Dual Chamber Prefilled Syringes Market Report Scope & Overview:

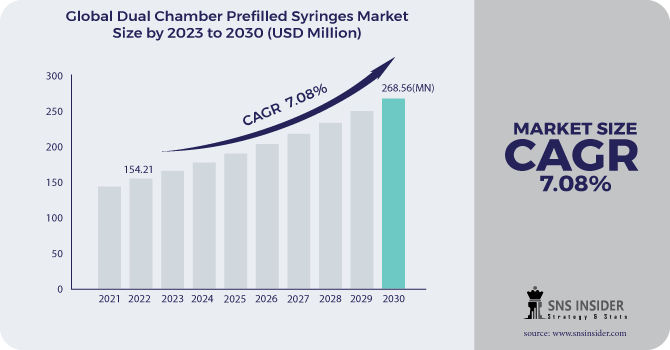

The Dual Chamber Prefilled Syringes Market size was USD 163.02 million in 2023 and is expected to reach USD 283.01 million by 2032 and grow at a CAGR of 6.32% over the forecast period of 2024-2032.

To Get More Information on Dual Chamber Prefilled Syringes Market - Request Sample Report

This report provides in-depth insights into the procedure volume statistics, analyzing the increasing adoption of image-guided biopsy techniques across various medical conditions. It explores technological adoption trends, highlighting advancements in imaging modalities and biopsy devices. Additionally, it examines regulatory and approval trends, detailing recent policy changes and their impact on market dynamics. The study also assesses the cost and economic impact, evaluating the affordability, reimbursement policies, and financial burden on healthcare systems. These insights help stakeholders understand market growth drivers and emerging opportunities.

U.S. held the largest market share in the North America region around 74%, in 2023. The good adoption of a new way of the drug delivery system. Strict regulatory framework in the country, primarily headed by the FDA, assures the safety & efficacy of prefilled syringes, thereby boosting the need for quality solutions. Moreover, the increasing incidence of chronic diseases, including diabetes, rheumatoid arthritis, and cancer, has driven the demand for prefilled syringes for injectable therapies. Pfizer Inc. and AbbVie Inc. are some of the companies that have been known to actively invest in developing premium biologics and combination therapies, ultimately steering market growth. An increase in government initiatives to enhance immunization and injectable drug delivery and a well-established distribution network have made the U.S. the largest market in North America.

Market Dynamics

Drivers

-

Growing preference for biologic and lyophilized drugs drives the dual chamber prefilled syringes market.

The rising demand for biologic drugs and lyophilized formulations is a key driver for the Dual Chamber Prefilled Syringes Market. Biopharmaceuticals, including monoclonal antibodies, gene therapies, and vaccines, often require reconstitution before administration. Dual chamber prefilled syringes offer a convenient and accurate drug delivery system, ensuring proper mixing while reducing contamination risks. The growing adoption of self-administration devices among patients with chronic conditions like rheumatoid arthritis and diabetes further boosts market growth. Additionally, pharmaceutical companies are increasingly shifting towards dual chamber syringes to enhance drug stability and extend shelf life. Regulatory support for prefilled syringes as a safer alternative to vials and ampoules strengthens their adoption. With ongoing advancements in biologic drug formulations, the demand for dual chamber prefilled syringes is expected to grow significantly.

Restraint:

-

High manufacturing and regulatory compliance costs restrain the dual chamber prefilled syringes market.

The Dual Chamber Prefilled Syringes Market faces a significant restraint due to high manufacturing and regulatory compliance costs. The production of dual chamber prefilled syringes requires advanced materials, precise engineering, and stringent quality control to ensure stability and sterility. Additionally, regulatory agencies such as the FDA and EMA have strict guidelines for drug-device combination products, leading to lengthy approval processes and higher compliance costs. The complexity of integrating lyophilized drugs and liquid formulations in a single device further increases production expenses. Moreover, pharmaceutical manufacturers must invest in specialized filling technologies and conduct extensive clinical trials to meet safety standards. These high costs limit the adoption of dual chamber prefilled syringes, particularly among small and mid-sized pharmaceutical companies, thereby restricting market expansion in price-sensitive regions.

Opportunity:

-

Increasing adoption of self-administration devices creates opportunities in the dual chamber prefilled syringes market.

