Antidepressants Market Report Scope & Overview:

Get More Information on Antidepressants Market - Request Sample Report

The Antidepressants Market Size was valued at USD 19.92 Billion in 2023, and is expected to reach USD 37.44 Billion by 2032, and grow at a CAGR of 7.66%.

The rising prevalence of depression is attributed to increased awareness and understanding of the disorder. There has been a significant global effort to educate the public and healthcare professionals about mental health, reduce stigma, and encourage early diagnosis and treatment. Organizations such as the World Health Organization (WHO) and various national health bodies have played crucial roles in this awareness campaign. As a result, more individuals are seeking help and being diagnosed, contributing to the observed rise in reported cases of depression. This heightened awareness is leading to more people being identified with depression, who might otherwise have gone untreated. For instance, the WHO reported in September 2021 that approximately 5.0% of adults globally experienced one or more depressive episodes in their lifetime.

The pharmaceutical industry has seen significant advancements in the development of novel biologics, which are contributing to the growth of the antidepressant market. Biologics, including monoclonal antibodies and gene therapies, represent a new frontier in the treatment of depression. These innovative treatments are designed to target specific pathways involved in depression, offering potentially more effective and personalized options compared to traditional medications. The development of biologics has been accelerated by advances in biotechnology and an improved understanding of the neurobiological mechanisms underlying depression. For example, drugs like ketamine and its derivatives, which work differently from conventional antidepressants, have shown promising results in treating treatment-resistant depression. This expansion in treatment options is expected to drive market growth as patients and healthcare providers seek out the most effective therapies.

|

Country |

Phone Number |

|

United States |

+1-800-273-8255 (988) |

|

Canada |

+1-866-387-2273 |

|

Mexico |

+52-800-011-1000 |

|

United Kingdom |

+44-116-123 |

|

France |

+33-0-800-13-0000 |

|

Germany |

+49-0800-11-13-14 |

|

Spain |

+34-91-717-00-11 |

|

Italy |

+39-199-696-969 |

|

Russia |

+7-8-800-100-75-03 |

|

India |

+91-91-9999-666-555 |

|

China |

+86-800-810-1117 |

|

Japan |

+81-03-5773-3696 |

|

South Korea |

+82-1399 |

|

Australia |

+61-13-11-14 |

|

South Africa |

+27-0800-21-1702 |

In economically developed countries like the UK and the US, the prevalence of depression is particularly notable. Rapid economic changes and high-stress environments contribute to mental health challenges, with many individuals experiencing depression across various age groups. For instance, data from the Anxiety and Depression Foundation of America in January 2022 indicated that around 6.8 million adults in the US, or approximately 3.1% of the population, are affected by generalized anxiety disorder annually. The high prevalence of these conditions in developed countries drives a substantial demand for antidepressant medications. The combination of increased awareness, the development of novel biologics, and the high disease burden contribute to a growing global market for antidepressants. As more individuals are diagnosed and seek effective treatments, the demand for antidepressants is expected to rise.

MARKET DYNAMICS:

Key Drivers:

-

Increasing Number of Cases of Depression Around the World is Propelling the Growth of the Market.

-

Increasing Awareness of Depression is Fueling the Growth of the Market.

Restraints:

-

Preference of Non-pharmacological Therapies over Pharmacological Therapies Pose a Significant Barrier to Market Growth.

-

Side Effects and Patent Expiry of Antidepressant Drugs are expected to Hamper the Growth of the Market.

Opportunity:

-

Development of Novel Antidepressant Classes Opens Up Significant Opportunities in Antidepressants Market.

-

Expansion of Digital Therapeutics and Telemedicine Integration Present Substantial Growth Opportunities.

KEY MARKET SEGMENTATION:

By Drug Class

In 2023, Selective Serotonin Reuptake Inhibitors (SSRIs) dominated the antidepressant market, accounting for approximately 45% of total sales. SSRIs are the most commonly prescribed antidepressants and are considered the primary treatment for major depressive disorder and anxiety-related conditions. According to the United States Food and Drug Administration (US FDA) guidelines, SSRIs are the first-line treatment for depression. Following the COVID-19 pandemic, there has been an increase in the prescription of SSRIs worldwide due to a surge in anxiety and depressive disorders. In Europe, the European Medicines Agency (EMA) reported a 12% increase in SSRI sales in 2023. SSRIs will likely continue to be the dominant class of drugs in the antidepressant market due to their affordability, wide availability, and effectiveness, particularly with the entrance of more generic options into the market.

By Distribution Channel

In 2023, hospital pharmacies held the largest market share and are expected to have a higher-than-average Compound Annual Growth Rate (CAGR) of around 55% among distribution channels. This increase is largely due to more frequent visits by both inpatients and outpatients for mental health prescription drugs through hospital pharmacies. Hospital admissions related to mental health conditions have increased by 25%, leading to a rise in the dispensing of antidepressants via hospital pharmacies.

