined data management.

-

Rising use of cloud-based software for real-time lab data tracking and reporting.

U.S. Veterinary Lab Automation Market was valued at USD 0.38 billion in 2025E and is expected to reach USD 0.73 billion by 2033, growing at a CAGR of 8.69% from 2026-2033.

The U.S. Veterinary Lab Automation Market is growing due to rising pet ownership, increased spending on animal healthcare, and the need for faster, more accurate diagnostics. Expanding veterinary clinics and technological advancements further drive adoption of automated testing systems.

Veterinary Lab Automation Market Growth Drivers:

-

Rising Companion Animal Ownership Driving Demand for Advanced Veterinary Lab Automation

Growing global pet adoption is significantly increasing the need for comprehensive and timely diagnostic testing, prompting veterinary clinics, hospitals, and diagnostic centers to invest in automated laboratory systems. As pet owners become more aware of preventive healthcare and demand higher-quality treatment, veterinarians require faster, more accurate, and high-throughput testing solutions. Automated analyzers and integrated lab systems help meet this rising diagnostic workload by improving efficiency, reducing manual errors, and enabling quick decision-making, ultimately supporting better clinical outcomes for companion animals.

In 2025, about 94 million U.S. households own at least one pet, representing 71% of all households, with around 68 million households owning dogs and 49 million owning cats. This growth in pet ownership correlates with increasing demand for rapid and accurate veterinary diagnostic testing

Globally, there are approximately 900 million pet dogs and 370 million pet cats as of 2024-2025, reflecting a large and growing base of companion animals requiring veterinary care.

-

Expansion of Veterinary Clinics and Diagnostic Laboratories Accelerating Adoption of Lab Automation

The rapid increase in veterinary clinics, animal hospitals, and specialized diagnostic laboratories is significantly boosting the adoption of automated analyzers and streamlined lab workflows. As veterinary networks expand and caseloads rise, facilities are seeking faster, more consistent, and high-volume diagnostic capabilities to support improved clinical efficiency. Automation enables laboratories to handle larger test volumes, reduce manual errors, and deliver quicker results, which is essential for meeting growing demand. This expansion is also encouraging investments in advanced diagnostic technologies that enhance productivity and support higher standards of animal healthcare.

|

Company |

Key Technologies/Products |

Description/Key Features |

|

Zoetis |

VETSCAN Imagyst (AI-powered digital microscopy) |

AI digital microscopy performing seven distinct AI diagnostic tests including fecal parasite detection; cloud AI algorithms; portable scanner; rapid, consistent analyses. |

|

IDEXX Laboratories |

SediVue Dx Urine Sediment Analyzer |

AI-powered automated microscopic analysis for blood, urine, fecal samples, improving accuracy and efficiency in smaller clinics. |

|

Vetology |

AI Virtual Radiologist engine |

AI analyzing radiographs, CT, MRI for rapid, detailed reports; automated cardiac measurements; integration with practice management. |

|

Digital |

AI practice management ecosystem |

AI-powered workflow automation with voice-to-text medical dictation, scheduling, telemedicine, inventory management. |

|

Goldie Vet |

AI transcription engine |

Converts veterinary conversations to detailed medical records securely, enhancing documentation efficiency. |

|

Heska (acquired by An tech) |

AI diagnostic tools, immunotherapy treatments |

State-of-the-art diagnostic imaging and tests for improved treatment speed and accuracy; integrated with practice management software. |

|

Signal PET |

Remote AI interpretation of veterinary radiographs |

AI-based imaging interpretation delivered remotely, enabling telemedicine diagnostics. |

|

Vet CT |

Advanced teleradiology services |

Combines AI and specialist radiologist input for veterinary imaging diagnostics. |

|

Antech Diagnostics |

Diagnostic platforms and AI-powered tools |

Integration of AI and digital tools for accurate and fast diagnosis aiding veterinary labs. |

Veterinary Lab Automation Market Restraints:

-

High Initial Investment Costs Limiting Adoption of Veterinary Lab Automation

Veterinary lab automation systems, including automated analyzers, integrated platforms, and advanced diagnostic technologies, require significant upfront capital investment. For many small and mid-sized veterinary clinics, animal hospitals, and diagnostic centers—especially in developing regions these costs can be prohibitive. Beyond the purchase price, additional expenses for installation, staff training, and infrastructure upgrades further increase the financial burden. As a result, many facilities delay or avoid adopting automation, relying instead on manual testing methods. This high initial cost remains one of the primary barriers to widespread market penetration.

