Tele-Epilepsy Market Report Scope & Overview:

Get More Information on Tele-Epilepsy Market - Request Sample Report

The Tele-Epilepsy Market Size was valued at USD 387.43 million in 2023 and is expected to reach USD 1468.32 million by 2032, growing at a CAGR of 15.98% from 2024-2032.

The tele-epilepsy market is growth is propelled by innovations in telemedicine, the rising incidence of epilepsy, and a heightened need for remote healthcare options. Epilepsy, impacting millions worldwide, necessitates ongoing observation and accurate management to modify treatments and avert seizures. Tele-epilepsy employs technologies like wearable EEG devices, mobile applications, and teleconsultations to remotely monitor patients, providing immediate insights into seizure occurrences. Ongoing monitoring enhances the quality of care by allowing for prompt interventions and more individualized treatment strategies.

The Tele-Epilepsy market is especially supported by the need for personalized care since tele-epilepsy solutions enable customized therapies driven by specific patient data. Moreover, the incorporation of artificial intelligence (AI) and machine learning into tele-epilepsy systems is improving the precision of seizure forecasting, monitoring, and treatment, providing increased dependability for both patients and medical professionals. Tele-epilepsy solutions are advantageous for both children and adults, as regular monitoring is essential for effectively managing epilepsy across all age groups. For young patients, prompt intervention and ongoing monitoring are essential for decreasing seizure occurrences and enhancing long-term results. For adults, tele-epilepsy offers a more adaptable and effective management strategy, particularly for individuals with hectic schedules or those residing in isolated regions. Healthcare providers and hospitals are progressively embracing tele-epilepsy services, acknowledging the opportunity to boost patient access to expert care and improve overall treatment results. The expanding healthcare infrastructure in emerging markets is anticipated to further speed up the adoption of tele-epilepsy, broadening its accessibility and enhancing care delivery worldwide. With ongoing technological advancements, the tele-epilepsy market shows great potential for bettering epilepsy care and elevating the quality of life for patients globally.

Tele-Epilepsy Market Dynamics

Drivers

-

The rising incidence of epilepsy diagnoses globally is a major factor fueling the expansion of the tele-epilepsy market.

Epilepsy, a chronic neurological disorder characterized by recurrent seizures, affects millions globally, and its prevalence is steadily rising due to factors such as an aging population, genetic factors, and improvements in diagnostic techniques. As the demand for continuous monitoring and management of seizure occurrences grows, tele-epilepsy services present a practical option. By utilizing remote monitoring technologies, patients are able to track their condition in real-time, providing crucial information to both patients and healthcare professionals to enhance seizure prevention and management. The increasing demand for tailored care is driving the adoption of tele-epilepsy services, offering a viable and efficient way to control the condition.

-

The progress in telemedicine, along with the creation of wearable gadgets and mobile apps, is playing a crucial role in the expansion of the tele-epilepsy market.

Tele-epilepsy solutions enable healthcare professionals to monitor patients remotely, reducing the need for in-person visits and providing timely information to effectively manage seizure events. Wearable EEG devices, along with teleconsultation systems, enable continuous seizure monitoring, leading to faster response times and improved treatment outcomes. These innovations are transforming the provision of epilepsy care, particularly in rural and underserved areas where specialized services are limited. The growth of telemedicine services and the integration of AI and machine learning into tele-epilepsy systems enhance the accuracy and reliability of seizure prediction and monitoring, making tele-epilepsy an extremely effective choice for both patients and healthcare providers.

Restraint

-

Growth hindrances of the tele-epilepsy market are the regulatory and reimbursement challenges associated with telemedicine services.

Telemedicine practices, such as tele-epilepsy, utilize technology for remote diagnosis and treatment, often encountering intricate regulations that differ by region and nation. In numerous instances, the absence of uniform regulations concerning telemedicine practices, particularly in specialized fields such as epilepsy care, generates confusion for both patients and healthcare professionals. Moreover, reimbursement policies for tele-epilepsy services continue to develop, as numerous insurers are reluctant to offer coverage for telemedicine consultations or remote monitoring devices. This establishes a financial obstacle for both patients and providers, hindering the broad acceptance of tele-epilepsy options. As regulatory structures evolve and reimbursement systems improve, these difficulties might diminish, but for now, they continue to pose a major barrier to market expansion.