The rising trend of self-administration for chronic disease management is creating lucrative opportunities in the Dual Chamber pre-filled syringes Market. Patients with conditions such as multiple sclerosis, diabetes, and autoimmune disorders are increasingly opting for pre-filled syringes that enable convenient at-home drug administration. Dual chamber syringes enhance patient compliance by allowing easy reconstitution of lyophilized drugs, eliminating the need for manual mixing and reducing dosing errors. Pharmaceutical companies are investing in patient-friendly drug delivery systems to cater to the growing demand for home healthcare solutions. Additionally, advancements in needle safety, auto-injector compatibility, and ergonomic designs are improving the usability of dual chamber prefilled syringes. With healthcare systems emphasizing cost-effective and efficient drug delivery, the expansion of self-administration trends presents a major growth opportunity for the market.

Challenge:

-

Challenges in ensuring long-term drug stability in dual chamber prefilled syringes.

One of the major challenges in the Dual Chamber Prefilled Syringes Market is ensuring long-term stability of both lyophilized and liquid drug components. Maintaining the sterility and efficacy of biologic drugs over extended storage periods requires advanced material selection, precise barrier technology, and robust packaging solutions. Factors such as moisture ingress, gas permeability, and potential drug-device interactions can affect the stability of sensitive formulations. Additionally, pharmaceutical companies must conduct rigorous compatibility studies to ensure that active ingredients remain effective until the point of administration. Variability in storage conditions across different healthcare settings and geographical regions further complicates stability concerns. Addressing these challenges requires continuous innovation in syringe materials, coatings, and sealing technologies to enhance drug shelf life and regulatory compliance, ensuring patient safety and product reliability.

Segmentation Analysis

By Material

The glass segment held the largest market share, around 72%, in 2023. Due to its unparalleled chemical resistance, non-reactivity, and stability among the available materials against biologic drugs and lyophilized formulations. Manufacturers such as SCHOTT AG and Gerresheimer AG have launched innovative borosilicate glass syringes that help maintain drug compatibility and stability and extend drug shelf life. The company also announced the launch of BD Effivax Glass Prefilled Syringe in 2023, which is a high drug stability prefilled syringe. West Pharmaceutical Services has also expanded its Daikyo Crystal Zenith polymer-based syringes as an option to classic glass. Pharmaceutical companies have been focusing on dual chamber formats for biologic drugs, leading to an increasing preference for glass-based syringes due to their superior moisture impermeability property that ensures accurate reconstitution of drug solution and storm contaminant-free drug delivery.

By Application

The Vaccines and Immunizations segment is estimated to dominate the salad dressing market with 27% market share during the forecast period, owing to increasing immunization initiatives around the world and the demand for stable, ready-for-use vaccine formulations. Likewise, BD and Gerresheimer broadened their dual chamber syringe portfolio to ensure precise dosing and long-term stability for temperature-sensitive vaccines. The increasing interest in self-administration and emergency vaccination programs is also helping to drive dual chamber prefilled syringe usage, especially concerning pandemic preparedness and childhood immunization campaigns.

By Distribution Channel

Hospitals held the largest market share at around 52% in 2023. They are critical for giving drugs in an emergency or the administration of biologic drugs. The leading pharmaceutical companies, including Rovi Pharmaceuticals and Nipro Corporation, are manufacturing dual chamber syringes as a hospital injectable device for accurate lyophilized drug reconstitution and decreased preparation time. SCHOTT Pharma expands syringe portfolio to strengthen drug stability and patient safety for hospital setting multi chamber syringe line SCHOTT Pharma has released in 2024 a scale up of our dual chamber syringe line. In another example, West Pharmaceutical Services' SmartDose technology combines dual chamber syringe functionality with digital supervision to maximize compliance for hospital home-use scenarios. As hospitals increasingly look for sterile, ready-to-use drug delivery systems, dual chamber prefilled syringes keep gaining popularity in critical care and the treatment of chronic diseases.