Initial setup costs for automation equipment, IT systems, and staff training can consume 15–20% of total project expenses, discouraging smaller or budget-limited veterinary practices from adopting advanced diagnostic automation.

High upfront costs and unclear short-term ROI hinder small clinics; automated lab systems costing USD 50,000–150,000 plus maintenance, software, and training expenses make adoption challenging.

Veterinary Lab Automation Market Opportunities:

-

Rising Investments in Veterinary Research and Biotechnology Creating Strong Growth Opportunities

Increasing investments in veterinary research, biotechnology, and academic institutions are driving significant demand for advanced laboratory automation solutions. As veterinary universities and research centers expand their capabilities in areas such as molecular diagnostics, genomics, infectious disease studies, and vaccine development, the need for high-precision, high-throughput automated systems continues to grow. These institutions require reliable, efficient, and standardized testing platforms to support complex research workflows, enhance data accuracy, and accelerate scientific discoveries, creating substantial opportunities for automation providers in the veterinary diagnostics market.

Global biotechnology investments overall are strong, with the biotech sector expected to reach USD 5.85 trillion by 2034, including significant contributions from animal health and veterinary biotechnology, illustrating a supportive innovation and funding environment.

-

Growing Demand for Point-of-Care and Rapid Testing Solutions Driving Automation Opportunities

The increasing need for swift and accurate diagnostic results in veterinary clinics, emergency settings, and on-field environments is creating strong opportunities for point-of-care (POC) and rapid testing technologies. Veterinarians are increasingly seeking portable, easy-to-use automated analyzers that deliver real-time results, enabling faster treatment decisions and improved patient outcomes. As pet owners and livestock managers prioritize timely diagnosis, demand for compact, reliable, and high-performance POC devices continues to rise, supporting broader adoption of automation in veterinary diagnostics.

Veterinary Lab Automation Market Segmentation Highlights

-

By Product Type: In 2025, Analytical Systems led the market with share 52%, while Software is the fastest-growing segment with the highest CAGR (2026–2033).

-

By Technology: In 2025, Immunodiagnostics led the market with share 29%, while Molecular Diagnostics is the fastest-growing segment with the highest CAGR (2026–2033).

-

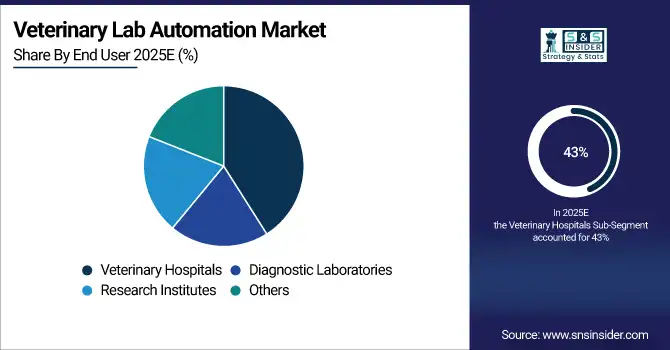

By End-Use: In 2025, Veterinary Hospitals led the market with share 43%, while Veterinary Hospitals is the fastest-growing segment with the highest CAGR (2026–2033).

Veterinary Lab Automation Market Segment Analysis

By Product Type

Analytical systems dominated the market in 2025, due to their essential role in high-volume testing, superior accuracy, and widespread use across routine diagnostics such as hematology and clinical chemistry. Their reliability, speed, and ability to handle diverse sample types make them indispensable in veterinary laboratories.

Software is expected to grow at the fastest CAGR from 2026–2033 as laboratories increasingly adopt digital platforms for data integration, workflow automation, remote monitoring, and real-time reporting. Rising demand for cloud-based solutions, connectivity with instruments, and enhanced decision-support tools is accelerating software adoption.