Tele-Epilepsy Market Segment Analysis

By Patient

According to patients, the Adult Category dominated the market with the highest revenue share of 54% in 2024. An adult with epilepsy faces a higher risk of experiencing serious complications following seizures, which enhances the importance of tele-epilepsy. The increasing incidence of epilepsy in adults is fueling market expansion. According to the CDC report, close to 2.9 million adults aged 18 and older in the U.S. indicated they were living with active epilepsy in the last few years. Moreover, 38% of U.S. adults with active epilepsy reported having a disability. Additionally, technological progress allows for real-time observation and tailored treatment strategies, thereby promoting market expansion.

The Pediatric segment is expected to experience a significant CAGR during the forecast period. Cases of epilepsy in children differ from those in adults, especially in terms of seizure varieties and epilepsy syndromes, since children generally possess more robust immune systems and are less prone to other illnesses. For example, juvenile seizures and epileptic conditions like Lennox-Gastaut syndrome, childhood absence epilepsy, and Dravet syndrome are often separate in the child population. Furthermore, the rise in epilepsy cases among children will enhance the growth of this segment. For example, the National Survey of Children's Health in 2022 indicates that around 456,149 children in the U.S. who are 17 and younger currently have active epilepsy.

By Component

According to component analysis, the Software segment dominated the market with a significant revenue share of 42% in 2023, driven by the widespread adoption of videoconferencing technology, audio devices, microphones, and various medical tools to facilitate virtual appointments. Furthermore, advancements in sensors and connectivity, like instant data transfer through mobile apps, improve the capabilities of these devices, consequently accelerating industry growth. Moreover, as an understanding of epilepsy care expands, the demand for specialized equipment that facilitates remote consultations and telemonitoring becomes more critical, thereby driving market expansion.

The service segment is expected to experience the fastest CAGR throughout the forecast period. The expansion of the segment will be driven by the widespread adoption of teleconsulting between doctors and patients. These services provide remote consultations, continuous patient monitoring, and tailored care plans that enable prompt interventions and enhance patient involvement. Moreover, the incorporation of educational materials and support systems in tele-epilepsy services improves patients' comprehension and handling of their condition. The previously mentioned factors are propelling the growth of the segment.

End-use

The Healthcare Consumer segment dominated the market, capturing a substantial revenue share of 53% in 2023, due to the growing empowerment of patients and their need for more personalized and accessible healthcare services. Furthermore, the incorporation of intuitive mobile apps and wearable technology enables patients to closely observe their health, monitor seizure occurrences, and obtain instant feedback, thus fueling market expansion. Moreover, increasing recognition of telehealth services among the public is driving market expansion.

The Hospital Providers segment is expected to experience the fastest CAGR during the forecast period. The increase is expected since patients favor hospitals for their treatment, providing convenience and a range of products in a single place. Furthermore, hospitals are ubiquitous and readily available to all patients, consequently aiding in segment growth. As of January 2023, there are approximately 7,335 functioning hospitals in the United States, according to the Definitive Healthcare HospitalView product. From August 2020 to January 2023, the total count of hospitals tracked in the HospitalView product increased by 88, reflecting a combination of new hospital openings and shutdowns.

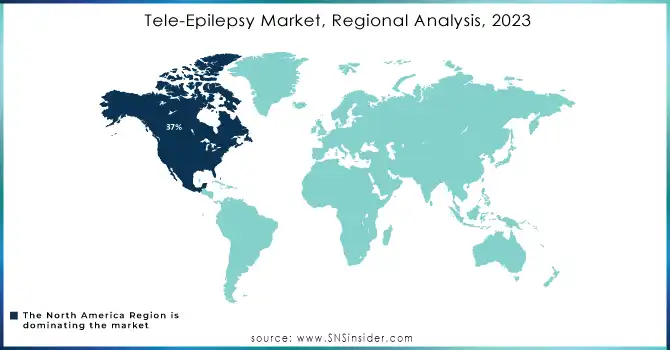

Tele-Epilepsy Market Regional Overview

In 2023, the tele-epilepsy market in North America held the largest revenue share of 37%, due to its advanced technological infrastructure, increasing incidence of epilepsy, and rising per capita income. Furthermore, the existence of numerous market participants and favorable government regulations in the area are enhancing regional development.

The tele-epilepsy market in the Asia Pacific region is expected to exhibit the fastest CAGR during the forecast period, driven by the growing use of smartphones and smart wearables, along with the increasing acceptance of telehealth services. Furthermore, the growing need for remote patient monitoring and related services, driven by heightened government investment in healthcare, is anticipated to drive industry growth.