.png)

Do You Need any Customization Research on Dual Chamber Prefilled Syringes Market - Enquire Now

Regional Analysis

North America held the largest market share at around 42% in 2023. This is owing to advancements in the biopharmaceutical industry, the presence of a large patient pool with chronic diseases, growing adoption of injectable biologics, and stringent regulations regarding drug safety and efficacy. This is due to the rising burden of chronic diseases, including diabetes, rheumatoid arthritis, and oncology conditions, in the region, which necessitates the need for prefilled, ready-to-use drug delivery systems. Companies such as BD, West Pharmaceutical Services, and Gerresheimer are expanding their dual chamber syringe offerings to provide storage solutions for biologic drugs as well as for their reconstitution. West Pharmaceutical Services introduced an improved dual chamber system with a rocker in the year 2023 for monoclonal antibodies, further cementing the dominance of the region. Moreover, favorable FDA approvals along with reimbursement for self-administered injectable therapy have also underpinned the market growth, making North America the leader in dual chamber prefilled syringes.

Europe held a significant market share in 2023. The increasing elderly population and growing incidences of chronic diseases, including rheumatoid arthritis, diabetes, and related diseases, are expected to drive the growth of advanced drug delivery systems in the region. Top companies like Gerresheimer, SCHOTT, and Becton Dickinson (BD) have increased their dual chamber prefilled syringe portfolios to allow accurate drug reconstitution along with improved patient safety. The new dual chamber system with high barrier properties for lyophilized drugs launched in 2023 marks competitive strength in Europe for Gerresheimer. Moreover, the growing support from government initiatives toward self-administration therapies, along with favorable reimbursement policies for self-injection devices, is predicted to drive the market growth in the region.

Key Players

-

Nipro Corporation (ClearJect DC Syringe, Nipro SafeDual)

-

Pfizer Inc, (Genotropin Pen, Xyntha Solofuse)

-

Credence MedSystems Inc. (Credence Companion, Credence Dual Chamber Syringe)

-

Biosciences Inc. (BioDual Chamber, BioInject DC)

-

SCHOTT AG (SCHOTT TopPac, SCHOTT SyriQ BioPure)

-

Arte Corporation (ArteSafe Dual, ArteFill DC)

-

Otsuka America Pharmaceutical Inc. (ABILIFY MAINTENA, Samsca Dual)

-

AstraZeneca plc (BYDUREON BCise, Fluenz Tetra)

-

AbbVie Inc (Humira Dual, Skyrizi DC)

-

Ypsomed AG (YpsoMate DC, UnoPen Dual)

-

Gerresheimer AG (Gx RTF DualChamber, Gx InnoSafe Dual)

-

Becton Dickinson (BD Hypak Dual, BD Intevia DC)

-

West Pharmaceutical Services Inc. (SmartDose DC, West ReadyPack)

-

Medtronic Plc (MiniMed DC, Guardian Sensor DC)

-

Sanofi (Lantus Solostar, Toujeo Max DC)

-

Amgen Inc. (Repatha Dual, Neulasta Onpro DC)

-

Eli Lilly and Company (Trulicity DC, Basaglar DC)

-

Roche Diagnostics (Accu-Chek DC, Actemra DC)

-

Bristol-Myers Squibb (Opdivo DC, Yervoy DC)

-

Merck & Co., Inc. (Keytruda DC, Bridion DC)

Recent Development:

-

In October 2024, SCHOTT Pharma, in partnership with Schreiner MediPharm and Körber Pharma, launched a blister-free syringe packaging solution to cut plastic waste and lower carbon emissions. This eco-friendly design replaces polymer blisters with 100% cardboard mono-material cartons, enhancing sustainability.

-

In October 2023, SCHOTT AG introduced FIOLAX Pro, an advanced Type I borosilicate glass tubing designed for the pharmaceutical industry. This innovation enhances chemical quality, eliminates heavy metals, and supports complex drug formulations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD163.02 Million |

| Market Size by 2032 | USD 283.01 Million |

| CAGR | CAGR of6.32 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Raw Material (Glass, Plastic), • By Application (Vaccines and immunizations, Anaphylaxis, Rheumatoid Arthritis, Diabetes, Autoimmune diseases Oncology, Others), • By Distribution Channel (Hospitals, Mail Order Pharmacies, Ambulatory Surgery Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nipro Corporation, Pfizer Inc., Credence MedSystems Inc., Biosciences Inc., SCHOTT AG, Arte Corporation, Otsuka America Pharmaceutical Inc., AstraZeneca plc, AbbVie Inc., Ypsomed AG, Gerresheimer AG, Becton Dickinson, West Pharmaceutical Services Inc., Medtronic Plc, Sanofi, Amgen Inc., Eli Lilly and Company, Roche Diagnostics, Bristol-Myers Squibb, Merck & Co., Inc. |