By Application

Immunodiagnostics dominated the market in 2025, owing to its broad application in infectious disease detection, hormone testing, and routine screening. Its high sensitivity, faster turnaround times, and ability to detect a wide range of biomarkers make it a preferred diagnostic approach in veterinary settings.

Molecular diagnostics is projected to grow at the fastest CAGR from 2026–2033 due to the rising need for precise pathogen detection, increasing focus on zoonotic diseases, and the expanding use of PCR-based and DNA/RNA testing. Advancements in automation and decreasing costs are further boosting its adoption in veterinary diagnostics.

By End User

Veterinary hospitals led the market in 2025, and are expected to grow at the fastest CAGR through 2033 due to increasing caseloads, rising pet ownership, and the need for rapid, on-site diagnostic results. Their growing adoption of automated analyzers, integrated software, and advanced testing capabilities supports faster decision-making, improved patient outcomes, and greater efficiency in clinical workflows.

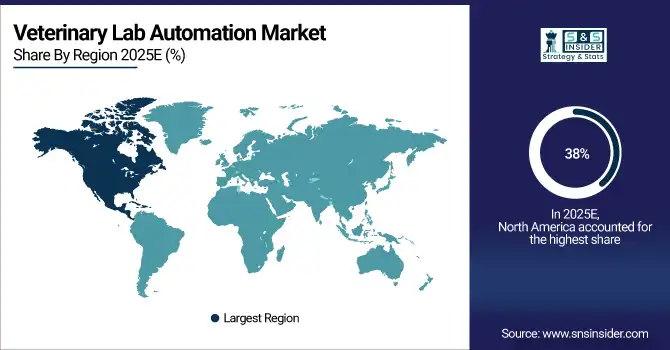

Veterinary Lab Automation Market Regional Analysis

North America Veterinary Lab Automation Market

North America dominated the Veterinary Lab Automation Market in 2025 with a 38% revenue share due to its advanced veterinary healthcare infrastructure, high adoption of automated diagnostic technologies, and strong presence of leading market players. Increased pet ownership, higher expenditure on animal health, and widespread availability of modern laboratory systems further support the region’s leadership in veterinary diagnostics.

The United States dominates North America’s veterinary lab automation market, driven by advanced veterinary infrastructure, high automation adoption, strong R&D investment, and expanding companion-animal diagnostic demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Veterinary Lab Automation Market

Asia Pacific is projected to grow at the fastest CAGR of around 11.04% from 2026–2033, driven by rapid expansion of veterinary clinics, rising awareness of animal health, and increasing investments in diagnostic infrastructure. Growing livestock populations, rising companion animal adoption, and government initiatives supporting veterinary disease surveillance are encouraging the adoption of automated laboratory systems across developing countries in the region.

China leads the Asia-Pacific veterinary lab automation market, supported by strong biotech investment, rapid AI-enabled automation uptake, and expanding diagnostic and research capacity.

Europe Veterinary Lab Automation Market Insights

Europe holds a significant share of the Veterinary Lab Automation Market due to its well-established veterinary healthcare systems, strong regulatory focus on animal health, and widespread adoption of advanced diagnostic technologies. The region benefits from high awareness of preventive veterinary care, rising demand for automated testing in companion and livestock sectors, and strong presence of research institutes and diagnostic laboratories driving continuous technological advancements.

Middle East & Africa and Latin America Veterinary Lab Automation Market

The Middle East & Africa and Latin America are seeing steady growth in veterinary lab automation as investments in animal healthcare, diagnostics, and disease surveillance increase. Rising livestock populations, zoonotic disease concerns, and expanding veterinary services especially in countries like Brazil, Mexico, and major MEA markets—are driving adoption of automated analyzers and digital solutions as laboratories modernize their workflows.

Veterinary Lab Automation Market Competitive Landscape:

IDEXX Laboratories, Inc.

IDEXX Laboratories, Inc. is a global leader in veterinary diagnostics, point-of-care devices, and digital practice-management solutions. The company focuses on integrating advanced laboratory automation, AI-enhanced diagnostics, and software-driven workflows to improve speed, accuracy, and efficiency in veterinary care. IDEXX continues to expand its ecosystem of analyzers, imaging tools, and cloud-based platforms, reinforcing its position as the most comprehensive provider of veterinary diagnostic infrastructure worldwide.

