Biopharmaceutical Excipients Market Size & Growth Overview:

Get more information on Biopharmaceutical Excipients Market - Request Sample Report

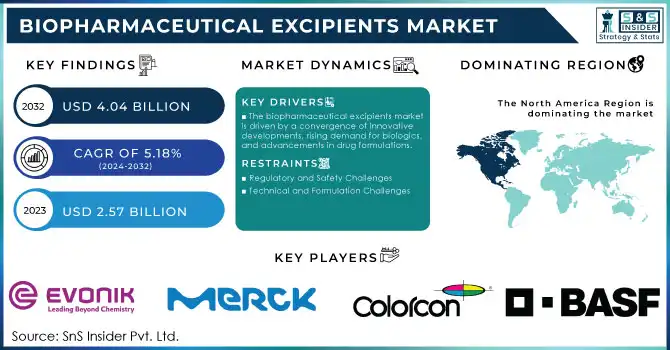

The Biopharmaceutical Excipients Market Size was valued at USD 2.57 billion in 2023 and is expected to reach USD 4.04 billion by 2032 and grow at a CAGR of 5.18% over the forecast period 2024-2032.

The biopharmaceutical excipients market is witnessing remarkable growth, driven by the rapid expansion of biologics and biosimilar therapies, alongside advancements in high-concentration drug formulations. Traditionally regarded as inactive components, excipients have evolved into active contributors to drug formulation, ensuring stability, enhanced solubility, and efficient delivery mechanisms. Surfactants like polysorbates are integral to over half of the monoclonal antibody formulations, addressing critical stability and aggregation challenges. Similarly, polymers such as polyethylene glycol (PEG) have seen significant adoption, with an annual application growth rate of approximately 12%, underscoring their importance in biopharmaceutical innovations.

The rise of high-concentration biologic formulations has highlighted the necessity for advanced excipients to overcome viscosity and protein aggregation issues. Over 70% of novel excipients are tailored specifically to meet the unique challenges of biologic drug formulations, including mRNA vaccines and monoclonal antibodies. Multifunctional excipients, which stabilize active ingredients while offering controlled-release functionalities, are experiencing a growth rate of nearly 15% annually, reflecting their expanding application across diverse drug delivery systems.

Sustainability is a key trend in this market, with more than 20% of newly developed excipients designed to align with eco-friendly and green chemistry standards. This aligns with increasing industry demands for sustainable production practices while maintaining stringent safety and efficacy requirements. Additionally, regulatory support for innovative excipients has accelerated, with multiple approvals granted each year, facilitating their integration into cutting-edge pharmaceutical formulations.

This robust growth trajectory highlights the critical role of biopharmaceutical excipients in advancing drug efficacy, optimizing manufacturing processes, and meeting the complex needs of next-generation therapeutics.

Market Dynamics

Drivers

-

The biopharmaceutical excipients market is driven by a convergence of innovative developments, rising demand for biologics, and advancements in drug formulations.

One key driver is the increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, which has fueled the demand for biologics. This has heightened the need for excipients that stabilize proteins, reduce aggregation, and ensure drug efficacy over extended storage periods. Another significant driver is the rise of high-concentration biologic formulations, necessitating excipients that address challenges such as high viscosity and solubility. Cyclodextrins and novel surfactants are increasingly employed to enhance injectability and patient compliance. For instance, over 70% of new excipients are designed to tackle specific issues in high-concentration biologic drugs.

Additionally, the development of multifunctional excipients, such as those enabling both stabilization and controlled drug release, is accelerating innovation in drug delivery systems. Multifunctional excipients are projected to grow at an annual rate of 15%, reflecting their adoption in next-generation therapies. Technological advancements, including single-use technologies in biopharmaceutical manufacturing, have further augmented the demand for excipients compatible with such systems. Moreover, sustainability concerns have led to the introduction of eco-friendly excipients, with over 20% of newly developed products incorporating green chemistry principles.

The increasing complexity of biopharmaceutical formulations and regulatory support for novel excipients underscore their indispensable role in addressing industry challenges while meeting growing therapeutic demands. These drivers collectively shape a vibrant, innovation-led excipient market.

Restraints

-

Regulatory and Safety Challenges

Novel excipients often require extensive toxicological and compatibility testing, leading to delays in approval processes. The high costs and lengthy timelines associated with these regulatory hurdles limit the adoption of innovative excipients.

-

Technical and Formulation Challenges

The complexity of biopharmaceutical formulations, including issues like excipient-drug interactions, stability under various conditions, and protein aggregation, poses a significant restraint. Incompatibilities between excipients and biologic drugs can lead to formulation failures, impacting the development and scalability of advanced therapeutics.

Key Segmentation

By Product

Solubilizers and surfactants/emulsifiers dominated the biopharmaceutical excipients market in 2023, accounting for approximately 42.0% of the market share. Their dominance is attributed to their essential role in enhancing the solubility and stability of biologics, particularly monoclonal antibodies and high-concentration protein formulations. These excipients mitigate aggregation issues and ensure consistent drug delivery, making them indispensable for injectable formulations.