Need Any Customization Research On Tele-Epilepsy Market - Inquiry Now

Key Players in Tele-Epilepsy Market

-

Daicel Arbor Biosciences (myBaits Target Capture Kits, myTXTL Cell-Free Protein Expression System)

-

Thermo Fisher Scientific (Ion Torrent Genexus System, Invitrogen QuantiGene Plex Assay)

-

NeuroPace, Inc. (RNS System, NeuroPace Monitoring System)

-

Cerner Corporation (Cerner Telemedicine Services, Cerner Epilepsy Management Software)

-

Livongo Health (now part of Teladoc Health) (Livongo for Epilepsy, Livongo Telehealth Platform)

-

Medtronic (Medtronic's Remote Monitoring Epilepsy Management System, Neurostimulators for Epilepsy Treatment)

-

MedeAnalytics (MedeAnalytics Telehealth Data Analytics, Epilepsy Monitoring and Management Solutions)

-

MyEpilepsyHome (by UCB) (MyEpilepsyHome, Seizure Tracker)

-

Epitel (Epitel Epilepsy Monitoring System, Epitel Seizure Detection Platform)

-

Embrace by Empatica (Embrace2 Seizure Detection Smartwatch, Embrace Seizure Alert Device)

-

Neuromotion (Neurostimulator for Epilepsy Management, Neuromotion Epilepsy Remote Monitoring)

-

Brain Sentinel (Brain Sentinel Epilepsy Monitoring System, Brain Sentinel Seizure Detection Wearable)

-

NeuroSigma (Monarch eTNS System, NeuroSigma Epilepsy Monitoring Solutions)

-

LivaNova (Vagus Nerve Stimulation for Epilepsy, Epilepsy Remote Monitoring Services)

-

BioSerenity (BioSerenity Epilepsy Monitoring Kit, BioSerenity Data-Driven Epilepsy Management Platform)

-

UCB Pharma (Vimpat, MyEpilepsyHome)

-

MedPage Today (Telemedicine Solutions for Epilepsy Management, Virtual Epilepsy Consultations)

-

ZygoCare (ZygoCare Tele-epilepsy Management Platform, Remote Epilepsy Monitoring Solution)

-

Epilepsy Foundation (Epilepsy Telehealth Resource Center, Epilepsy Telemedicine Toolkit)

-

BenevolentAI (AI-based Epilepsy Treatment Platform, Epilepsy Data Analytics for Remote Care Solutions)

Key Suppliers

These suppliers support various aspects of tele-epilepsy products and services, from hardware and wearables to software solutions for remote monitoring and data management.

-

STMicroelectronics

-

Cisco Systems

-

Analog Devices

-

Texas Instruments

-

Intel Corporation

-

Microsoft Corporation

-

Qualcomm

-

Samsung Electronics

-

Thermo Fisher Scientific

-

Illumina

Recent Developments

-

In June 2024, Daicel Arbor Biosciences introduced a revised edition of their myTXTL kits, designed for cell-free protein production and supporting the creation of therapeutic proteins, including those aimed at treating epilepsy. This launch is anticipated to indirectly but positively influence epilepsy treatment, boosting research on therapeutic proteins.

-

In October 2023, Thermo Fisher Scientific gained attention by purchasing Olink Holding for USD 3.1 billion, enhancing its proteomics expertise. While not explicitly connected to tele-epilepsy, this purchase might inspire advancements in molecular diagnostics, which could subsequently be incorporated into tele-epilepsy monitoring systems for enhanced patient care.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 387.43 million |

| Market Size by 2032 | US$ 1468.32 million |

| CAGR | CAGR of 13.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Patient (Pediatric, Adult) • By Component (Software, Hardware, Services) • By End Use (Hospital Providers, Payers, Healthcare Consumers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daicel Arbor Biosciences, Thermo Fisher Scientific, NeuroPace, Inc., Cerner Corporation, Livongo Health (now part of Teladoc Health), Medtronic, MedeAnalytics, MyEpilepsyHome (by UCB), Epitel, Embrace by Empatica, Neuromotion, Brain Sentinel, NeuroSigma, LivaNova, BioSerenity, UCB Pharma, MedPage Today, ZygoCare, Epilepsy Foundation, BenevolentAI. |

| Key Drivers | • The rising incidence of epilepsy diagnoses globally is a major factor fueling the expansion of the tele-epilepsy market. • The swift progress in telemedicine, along with the creation of wearable gadgets and mobile apps, is playing a crucial role in the expansion of the tele-epilepsy market. |

| Restraints | • Growth hindrances of the tele-epilepsy market are the regulatory and reimbursement challenges associated with telemedicine services. |