-

January 12, 2024: Launched the inVue Dx slide-free cellular analyzer, enabling automated cytology and blood-morphology evaluation to streamline in-clinic diagnostic workflows.

-

February 15, 2024: Introduced Vello, a pet-owner engagement software platform that enhances communication, compliance, and visit coordination for veterinary practices.

-

March 2025: Released the Cancer Dx panel for early detection of canine lymphoma, expanding IDEXX’s oncology diagnostics capabilities.

-

May 1, 2025: Q1 earnings highlighted 300+ global placements of in Vue Dx, underscoring strong adoption of its point-of-care instruments and strengthening of lab-automation workflows.

Zoetis Inc.

Zoetis Inc. is one of the world’s largest animal-health companies, expanding aggressively into diagnostic automation, AI-powered imaging, and cloud-connected laboratory systems. The company’s Vet Scan and Imagyst platforms are central to its strategy of transforming veterinary diagnostics through machine learning, digital cytology, and streamlined reference-lab integration. Zoetis also continues to strengthen its diagnostics network with expanded facilities and data-driven capabilities.

-

September 17, 2024: Announced a new cartridge-based AI-powered hematology analyzer, enhancing automation and precision in in-clinic blood analysis.

-

June 2, 2025: Launched AI Masses, an AI-powered cytology feature for the Vet Scan Imagyst analyzer, improving automated detection and interpretation of cytologic samples.

-

May 14, 2025: Established a new state-of-the-art reference laboratory in Louisville, expanding Zoetis’ diagnostic-services footprint across its reference-lab network.

Heska Corporation

Heska Corporation is a long-standing provider of advanced veterinary diagnostic instruments, imaging solutions, and point-of-care testing platforms. The company is known for its chemistry, hematology, and allergy-testing systems designed for rapid, reliable in-clinic diagnostics. Recent corporate developments indicate a strategic shift following its acquisition, with fewer publicly listed new-product announcements during 2024–2025.

-

April 3, 2023: Mars, Inc. announced its intent to acquire Heska, marking a significant consolidation in the veterinary-diagnostics market and strengthening Mars’ global diagnostics capabilities.

Veterinary Lab Automation Market Key Players

Some of the Veterinary Lab Automation Market Companies are:

-

IDEXX Laboratories, Inc.

-

Zoetis Inc.

-

Heska Corporation

-

Sysmex Corporation

-

Horiba Ltd.

-

Boule Medical AB

-

Hemo Cue AB

-

Shenzhen Mindray Animal Medical Technology Co., Ltd.

-

Antech Diagnostics, Inc.

-

Scopio Labs

-

Indica Labs Inc.

-

Thermo Fisher Scientific Inc.

-

BioMérieux SA

-

Randox Laboratories Ltd.

-

Siemens Healthineers AG

-

Midmark Corporation

-

B. Braun SE

-

Covetrus Inc.

-

Carestream Health

-

PetDx

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.34 Billion |

| Market Size by 2033 | USD 2.60 Billion |

| CAGR | CAGR of 8.71% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Pre-Analytical Systems, Analytical Systems, Post-Analytical Systems, Software, Others) • By Application (Clinical Chemistry, Hematology, Immunodiagnostics, Molecular Diagnostics, Others) • By End User (Veterinary Hospitals, Diagnostic Laboratories, Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IDEXX Laboratories, Inc., Thermo Fisher Scientific Inc., Zoetis Inc., Heska Corporation, Abaxis, Inc. (now part of Zoetis), Mindray Medical International Limited, Siemens Healthineers AG, Randox Laboratories Ltd., Agrolabo S.p.A., Neogen Corporation, Bio-Rad Laboratories, Inc., Virbac S.A., VCA Inc. (now part of Mars, Inc.), Beckman Coulter, Inc. (a Danaher company), Eurolyser Diagnostica GmbH, Scil Animal Care Company GmbH (a Heska company), Shenzhen Bioeasy Biotechnology Co., Ltd., IDvet, Skyla Corporation, Biochek B.V. |