Polyols are the fastest-growing product segment due to their widespread use as stabilizers in biologics. They prevent protein aggregation and oxidative stress, crucial for maintaining the efficacy of advanced biologics such as gene therapies and mRNA-based vaccines. The rising demand for these complex therapeutics has driven the rapid adoption of polyols in the market.

By Formulation

Injectable formulations held the largest share in 2023, capturing 55.0% of the market. The dominance is due to the growing prevalence of chronic diseases requiring biologics, many of which are delivered via injections. Injectables ensure precise dosing and high bioavailability, making them the preferred choice for biologic therapies.

Topical formulations are the fastest-growing segment, driven by innovations in dermatological biologics and transdermal delivery systems. These advancements cater to patients' demand for non-invasive treatments while ensuring localized and targeted drug delivery, boosting their adoption across various therapeutic areas.

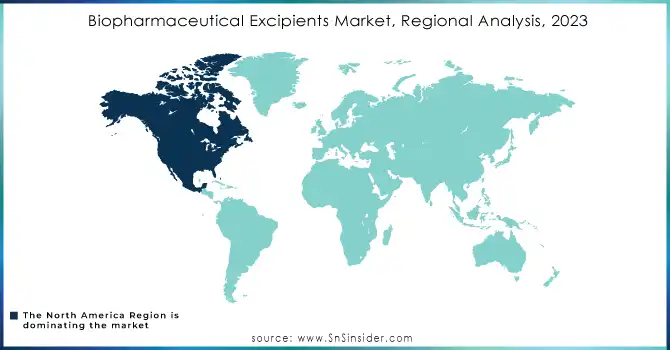

Regional Analysis

In North America, the market in terms of both revenue and innovation, accounted for the largest share in 2023. This dominance was primarily attributed to the robust pharmaceutical industry in the U.S., coupled with significant investments in biopharmaceutical research and development. The region also benefited from favorable regulatory frameworks that expedited the approval of new excipients and biologics, making it a hotspot for excipient innovations and production.

Europe followed closely, driven by increasing R&D activities, a well-established pharmaceutical sector, and a growing preference for biologics in therapeutic areas such as oncology and autoimmune diseases. The region also focused on sustainability, with many companies opting for green chemistry principles in excipient production. The approval of new excipients by the European Medicines Agency (EMA) further bolstered market growth.

In Asia-Pacific, the market is expected to experience the highest growth rate over the next few years. The expansion is fueled by increasing investments in biopharmaceutical manufacturing capabilities, particularly in China and India, which are becoming major hubs for both the production and consumption of biologics. Additionally, the rising prevalence of chronic diseases and growing healthcare access in emerging economies are driving demand for excipients tailored to high-concentration biologic formulations.

Need Any Customization Research On Biopharmaceutical Excipients Market - Inquiry Now

Key Players

Embulix, Glucaflux

-

Colorcon (BPSI Holdings Inc.)

Polyplasdone, Primojel, Opadry, Aquacoat

Kollicoat, Eudragit

-

Associated British Foods plc

Pharmasoft, PharmaGlide

-

Signet Excipients Pvt. Ltd (IMCD)

Imwitor

-

Sigachi Industries Limited

Sigacel

-

Spectrum Chemical Manufacturing Corp.

Hydroxypropyl Methylcellulose (HPMC)

-

Roquette Frères

Polyols, Mannogem

-

Clariant

Crosfield, Lupasol

-

DFE Pharma

Pharmaflow, Spheron

-

J. RETTENMAIER & SÖHNE GmbH + Co KG

VIVAPUR

-

Evonik Industries AG

Eudragit, SmartGels

Recent Development

-

In July 2023, Roquette acquired Qualicaps to enhance its expertise and capabilities in developing pharmaceutical excipients.

-

In June 2023, Lubrizol Corporation entered into a licensing agreement with Welton Pharma, enabling Welton to utilize the Apisolex excipient across multiple regions. This collaboration aims to advance the development and commercialization of a new SN-38 formulation for treating colorectal and gastrointestinal cancers.

-

In March 2023, Evonik Industries AG initiated the construction of a new facility in Indiana, U.S., aimed at enhancing the global supply chain for functional excipients, specifically for RNA medicines. This expansion is set to significantly support the biopharmaceutical excipients market and bolster the production capabilities needed for RNA-based therapies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.57 Billion |

| Market Size by 2032 | US$ 4.04 Billion |

| CAGR | CAGR of 5.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Solubilizes & Surfactants/Emulsifiers (Triglycerides, Esters, Others), Polyols (Mannitol, Sorbitol, Others), Carbohydrates (Sucrose, Dextrose, Starch, Others)] • By Formulation (Oral, Topical, Injectables) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA, Colorcon (BPSI Holdings Inc.), BASF SE, Associated British Foods plc, Signet Excipients Pvt. Ltd (IMCD), Sigachi Industries Limited, Spectrum Chemical Manufacturing Corp., Roquette Frères, Clariant, DFE Pharma, J. RETTENMAIER & SÖHNE GmbH + Co KG, Evonik Industries AG. |

| Key Drivers | • The biopharmaceutical excipients market is driven by a convergence of innovative developments, rising demand for biologics, and advancements in drug formulations. |

| Restraints | • Regulatory and Safety Challenges • Technical and Formulation Challenges |