This trend is exacerbated by individuals who have had little contact with the mental health system and present in severe distress, leading to higher antidepressant prescriptions through these sites. Factors such as the expansion of psychiatric units and government policies aimed at improving mental health services are also contributing to the greater footprint of hospital pharmacies in this market.

The retail pharmacy sector had a smaller market share of around 30%, with increased accessibility and convenience, but it is rapidly growing. Online pharmacies, constituting almost 15% of the market, have been driven by telemedicine and online prescription services, especially during the pandemic.

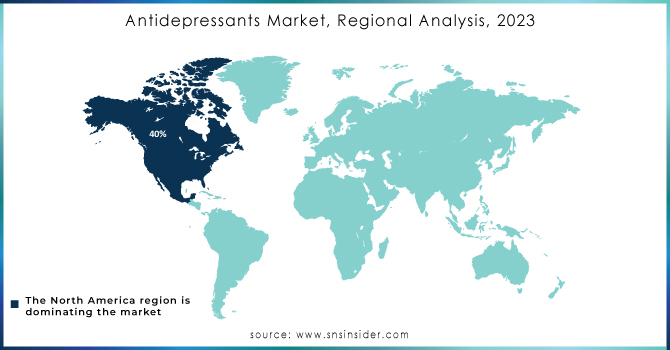

REGIONAL ANALYSIS:

In 2023, North America led the market for antidepressants, holding a substantial global market share of about 40%. The United States, in particular, contributed to this leadership position due to the prevalence of mental health disorders and a well-resourced healthcare system. Statistics from the U.S. Centers for Disease Control and Prevention (CDC) estimated that about 17.3 million American adults suffered from a major depressive episode in 2023, creating an environment conducive to pharmaceutical treatment with antidepressants. Additionally, around 13.4% of American adults were reported to have been using antidepressants in that year.

This dominance is further bolstered by significant government interest and investment in mental health programs. Notably, the United States allocated USD 1.5 billion of federal monies for mental health services funding for 2023 alone. North America's sophisticated pharmaceutical industry and key market players like Pfizer and Eli Lilly make it easy for affected patients to access various antidepressant medications.

Following North America, the European market held a share of almost 30%, driven by factors such as health policies and steadily rising public acknowledgment of developments in mental health treatment. Government-backed campaigns in countries like the UK and Germany have resulted in significant increases in diagnoses and treatment for mental health conditions.

Need any customization research on Antidepressants Market - Enquiry Now

KEY PLAYERS:

The players operating in the antidepressant market are the following:

-

Pfizer: Zoloft (sertraline), Effexor XR (venlafaxine), Pristiq (desvenlafaxine)

-

Eli Lilly and Company: Prozac (fluoxetine), Cymbalta (duloxetine)

-

GlaxoSmithKline: Paxil (paroxetine), Wellbutrin (bupropion)

-

Johnson & Johnson: Remeron (mirtazapine)

-

AbbVie: Trintellix (vortioxetine)

-

Lundbeck: Abilify (aripiprazole)

-

AstraZeneca: Seroquel (quetiapine)

-

Merck & Co., Inc.: Remicade (infliximab)

-

Takeda: Vyvanse (lisdexamfetamine)

-

Janssen Pharmaceuticals: Risperdal (risperidone)

-

Novartis: Trileptal (oxcarbazepine)

-

Sandoz: generic

-

Teva Pharmaceuticals: generic

-

Mylan: generic

-

Sun Pharmaceutical Industries: generic

-

Aurobindo Pharma: generic

-

Dr. Reddy's Laboratories: generic

-

Intas Pharmaceuticals: generic

-

Glenmark Pharmaceuticals: generic

-

Cipla: generic

RECENT DEVELOPMENTS

-

In August 2022, the U.S. FDA approved dextromethorphan-bupropion (Auvelity, Axsome Therapeutics) for the treatment of major depressive disorder in adults. It is the only medication that takes effect within 7 days of intake.

-

In April 2022, a study showed that vortioxetine, available under the brand names Trintellix or Brintellix, was more effective in treating major depressive disorder (MDD) compared to desvenlafaxine, which is the active ingredient in Pfizer's anti-depression drug Pristiq.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 19.92 Billion |

|

Market Size by 2032 |

US$ 37.44 Billion |

|

CAGR |

CAGR of 7.66% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Drug Class (Selective Serotonin Reuptake Inhibitors, Serotonin & Norepinephrine Reuptake Inhibitors, Atypical Antidepressants, Tricyclic Antidepressants, Monoamine Oxidase Inhibitors (MAOIs) & Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

GlaxoSmithKline PLC, AbbiVe Inc., Sun Pharmaceuticals Pvt. Ltd, Eli Lilly and Company, Johnson & Johnson, Pfizer Inc., Merck & Co. Inc., Sanofi, AstraZeneca, Dr. Reddy's Laboratories, H. Lundbeck AS & Other players |

|

Key Drivers |

•Increasing Number of Cases of Depression Around the World is Propelling the Growth of the Market |

|

RESTRAINTS |

•Preference of Non-pharmacological Therapies over Pharmacological Therapies Pose a Significant Barrier to Market Growth. |